Finance Minister Releases SAGE Interim Report

[Updated with video] Minister of Finance Bob Richards released the SAGE Commission’s Interim Report to the public today [July 29], which contains the interim findings and recommendations from the SAGE Commissioners.

The SAGE Commission’s primary objective is to streamline Government processes, including Quangos, improve delivery of services and make Government more efficient, more cost-effective, more transparent and more user-friendly.

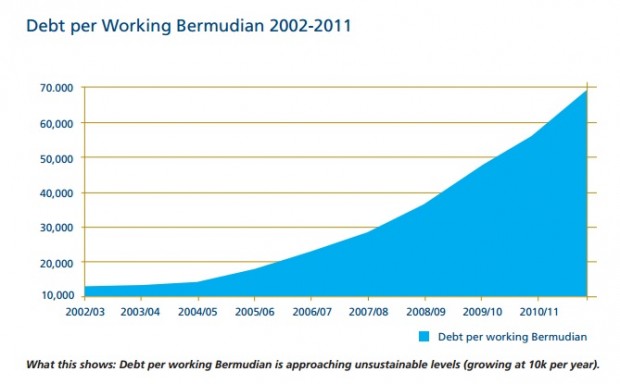

Chart extracted from the report showing the growth in debt per working Bermudian:

Commission members have been working with all stakeholders, including the general public, to formulate ideas and get suggestions on how best to manage, control and reduce Government spending over time contributing to a proactive deficit reduction plan.

The recommendations include:

- Government act immediately on its policy of mandatory retirement at age 65

- Government institute an immediate hiring freeze on all categories of employees including, but not limited to, permanent, temporary, relief, contract and consultants.

- A cross-Ministry committee is formed immediately to prepare and implement a plan to address the collection of all amounts owed to Government including taxes, fees, fines and social insurance contributions.

- Until such time as a cross-Ministry committee prepares a comprehensive asset management plan for all Government assets to ensure that existing Government-owned or leased assets are effectively and fully utilised, there should be: i. no new spending for capital or development projects; and ii. no new leases for new or replacement accommodation or renewal of leases.

- Government immediately form a SAGE-like Commission to review health care cost containment in Bermuda, and one review economic growth and the current lack of liquidity in Bermuda.

The full report is available below [PDF here]:

Update 11.29am: At a press conference this morning, SAGE Commission Chairman Brian Duperreault commented on the report saying they have three months left to complete data collection and interviews, and to write the final report.

In his comments, Mr. Duperreault said, “Hard decisions must be made. In the case of pensions, promises will have to be broken if the young people coming up behind us are going to have any hope of receiving a pension when they retire. Currently, anyone aged 37 and younger won’t get a pension when he or she retires at age 65.

“Our health care system is simply unsustainable. Government can’t afford to continue to subsidise it, so we’re looking at costs tripling in the next eight years – and those costs are going to fall on the shoulders of every person in Bermuda. The Bermuda Health Council estimates $26,000 in total health care costs per person by 2021.”

Mr. Duperreault’s full comments follow below:

“As required by the SAGE Commission Act, we gave Minister Richards a copy of the interim report, and with its release by the Minister, we would like to comment on it now.

“This report is, by design, simple and to the point. Its purpose is to spell out the issues facing the country, provide concrete data to illustrate our initial findings and recommendations, and generate discussion.

“Going forward, we’ll continue the dialogue we’ve begun with the Bermuda Civil Service and the public with a view to producing a final report that represents the best of our collective wisdom. That report will be a blueprint for how to establish the type of government Bermuda needs and can afford.

“Early on in our process, we began to get a good sense of what’s working and what isn’t working in our Government. As we became more deeply involved in information gathering and fact-finding, we have been able to analyse and collate data that validated those early indications.

As a result, the SAGE Commissioners are confident in our interim findings. There are six of them:

“1. We believe the public is unaware that there is a substantial body of work, prepared by Government employees and others, that addresses the issues facing Bermuda, and that few of the recommendations have been acted upon.

“2. The pension schemes operated by the Bermuda Government for the benefit of its employees, Ministers and Members of the Legislature, and the public, are unsustainable in their current form and as currently operated.

“3. Preliminary indications are that health care costs are unsustainable on an ongoing basis.

