Balance Of Payments & International Investment

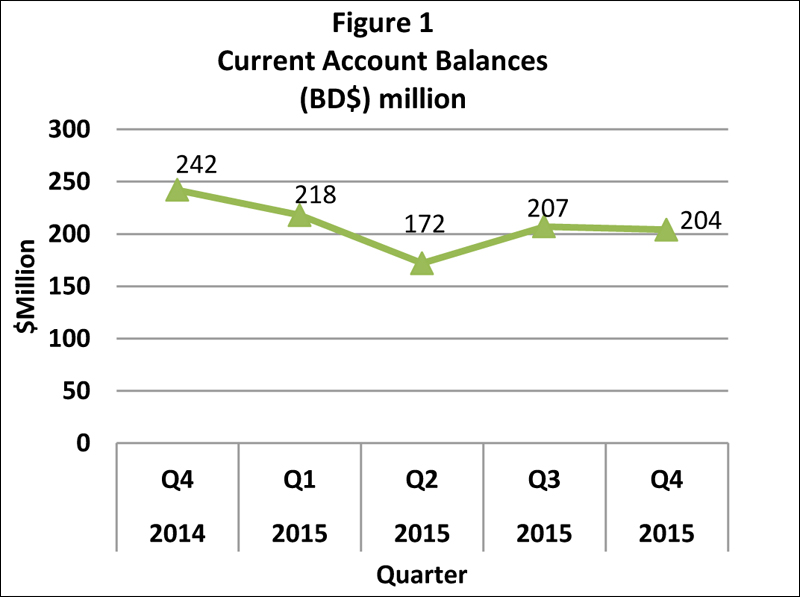

The Bermuda current account recorded a surplus of $204 million in the fourth quarter of 2015, according to the most recent Balance of Payments and International Investment Position report.

“The current account surplus stood at $204 million for the fourth quarter of 2015. This represented a $38 million decrease from the $242 million surplus in the fourth quarter of 2014,” the report said.

“The decrease in the current account surplus reflected mostly a reduction in net receipts for insurance services and a small decline in the surplus on the primary income account. In contrast, the deficit on merchandise trade narrowed due to lower payments for imported goods.

“The value of goods imported fell 3.0 per cent to $227 million during the quarter. Imported goods from the Island’s largest trading partner the United States of America fell by $31 million. In contrast, imports from Canada grew by $17 million.

“Among the commodity groups, the decline was reflected primarily in the imports of fuel which dropped $18 million year-over-year. Imports of food, beverages and tobacco also contracted by $4 million. In contrast, imports of finished equipment and transport equipment rose by $7 million and $5 million, respectively. Revenue from exports fell by $1 million to $4 million during the quarter.

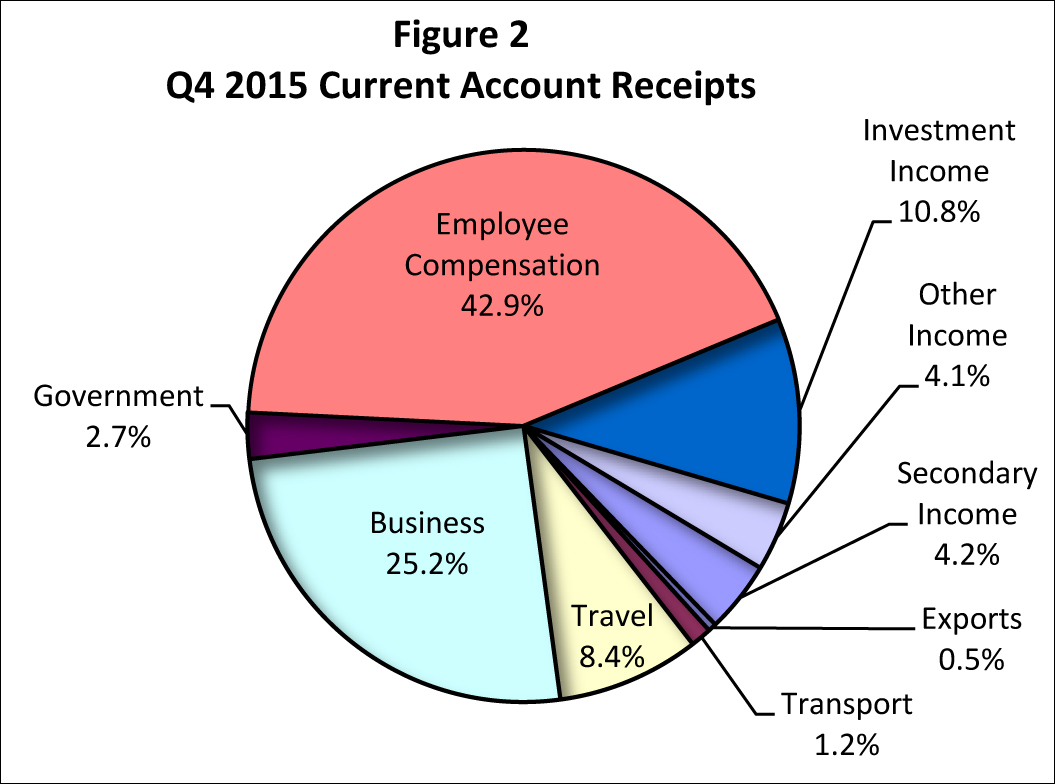

“Receipts from services transactions stood at $305 million during the quarter. Among the services categories, receipts from business services fell $24 million due primarily to a fall in insurance services, specifically reinsurance claims recovered.

“Receipts from travel services declined $5 million due to lower expenditure by air visitors. In contrast, revenue from transportation services increased by $2 million during the quarter.”

The full report is below [PDF here]:

The graph looks like a seagull.

Any economists out there that can decipher what this means please?