Premier On $15 Million Economic Relief Package

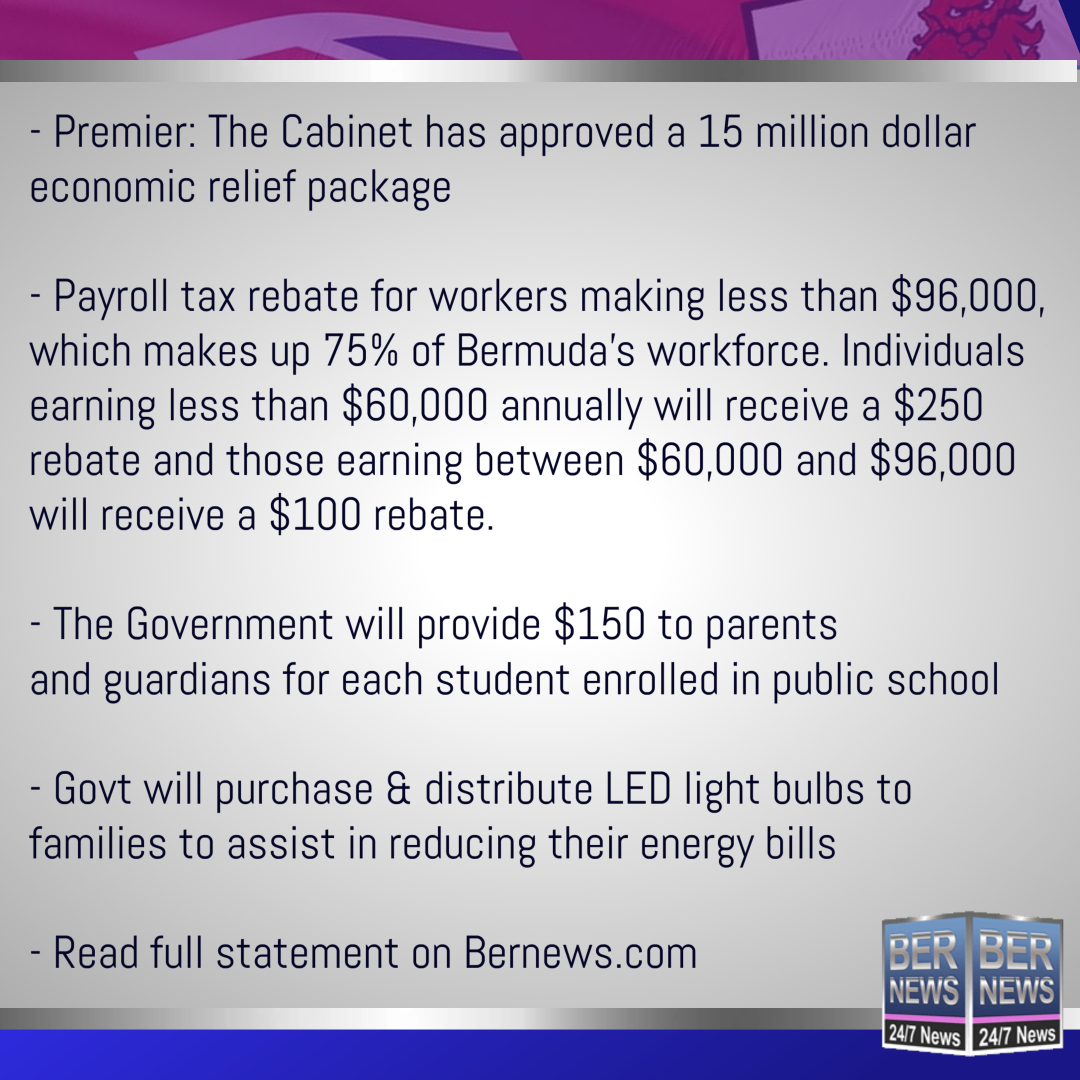

The Cabinet has approved a $15 million economic relief package which will include a payroll tax rebate for workers making less than $96,000 which will be provided via direct deposit into bank accounts, $150 for parents and guardians for each student enrolled in public school and more, Premier David Burt said.

