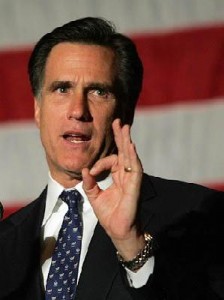

‘Romney’s Bermuda Tax Holiday’

With prohibitive GOP Presidential favourite Mitt Romney’s legal use of off-shore domiciles including Bermuda for tax avoidance now gaining traction as a campaign issue, voters shouldn’t be questioning the candidate’s lack of political judgement or perceived remoteness from the average recession-battered American.

With prohibitive GOP Presidential favourite Mitt Romney’s legal use of off-shore domiciles including Bermuda for tax avoidance now gaining traction as a campaign issue, voters shouldn’t be questioning the candidate’s lack of political judgement or perceived remoteness from the average recession-battered American.

Instead they should be asking if a Romney Administration would have the fortitude to close loopholes in the US tax code, says an editorial entitled “Romney’s Bermuda Tax Holiday” at the Politico website today. [Jan. 20]

Communications director of the Task Force on Financial Integrity & Economic Development Dietlind Lerner and new media/advocacy coordinator for the think tank E.J. Fagan said loopholes in the US tax code like the ones former Massachusetts Governor Mr. Romney benefitted from cost Washington billions of dollars in tax revenue every year.

“As international financial crises threaten governments in Europe and Africa, and Occupy Wall Street protests continue in cities around the country, the measure of a future president should not be that he took advantage of a great business deal,” said the writers. “Rather should be that, if elected, he could be trusted to put an end to this entire process of legally sanctioned tax avoidance which is so harmful to our country.”

The full editorial appears below:

Mitt Romney’s direction of Bain Capital’s tax avoidance activities now threaten to become a major campaign issue. But how questionable are his actions? We need to ask: “What would I do if I could legally avoid paying income tax?”

In taking advantage of tax regulation for personal gain, Romney followed a legal strategy likely used by countless other businessmen and politicians. But since he is running for office, maybe we need to establish some safe-guards so that such problematic choices are not legally condoned.

A plausible scenario plays out like this: I hire an accountant. Doing her job, my accountant tells me that if I sign a few legal documents and route my money through a small Caribbean island, I could keep more of my paycheck and pay a lower tax rate. I may have earned my money in the United States, but legally I can claim that it was, in fact, earned in a tax haven.

If it is entirely legal, which your accountant later assures you is the case, then what’s the problem? Well, this loop-hole, so beneficial to you, deprives the government of cash to help fund, for example, public libraries, or new trucks for fire departments or subsidized heating for the elderly. .

This is more or less what happens when wealthy people and corporations shelter their money in Bermuda — or another of some 60-odd tax havens available around the globe. It’s essentially what Romney did with Bain Capital.

According to a 2007 “Los Angeles Times” article, under Romney’s leadership, Bain Capital set up a shell corporation called Sankaty High Yield Asset Investors Ltd, based in Bermuda. It has no documented staff or actual office in Bermuda. Without breaking any laws, Bain Capital could avoid paying corporate tax in the United States

Bain was in total accordance with the law by using these offshore arrangements. It was just taking advantage of a serious problem in our tax code, which allows well-off companies and individuals to shift money out of the economy to avoid paying their fair share of tax.

It’s difficult even to estimate exactly how much tax money the US government is deprived of each year through what is now-legal tax avoidance. Companies don’t have to report money invested in offshore vehicles. The use of these vehicles is now common practice in the finance industry. Consider that Sen. Carl Levin [D-Mich.] estimates that we lose approximately $100 billion per year in illegal tax evasion — which is more risky than mere tax avoidance. This number must be far higher.

As international financial crises threaten governments in Europe and Africa, and Occupy Wall Street protests continue in cities around the country, the measure of a future president should not be that he took advantage of a great business deal. Rather it should be that, if elected, he could be trusted to put an end to this entire process of legally sanctioned tax avoidance which is so harmful to our country.

Certainly, with greater transparency, we wouldn’t need estimates and imagination to understand the damage being done.