“Private Tax System That Saves Them Billions”

The NY Times has featured a report on the tax system — entitled “For the Wealthiest, a Private Tax System That Saves Them Billions” — saying that an “esoteric tax loophole” has saved rich people millions in taxes, with the “trick” being to “route the money to Bermuda and back.”

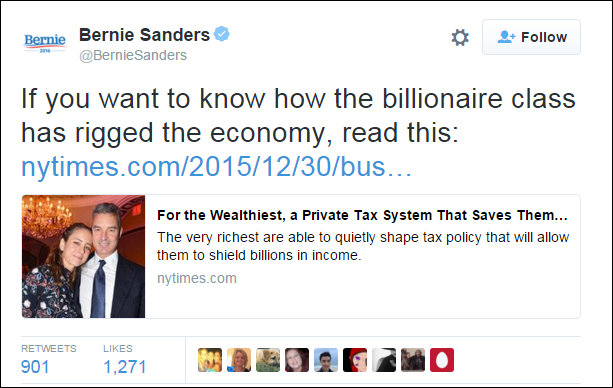

The article, which was posted online yesterday, has attracted over 2,000 comments already and has also been tweeted/retweeted thousands of times, including by Democratic Presidential candidate Bernie Saunders.

The NY Times reports, “The hedge fund magnates Daniel S. Loeb, Louis Moore Bacon and Steven A. Cohen have much in common. They have managed billions of dollars in capital, earning vast fortunes. They have invested large sums in art — and millions more in political candidates.

“Moreover, each has exploited an esoteric tax loophole that saved them millions in taxes. The trick? Route the money to Bermuda and back.”

“Mr. Loeb, for example, has invested in a Bermuda-based reinsurer — an insurer to insurance companies — that turns around and invests the money in his hedge fund.

“That maneuver transforms his profits from short-term bets in the market, which the government taxes at roughly 40 percent, into long-term profits, known as capital gains, which are taxed at roughly half that rate.

“It has had the added advantage of letting Mr. Loeb defer taxes on this income indefinitely, allowing his wealth to compound and grow more quickly. The Bermuda insurer Mr. Loeb helped set up went public in 2013 and is active in the insurance business, not merely a tax dodge.”

Click here to read the full report on the NY Times website.

Bermuda= Tax haven for the rich.

New York City: cash hideaway for the the rest of the world’s rich.

so the reinsurer is legit, actually conducting business in bermuda…..so whats the problem…move on folks, nothing here

The only way Bob Richards can think of to generate or sustain cash for gov.coffers is to maintain land tax that doesn’t reflect current property values . Funny thing is , is that the companies that are domiciled here on Island have recently invited the Bermuda Government of the day to a larger share of tax revenue . These are the companies highlighted in this very interesting , very insightful and very intriguing article , …thanks Bernews for the look out !

So the question remains , why hasn’t Bob accepted the invitation ? I could be devious and wonder out loud as to why ! So the diehard UBP/BDA/OBA fan base must ask their leaders why ! Why not accept a bit more , especially when those giving want to give more ?

One more question asks Columbo , what is the value of the UBP/BDA/OBA ‘s election war chest nowadays ?

AH coffee,looking for someone elses money to spend instead of earning it BY WORKING.

Dont worry brother the writing is on the wall,but most dont want to see it.

As margret thatcher SAID,liberals are fine as long as they have other peoples money to spend,or some thing like that.

Interesting how ONE THIRD OF OUR WORKFORCE is Expat,and without them WE WOULD NOT HAVE AN ECCONOMY.Or maybe an ecconomy like Cuba where Goverment workers get $25 per month,NOT an hour and NOT a week but a month.