What’s Being Considered For The 2018 Budget?

[Updated] Not moving ahead with the second phase of the payroll tax proposal by the former Government, payroll tax relief for repatriating jobs back to Bermuda; a Professional Services Tax on legal, accounting & other business consultancy services; a sugar tax, and taxing commercial rents are some of the initiatives being considered for the 2018/19 Budget, which is set to be delivered on February 16th.

Saying that Government “want to establish a clear and transparent Budget process,” Premier and Minister of Finance David Burt recently released a 35-page Pre-Budget Report, detailing some of the considerations for inclusion in the budget.

The report noted that the policy options listed “are for discussion purposes and that no decisions on any of the above for the 2018/19 budget have been made,” and they welcome feedback, as they “look to involve as many as possible in the Open Budgeting Process.”

Comments can be emailed to openbudget@gov.bm, and the Finance Minister and Junior Finance Minister will host a public meeting at 6pm on January 30th at St. Paul’s Centennial Hall where they “will give a presentation and open the floor to suggestions, comments and recommendations.”

This Budget will be the first Budget delivered by the PLP Government following their victory at the polls last year.

Update: Opposition Leader and Shadow Finance Minister Jeanne Atherden said, “The Finance Minister has to make a choice on which policy options he will adopt in his budget to produce the desired fiscal result of balancing the budget.

“As the Shadow Finance Minister and Leader of the Opposition, I look forward on February 23rd, as part of the Reply to the Budget 2018/2019, to commenting on the policies presented in Premier Burt’s first budget.”

An extract from the Pre-Budget report [PDF] is below detailing some of the considerations:

“The following are considerations for inclusion in next year’s budget. One of the main objectives of a pre-budget statement is to provide a document that elicits discussion from stakeholders. Prior to finalising the budget, the Government will hold public forums and meetings with stakeholders and discuss the ideas outlined below.