“4. There is a lack of accountability in the management of employees in Government service which has created a culture that inhibits innovation, creativity and leadership.

“5. Significant improvements to efficiency and effectiveness in the Bermuda Government could be made through improved central management of key strategic functions, information systems and human resources. Core functions, such as real estate management, could be centralized; the multiple Human Resource management and Information systems that stem from the Civil Service and the Public Service could be integrated; and a single, common point of access to Government services, particularly those delivered over the Internet, could be provided.

“6. The work of the SAGE Committees has been hampered by not being able to find comprehensive and centralised information on the number of individuals employed in the Civil Service and the wider Public Service, or comprehensive and centralised information on the assets, particularly properties, owned by Government. Even as I speak, I’m not sure I can tell you exactly how many people are currently employed in the Bermuda Government.

As a result of these findings, we make the following interim recommendations, and there are six of these:

“1. The Bermuda Government should act immediately on its policy of mandatory retirement at age 65.

“2. Government should institute an immediate hiring freeze on all categories of employees including, but not limited to, permanent, temporary, relief, contract and consultants.

“Let me give you some background to this recommendation. As of July 9, 2013, there were 548 posts vacant in Government. If these posts are left unfilled, the estimated cost savings – based on a salary average of $70,000 per post, together with the savings on benefits – would amount to more than $40 million.

“We’re also recommending that any funds in the budget – associated with the posts that aren’t filled – be frozen immediately.

“Having said that, we’re aware that in certain specific cases, and subject to the discretion of the Minister of Economic Development, additional employees are required to meet International conventions or to support revenue generation for the Government and the Island as a whole.

“3. A cross-Ministry committee should be formed immediately to prepare and implement a plan to address the collection of all amounts owed to Government including taxes, fees, fines and social insurance contributions. This plan should only consider using existing resources within the Government or outsourcing collection to a debt collection agency.

“4. Until a cross-Ministry committee prepares a comprehensive asset management plan for all Government assets to ensure that existing Government-owned or leased assets are effectively and fully utilised, there should be no new spending for capital or development projects, and no new leases for new or replacement accommodation or renewal of leases.

“5. Government should form a SAGE-like Commission to review heath care cost containment in Bermuda. This is a complex issue that requires singular, specialized focus. We don’t have the time to do justice to a review of health care. But it must be done. Health care costs are spiraling out of control.

“And, finally,

“6. Government should immediately form a SAGE-like Commission to review economic growth and the current lack of liquidity in Bermuda. The SAGE Commission has been charged with reviewing costs but someone has to look at revenue generation and job growth. As I’ve said before, we can’t cut our way to recovery. We have to find ways to grow our economy.

“We feel these initial recommendations can be implemented now, and we hope they will be. They represent input from a broad range of individuals and organisations in the public and private sector. You’ll find a list of the people we’ve heard from and met with in our report.

“As I said earlier, a lot of good work has already been done by Government employees and others. But their recommendations, many of which are echoed in our interim report, haven’t been implemented.

“There may be many reasons for this, but one reason is that taking action on some of these recommendations was, and still is, difficult. Hard decisions must be made.

“In the case of pensions, promises will have to be broken if the young people coming up behind us are going to have any hope of receiving a pension when they retire. Currently, anyone aged 37 and younger won’t get a pension when he or she retires at age 65.

“Our health care system is simply unsustainable. Government can’t afford to continue to subsidise it, so we’re looking at costs tripling in the next eight years – and those costs are going to fall on the shoulders of every person in Bermuda. The Bermuda Health Council estimates $26,000 in total health care costs per person by 2021.

“In this age of instant messaging, Google hangout and Cloud-based data collection, it makes no sense that we can’t build a central point of access to Government and its services, or that our databases are spread so far and wide that we can’t accurately aggregate staffing levels. We have the tools to fix this, so let’s do it.

“I’m told that the SAGE Commission’s report will gather dust on the shelves because there’s no political will to carry out our recommendations.

“I don’t believe this is up to the politicians. It’s up to all of us. We’re the ones who have to care enough to support the changes that have to be made. We’re the ones who have to look our kids in the eye and say “I know I did what I could to leave you a country that’s in good shape.”

