Reviewing The Retirement Age Report Tabled

The Report of the Labour Advisory Sub-Committee entitled ‘Reviewing the Retirement Age’ was tabled in the House of Assembly on Friday.

Premier David Burt said, “Members will recall this Government’s 2018 Speech From the Throne in which we noted the following: ‘The time has come to revise the mandatory retirement age to take account of our longer lifespan, the necessity to add stability to pension funds and to promote greater choice among the working population about when one retires from full-time employment.’

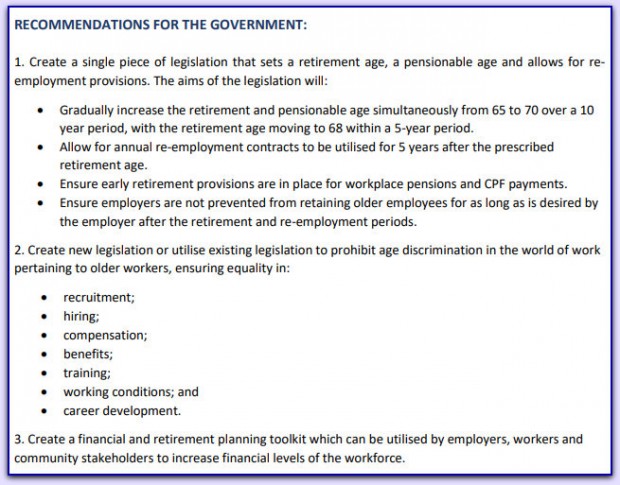

Screenshot from the Report:

“In keeping with the promise to invite the Legislature to ‘discuss options for such revisions to the age of mandatory retirement from the Public Service..’ Honourable Members and the public will have noted from the Order Paper that I will today table a Motion inviting this Honourable House to agree the recommendations of the Report of the Labour Advisory Sub-Committee entitled Reviewing the Retirement Age.

“The Report now tabled for the consideration of Honourable Members provides useful details and a sound rationale in support of its recommendations. There is a need to stabilize pension funds; to allow working men and women the benefit of greater capacity to earn and therefore better prepare for their eventual retirement; and to use the longer lifespan in the modern era to the benefit of the society and the people of Bermuda.

“Mr. Speaker, following the debate on the Report and what I hope will be the unanimous support of this Honourable House and ‘the other place’, the Government will revert with amendments to the Public Service Superannuation Act to give effect to some of these recommendations.”

The Premier’s full statement follows below:

Mr. Speaker, there is a growing tendency to use statistics around our declining birth rate and what is referred to as the “graying of our population” in support of arguments that mitigate against innovation or economic success. Make no mistake, the trends are challenging and are not unique to Bermuda. However, the responsibility of leadership is to convert challenging trends into opportunities for growth and sustainability.

Mr. Speaker, Honourable Members will recall this Government’s 2018 Speech From the Throne in which we noted the following:

“The time has come to revise the mandatory retirement age to take account of our longer lifespan, the necessity to add stability to pension funds and to promote greater choice among the working population about when one retires from full-time employment.”

Mr. Speaker, in keeping with the promise to invite the Legislature to “discuss options for such revisions to the age of mandatory retirement from the Public Service..” Honourable Members and the public will have noted from the Order Paper that I will today table a Motion inviting this Honourable House to agree the recommendations of the Report of the Labour Advisory Sub-Committee entitled Reviewing the Retirement Age.

Mr. Speaker, as was observed in November’s Throne Speech, “in many cases, the designation ‘senior citizen’ does not describe our energetic men and women aged sixty-five and older”. The Report now tabled for the consideration of Honourable Members provides useful details and a sound rationale in support of its recommendations. There is a need to stabilize pension funds; to allow working men and women the benefit of greater capacity to earn and therefore better prepare for their eventual retirement; and to use the longer lifespan in the modern era to the benefit of the society and the people of Bermuda.

Mr. Speaker, following the debate on the Report and what I hope will be the unanimous support of this Honourable House and “the other place”, the Government will revert with amendments to the Public Service Superannuation Act to give effect to some of these recommendations.

I wish to be clear, Mr. Speaker, this initiative is part of a series of measures which will be implemented by this Government to promote more economic activity in Bermuda. The reality of the trends in many societies has caused several countries to take similar steps while concurrently pursuing economic diversification and other growth strategies. We must do the same.

Thank you Mr. Speaker.

The full LAC Sub-Committee: Reviewing the Retirement Age 2018 Report follows below [PDF here]

In a nut shell it all means?

It means almost half of all people will be dead before they see their first social insurance cheque.

You got it!

How will that help those who need to retire early? SMH?

If you thought retirement was beyond comprehension before this should make you giddy.

Is this lowering the cost of living like they promised? Sounds like a sentence to 5 more years of work to me, and even then I’ll be lucky to receive a gov’t pension!! Keep drinking de titty milk!! Hahahahaha!!!

They got us into huge debt. They are increasing taxes every time they speak. And now they want to effectively take away the main part of our pensions – the first five years – the years we are most likely to collect. Taken away by these idiots because they spent the money on useless crap.

They want us in financial slavery for our entire lives.

Not quite. The Government pension scheme has been underfunded for decades. That part of our debt is not solely the fault of the PLP Governments over the past 20 years.

The real problem with the Government pension scheme is that successive Governments, from Sir John Swan until now, have not had the guts to tell civil servants that they cannot continue to have a final salary pension scheme, they must rely on their contributions, not their final salary from Government, for their post-retirement pension payments.

Until that happens, the Government pension debt will only get worse.

Apart from the Civil Service and the courts there is no mandatory retirement law that I am aware of. I will want to retire at 65 and I do not want to have to keep working just to pay more taxes

Agreed Joe… I’m 60 and been planning my retirement for the past 3-4 years…(getting things in place for 65) i don’t want to work past 65.. and really don’t want too!!

And what about all these jobs that force retirement (on full pension) at 55?

You can retire and pay tax or work and pay tax. It’s really up to you. I am going to work and then take a lump sum and go to the DR and blow it all!

And this hurts all young people trying to get into jobs now held by old people who should retire and enjoy their retirement! How is a young person ever going to own their home? Vote OBA!

Shocking made up as they go along politics