“Payroll Tax

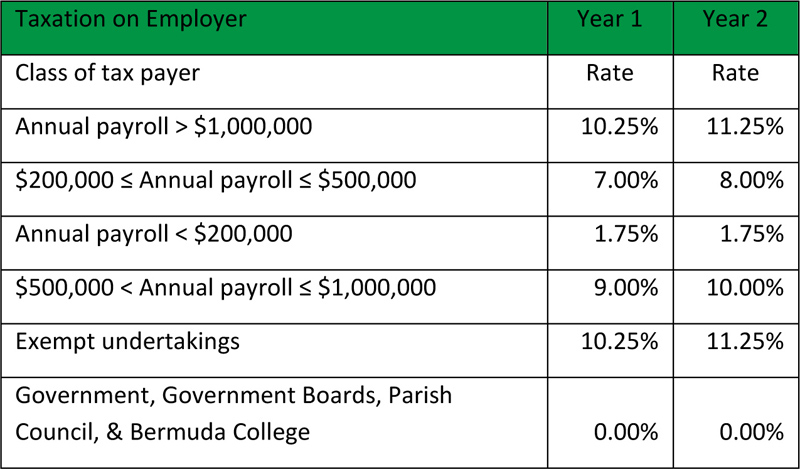

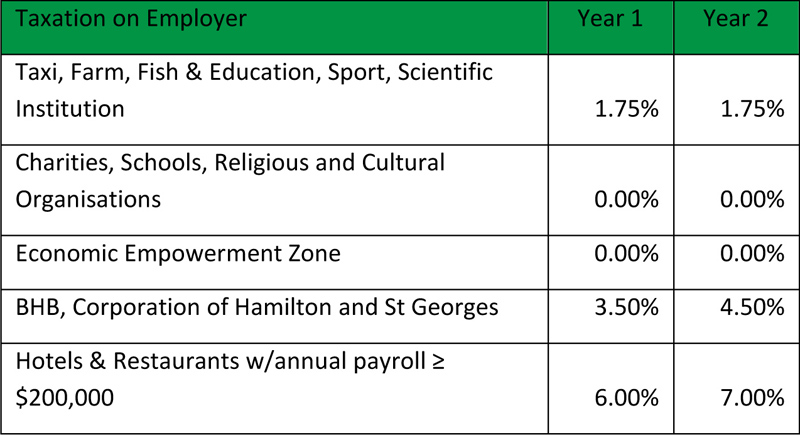

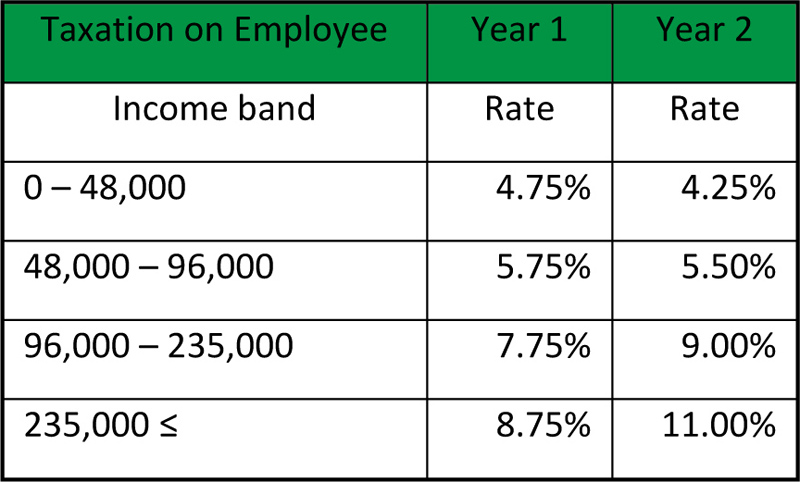

“In 2017/18, the former Government reformed payroll tax, making it progressive, as well as providing additional revenue. Customs duty was also increased, and a new Financial Services Tax on Banks, Insurance Companies and Money Service Businesses was introduced. The former Government’s overall proposals for the 2018/19 budget were as follows:

- “Continuing the payroll tax reform to increase progressivity and provide additional revenue;

- “Increasing customs duty and excise taxes;

- “Introducing a GST; and

- “Various other smaller increases in fees and taxes.

“It was anticipated that these proposals would generate revenue in 2018/19 of $1.110 billion.

“The Payroll Reform was as follows:

“In their latest report, the FRP noted the following: “The current tax structure is excessively weighted towards the taxation of labour and goods and has the perverse effect of taxing companies that create employment while leaving those that do not largely tax free. Payroll tax will become an increasingly problematic source of income as Bermuda’s comparative advantage to international companies as a place to do business is eroded through reductions in rates of corporation tax elsewhere. It will be essential to look for sources of revenue that spread the burden more evenly across the economy.”

“Taking into consideration the above, and the recent US tax reforms, the Government is considering not moving ahead with the implementation of the second phase of the payroll tax proposal put forward by the former Government. This Government is very cognizant of the contribution made by International Business [IB], which is 27% of GDP. With the short time afforded to international business to work out the impact of the US tax reform, we believe that it is wise for this Government to reduce uncertainty and send a clear message concerning the importance of IB to Bermuda’s economy. The Government still intends to lower the rates of payroll tax for lower income workers and will ensure that any measures to offset that reduction from higher earners will not increase the overall payroll tax burden in the economy.

“Incentives to Repatriate Jobs to Bermuda

“We will work very closely with key business stakeholders over the next couple of months to create incentives to relocate jobs to Bermuda and will consider providing payroll tax relief for the repatriation of jobs back to Bermuda.

“Payroll Taxes for the Taxi Industry

“The Government is currently considering a proposal from the Bermuda Taxi Owners Association for an amendment to the Payroll Tax Rates Act 1995. This proposal involves a one-time payroll tax payment per taxi to be paid yearly at the Transport Control Department, in addition to the licensing fee, at or before the end of September.

