AON: Reinsurance Capital Continued To Climb

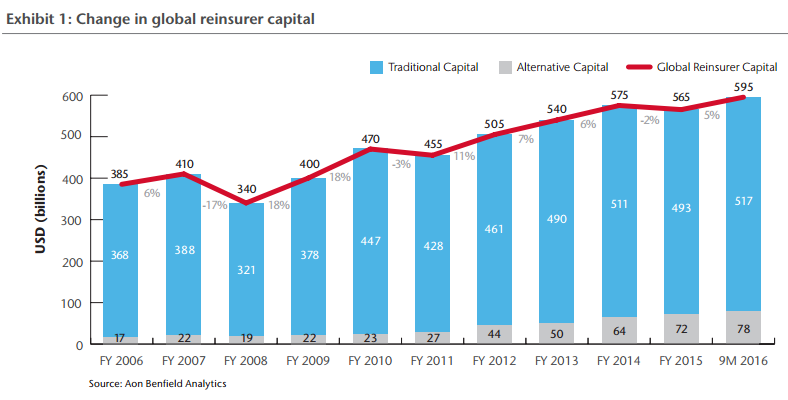

“Reinsurance capital continued to climb, increasing 5.3 percent to USD595 billion through nine months at September 30, 2016,” according to the recently released Reinsurance Market Outlook from AON, which added that the “pick-up of M&A activity in Q4 2016 and potential interest rate increases could signal potential capacity restrictions.”

The report [PDF] said, “Reflecting a new peak in supply, capacity continues to outpace the growth of reinsurance demand despite insurers continued efforts to optimize their view of reinsurance as capital and expand into growing lines of business and new innovation.

“Reinsurance capital continued to climb, increasing 5.3 percent to USD595 billion through nine months at September 30, 2016.

“While traditional reinsurance capital increased 4.7 percent during the period, alternative capital increased by only 9.6 percent, the smallest growth it has reported in 5 years.

“This result further suggest that traditional capacity is using all the tools at its disposal in order to stave off market share growth from alternative capital.

“Overall demand increased for the industry, but growth has been isolated to few regions and lines of business.

“For January 2017 renewals, some insurers in the US and Europe looked to secure additional property catastrophe capacity as terms and conditions continued to move in their favor and/or they looked to meet new regulatory requirements and evolving rating agency thresholds.

“While growth in new lines such as mortgage and cyber also continues, slow insurance growth in many regions with low primary insurance penetration saw stable reinsurance demand. Importantly, further evidence of insurer appetite for growth is surfacing in the form of investments in innovative insurer technologies in both organic and inorganic forms.

“Beyond demand increases, insurers in a number of global regions also looked to increase the proportion of protection provided on a multi-year basis as reinsurers in turn looked to lock in participations.

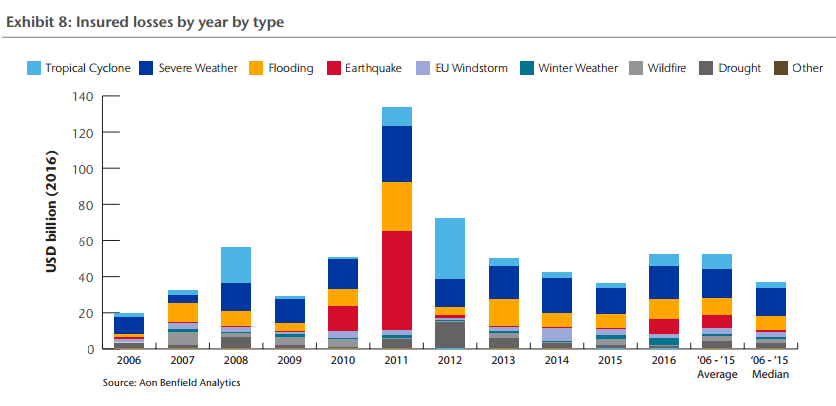

“Insured catastrophe losses ended 2016 at USD53 billion, slightly above the 10 year average for the first time since 2012 and sixth in insured catastrophe loss activity over the last 25 years.

“Despite this, uninsured losses continue to highlight the protection gap in coverage for emerging markets. In addition, macro catastrophe loss impacts on the reinsurance market were mitigated by the higher contribution in loss activity from perils like severe convective storm, flood, and fire that typically result in lower ceded losses.

“As we look to future 2017 renewals, the pick-up of M&A activity in Q4 2016 and potential interest rate increases could signal potential capacity restrictions.

“Our expectation is that these impacts will be slow to manifest and enough excess capital remains in the market to continue the trend for better terms and conditions for insurers seen at January 2017.”

Click here [PDF] to read the full report.