Bermuda Hosts Financial Technology Summit

Bermuda this week hosted a two-day summit [January 29-30] on financial technology which included Mr. Arjoon Suddhoo, the Commonwealth Deputy Secretary-General, as well as representatives from central banks in the Americas and Europe.

“This was a small, private, invitation only conference of approximately 20 attendees, funded entirely by the Commonwealth Secretariat,” A Government spokesperson explained.

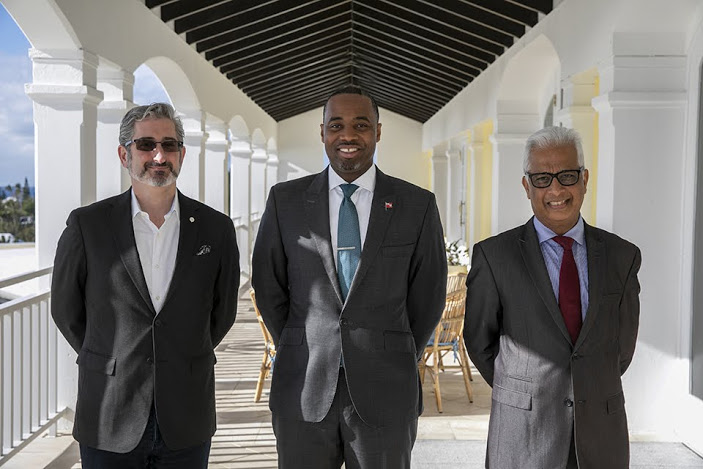

“Workshops were designed to help commonwealth member countries build robust Fintech ecosystems, learning from Bermuda’s experience and knowledge in the industry. Premier the Hon David Burt, JP, MP, delivered opening remarks on the first day of the summit and also welcomed Mr. Suddhoo to the Cabinet Office for a courtesy visit.”

“I’m delighted that the Commonwealth Secretariat chose to host this Fintech Toolkit Workshop in Bermuda,” commented Premier Burt.

“I wish to thank Mr. David Shrier, Founder and Managing Director, Visionary Future, for asking me if Bermuda would host this workshop. Of course, it goes without saying that it was our pleasure to do so.”

“The aim of this workshop is to help member countries to build robust Fintech ecosystems and assist in the development of the Fintech Toolkit for Commonwealth Countries. We have worked with some of the top thought leaders in the space, which has helped us to develop our legislative and regulatory framework, which is the foundational pillar of our ecosystem.”

Premier Burt’s remarks:

Dr. Arjoon Suddhoo, Mr. David Shrier, Distinguished Guests, Ladies and Gentlemen.

Good Morning and welcome!

I’m delighted that the Commonwealth Secretariat chose to host this Fintech Toolkit Workshop in Bermuda. I wish to thank Mr. David Shrier, Founder and Managing Director, Visionary Future, for asking me if Bermuda would host this workshop. Of course, it goes without saying that it was our pleasure to do so.

The aim of this workshop is to help member countries to build robust Fintech ecosystems and assist in the development of the Fintech Toolkit for Commonwealth Countries. We have worked with some of the top thought leaders in the space, which has helped us to develop our legislative and regulatory framework, which is the foundational pillar of our ecosystem.

Bermuda took the position that since this was an emerging and disruptive technology; it was important to create laws first so that people could have a fair, safe and well-regulated space to innovate, create and develop ideas. We have been working diligently to build a technology-friendly ecosystem that would support and encourage innovation, and we are happy to share our story with our colleagues from around the world.

It is important to recognise that we believe that Fintech is the future. And, it is certainly something that has the potential to provide financial freedom and services to the many adults around the planet who currently do not have access to bank accounts, credit cards or the financial freedom that citizens in further developed countries expect and take for granted.

Of course, there are a number of countries here from the Caribbean. One of the things which Bermuda has recognised, just like other Caribbean countries have recognised, is the trouble that has happened with our various economies due to the impacts of de-risking. Through financial technology, whether it is bypassing the existing corresponding banking networks or whether it is also making sure we that can use this technology to track payments and make sure that we reduce the risk of financial crime, these are all important aspects of Fintech.

Building financial freedom is consistent with the goals of the Commonwealth, which is to achieve financial inclusion and improve the quality of lives of those who are less fortunate, in whichever of the countries they may be. Fintech is also important because it provides an opportunity for entrepreneurship and has the power to democratise finance.

For us, this workshop is all about sharing. Wherever we travel throughout the world, we have shared the Bermuda Fintech story. We freely share our legislation and our regulatory framework; it is not something that we keep to ourselves. As Fintech products continue to spread, and there is regulation throughout the world, we believe that the best way for countries to work together is to share their experiences so they can learn and develop. That’s the best way to ensure that our citizens can take advantage of the benefits these new technologies have to offer. We want to make sure that you take the opportunity to share what you are doing with your respective countries. We understand that some countries are farther along than Bermuda in some spaces, and there are some places we are farther along. But I’m sure that we can all work together.

So please use this opportunity to learn, network, understand what we are all doing and let us all work together to build a brighter future for all of our citizens.

Thank you and enjoy your time in Bermuda.

Read More About

Category: All, Business, News, technology

wasted time and money