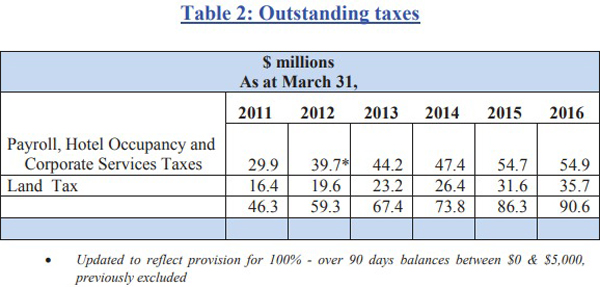

Tax Arrears Of $90.6 Million As Of March 2016

“As at March 31, 2016, the amount of payroll, hotel occupancy, corporate services and land taxes greater than 90 days in arrears was $90.6 million,” according to the recently released Auditor General’s report.

The report said, “As the unfunded liability increases, arrears of payroll and other taxes and pension contributions also continue to increase. Measures to reduce taxpayer indebtedness to Government have been largely unsuccessful.

“More effective collection of outstanding revenue by Government would help reduce the need for borrowing along with its associated finance costs.

“As at March 31, 2016, the amount of payroll, hotel occupancy, corporate services and land taxes greater than 90 days in arrears was $90.6 million compared to March 31, 2011, when the comparative amount owed was $46.3 million. Table 2 below shows Payroll, Hotel Occupancy, Corporate Services and Land Tax as at March 31 greater than 90 days in arrears: ”

“In the previous report regarding the Consolidated Fund, it was recommended that Government should establish and communicate a plan to address taxpayer indebtedness. In its response, the Ministry of Finance agreed and indicated that the Government was looking at increasing resources in its Debt Enforcement Unit [DEU] to assist with debt collection as this was a high priority of Government.

“Whatever actions have been taken in the intervening years, Table 2 shows that they have not been successful. Accounts receivable of the Office of the Tax Commissioner have increased by $37.3 million [approximately 20.5%] over the five-year period ended March 31, 2016. The provision for doubtful accounts has increased over the same five year period by $43.5 million [approximately 114%].

In noting the Ministry of Finance Response, the report said, “Government continues to place a high priority on collecting outstanding pension contributions and taxes. Unfortunately due to the extended recession there are many small businesses that have struggled to meet their tax obligations in a timely fashion. This has resulted in some increases in the level of indebtedness to Government.

“Government will work with these businesses to make suitable arrangements. However, there are others who simply ignore their obligations. For this group, Government will continue to use all available means to collect overdue taxes, thereby improving Government’s cash flow and reducing its need for borrowing.

“The Tax Commissioner have their own debt collection resources. The Tax Commissioner pursues taxpayers and once all efforts to collect receivables have been exhausted, the debt may be referred to the DEU of the Attorney-General’s Chambers for Supreme Court Writs. The Government understands that increased cooperation and liaison between Government departments can be quite effective in increased tax compliance.

“Currently revenue collecting departments are supported by the various Departments who will withhold permits and vehicles where taxpayers are in arrears with taxes. Government has also used the offsetting provision in the legislation that allows Departments to claw back any monies due to taxpayers from Government [i.e. Works and Engineering contracts].

“Also, Departments have set up installment plans and have successfully progressed matters in the courts through the Department of Public Prosecutions. The Tax Commissioner, the Director of Department of Social Insurance and the Director of Public Prosecutions have held a series of meetings to address the situation of delinquent employers and unpaid Payroll Tax and Social Insurance Contributions.

“The Tax Commissioner and the Director of Social Insurance will start to forward employer files to the Director of Public Prosecutions for prosecuting employers, companies and individuals, for offences related to delinquent payments pursuant to their respective legislation.

“The Ministry recognizes that further action is required in order to facilitate the settlement of Government debt as a priority and will provide the appropriate resources required to meet this objective.”

The Auditor General’s Report follows below [PDF here]:

Ok Cool, thats why im poor. Thanks PLP

OBA was the governing party in 2016

What a loser.

And the PLP was the governing party in 2011 and 2012. And on March 31, 2013, the OBA had been in power for 3 months. Most of this $90m uncollected was under the PLP.

Why can’t the govt collect the taxes that are due????

Why should the rest of us pay more taxes when they can’t even be bothered to collect the taxes they’re already owed?