The Government “will purchase and distribute LED light bulbs to families to assist in reducing their energy bills” and the relief package also contains a “15% increase in the food allowance budget for the Department of Financial Assistance.”

Speaking in the House of Assembly today [July 15, the Premier, who is also the Minister of Finance, said, “The Cabinet on behalf of this Progressive Labour Party Government, has approved a 15 million dollar economic relief package to ease the burden on working families in Bermuda.

“The relief package will include a payroll tax rebate for workers making less than $96,000, which makes up 75% of Bermuda’s workforce. Individuals earning less than $60,000 annually will receive a $250 rebate and those earning between $60,000 and $96,000 will receive a $100 rebate.

“It is expected that by September applications will be made available where 75% of Bermuda’s workers will be eligible to apply for their rebate. Once approved, the applicant will receive a direct deposit in their bank account.

“Also as part of the relief package the Government will provide $150 to parents and guardians for each student enrolled in public school,” the Premier said, adding that “with this payroll tax rebate and school supply support, a family of four with two school-aged children can receive up to $800.”

“The Government will purchase and distribute LED light bulbs to families to assist in reducing their energy bills,” the Premier added.

“This relief package contains a 15% increase in the food allowance budget for the Department of Financial Assistance to provide more support to families in need of food assistance.

“The relief package also include an extension of duty relief on the importation of vehicle fuel to ensure the ongoing freeze in fuel prices at the pump. This extension will help families, taxi operators, fishermen, tour operators and local businesses. The amount of this relief for this Fiscal year is estimated to be $6.4 million.

Premier Burt added that it is “important to reiterate that these relief items would not be possible without the increase in revenue received from the travel authorisation and tourism-related taxes.”

The Premier’s full statement follows below:

Mr Speaker, by any measure Bermuda is an affluent society. But that affluence has created a society in which economic pressures make it increasingly difficult for many hardworking people to keep up. Legitimate aspirations are frustrated by runaway costs of basic items which are necessities for life in this community. The high cost of living creates circumstances which sometimes defy economic theory but create a reality which the Government has a responsibility to address.

Mr Speaker, the package of relief we provide today is the start. This is what we can do now and the start point must be to provide assistance to those who need it most. Today’s relief package is a beginning and represents a deliberate effort of this Government to put more money into the pockets of people who need it most. Today’s relief provides support in key areas identified as critical to the people of Bermuda who need that hand up and the support of their Government to thrive.

Mr Speaker, in the 2022/23 Budget Statement this Government promised ‘relief now and more relief to come’ and it is in keeping with that promise that I introduce a relief package which will provide working families direct support during this period of global inflation.

Mr Speaker, the challenges of today’s economic climate are not unique to Bermuda as many countries around the world are grappling with inflation and supply chain disruptions. We have seen the consequences of governments not acting to protect their citizens against these increases. In Bermuda, this Government acted early, and as we have done since returning to office, provided relief to the workers of this country.

We acted early to protect the people of Bermuda from rising fuel prices. One of my first actions upon resuming the role of Minister of Finance was rejecting the increases requested by fuel companies. We have worked with the fuel importers to keep prices at the pump frozen. Without this action, the average working family would be paying $23 more to fill up their cars that they use to transport their family to school, camp, activities, and work. Without this action, taxi & minibus operators would be paying $35 more each time they filled up their tanks to transport tourists around our island. Mr Speaker, while we’ve heard a lot of comment from the opposition, the fact is no one on this island has paid more at the pump than they did in February to refill their vehicles – despite the significant fuel price increases that other countries around the world are experiencing.

Mr Speaker, the Government has listened to the concerns of many Bermudians regarding the cost of living and our record has shown that we have been responsive to the needs of the people. In this year’s budget, we again reduced payroll tax for persons making less than $96,000, reduced vehicle licensing fees by 10%, and provided land tax relief for charities and registered care homes. Yet we recognise more can and must be done. This Government has always looked out for working people and families, we have always done what we can, when we can, to provide support where support is needed. Since we’ve been in office, the cumulative payroll tax savings for a worker making $48,000 a year is just under $5,000. That is $5,000 more that a parent has had in their pockets to provide for their families.

