Appleby Reports Offshore M&A Activity For Q2

Bermuda experienced a 20% increase in the number of deals in the second quarter of 2013 when compared to the same quarter one year ago, according to a report released today by Appleby. In a healthy second quarter, Bermuda recorded 98 deals accounting for USD7.01bn in value.

The latest edition of Offshore-i, the firm’s quarterly report, which provides data and insight on merger and acquisition activity in major offshore financial centres, focuses on the second quarter of 2013. The report presents a relatively positive picture, suggesting that there may be some stabilisation of transactional activity levels after the volatility of the last few years.

Bermuda Second in Deal Volume Among Offshore Jurisdictions

This last quarter saw Bermuda as the second busiest offshore jurisdiction for two periods running. In addition to holding its position from Q1 2013 as the second busiest offshore jurisdiction, Bermuda’s average deal value and volume held steady, increasing slightly from the previous quarter.

“The significant increase in transactions over the same period last year show that dealmakers are continuing to find value in operating in Bermuda,” said Timothy Faries, Appleby’s group head of corporate and commercial in Bermuda. “With the numbers stable from Q1 of this year to Q2, and with large deals rumored for Q3, we remain hopeful that this pattern will hold.”

In Bermuda’s biggest deal of Q2 2013, investment management company First Pacific announced plans to raise USD500m through a rights issue, with new shares representing 11.1% of the company’s enlarged share capital. Bermuda is also home to the largest rumored deal for Q3 2013 – the expected USD7.1bn 100% acquisition of Bermuda-based China Resources Gas Group by China Resources Power.

Offshore Markets Outlook Positive, with Business Confidence Stabilising after Several Volatile Years

M&A activity across offshore markets in the second quarter of 2013 presents a relatively positive picture, with both the number of deals completed and their value remaining broadly stable compared with Q1. This suggests that there may be some stabilisation of transactional activity levels after the volatility of the last few years.

Cameron Adderley, Partner & Global Head of Appleby’s Corporate & Commercial department comments: “The number of deals has started to form a pattern averaging out around 500 per quarter in five of the last six quarters and so far this year we have seen 493 deals in Q2 and 491 in Q1. We feel comfortable asserting that business confidence is at last returning to the markets.”

Frances Woo, Appleby’s Group Chairman added: “When we look to gauge the relative strength of the offshore markets as compared to other major world regions, this quarter we find these numbers are encouraging with the offshore markets now ranking sixth globally in terms of cumulative deal value, only just behind South and Central America. The offshore market is more active than Oceania, Africa and the Middle East. And when we look at average deal size we again find a source of positive news; here the offshore region ranks third globally, behind only North America and South and Central America in Q2 2013.”

Global Offshore Market: Q2 2013

The key themes emerging from the report show that in the second quarter of 2013:

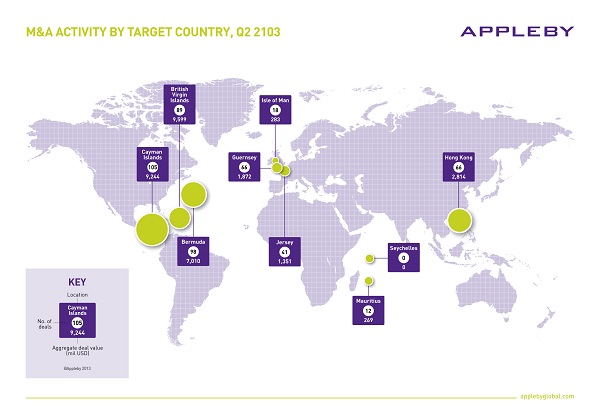

- There were 493 deals involving offshore targets completed with an aggregate value of USD31.6bn, putting the quarter slightly ahead of Q1 2013.

- The average offshore deal size was USD64m for Q1 2013, the same as for 2013 to date. If this is maintained or improved, to the year end, deal sizes in 2013 would be greater than they have been in at least five of the last eight years.

- By average deal size the offshore region ranks 3rd globally, behind North America and Central and South America in Q2 2013.

- Acquisition activity led by companies incorporated offshore rebounded in Q2 2013 after a weaker first quarter, and there were 426 deals with a cumulative value of USD34bn, up 11% in terms of volume and 29% by value.

- In Q2 there were only three deals announced valued in excess of USD1bn. Instead the majority of money was spent in the mid-market on transactions valued at between USD200-700m. We see this strengthening of the mid-market as a crucial step towards recovery.

- Finance and insurance deals continued to drive the offshore M&A markets with 168 deals with a combined value of USD10bn, up quite considerably on Q1 2013, when there were 147 deals in the sector worth USD6.5bn.

- The most popular deal type was the minority stake transaction, of which there were 295 that contributed USD11.5bn to the cumulative deal value for the quarter.

- Hong Kong acquirers spent the most money in Q2 2013, with an aggregate deal value of USD13.7bn that represented 40% of total spending by offshore acquirers.

- Initial Public Offering activity is looking increasingly bullish, with both the volume and value of IPOs up considerably in Q2 2013 with 17 deals and a cumulative value of USD2.4bn. Q2 2013 was the best quarter since 2011 for IPOs and planned IPOs, with 39 deals in total worth USD4.1bn.

Strength of the offshore market globally

In comparison to other major world regions, the offshore world has seen its global position remain at sixth in terms of cumulative deal value, with more money spent on offshore registered businesses than on those in Africa and the Middle East combined. The offshore market has also seen more deal volume than Central and South America, Africa or the Middle East.

In terms of average deal size in 2013, the offshore market is ranked 3rd globally, behind only North America and Central and South America, and with an average deal size of USD64m. This puts the offshore sector above Western Europe [USD60m] and the Far East and Central Asia [USD36m]. The offshore markets accounted for 3% [USD31.6bn] of all global economic deal values which stood at a total of USD1.1tr for the second quarter of 2013.

“These numbers are encouraging,” says Cameron Adderley, “the offshore market is definitely gearing up for an increasingly active period. ”