“In closing, I want to thank my fellow Commissioners – Kenneth Dill, Catherine Duffy, Peter Hardy, Don Mackenzie and Kim White. They’re working around the clock on this project, as are the Chairs of our four Committees – Dame Jennifer Smith, Tom Conyers, Martha Dismont and Henry Smith – and the members of their committees. We’re all supported by staff and volunteers who likewise are spending thousands of hours getting this work done. You’ll find the names of everyone who’s been involved so far in our interim report.

“We have three months left to complete our data collection and interviews, and to write our final report. We will continue to engage Government, its employees and the public throughout this process.

“The blueprint we submit in October will be one that’s pragmatic but sensitive to the Island’s social and cultural needs; one that positions us competitively; and one that serves Bermuda’s best interests, now and for generations to come.”

-

The release of an interim report is unfortunate since the deadline for submissions has not yet passed. Therefore, the commission may receive a submission that completely changes their recommendations.

In addition the leading chart that shows debt per working Bermudian is misleading, if not inflamatory. For example, ‘debt per working Bermudian’ is not a relevant measure since each person does not repay the debt. A more relevant measure is national debt as a percentage of GDP or the percentage of debt service in relation to the overall budget.

My rationale is that individuals do not repay national debt. The debt is repaid by government revenue which is primarily raised through taxation. Sustainable levels of taxation depend on the overall level of GDP.

This type of analysis is typical political fodder and is sometimes considered to be intentionally misleading. Another conclusion is that it demonstrates the incompetence of the author of the document, which would be a horrible conclusion since the government have indicated that they will act on their recommendations to improve government efficiency and costs.

I guess we should all brace ourselves for an interesting fall, when the House reconvenes.

And who pays taxes if it’s not working Bermudians (the expats can, and will, leave if and when they want to)?

Help me to understand the rationale-

“My rationale is that individuals do not repay national debt. The debt is repaid by government revenue which is primarily raised through taxation.”

You said that;

indivdual do not repay debt

debt is repaid by government revenue

Which is raised through taxation

Taxation of who? Individuals and businesses.

@ Truth (Original)

If any individual taxpayer does not pay taxes because they are unemployed for example, are they held accountable for their share of taxes? No! Thus the notion of individuals being responsible for paying national debt is not correct.

On the contrary, if an individual owes personal debt ie a mortgage or car loan and they can not pay, they are still held responsible for the debt. If necessary the securing asset will be ‘confiscated’ or they may be processed through the Courts.

Thus there is no individual responsibility to repay debt and the notion of national debt per individual is only emotive.

For anyone with any taxable assets or events now or in the future (including buying anything, importing anything, earning wages, owning a house, owning a vehicle, employing anyone, etc) then the responsibility to repay the debt is much more than ‘emotive’. The debt has huge implications about the taxes that need to be raised. Ask the people in Greece, or Cyprus. But for people who don’t work, don’t own anything, don’t buy anything, and never see themselves ever earning or buying anything, yeah, I guess tax is less relevant.

You’re forgetting though that under the Bermuda taxation system, every single resident is a taxpayer, regardless of whether they are employed or not. The lion’s share of Government’s revenue comes from Duty (payroll tax is just an additional revenue stream). If you consume anything on this island then you are a taxpayer. Employed or Unemployed you pay tax, and that money goes to service the debt (to the tune of $160mil per year t the current level).

The notion that the individual is ultimately responsible for paying the national debt is very much correct. However it is also correct to point out that the degree to which each individual meets that debt obligation is dictated by the degree to which they contribute to Government’s revenues: The more productive/luckier individuals pay a greater share than the less productive/unluckier individuals, but they are all individuals and they are all paying towards servicing the debt.

$2,906,644,000, that is $2.9BILLION in unfunded pensions liability to be paid in the future!! thats scary to say the least!

It’s a given that the real number is higher than that. Without seeing the actuarial report it’s a given that the interest rate assumptions are unrealistically high.

All world pension funds are under funded.

That is nowhere near true. Many huge pension funds are fully funded, and some have surpluses. But they don’t teach you that at PLP propaganda school do they.

Only the defined benefit ones (which most Governments have), not the defined contribution ones (which most private sector employees have). But I don’t see the relevance of your statement. Just because the UK, US and Timbuktu defined benefit pension funds are underfunded matters not one bit to the fact that ours is underfunded and we, and future generations of Bermudians, will have to deal with that problem.

