Column: The ‘Goldilocks Economy’ In The USA

[Written by Joseph Sroka]

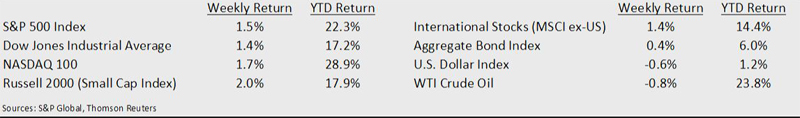

Lots of positives stacked up this past week with the Fed lowering short-term interest rates by 0.25%, a stronger than expected employment report, and continued progress on U.S. – China trade. These along with good third quarter earnings reports pushed the S&P 500 into record territory.

The Federal Reserve lowered its short-term target rate by 0.25% to a 1.50% to 1.75% range.This is the third interest ate reduction of the year and, in our view, probably the last that is needed unless economic conditions worsen.

The interest rate announcement was followed later in the week by a better than expected employment report for October. With low interest rates and strong employment, the U.S. is experiencing what is sometimes referred to as a “Goldilocks Economy”. This is explained below on our Dissecting Headlines section.

Of the 356 companies that have reported 3Q earnings, 76% have exceeded expectations, 8% have met expectations and 17% have reported below expectations. Current expectation is for a 0.8% decline in year/year earnings on 3.7% revenue growth versus last week’s consensus of a 2.0% earnings decline on a 3.4% increase in revenue. For the coming week, 88 companies in the S&P 500 are scheduled to report earnings.

Dissecting Headlines: Goldilocks Economy

You may have seen some financial headlines this past week referring to a “Goldilocks Economy”. Similar to the fairytale when Goldilocks tastes the porridge in the bear’s house, the baby bear’s porridge wasn’t too hot and it wasn’t too cold, it was “just right”.

This reference is carried over as a metaphor for the economy when economic conditions aren’t so hot that inflation and rising interest rates are a worry, but also that growth is not anemic where one would worry about an imminent recession. The economy is just right.

This is the U.S. economy now. Inflation remains contained and the Federal Reserve has been accommodative on monetary policy. Employment is at record levels and, despite some weakness in the manufacturing sector [perhaps due to U.S.—China trade issues], GDP growth has been good.

The worry, of course, is what happens when the bears come home. For now, that does not appear to be an immediate concern, but we are always on the look out.

- Joseph Sroka, CFA, CMT. Director of the BIAS Group of Companies

20 Most Recent Opinion Columns

- 28 Oct: Column: ‘Halloween Nightmare Of Policies, Tax’

- 28 Oct: Column: Earnings & The Halloween Economy

- 28 Oct: Column: ‘Truly Sad To See This Side Of Doctors’

- 28 Oct: Column: Premier Burt Is ‘Failing All Of Us’

- 27 Oct: Column: Will The Premier Keep His Promise?

- 23 Oct: Column: British Virgin Islands Development Path

- 23 Oct: Column: Key Questions Remain Unanswered

- 22 Oct: Column: Corporate Earnings Reporting Season

- 18 Oct: Column: Kempe on Economy, Govt & Policies

- 17 Oct: Column: Proposed $1M RA Budget Increase

- 14 Oct: Column: How Do You Weigh A Live Whale?

- 13 Oct: Column: Working To Build A Digital Economy

- 10 Oct: Column: 1-2-3’s Of The Cultural Tourism Strategy

- 06 Oct: Column: Storms Impact On World Coastlines

- 16 Sep: Column: Work To Turn This Situation Around

- 16 Sep: Column: ‘Clean Up The OBA’s $165 Million Mess’

- 15 Sep: Column: Government Healthcare Reform Goals

- 11 Sep: Carla Seely Column: Trapped In The Middle

- 11 Sep: Column: Rev Foster Was An ‘Iconic Clergyman’

- 04 Sep: Column: Education Minister On SCARS Training

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-