Proposed Changes To Payroll Tax System

Proposed changes to the payroll tax structure “will see all persons earning under $105,000 annually paying less in payroll tax compared to the prior year,” the Premier said today as he provided an overview on the Government’s 2023/24 Pre-Budget Report, which contains proposals the “Government wishes to solicit feedback on prior to finalising the 2023/24 budget.”

Speaking in Parliament earlier today, Premier David Burt said, “The proposals for changes to employee payroll taxes include changes to rates to reduce payroll taxes for lower and middle-income workers. It is proposed to exempt the first $48,000 of labour income for all workers from payroll tax. This proposed change will remove 30% of the workforce from being liable for payroll tax while providing relief to these workers who are most affected by reduced purchasing power due to the high global inflation. To compensate for lost revenue, the next 3 tax bands are proposed to be adjusted upwards. The result of these proposed rates will see all persons earning under $105,000 annually paying less in payroll tax compared to the prior year.”

The Pre-Budget Report said, “The policy options below contain proposals from the Government and submissions received that the Government wishes to solicit feedback on. Prior to finalising the 2023/24 budget, the Government will engage with the public and with other stakeholders to receive feedback on the policy considerations outlined below.

“The Government continues to consider prudent measures regarding its payroll tax structure that will lessen the financial pressures experienced by a majority of Bermudians and Bermudian businesses alike. The objective is to make the payroll tax system more progressive, reducing the tax burden on low and middle-income workers and small to medium-sized businesses.

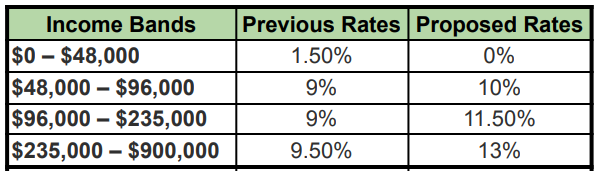

“To achieve this aim, the Government proposes the following for consultation:

Employee Payroll Taxes

- “Eliminating payroll tax for the first $48,000 of labour income for all employees. This proposed change will remove 30% of the workforce from being liable for payroll tax while providing relief to these workers who are most affected by reduced purchasing power due to the high global inflation.

- “To compensate for lost revenue, the next three tax bands will need to be adjusted upwards, and the proposed rates are provided in Table 1, below.

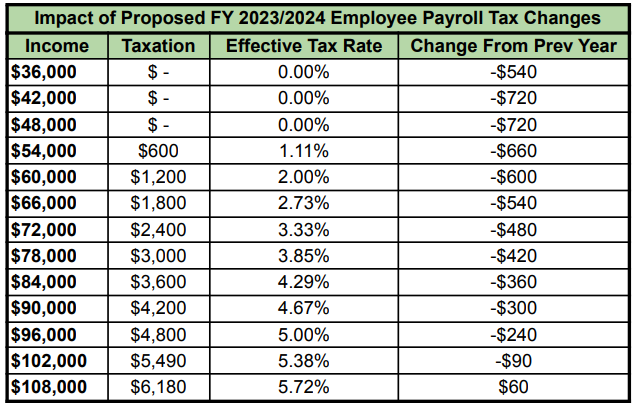

- “The result of these proposed rates will see all persons making under $105,000 annually paying less in payroll tax compared to the prior year [Table 2].

- “These proposed changes are estimated to result in $19.6 million in additional revenue for the treasury.

Chart extracted from the report

Business Payroll Taxes

- “Reduction of payroll taxes for small and medium-sized businesses [payrolls under $1 million], hotels, restaurants, and retailers, as detailed in Table 3, below.

- “Elimination of the payroll tax for farmers, fishermen, educational, sport and science institutions, and small businesses with an annual payroll of less than $200,000.

- “Increase in exempted company payroll tax from 10.25% to 10.75%.

- “These proposed changes are estimated to be revenue neutral to the treasury.”

Chart extracted from the report

The report also mentioned the “Elimination of Double Taxation for Self-employed Persons” saying that, “In an effort to avoid double taxation, the Government has been asked to consider removing the requirement for self-employed persons to pay both the employer and employee portion of payroll tax and only be responsible for paying the employee portion.”

The report also proposes a pay increase for Government workers, stating, “The salaries and wages of public sector workers have not kept up with the increases that have been seen in the private sector. Though the aforementioned proposed tax changes will increase take-home pay for all blue-collar workers, it is no longer feasible to maintain the position of no pay increases during the 2023/24 budget cycle due to rising global inflation.

“As a result, the Government has adjusted its financial mandate to award public sector workers a pay increase. These increases will need to be reflected in spending plans and offset by revenue increases or cost decreases to meet the Government’s budget targets and ensure that the budget is balanced in the 2024/25 fiscal year.”

“If you wish to log your comments/feedback please visit forum.gov.bm or email openbudget@gov.bm. The deadline for submissions is January 13, 2023,” the report states.

The full 2023-24 Pre Budget Report follows below [PDF here]:

Pay rises for the public sector? Guaranteed pay and benefits since 2019 while those in the private sector, except IB, have seen no pay, let alone reduced pay. Public sector benefits including defined pensions for what? Makes you want to vomit. More debt because the private sector won’t pay, and why should they.

This is a massive slap in the face for international business. Whether you like it or not, those top level guys – the ones who control jobs, Bermudian jobs, are the ones getting penalised here.

What do you think they are going to do?

Burt and Hayward, you just don’t get it, do you?

Makes sense. Very simple self explanatory.

Shouldn’t everyone be expected to chip in, even if only a little?

They really are utterly bereft of ideas. Clueless.

The issue isn’t just about income, it’s also about expenditure and efficiency. The public sector is over employed by about 35%.