BMA: Strong Underwriting Statistics For Insurers

The Bermuda Monetary Authority today released the latest underwriting statistics for Bermuda’s international insurance market.

The Bermuda Monetary Authority today released the latest underwriting statistics for Bermuda’s international insurance market.

Craig Swan [pictured], Managing Director, Supervision, at the Authority said, “These statistics demonstrate the continued significance of the Bermuda [re]insurance marketplace and underline its major role in the world’s risk transfer industry.”

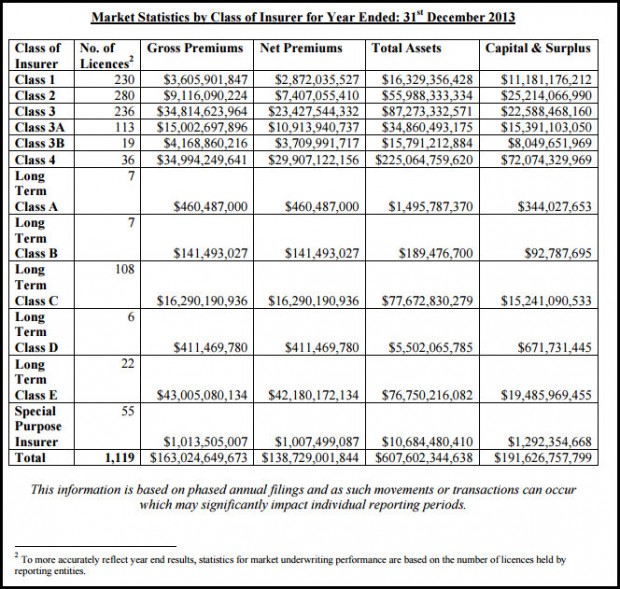

“Bermuda’s insurance sector recorded $163.0 billion in gross premiums – an increase of 35.3% year on year,” Mr. Swan said.

“Aggregate net premiums written were $138.7 billion, up 41.4% from the $98.1 billion written the previous year.”

“Overall, the market recorded aggregate total assets of $607.6 billion and held aggregate capital and surplus of $191.6 billion,” Mr. Swan said.

Looking specifically at Bermuda’s commercial re/insurers, gross premiums written were $130.1 billion, total assets were $482.2 billion and capital and surplus was $138.3 billion.

Bermuda’s captives wrote $32.9 billion in gross premiums and reported total assets of $125.4 billion. Reported capital and surplus for Bermuda’s captives was $53.3 billion.

In terms of Q1 2015 registrations, the Authority registered 14 new insurers and five insurance intermediaries during the first three months of 2015. This compares to 12 new insurers and four new intermediaries recorded during Q1 2014.

“These statistics clearly demonstrate the market’s continued resilience in the face of increased competition and a prevailing soft market,” Mr. Swan said. “Bermuda’s remains one of the world’s most important insurance markets.”

For those of us Mr. Craig Swan who aren’t “savory faire”, out of all them billions of dollars, what percentage does the Bermuda Government get? Inquisitive minds would like to know.

40% increases equals to how many additional Bermudian jobs