UK MP Brings Up ‘Sanction Of Direct Rule’ Again

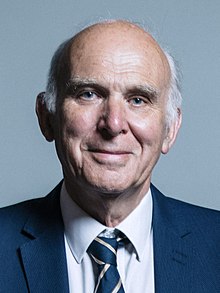

British Liberal Democrats leader Sir Vince Cable has again brought up the concept of instituting direct rule over the British Overseas Territories, asking the Minister whether he agrees that if the Territories “will not reform we should resort to the sanction of direct rule.”

British Liberal Democrats leader Sir Vince Cable has again brought up the concept of instituting direct rule over the British Overseas Territories, asking the Minister whether he agrees that if the Territories “will not reform we should resort to the sanction of direct rule.”

This is not the first time the British politician has mentioned direct rule, as following the Paradise Papers matter in 2017, he suggested the UK impose the “sanction” of direct rule if “our dependent territories and crown colonies will not uphold basic standards on tax.”

While he may be suggesting it, in reality the party Sir Vince Cable leads holds less than a dozen seats in the 650 seat British House of Commons, so he actually does not hold the power to implement a colonial-style direct rule, which is a drastic scenario in which the UK would effectively take over many aspects of governing the Territories.

While the concept of direct rule does not appear to have widespread support among British politicians, legislating for the territories does, with a bill gaining enough support to pass last year, and this conversation happened as MPs were discussing the UK’s plans to force Overseas Territories — including Bermuda — to make their beneficial registers public.

A beneficial ownership register is a database of information on business owners, and while the vast majority of nations worldwide do not make theirs public, the UK does, with their register going public in 2016.

The Bermuda’s Government’s position over the years has been that they maintain a register, provide information to official entities at request and will make the register public when it becomes world standard, which it currently is not.

However, last year the British Parliament invoked their power to pass legislation to order Overseas Territories to implement public registers, a move which was condemned by some the island’s elected leaders as an act of colonialism.

The British Government previously confirmed that the UK “will prepare draft legislation by the end of 2020, with all Overseas Territories expected to have fully functioning public registers by the end of 2023,” a timeline some British MPs have complained is too slow.

According to the Hansard from a recent sitting of the British House of Commons, Conservative MP Nigel Mills asked the Minister of State,“What recent discussions the Government have had with authorities in the [a] overseas territories and [b] Crown dependencies on establishing public registers of the beneficial ownership of companies.”

In response, the Minister of State Sir Alan Duncan said, “Lord Ahmad, the Minister responsible for the overseas territories, along with the Prime Minister’s anti-corruption champion, my hon. Friend John Penrose, discussed the Government’s approach to the Sanctions and Anti-Money Laundering Act 2018 with overseas territories leaders on 5 December. Government Ministers and officials routinely discuss with the Crown dependencies a range of matters relevant to them, including company registers of beneficial ownership.”

Mr Mills then asked, “What date the Government will set in the Order in Council if the overseas territories do not move voluntarily on this issue, and will he confirm that the end of 2023 will be far too late, given that it would be five years after the House voted on it?”

In response, the Minister of State Sir Alan Duncan said, “As required by the 2018 Act, we will prepare draft legislation by the end of 2020. All the overseas territories are expected to have fully functioning public registers in place by the end of 2023, as my hon. Friend says, as part of the Government’s call for all countries to make such registers the global norm by that date. The plan is to make 2023 consistent for both.”

Leader of the Liberal Democrats Vince Cable asked the Minister of State, “From the vantage point of having introduced the original public register, may I ask the Minister whether he agrees that it is utterly intolerable that British territories and dependencies should be used as a covert conduit for British tax dodgers, and that if they will not reform we should resort to the sanction of direct rule?”

In response, the Minister of State, said, “We will stick by the timing, but I think that a lot of work has already been done so that they could perhaps be in place before that date. I am confident that progress is being made as we would wish.”

Shadow Minister of Foreign and Commonwealth Affairs Helen Goodman asked the Minister of State, “Over and over again the Government have let the overseas territories off the hook. Now the Government are saying that the territories do not need to have public registers of beneficial ownership until 2023—at a cost, incidentally, of £50 billion to the British taxpayer. The law we passed last May required the Government to act in 2020. Does that not take the Government’s contempt for Parliament to a new low?”

In response, the Minister of State Alan Duncan said, “No. I share the hon. Lady’s view that overseas territories with financial centres should meet international standards on tax transparency and anti-money laundering, but most overseas territories are either being evaluated or due to be evaluated by the financial action taskforce and are working to deliver their commitments made to the European Commission to prevent them from being included on the EU’s list of non-co-operative tax jurisdictions.”

The continued discussions in British Parliament about the Territories and the British Parliament invoking their rarely-used ability to pass laws for the self governing islands comes as the UK is embroiled in Brexit, with the UK preparing to leave the European Union in a few weeks.

Read More About

Category: All

Vince Cable is nothing but a prat talking prattle. The UK cannot impose direct rule over a colony except in very special circumstances. Even a quick look at Wikipedia would have told Vince Cable that.

Our government must take us to independence. Remaining attached to THE GREAT BRITAIN, is ridiculous!!

Why?

Let’s 1st have them focus on difficult things like the bus schedule.

The British Government would do a much better job than the plp