Mr Speaker, within the Budget Statement, under the theme of ‘more relief to come’, I announced that if the Government outperformed expectations we would ensure that half of the savings would be used to provide further relief. This strategy placed further importance on the Government’s fiscal management as it has been designated as the means to create capacity to provide support for the people of Bermuda.

Mr Speaker, it is encouraging to report, as I mentioned in previous statements, for fiscal year, 2021/2022, original estimates anticipated a budget deficit of $124.7 million and the most recent revised figures anticipate a $30 million improvement with the deficit for the year forecasted to be $94.6 million. These results are a direct reflection of the government’s fiscal prudence, the island’s expanding international business sector and increased revenue gained from the Travel Authorisation fee.

Mr Speaker, In keeping with our promise to return half of the amount of any improved performance to the taxpayers in this country, the Cabinet on behalf of this Progressive Labour Party Government, has approved a 15 Million dollar economic relief package to ease the burden on working families in Bermuda.

Mr Speaker, I am pleased to inform this Honourable House that part of the relief package will include a payroll tax rebate for workers making less than $96,000, which makes up 75% of Bermuda’s workforce. Individuals earning less than $60,000 annually will receive a $250 rebate and those earning between $60,000 and $96,000 will receive a $100 rebate. It is expected that by September applications will be made available where 75% of Bermuda’s workers will be eligible to apply for their rebate. Once approved, the applicant will receive a direct deposit in their bank account.

Mr Speaker, also as part of the relief package the Government will provide $150 to parents and guardians for each student enrolled in public school. This payment is to assist with school essentials as we recognize the financial burden encountered annually when preparing to send children back to school. Mr Speaker, as the father of two children who seem to be growing by the day, I know that last year’s shoes and uniforms may not fit in September. The Minister of Education will be sharing further details pertaining to the rollout of this initiative in the coming weeks.

Mr Speaker, with this payroll tax rebate and school supply support, a family of four with two school-aged children can receive up to $800. We are determined to put more money back into the pockets of working families.

Mr Speaker, as part of this relief package, the Government will purchase and distribute LED light bulbs to families to assist in reducing their energy bills. It is widely known that the cost of energy in Bermuda is amongst the highest in the world and is a contributory factor to the country’s high cost of living. In response, the LED lights distributed under this proposal will use up to 85% less energy which will help reduce the household energy costs for Bermuda’s families. The Deputy Premier will share more details about this investment that will reduce energy bills in August.

Mr Speaker, our fellow Bermudians who receive financial assistance are often seniors, differently abled or those who have not yet found employment. They have themselves and their families to feed and support. These are our fellow Bermudians whose circumstances mean that they need help. This relief package contains a 15% increase in the food allowance budget for the Department of Financial Assistance to provide more support to families in need of food assistance.

Mr Speaker, earlier today I tabled a Supplementary Estimate that Honourable Members will be invited to support which will fund:

- The payroll tax rebate

- The school supply support

- The purchase of LED lights for Bermudian families; and

- An increase in the food allowance budget for the Department of Financial Assistance

Mr Speaker, the relief package also include an extension of duty relief on the importation of vehicle fuel to ensure the ongoing freeze in fuel prices at the pump. This extension will help families, taxi operators, fishermen, tour operators and local businesses. The amount of this relief for this Fiscal year is estimated to be $6.4 million. The Customs Tariff Amendment Act that I will table in this Honourable House later today will grant the Minister of Finance the ability to vary the rate of vehicle fuel duty.

Mr Speaker, it must be noted that fuel taxes were doubled under the previous administration. However, this Government is committed to reducing the tax burden in Bermuda and over the last 5 years, we have continuously reduced taxes for working families.