This reports show nothing but OBA talking points…another waste of Taxpayer dollars…

recall when govt pensions where put in place and who was the intended target….the shite is coming back to bite….

I could have told you the facts not the fluff to make the OBA look good, for free…….cost are raising wages are not…and govts around the world are not the most efficient….

heck 1998 Bermuda govt was still only accepting cash, and issues paper receipts…..how long had debit card technology been available . nothing was being done electronically… so it is not hard to believe they are not efficient…

he came, he saw, he conquered, jus like the jews in biblical times, they wanted a king, and they got one (Saul) than turned gold into led in short time….. don’t worry, be happy we can turn our golf courses into caricom style banana plantations that one articulate previous Premier envisioned

That $70,000.00 each owed by Bermudians is beyond the comprehesion of most of them. It is not real to them. As surety as your credit card bill is real & must be paid, so must this bill.

How did it go from $10,000.00 to $70,000.00 in 10 years? Where did it go? Who was responsible for this debt beyond imagination?

Tough times are ahead. Future generations will be cursing the voters of 1998 to 2012.

Well,well,well.The rubber is meeting the road.Thankyou PLP for putting us and our children in the tank.The sea of debt will consume us,leading to massive unemployment,increased criminal activity and increased emigration.Thats right,as the ship sinks those that can leave will,and those that cannot drown.

Thankyou PLP for taking care of yourselves whilst your country got ruined.

There is a saviour,and that is one who is willing to take calculated risks,maybe unpopular ones,that will turn our economy around.If if does not happen,we will join the ranks of countries in the third world!

Can someone, anyone, show me where the $1.5bn debt that costs $160m a year to service, not even pay off, can be seen? Where are the revenue generating infrastructure? Where is the so called investment? To save me and effort, there isn’t any. It is all spent on nothing with nothing to show for it. Not even a house, well at least not owned by the taxpayer who paid for the debt. No money to pay to repair the causeway 10 years after Fabian. PLP spokespersons – please speak up.

@ Ringmaster

Forget the drama

Capital investments include heritage wharf in dockyard (no megaships without them), golf course improvements (no grand slam without them), Dame Browne Evans building (less government payment of rents to the private sector and a more healthy environment for police officers), Tynes Bay (to burn our mountains of trash), significant airport improvements (to meet international standards to allow our IB guests and visitors), improvements to schools, many new lost cost and reasonable cost houses (which dampens the social ills from poor housing) etc.

Whilst we may all criticize and complain (in some cases with validity) about the TOTAL debt, there have been several infrastructure improvements that are for the benefit of all residents.

Tynes Bay was built pre-PLP. If you add up the cost of the other projects, including the cost ovverrun on the court buildings and the totally wasted $60m at Grand Atltantic, it comes to about $250m, which means we have nothing to show for the other $1.25bn. So Ringmaster wins the debate.

@Vote for Me.

The $1.5bn debt excludes the latest $300m that the current administration has had to borrow because of the PLP legacy. Using Sandy Bottom numbers which look pretty close to actual, it still means $1.5bn has not been invested in anything tangible that is infrastructure. By the way the Dame Browne Evans building was changed from the original purpose of being the central place for the legal system, police, magistrates court and Supreme Court, much of it was converted into plush offices for MPs. Back to you.

@ Sandy Bottom and Ringmaster

There are many other examples of the capital expenditure that comprises the $1.5bn. I was only givng a sample. Cedarbridge was built by UBP but some of the cost of building remain as part of the $1.45bn. In addition there have been significant upgrades to Tynes Bay under the PLP administration.

Other investmetns include the Berkeley, Sylvia Richards Seniors Home in St. George, a general upgrade for seniors housing, substantial upgrades to the airport facilities etc.

In addition to the previou, there were some operational upgrades including fast ferries, bus fleet etc. I could provide a more extensive list but i only wanted to give a sample to ‘alleviate the original drama posting’ from Ringmaster.

I think one of the Workers Voice editions that was published clse to the Dec 17 date posted a full list of capital expenditures.

Time to look at pension and health care methodology. Look at the growth of the local insurance companies over the last 15 years. Their growth mirrors the debt and increase in costs faced by Government.

Options:

Nationalize

Legislate

Is there a viable escape route here?