CTJ Release ‘Offshore Shell Games 2016′ Report

“Fortune 500 companies are holding nearly $2.5 trillion in accumulated profits offshore for tax purposes,” according to a report released by the tax advocacy organization Citizens for Tax Justice, which says that “tax haven use is now standard practice among the Fortune 500.”

The report, titled Offshore Shell Games [PDF], said, “U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses or individuals when it comes to paying taxes.

“Corporate lobbyists and their congressional allies have riddled the U.S. tax code with loopholes and exceptions that enable tax attorneys and corporate accountants to book U.S. earned profits to subsidiaries located in offshore tax haven countries with minimal or no taxes,” the report stated.

“The most transparent and galling aspect of this is that often, a company’s operational presence in a tax haven may be nothing more than a mailbox. Overall, multinational corporations use tax havens to avoid an estimated $100 billion in federal income taxes each year.

“But corporate tax avoidance is not inevitable. Congress could act tomorrow to shut down tax haven abuse by revoking laws that enable and incentivize the practice of shifting money into offshore tax havens.

“By failing to take action, the default is that our elected officials tacitly approve the fact that when corporations don’t pay what they owe, ordinary Americans inevitably must make up the difference.

“In other words, every dollar in taxes that corporations avoid must be balanced by higher taxes on individuals, cuts to public investments and services, and increased federal debt.

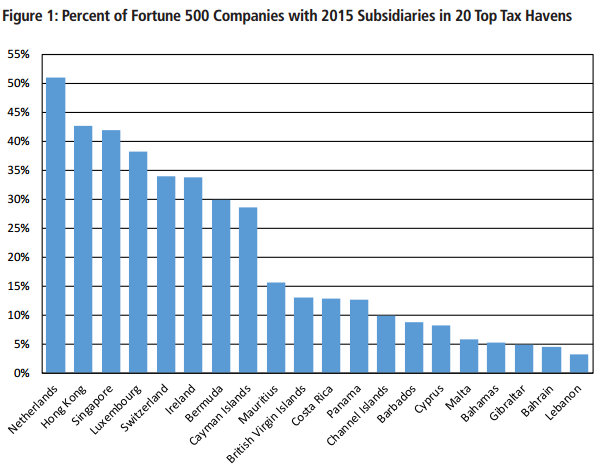

Chart extracted from the report:

“This study explores how in 2015 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income,” the report added.

“It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s wealthiest corporations benefit the most from this tax avoidance scheme.”

The report alleges that both Bermuda and Cayman Islands are “two particularly notorious tax havens,” and says the “most popular tax haven among the Fortune 500 is the Netherlands, with more than half of the Fortune 500 reporting at least one subsidiary there.”

Citizens for Tax Justice — which released a similar report last year — defines itself as a “public interest research and advocacy organization focusing on federal, state and local tax policies and their impact upon our nation.”