Mr Speaker, many will say this relief package is not enough, and as a Government – we get it; but it is also critical we balance being fiscally responsible while providing relief. This package is not perfect but it is a start and will make a difference in the lives of many Bermudians who want to know the Government is on their side and has their best interests at heart.

Mr Speaker, I must also emphasise that this package is not the end of the relief this PLP Government will deliver. The cost of food is increasing and, in concert with the Cost of Living Commission, food importers and supermarkets, this Government will reduce the price for essential goods that many families must buy weekly. In consultation with the Commission, the Government will reduce the duty on staple goods and ensure those savings are passed on to consumers. Part of this $15 Million relief package includes a provision for this duty relief that will result in reduced prices for working families.

Mr Speaker, this is incredibly complex work, but it is work that I hope will engender bipartisan support in this Honourable House, as it reflects what we all promised to do on entering elected service: to serve the people.

Mr Speaker, it is important to reiterate that these relief items would not be possible without the increase in revenue received from the travel authorisation and tourism-related taxes. Bermuda’s budget, like countries around the world, has been affected by Russia’s invasion of Ukraine. However, as the Minister of Tourism will share with this Honourable House later today, Bermuda is enjoying a stronger than expected tourism season and this increased revenue from the Travel Authorisation & tourism taxes has exceeded the losses from the war and is supporting this relief to working families.

Mr Speaker, I wish to also advise this Honourable House that Cabinet will shortly be invited to approve further measures which will be directed to meeting the staffing shortages in key areas like the Bermuda Police Service and the Bermuda Fire & Rescue Service to ensure the safety and security of Bermuda. Additional measures will also include increased provision of mental health options for Bermudians, independent living coordinators for young people ageing out of care, support for increased local entertainment, resources to boost youth employment and expanded summer camp spots.

Mr Speaker, next Monday will mark five years since this PLP Government was elected. During that time workers have seen their taxes cut, support for the vulnerable has been increased, seniors have seen their pensions rise, and Bermudians have received increased scholarships, training, and apprenticeships.

In May, Standard & Poors said, “Economic recovery is underway in Bermuda”.

Mr Speaker, as our economy recovers, Bermuda can be assured that this Government is committed to providing even more relief to ease the burden on working families. For five years we’ve demonstrated that commitment, and today we add to that record by delivering a first-of-its-kind relief package for working families in Bermuda.

Thank you, Mr Speaker.

Yet another payment to ensure votes in favour of the PLP at the next election

But had they done nothing then you would say “they have done nothing”.

Damned if they do, damned if they don’t.

Its likely by your comment that you don’t need any relief, and that’s fine, but many do, and many will welcome the assistance.

I fully accept that there are people in Bermuda that need such relief. Many of them are relatives of mine. That was not my point.

My point is that in the span of 1 generation we have gone from little or no current account debt to MORE THAN $3 BILLION in current account debt and the PLP Government gives away another $15 million.

We cannot keep this up.

therein lies the difference in mentality.

you see this as “giving away $15million”. Others see it as helping out the people in time of need.

The other thing is that a $150 handout isn’t a fix by any means.

$150 is gone by the next grocery shopping day.

When times are hard, the average citizen is finding ways to reduce spending, save money here and there.

Government on the other hand seems completely reluctant to curb their own spending, instead continuing to borrow from here and there, throwing trinkets where they may, adding taxes under the guise of helping the community, and blaming the other political party for every malady affecting the country.

It’s unsustainable but as far as the politicians go, it’s all about trying to stay in power.

Bet you this money came from the TA form @ $40 a pop from cruise ship and airline passengers. Burt you calling another snap election or playing chess for the PLP delegates conference in Oct/Nov? Either way it doesn’t matter, until Bermuda has a strong opposition party that’s not viewed by the majority voters as a bunch of weak useless rejects it will be 30-6.

Unfortunately it seems the money is coming from more debt. The budgeted deficit is $124.7million. However an increase in revenue (maybe part is TAF) has reduced this by $30million, so we will give back $15million. All this does is lower the deficit to $110 million. It still has to be funded by debt.

