Govt: 2019/20 First Half Fiscal Performance

The Ministry of Finance today [Dec 23] reported on the 2019/20 First Half Fiscal Performance and provided an updated Economic Review for 2019.

The Ministry said that highlights include:

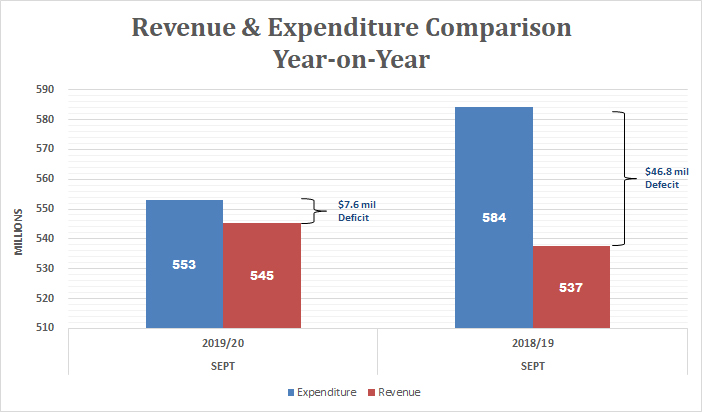

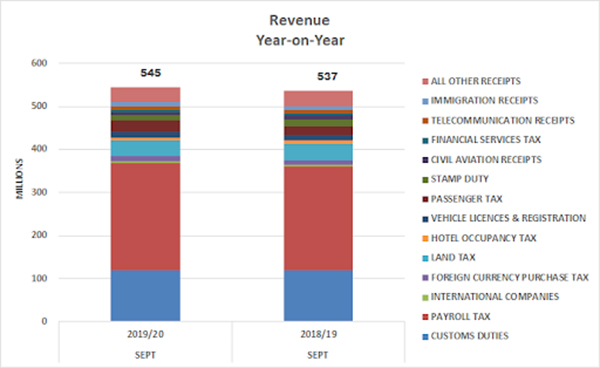

- “Total Revenues of $545.4 million [Up $7.9 million versus First Half 2018/19]

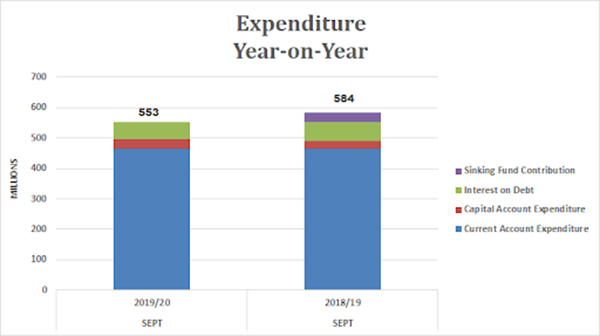

- “Total Expenditure of $552.9 million [Down $31.4 million versus First Half 2018/19]

- “Interest Expense of $58.3 million [Down $3.4 million versus First Half 2018/19]

- “Deficit of $7.6 million [Down $39.2 million versus First Half 2018/19]

2019/20 First Half Fiscal Performance:

“The headline numbers for the 2019/20 National Budget are as follows: a revenue target of $1.12 billion; current expenditure of $1.05 billion, including debt service; capital expenditure of $64.7 million; and a projected surplus of $7.4 million.

“Revenues for the six months ending September 2019 are $545.4 million; this is $7.8 million [1.4%] higher than in September 2018. It should be noted that the increase in revenue is due to a larger collection in Customs Duty, Payroll Tax, Foreign Currency Purchase Tax, Telecommunication Receipts and Passenger Tax which are offset by lower receipts in Land Tax, Hotel Occupancy Tax, Stamp Duty, Civil Aviation Receipts and All Other Receipts.

“In general total revenues are tracking slightly below budget estimates, however the strength in Payroll Tax and Passenger Tax receipts increases the chances of meeting the total revenue target for the current fiscal year.

“Current expenditures, excluding debt service, are presently tracking 0.05% or $0.2 million below budget estimates. It should be noted that in certain instances expenditures are not made evenly over the year which may distort actuals when compared to budget;.

“The $463.7 million spent in the first six months of 2019/20 represents approximately 49.9% of the total current account budget of $929.9 million and are over $200,000 less than the first six months of 2018/19.

“Capital expenditures for the period ending September 2019 are $4.4 million higher than in September 2018. This is primarily due to a new capital grant for WEDCO to develop King’s Wharf and various other on-going Ministry of Public Works development projects.

“Total current and capital spending to date, excluding debt service, is $4.2 [0.85%] million higher than last year’s spending.

“Interest expenses are tracking 5.8% or $3.4 million lower than 2018. This is due to lower debt levels and strategic Asset/Liability Management by the government in which relatively expensive debt has been refinanced by less expensive debt.