“Cracking Down on Notional Abuse

“The Office of the Tax Commissioner [OTC] has undertaken a process to review and amend notional income levels for the professions deemed particularly at risk of underdeclaration and has notified the professionals of the revised notionals. As a second step, in the near future, the OTC intends to update the Payroll Tax Act with more objective criteria for determining notionals going forward and will seek to enforce the notionals more robustly in the future. The Government will increase resources at the OTC to perform audits of those declaring notional salaries to cut back on abuse and to ensure that all pay their fair share.

“Financial Service Tax

“In the 2017/18 budget, the former Government enacted the Financial Services Tax Act 2017. This act introduced a financial services tax on insurance premiums, excluding health, money transmissions of a money service business and bank assets. Since the Act came into force, there have been some queries from the financial service providers in the insurance sector with regard to the definition of “gross premiums”, therefore, in 2018/19, the Government will amend the Financial Services Tax Act 2017 to provide for greater certainty.

“General Service Tax

“The General Service Tax [GST] will not be implemented in 2018 as proposed by the previous government, but as an interim measure, the Government is considering implementing a Professional Services Tax [PST] in 2018/19, limited initially to services provided in the legal and accounting professions and other business and management consultancy services. This PST is to be imposed on selected services delivered to companies resident in Bermuda. The tax is to be charged/payable by every registered service provider on the value of services to final consumers or other businesses.

“Customs Duty

“The following are the changes to customs duty currently under consideration by the Government:

- “The Speech from the Throne on 8th September 2017 formally introduced the policy for a sugar tax. The Speech stated: “…the Government will begin consultation for the introduction of a Sugar Tax on the sale of certain foods and beverages in Bermuda.” It is proposed to introduce the sugar tax as an increase in the rate of duty on a limited group of items. The Ministry of Health has already released a consultation paper on this matter.

- “To reduce the cost of certain essential foods and textiles, the Ministry of Finance is considering duty relief on these items.

- “The Ministry of Finance, in consultation with the Ministry of Health, is planning on further increasing the duty on tobacco imports to close the inconsistency between duty rates on cigarettes and tobacco.

“Biennial Fee Increase

“The biennial fee increase is scheduled to take effect this year. All fees will be reviewed to ensure that there is reasonable cost recovery for the provision of the various services offered by a range of government departments.

“Telecommunications Sector

“As an additional revenue measure, the Government is considering increasing fees on cell phones and the Government Authorization fee of 2.5% imposed on the electronic communications industry.

“Commercial Rents

“Some Bermudians have enjoyed the benefits of international business’s continued presence in Bermuda and collect commercial rents from their properties in the City of Hamilton and elsewhere. In order to broaden the tax base, the Government is considering taxing commercial rents. The tax will be charged on persons who rent out commercial properties for rental income. Initially, it is proposed that the tax will be charged on the annual rental value of the property and that certain deductions, such as mortgage payments, will be allowed. There may also be exemptions for certain areas such as the Economic Empowering Zones.

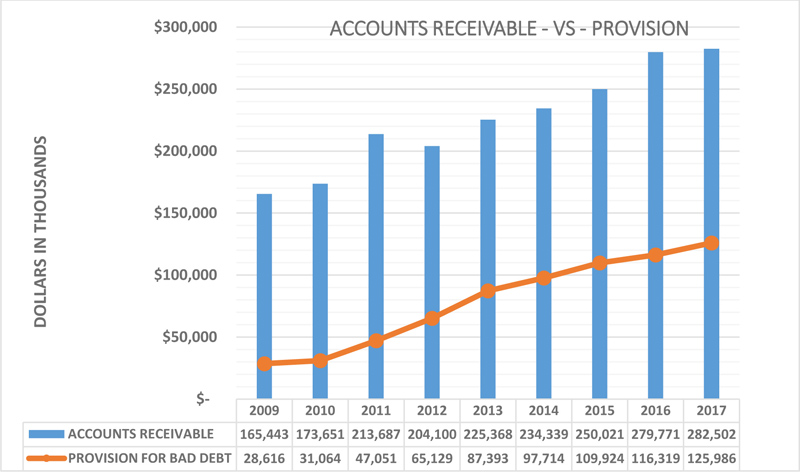

“Tax Collection & Accounts Receivable

“Tax collection and accounts receivable have been a considerable problem for the Government for years and it is time to take additional action.