This is the clearest sign that there is no chance that with a PLP Government that Bermuda’s debt will ever be paid down. Should a miracle occur and the revenue exceeds expenses, highly unlikely, there is so much infrastructure that needs replacing and ongoing maintenance generally, let alone a public sector pay rise, that any surplus money and more will be spent.

Facts about the oba even their supporters know this.

Many people are desperate for some kind of relief from the ever increasing prices of goods and services. I think this small bit will be well-received by those persons eligible.

That said, the Premier thinks he’s slick by adding this:

‘Premier Burt added that it is “important to reiterate that these relief items would not be possible without the increase in revenue received from the travel authorisation and tourism-related taxes.”’

He’s really not as clever as he thinks he is.

I’m surprised he didn’t seize the opportunity and say ..

“If it wasn’t for the awful airport deal and Morgans Point we could give you so much more “.

He doesn’t need to talk about the $43 mill and $190 mill the oba has out slaving out for those projects. They will never win.

No-one else , no matter who they are , is going to win because the electorate has shown us what they really like.

Yes, Bermuda has hopped up on the worlds stage and loudly proclaimed that Bermuda is intolerant of people not like us.

Bermudians are proudly homophobic, racist and xenophobic….while the rest of the world grows up, Bermuda regresses.

“He’s really not as clever as he thinks he is.”

Agreed. He inadvertently told the truth!

If you have 3 kids in public school then you will get $450 to put towards their supplies. Additionally if you make between 60 and 96K then you will add another $100. If you make under 60K then you get $250.

I think that extra will go a long way in purchasing school shoes or socks or assisting with uniforms and supplies. No it may not cover everything but it more than you would have had yesterday. And if you don’t want it, or appreciate it, then you don’t have to accept it!

So my tax payer dollars help support the public school system. However, because of the awful job the Min Of Education and the PLP have done over the last 20 years there is no way I will send my kids into the public school system. So, I am working two jobs and paying twice to educate my children because of the horrible job they are doing! I’m paying once thru my taxes(duty, payroll, social insurance and so on) and a second time for private school. And I don’t qualify for relief! What makes you think I’m not suffering and don’t need relief from your bad policies, reckless spending and bad governing. You think because my kids go to private school Im loaded!

Thanks for nothing!.

So true ,

but we cannot change this governments hidden adjendas which are not so hidden any longer .

“$150 for parents and guardians for each student enrolled in public school and more”

Not fair. Not all parents of private school kids are well off….and there are plenty well off parents with kids in public school. Why not give this money to all Bermudian kids, regardless of private or public school.

There are a good number of parents who are doing yeoman’s work to have enough funds to enroll their children in private school, so I’d tend to agree with this comment.

I think that by focusing on those in public school he’s trying to convey the narrative that the relief is for those at the lower end of the economic spectrum for whom private school isn’t even a possibility.

“I think that by focusing on those in public school he’s trying to convey the narrative that the relief is for those at the lower end of the economic spectrum for whom private school isn’t even a possibility.”

I agree, and that demographic tends to be consistent PLP supporters

This just is not fair. I know plenty of parents struggling to afford private school tuition….. many of whom have special needs kids or kids with developmental challenges who cannot get the support from the public system. I also know many private school parents whose kids are reliant on financial assistance from the school and are still struggling to make ends meet.

The premier has kids in public school, with his massive pay package, he is able to get this rebate. Not fair.

Give the money to all Bermudian kids.

“Give the money to all Bermudian kids.”

Unfortunately, your chosen government isn’t governing for all Bermudians…just the ones that ‘look like them’.

Agree with this. I hate this “boxed mentality” what if my child is receiving a scholarship got academic merit, what if grandparents are paying for education and I make 80k why should I not get the benefit.

Let’s be far Bermuda.