“The $58.3 million paid in interest expense represents 10.7% of the revenue collected for the period which beats September 2018 in which 11.5% of the revenue collect was used to pay interest.

“For the first six months of 2019/20 Government incurred a deficit of $7.6 million, compared to a deficit of $46.8 for the corresponding period in 2018/19. This deficit was financed by a Credit Facility with a local financial institution.

“Gross debt at the end of September 2019 stood at $2.7 billion. Net of the Sinking Fund debt was $2.56 billion. During this period Government had to borrow $88.5 million to make good on its guarantee and purchase the interest of the Tranche B lenders for the Caroline Bay project. In October the Government incurred an additional $81.5 million in borrowing to make good on its guarantee and purchase the interest of the Tranche C lenders for the Caroline Bay project.

“The Caroline Bay project will result in the Government incurring additional interest expenses of approximately $4.0 million in this fiscal year and other expenses relating to professional services and the amount owed to contractors and sub-contractors associated with this project.

“The increase in borrowing runs counter to the plan that was outlined in this Government’s budget statement in February which stated that we had no plans to incur any additional long-term borrowings in this fiscal year. While this turn of events was unplanned, the Government’s commitment to being prudent stewards of the public purse remains unchanged.

Bermuda Economy 2019: Mid-Year Economic Review

Summary Economic Indicators: Mid-Year Economic Review 2019

*Comparative data over the first half of 2019, except when otherwise indicated.

- “The year to date [August] average Consumer Price Index was 1.0% and the 12 month average rate was 1.0%. The primarily causes of inflation during the last twelve months were increased costs in Health Insurance premiums of 3.1% in April and increases in the average costs of various food items throughout the year.

- “Imports increased by 15.2% over the first two quarters of the year to register at $603 million. The majority of the increase can be attributed to a $65.5 million or 88.3% gain in the imports for machinery due in large part to BELCO’s new generator. The other category that contributed significantly to the rise in the level of imports was finished equipment.

- “Air arrivals during the first three quarters of 2019 fell by 4.5% while the number of cruise passengers increased by 14.2% over the same time period. Total visitor arrivals were up 7.4% versus a year ago.

- “Total air visitor spending in the first nine months rose by $12.1 million or 3.8% settling at $327.5 million.

- “There were 12,015 international companies and partnerships registered in Bermuda as of September 2019, representing a 1.2% decrease compared to the 2018 total of 12,156.

- “476 new international companies and partnerships were registered in Bermuda during the first nine months of 2019 representing a 19.2% decrease when compared to the 2018 registrations of 589.

- “Total value of new construction projects started for the first six months of this year fell by 19.3% from $62.1 million to $50.1 million. This decrease was due largely to Government funded projects which began in the first half of 2018 not being duplicated to the same extent in 2019.

- “The estimated value of construction work put in place was $136.4 million, an increase of 20.3%. The majority of the growth can be attributed to work performed on hotels and guest houses.

- “Based on preliminary estimates from the Office of the Tax Commissioner, employment income for the first 6 months of 2019 increased by $72.9 million to $1.885 billion, an increase of 4.0% when compared to the first 6 months of 2018. This level of compensation represents one of the highest on record.

- “Total retail sales for the first seven months of 2019 decreased by 1.5% or $9.8 million to register at $656.3 million.

- “Bermuda’s Balance of Payments for the second quarter of 2019 recorded a surplus on the current account of $161 million, which was $29 million less than the corresponding surplus in 2018. The decrease in the current account surplus was due in large part to an $11 million decline in financial services and a $10 million decrease in employee compensation.

- “Based on figures released by the Bermuda Monetary Authority, Bermuda’s money supply contracted by 1.5%, or $52 million, year over year at the end of the first quarter of 2019. The money supply declined mainly due to a decline in local customer deposit liabilities which were down 2.0% or $64.7 million.

- “The Banking sector’s total assets declined by 0.5% or $0.1 billion at the end of March 2019. The reduction was driven by a decrease in investments which fell by 4.3% or $0.4 billion over the past year.

- “Loans & Advances fell marginally by 1.2% over the first quarter of 2019 while customer deposits contracted by 1.6% or $0.3 billion for the same time period.

“Over the course of 2019, the economy has experienced a shift in the outcomes of a few of the indicators when compared to 2018. This year air arrivals are down after experiencing a revival over the last few years and imports and employment income have grown after declining last year. However, total visitor numbers, construction levels and the low level of inflation continue to have a positive effect on the economy.

“Conversely, retail sales and international company registrations continue to offset the positive aspects of the economy. Throughout the economic swings, the Government continues to make a concerted effort to stimulate domestic spending and foreign investment in Bermuda through targeted investment strategies and diversification of business development initiatives. This should lead to higher employment numbers providing sustained economic growth in most sectors.”

The decrease in spending clearly shows financial discipline by the government under Premier Burt and Minister Dickinson.

The narrative that spending is out of control is clearly muted by these statistics although certain segments of society will continue to run with them.

