Butterfield Introduce $2 ‘Statement Imaging’ Fee

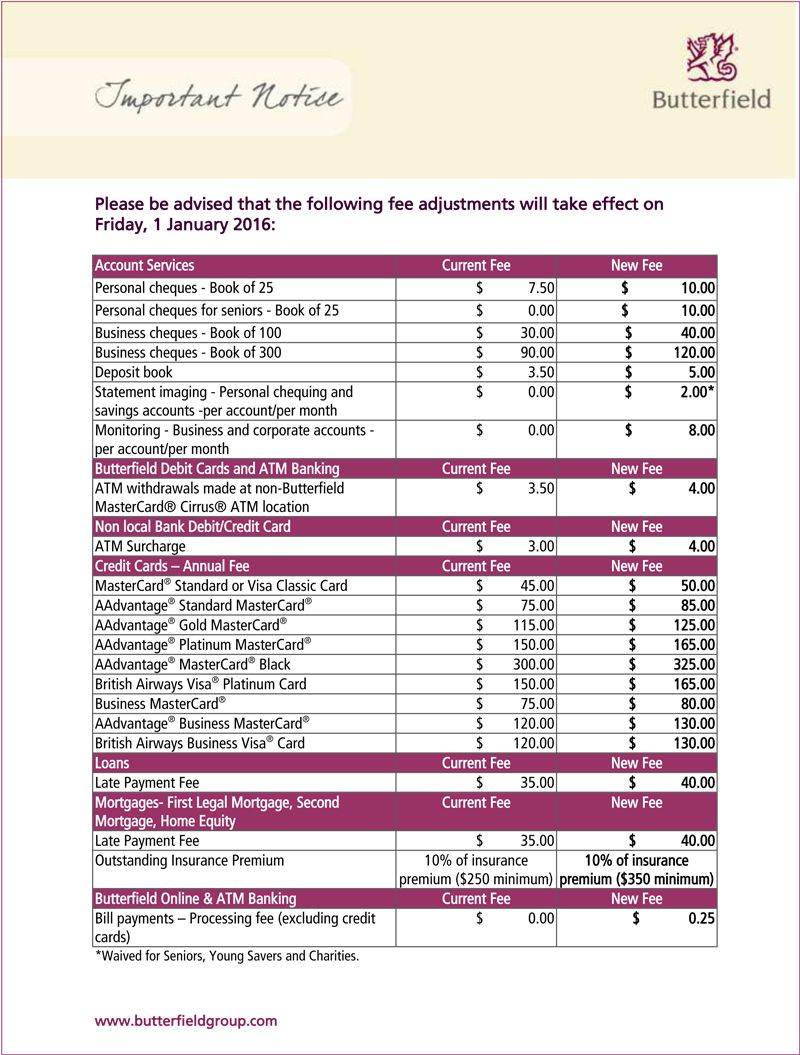

Saying they adjust service fees “based on a variety of factors, including changes in customers’ channel usage preferences and associated transaction volumes,” the Bank of Butterfield has amended their fee structure, including introducing a $2 charge for “statement imaging.”

A Bernews reader emailed in about the $2 charge, and suggested that if customers reverted to posted statements it would remind the Bank “how much they are saving when we utilize e-statements.”

In response, a spokesperson said, “Butterfield continually reviews and adjusts fees for services based on a variety of factors, including changes in customers’ channel usage preferences and associated transaction volumes, as well as changes in the costs of providing services.

“Butterfield is pleased to provide a wide range of secure and convenient financial services to Bermuda residents at prices that are competitive and which provide good value.”

The notice below of fee adjustments, effective January 1st 2016, is taken from the Bank’s website

Don’t we all wish we could get away with just arbitrarily raising fees 10% – 15% – 50% or more.

There’s a few more fees they can add:

- a teller assistance fee.

- an elevator service fee.

- a fresh air fee.