“Government continues to place a high priority on collecting outstanding pension contributions and taxes. Unfortunately due to the extended recession there are many small businesses that have struggled to meet their tax obligations in a timely fashion. This has resulted in some increases in the level of indebtedness to Government”

Some increases? The increase in debt over the 5 years covered is nearly double! If a business is unable to pay its debts it is bankrupt and allowing it to continue trading is rewarding poor behaviour.

This is totally unacceptable. There should be an integrated system and personnel that works to not only collect taxes but immediately impose harsh penalties like stopping offenders from travel, withhold renewal of drivers licences, and file immediate court appearances for arrears over 30 days.

You would think that this would be a very high priority for Government given Bermuda’s crippling deficit.

What crippling deficit! I thought the bit coin bailed us out.

How much money are all the new taxes expected to raise and how does this compare to the $90 million owed? Applying more taxes to make up for already unpaid taxes is quite plan. If I stopped paying land tax I think I know what would happen.

Not in Bermuda apparently. In the US houses are sold all the time for unpaid taxes. In Bermuda, paying tax is optional!

why should I pay my taxes ???????????

who are those “late ” payer ?

make all names public to enable us to judge .

maybe we will find some friends and family members

Why are we still not told the exact amount of our current debt?

It would also help to collect taxes if the government updated their records in a timely manner. My Land Tax bill has had the wrong address for the past 6 years. I’ve advised them and they say that it will be corrected on the next billing cycle, but it still hasn’t been done. I have to contact them every time I want to pay my Land Tax bill. Ridiculous.

Don’t feel bad. For years they sent me a bill for a building that had been TORN DOWN. Yes, they had been notified multiple times that the building no longer existed.

The reality is that many, many businesses can simply not meet the tax bill – mine included. We are not even treading water, we’re slowly sinking using up our capital reserves. Bob Richards did not give a damn and spent his days giving away the country to foreign interlopers whilst being dismissive of local firms in the most arrogant and derogatory ways – often straight to our face. There should be a tax amnesty because of the damage he and his lot incurred.

How did Bob Richards hurt your company? You do realise the PLP has and is going to inflict more tax hurt on small businesses via their slew of tax hikes and institution of minimum wage.

So please explain in detail how Bob Richards hurt your business. And if you are going to blame tax increases then you better look at your beloved PLP and their $400mn annual deficits as the root cause.

* And if you are going to blame tax increases then you better look at your beloved PLP and their $400mn annual deficits as the root cause.*

And that’s it folks . In a nutshell .

Maybe if Government spent tax money in a responsible way taxpayers would be more inclined to pay taxes. So far Government makes no effort to cut expenses. Maybe some taxpayers are protesting with the only weapon they have. Withholding payment.

Nice to see you for once being critical of your beloved OBA…You do know the stats state that the arrears nearly doubled under their leadership?

From $59.3 to $90.6 is “nearly doubling”? You need a new calculator mate. What you’re using there is called “Burt math”.

Better wind the string around that top & try to spin it again. IMO Government has been wasteful for many many years under the UBP. The PLP took it to a whole new level with the bloating of the civil service.

If you have a tax errears you must understand why!

It would be interesting to know what mechanisms are in place to collect these taxes, and have they been used regularly. Everyone, and every business has fallen into arrears. How has the economy affected the average business

Perhaps the Chamber of Commerce has it’s finger on the pulse and would like to offer a comment. What portion is owed by us as citizens. Is there a need for a variety of education tools needed to help raise awareness of the situation, as well as a penalty free period to get the taxes paid or establish a payment schedule.

Certainly need to applaud those who have paid their taxes regularly, as well as applaud those who are facing challenges and have been in contact with the tax office Bermuda is described as the third richest nation in the world, does that mean the two nation’s ahead of us owe no debt to the tax office.

How can Bermuda be anywhere near the top of being wealthy what we have a $2.5B debt which per person is way higher than even the US. This happened virtually overnight through very poor fiscal management. Take a guess at who was in power when it happened.

There seems to be a very clear pattern of poor tax collection during the oba years. It should be fairly consistent regardless of who’s in power.

You do realise it got to $59.3m under the previous PLP don’t you?

err , the stats clearly show that at 2012 they were already up to 59mil uncollected , so this clearly didn’t begin with the OBA.

But who wants to pizz off potential voters by haranguing them for unpaid taxes ?