$208 Billion Paid To US Customers Since 1997

Bermuda reinsurers paid out US$208.7 billion to US policyholders and cedants for large catastrophes, related property insurance and general liability losses over the past 20 years, according to commercial market claims data collected by the Bermuda Monetary Authority.

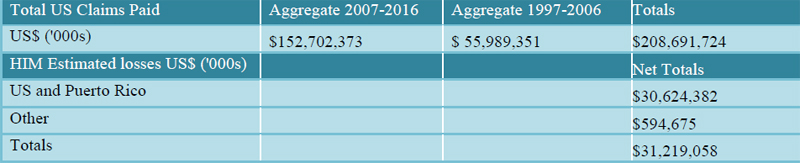

“From 1997 to 2006, claims payments to US policyholders and cedants totalled US$56.0 billion; between 2007 and 2016, this increased significantly to US$152.7 billion,” the BMA said.

“More recently, the devastating 2017 hurricanes Harvey, Irma and Maria [HIM] led to recorded estimated losses of US$31.2 billion net of reinsurance costs for Bermuda [re]insurers. Of this amount, the US and Puerto Rico accounted for US$30.6 billion net.

“Based on publicly available catastrophe loss estimates, Bermuda reinsurers will be picking up 30% of the Harvey, Irma and Maria losses from this record-setting hurricane season. This information comes from the BMA’s first US Data Claims Survey completed earlier this month.

“The loss information includes both direct insurance and reinsurance. A total of 250 companies responded to the survey including both commercial insurers/reinsurers and alternative capital entities and insurance linked securities funds.”

Craig Swan, Managing Director, Supervision [Insurance] said, “The $30 billion or 30% of US losses paid by Bermuda [re]insurers demonstrates the key role Bermuda plays in the supply of risk capacity to that country.

“In fact, the survey results show the significance of the Bermuda [re]insurance market’s contribution to the US over the past two decades. US insurers cede risk to Bermuda, diversifying that risk globally, making the cost of buying insurance – particularly property/catastrophe insurance – more affordable to customers living in US danger zones.”

“The Authority is grateful to the companies that took part in the survey,” Mr. Swan said. “This data and the European Union [EU] claims data released in September [over $70 billion was paid out by Bermuda reinsurers to EU policyholders and cedants over the past 20 years] demonstrates the valuable role Bermuda plays in diversifying risk globally in an increasingly competitive world marketplace.”

According to the Standard & Poor’s Global Reinsurance Highlights 2017, 13 of the top 40 global reinsurance groups ranked by net premiums written are domiciled in Bermuda and regulated by the BMA.

Now THIS is the type of data we need our Premier to showcase on a global scale as it highlights Bermuda as a partner worldwide and shows that we support global outcomes!

Take this on a road show!

Yes, but in light of their Paradise Papers “issue,” can we trust a single word that comes out of the BMA’s mouth? Who else do they have special deals with? Who else on the island failed to meet compliance criteria but were given 5 years to correct themselves??

Yes BMA, that’s on you.