- a fee to talk to a live person, an extra fee to talk to someone in English with a surcharge to talk to someone who can actually help you.

I’m in the wrong business. I need to open a bank.

*- a fee to talk to a live person, an extra fee to talk to someone in English with a surcharge to talk to someone who can actually help you.*

BNTB has obviously learned well from watching the worst bank in Bermuda … HSBC

As priceless as your suggestion above is , please don’t give HSBC any more ideas .

Can you imagine , charging clients for a savings account ? Customer’s money that the bank makes double digit interest profits off of ?

Seeing as all the new Butterfield management is from HSBC it’s not much of a stretch to imagine they’ve brought all their ‘good ideas’ with them!

they do charge for savings accounts… $1 per month.. #whereyoubeen

And a fee to walk into the bank. Let’s call it a ‘door administration’ fee.

This is ridiculous. I hope they reconsider this opetion

Ha, good luck with that one. The CEO and shareholders are already licking their chops at the dividends/profits to come from this move.

No notice, just posted on a website that hardly anyone goes to.

smh

Bend over and take it!

The Seniors really got stiffed, and I imagine they are the ones that use cheques the most!

Technology for seniors now days is still a bit beyond them, so because they can’t use technology they will stiff them with a ridiculous fee to buy cheque books now!!!

Butterfield need to get it together if they still want to be the respected and appreciated local bank.

Should look at the bottom of the fees listed and it states that Seniors, Young Savers and Charities are waived

Not so. Read again.

Only for statement imaging as denoted by *.

Chequebooks up from $0 to $10 for seniors.

There is an asterisk next to the ONLY fee that is waived.

That’s for statement imaging, not cheques. I was referring to the cost of cheques which to most of them – that’s their way of banking.

I see that now

They are not the only Pirates in Bermuda!

How can they justify a $2 fee for an imaged statement? What cost are they covering? Wear and tear on the software? LOL!

250,000 accounts x 2 = 500,000 million

lols @ “coming into effect on Jan 1, 2016″

…oh your mean 5 weeks ago?!

What is statement imaging…..wouldn’t each transaction just be listed on-line….and the balance be online…..I mean can we avoid looking at an ABSOLUTELY POINTLESS Scanned copy of something and therefore not pay this ridiculous fee????????????

I understand for business you may need a statement, but just looking at the balance and transactions as listed in date order should be fine for the regular person.

From speaking with a bank rep today, the bank by law is required to produce a statement. Ok, whatever. The catch is that US as the customer do not have the ability to tell the bank that we don’t want the statement. So the fee is in stone no matter what.

At this point, I think the relevant regulatory bodies need to get involved.

One sure fix…take your money out…what are you gaining by giving it to them and allowing them to profit from your blood,sweat n tears…security you say? Barnes or Wards have sufficient products for sale…leave the bankers to the wealthy who can afford to pay someone to keep an eye on their cash…things would change then or they will close down.

It’s the same as Robin Hood Restaurant- $2.00 for take out pizza. I say what am I paying for. they tell me the box! Cool next time I will bring foil!

Lesson: if they can’t stick it to u one way they will find another

My wife needed some printed statements from Butterfield for her USA income tax. Was told there would be a $40.00 charge per page come on!!!!. Seems to me they can just charge what they want, we have no choice but to take it or leave it.

The new Fee Schedule is a scandal and an insult to the Customer. Why do the Bank Of Butt need more revenue/profits?

If it was not such a hassle to change Banks – no doubt the Bank of Butt would lose a ton of Customers – and they know that. How are they able to justify charging Seniors $10 per (new) cheque book – when hitherto such was free. How are they able to justify charging a $0.25 fee for each and every bill payment made on line, when we are being encouraged to use ‘on line banking’.How many Customers – alone Seniors- were aware of these Fee increases until the letter to the Editor and the Media exposed it. The Bank should be utterly ashamed of themselves and withdraw these immediately. The situation calls for a boycott of the Bank of Butt which of course will not happen, sadly – but(no pun intended!) if everybody was to pay their bills by cheque and deliver to the Supplier- the necessary processing would cost the Bank more than the $0.25 cents. Furthermore if one looks carefully at the Notice, bills paid by Debit Card incur no Fee!!!! Wow! Is that an oversight- just like ‘Bermuda’s First Bank’. The last now!