How much of this is due to suspended payments to the sinking fund?

Ya it doesn’t fit there we are all doomed under the PLP narrative.

Their*

And it would have been much better if it wasn’t for Caroline Bay…

True, but that was a potential problem known about before the budget was released. There should have been a contingency amount included but then the PLP couldn’t say there would be a budget surplus. Not accepting facts come back to bite.

You haven’t actually read the full report, have you? Let me trim the fat just a little.

“The primarily causes of inflation during the last twelve months were increased costs in Health Insurance premiums of 3.1% in April and increases in the average costs of various food items throughout the year.”

“Imports increased by 15.2% over the first two quarters of the year…. due in large part to BELCO’s new generator”. i.e. a on-off

“Air arrivals …. fell by 4.5% while the number of cruise passengers increased by 14.2% over the same time period. Total visitor arrivals were up 7.4% versus a year ago.” Much more income comes from air arrivals.

“Total air visitor spending in the first nine months rose by $12.1 million or 3.8% settling at $327.5 million” Compared to the previous period? Conspicuous lack of data here.

“There were 12,015 international companies and partnerships registered in Bermuda as of September 2019, representing a 1.2% decrease compared to the 2018 total of 12,156.” A decrease, and how many of these employ real people?

“476 new international companies and partnerships were registered in Bermuda during the first nine months of 2019 representing a 19.2% decrease when compared to the 2018 registrations of 589″. A decrease, and how many of these employ real people?

“Total value of new construction projects …. fell by 19.3% from $62.1 million to $50.1 million”.

“The estimated value of construction work put in place was $136.4 million, an increase of 20.3%. The majority of the growth can be attributed to work performed on hotels and guest houses”. Good news, on the face of it. Prwsumably this includes Morgan’s Point?

“Based on preliminary estimates from the Office of the Tax Commissioner, employment income for the first 6 months of 2019 increased by $72.9 million to $1.885 billion, an increase of 4.0% when compared to the first 6 months of 2018. This level of compensation represents one of the highest on record.” And is exactly what will drive employers away.

“Total retail sales …. decreased by 1.5% or $9.8 million to register at $656.3 million.

“Bermuda’s Balance of Payments …. recorded a surplus on the current account of $161 million, which was $29 million less than the corresponding surplus in 2018″

“Bermuda’s money supply contracted by 1.5%, or $52 million, year over year at the end of the first quarter of 2019″

“The Banking sector’s total assets declined by 0.5% or $0.1 billion at the end of March 2019″

“Loans & Advances fell marginally by 1.2% over the first quarter of 2019 while customer deposits contracted by 1.6% or $0.3 billion for the same time period.

And you think that this is good news????

Please note they intentionally left out the sinking fund along with whatever else to fudge the results.

“The narrative that spending is out of control is clearly muted by these statistics although certain segments of society will continue to run with them.”

Similar to all the lies the plp continue to tell about the Americas Cup?

What lies have the PLP told about the America’s Cup? The only ppl lying or omitting truth about the America’s Cup is the OBA and their failure to include the 39 million dollar Cross Island in their little report.

I can well remember the PLP going around saying the AC had cost $140m during the election campaign. ‘$140m given away to billionaires’ is how they characterized it.

“The only ppl lying or omitting truth about the America’s Cup is the OBA and their failure to include the 39 million dollar Cross Island in their little report.”

There we have it, the independent PWC report is clearly being dismissed by the PLP and its supporters as a “little report”.

Looking at the half year numbers compared to the 2019/20 budget, there needs to be some significant changes in the second half. Revenue will need to be $30m more and spending $56m less to have a budget surplus (ignoring the $50m or so not paid int the sinking fund). Seems highly unlikely. That’s an $86m movement, and to get close to that there will need to be some major spending cuts, or increase in debt.

Looking at the half year numbers compared to the 2019/20 budget, there needs to be some significant changes in the second half. Revenue will need to be $30m more and spending $56m less to have a budget surplus (ignoring the $50m or so not paid int the sinking fund). Seems highly unlikely. That’s an $86m movement, and to get close to that there will need to be some major spending cuts, or increase in debt.

“Current expenditures, excluding debt service, are presently tracking 0.05% or $0.2 million below budget estimates”

Yes, I could change the appearance of my financial appearance by not paying (or saving to pay principal) and paying interest only. That is the effect of abandoning payments into the sinking fund.

“The increase in borrowing runs counter to the plan that was outlined in this Government’s budget statement in February which stated that we had no plans to incur any additional long-term borrowings in this fiscal year.”

Then why borrow $50 million more than you needed to borrow?

“Then why borrow $50 million more than you needed to borrow?”

25-11

family and friends

plantation questions.

know your place.

Thanks to you UBPers/oba Bermuda has to pay 185 mill for a hotel. Now run along and tell Jetgate Craigy what to say as the strings are pulled.