Exactly True! Even Home Schoolers are being left out. We pay for books and a curriculum too! Many families will fall through the cracks and not get the help they so desperately need! Add Chronic sickness needing specialists and paying medical bills, an old car that keeps breaking down and one income to support 5! Very difficult! We will be left out, so we will exist week to week and hope for a few of those light bulbs that they are talking about. Thank goodness we are able to receive a few groceries free each week from Warwick as a few others are to. Without that it would be even more difficult. For us it is no steak, shrimp, and luxury stuff like that. Try a few vegetables, Ramen noodles and bare essentials. Many families with multiple children are barely surviving these last few years. All we can do is hope for proper aid while we try to be constructive in our daily living.

Please don’t leave out the children, you are only shooting yourselves in the foot!

Pure wickedness

So parents working two or three jobs to give their kids a good education in a private school and saving government the 25K a year it would costto educate them in public schools get nothing? On the other hand parents who could afford to put their kids in private schools but send them to public schools and spend the 25K per year on trips, new cars and boats get a handout? Welcome to Blurtanomics!

Let me be sure I understand this correctly. So I work and pay taxes to pay Burts salary but I’m not good enough to get financial relief. If I was rich I would not be working!!!!!!! And Burt whos salary my working taxes go towards paying for his salary and is NOT hurting financially can claim $150 for his kids but I can’t! Last time I wason a plane I got on board and walked past him while he sat in 1st class. But he qualifies and I don’t?

Give the money to the school, so they can get what they really need. $150.00 per student per school goes along way. Too many teachers are paying out of their own pockets. Where is all this coming from?

There are so many inefficiencies when it comes to teachers paying out of pocket or parents paying out of pocket for basic supplies, it’s ludicrous.

Money ‘for school essentials’ could easily be allocated directly to the classrooms who should be able to get better deals buying in bulk.

Nope, instead we’ll get the usual letters before start of term asking each parent to buy a container of disinfectant wipes, a bunch of markers and pencils, and so on. We just seem to enjoy inefficiency in this country.

Yes they will. Even if they are voted out, $3 billion remains and continues to count.

And that’s the problem. Who would want to take it on?

As I’ve said before, there isn’t enough pepper spray to deal with the outcry after difficult decisions are made.

“The government will purchase and distribute LED bulbs”.

So there is evidently a PLP insider who ‘coincidentally’ supplies LED bulbs, obviously. They never do anything unless it’s to make someone rich at the expense of taxpayers.

You (we) must have missed the non tendered contract, one more of many. Secrecy is the name of the game these days.

This is discrimination.

I know of two people who are earning less than 60k who are living week to week because they are putting their children through private school. They don’t qualify for the rebate. This is unfair. Public school is free, but private school is not. On a net basis the two families who won’t get the rebate have 33 percent less money thank the ones who do qualify for the rebate.

LED lightbulbs…How underwhelming.

Switching to LED lightbulbs will NOT reduce anyone’s energy bills. It may minimally reduce the increase in their bill by minimally lowering their energy consumption. It will not reduce anyone’s bill. To not have this basic grasp on the reality of how things work is shocking.

Who the hell doesn’t have LED bulbs nowadays anyway?

And the big question. What gov department is administering this rebate? Please not labour and training. Please make this an online process because we don’t need any financial shortfalls that require auditors after the fact chasing money that was incorrectly applied.

According to what was said in the HoA, they are making it simple. No one will check up to ask how the rebates will be spent. No checks so no one can find out if the money was incorrectly applied. Makes perfect sense from a politician’s viewpoint, after all it’s Government money, nothing to do with tax payers.

So led is supposed to lower light bills. What about those of us who did this years ago and our bill continues to rise because of facilities charges etc. The usage is only approx 30% of the make up of the bill.

Giving rebates to people sounds a lot like electioneering vs really helping. Even the increase in pension which is approx 30 to 45 a month increase.

Understand trying to help people but the rebates do not come across as equitable as all persons need help. If the rebate is for children then all children regardless of where they co school or do the same as the rebate for parents making under 96k. And do same as rebate under 60 get 150 and over 100.

Also with split families how do you decide which patent get the rebate.

Just my opinion