“The Government will ensure that the Office of the Tax Commissioner [OTC] has the resources that it needs to collect taxes that are due. Due to staffing shortages, not all taxes are being collected and adjudicated. The Government has authorised the filling of these long-vacant posts to assist in revenue collection.

“The Government will also enhance the links between IT systems in government departments to place more restrictions on individuals, homeowners and business who are not current with their tax obligations. These links will also assist the OTC in identifying employers who may be underreporting taxes to better direct resources for enforcement.

“The Government will take additional action by looking at all accounts that are listed as “provision for bad debt”. These accounts will be analysed and those accounts that are deemed collectible and do not have payment plans in place will be handed over to the Debt Enforcement Unit in the Attorney General’s Chambers to take action.

“The Government is considering implementing a Tax Amnesty Programme. The proposed amnesty would provide eligible tax payers with a defined timeline to settle the total amount due in return for forgiveness of the late penalties that have been assessed as part of long-outstanding tax bills.

“The Government emphasises that the policy options listed above are for discussion purposes and that no decisions on any of the above for the 2018/19 budget have been made. During the month of January, the Government will hold public meetings on the above policy options to encourage public debate and discussion on the priorities for the 2018/19 budget. The Government welcomes feedback on this report, as we look to involve as many as possible in the Open Budgeting Process.”

Well he ain’t going to balance the budget.

Not going to reduce it.

Taxing his brothers and sisters won’t help.

Hiring his ace boys….ah naver mind.

2018.

The year of Jack and no bean…

Just a few observations.

Repatriate jobs. Sounds good, but is the exodus of people taking jobs with them during the prior PLP Government. Unless you fire those people the jobs are not coming back. Jobs didn’t go, people took them with them

Commercial rents. Sounds good but all that will happen is that owners will mortgage them and get the deduction, so no tax.

Encourage investment by PRC holders. Only a few months ago there were marches and demonstrations against granting status to PRC holders. Does Premier Burt really think PRC holders will invest here with all the negative actions the PLP take? Invest but receive no rights, no vote and remain second class citizens? Can’t wait to see the small print – hire Bermudians only, must be unionized etc etc. Suddenly the PLP love PRC holders? Laughable, maybe Premier Burt but he isn’t in charge. The people are.

Revenue is not the main issue, Government costs are and they have to be reduced.

Utter b/s.

They seem to want to kill jobs, kill investment, and shrink the economy. I am sure they will succeed.

Yep – keeps their Kool Aid base happy

Knowing personally a healthy handful of ex Bermuda residents that have moved on and taken the job with them, to repatriate them is going to be easier said than done.

Locations the jobs have been exported to that I know of (along with the employee and their family) are Zurich, Manilla, UK, Dublin, USA, Canada, Cayman.

Many of the above moved during the 6 year rule, but not exclusively.

I doubt if any of them would willingly return to Bermuda. They are settled, have more rights now, kids in schools etc. New lives.

The old adage that its easier to knock something down than build it up springs to mind.

To be fair, at least the New Premier is thinking outside the box and trying to rebuild; I just don’t see how this is going to fly.

“a Professional Services Tax on legal, accounting & other business consultancy services; a sugar tax, and taxing commercial rents are some of the initiatives being considered for the 2018/18 Budget”

All of which will be passed on to the consumer.

Everything in this is negative, remember Mr Burt for every action there is reaction, you rsally need to look further down the road

Everything in this is negative, remember Mr Burt for every action there is reaction, you really need to look further down the road