To ‘Keepin it Real …4Real”. I wish I didn’t have to use any bank but unfortunately I get paid by direct deposit and that is the only way I am allowed to get paid. You can bet if it wasn’t for that no bank would get my money.

All Butterfield customers should take their money out.

Banks used to be such a noble profession. Now they are not!

We get an insulting interest on money and now they want to slap horrendous fees on us. I wonder how much of their profit for these transactions are for the increase of staff salaries…. Probably nuffin!

The fee that I want to charge them is a local local representative fee when I have a problem not some overseas person that can’t do anything for me when I have an issue.

Today I’ve learned the following from a customer rep:

- The ‘image scan’ is for the bank to ‘by law’ produce a statement. You do not have the right to ‘not’ accept the statement. So basically, as far as the bank is concerned, suck it up because the fee is in stone:

- the 25 cent fee applies not only to bill payments, but to transfers between accounts.

To the bank, I don’t enjoy being screwed by anyone else but my wife. Thank you.

Its $2… Get over it.

First, alot of this has to do with principle, lack of adequate notice, fees outstripping interest rates and people in general getting fed up with everything going up but their salaries. Now, times $2 by the number of accounts you have, and 25 cents for EVERY bill payment or transfer and it will add up.Unless you’re actually getting more money in interest than the bank is taking from you in ‘service fees’, then I can’t see how any right-minded person would trivialize it as you have.

Alot of these processes are automated, so what is being maintained? You don’t think the bank makes enough profits to cover operating costs when they’ve spent the past 5 years closing branches and making hundreds of employees redundant? The bank isn’t doing anything right now literally for you financially but providing a place to keep your money that they’re making money had over fist on, giving you crap interest rates and charging you 6-fold in fees. And you’re ok with this??

Can’t we turn off the statement thing all together? We DON’T need them! We can see all activity online without the online statements!!!

I asked about this yesterday. The customer rep informed that by law, they are obligated to produce statements. So with that, I asked if we can choose not to receive statements either physically or electronically, to which the answer was no. So basically, you are stuck with the fee regardless of whether you want/need a statement, whether you print it off or not.

You are correct that simply clicking on your account number shows you activity, so if that’s all you’re interested in you don’t ‘need’ a formal statement.

The simple reality is, this is not improving the customer experience. I have 3 accounts for a reason, and with these new fees I am now going to consolidate accounts to avoid 3 different ‘image’ fees,and have already spoken with my wife about removing a good portion of our money all together. This is putting me in position to make choices that TAKE options from me, not enhance my customer experience. Of course, many will do this and the bank will then respond by hiking/introducing new fees. The banks do this knowing that we have less and less options as the customer. For all purposes, we are being held at random by their bloodsucking practices.

A few ideas to consider:

-as aforementioned, consolidate accounts as much as you feasibly can

- if you pay online, contact your service providers( Belco, cablevision, ISP etc) and set up automated debit payments.

-review fee schedules for the all banks, and act accordingly. Alot of people complain about HSBC, myself included, but CURRENTLY they do not charge for internal transfers, bill payments, and their account service fees are ‘only’ $1, as opposed to Butterfield now charging you $2 for ‘image fees’ and .25 per online transaction. Clarian does not charge you for online transactions, but they do charge $3 a month for savings maintenance fees. At this point, they’re all less than desirable, but choose the lesser evil.

I hope that we as Bermudians respond to this strongly, as opposed to b******g about it for a week and then begrudgingly accepting it. We need to show these people that THIS IS NOT GOOD ENOUGH.