Column: Horner On Global Boundaries & More

[Column written by Patrice Horner]

The earth has entered the Anthropocene Age, where humans have impacted all parts of planet and exceeded the global boundaries of what can support biodiversity and the climate. This year’s ILS Convergence Conference in Bermuda last week brought a battery of climate and insurance expertise to the island. Bermuda is the largest domicile in Insurance Linked Securities [ILS]. It is on the forefront of climate and catastrophic insurance coverage.

With the start of the industrial revolution in the 1880s, humankind began shaping the planet on a global scale. “Humankind is no longer is safe operating space.” This is not an abstract concept anymore. The time scale for correction is extremely short. “We are already deep in negative time,” explained Peter Schlosser, Vice Provost of Global Futures at Arizona State University [ASU] and Director of the Global Futures Laboratory. He delivered a keynote address for ILS Convergence 2024 exploring the crucial intersections between climate change, ocean science, and risk management.

The energy industry is barely generating sufficient energy to keep up with growth, yet it is a major source of greenhouse gases [GHG]. In 2023, the results from its impact on temperature were startling. There are secondary drivers. Glacier are melting, causing 0.4 Celsius increase in GHG from the lack of cooling. Glaciers have typically chilled the planet. The planet is 25% into an interglacial swing. This is an interlinear swing inside the larger impact of the GHG macro swing. Once glaciers are lost, the brakes are off.

Ocean heat content is beyond averages [2013-2023]. It was pushed to new levels in 2023-24. This new ocean temperature impacts climate change exponentially in a variety of ways. Due to changes in the hydrologic cycle, drought touches a quarter of humanity according to UN. Urban heat islands are adding to global warming. “You can feel the ambient change radiating from the building.” There are increases in warming from a number of global impacts around the world. “If it reaches a certain resonance, it can bring the system down.” Population, fertilizers, temperature, and water use all work against the limits of the planet. Schlosser adds that “we are asking the planet to give more than it has to offer.”

This challenge can be transformed into an opportunity by creation of several new trillion-dollar industries. Transform energy, remove carbon, change the food system; these are each trillion-dollar industries in their own right. If we do not act quickly, we will face the ultimate sacrifice, and the planet will regulate to our extinction. Universities have the responsibility to address world needs. ASU Global Futures Laboratory is using an enterprise approach. Scale, speed, impact. There is a fifth wave of higher education national service universities, including ASU, Penn State, and U of Maryland. The ASU Julie Ann Wrigley Global Futures Laboratory has four schools designed to sustain global habitability and improve global humankind.

The concept was started in 2004 and actualized in 2023. It covers monitoring health of critical ecosystems, including ocean coral here and in Hawaii. It keeps a global coral registry. And addresses topics as varied as energy, grids, carbon capture, materials, fuels, and renewables. Gigatons of carbon must be removed by the quarter century. The Water Institute is addressing conservation. The largest reservoirs in the States are reaching ‘dead pool’ state where no water can be released for downstream use. This is especially critical to the southwest in the States. The Global Futures Lab is exploring how the southwest will be able to support the population and the industry. SWISSY is a collaboration across Nevada, Arizona, and California.

ASU Global Futures is evolving a ‘decision theatre’ for support in advanced decision-making for complex issues. Societal acceptance has to be engineered into the process of finding solutions. Data are applied to algorithms with AI interfaces to build innovative modules for advanced learning. ‘Dreamscape learning’ is AI-supported learning with virtual reality headsets with a global perspective over the past and potential futures. Such innovation in education will meet the demand growth, from 220 to 380 million students from 2021-2030. This is application of science in support of industry innovation. The ASU Bermuda Tuition Scholarship program is making available five full tuition scholarships for Bermudian students, awarded on a competitive basis, to study any program in person at one of ASU’s campuses.

Risk and opportunities on the leading edge of science

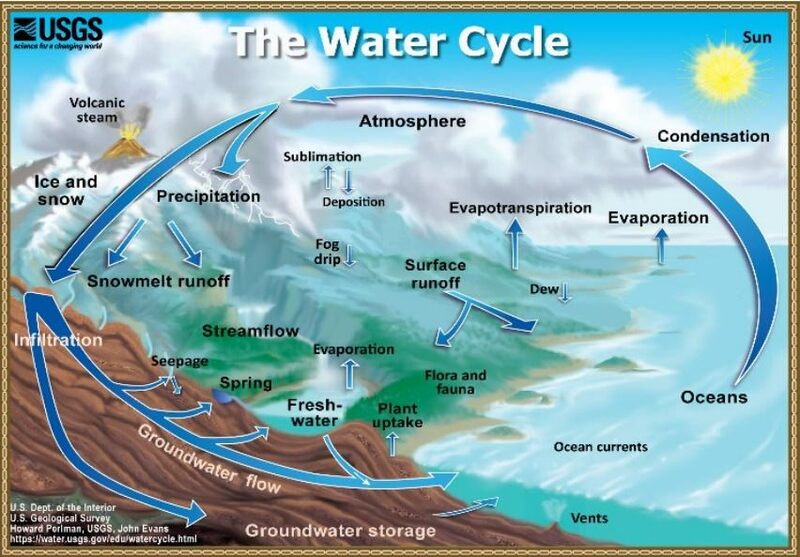

The oceans and land exhale moisture into the atmosphere, which returns to earth in rain or in hurricanes. The hydrologic cycle or water cycle drives the circulation of moisture on the planet. Only 5% of the water is in cycle. This cycle creates climate. Dr. Upmanu Lall, Professor, School of Complex Adaptive Systems, Arizona State University [ASU], explains that ocean and atmosphere circulation temperature ‘spatial gradients’ converge into extreme weather regions. Oceans temperature changes evolve more slowly than the atmosphere but have reached record highs. Physics-based models with machine learning tools can identify spatial patterns hidden in the statistics up to 18 months in the future. But physics-based models are lacking the data needed for underwriting models. With machine learning, the data is enhanced but not perfected for insurance purposes.

Dr. Elizabeth Harris is VP of Modelling & Research at Ariel Re. Dr Harris elaborated that the northern Atlantic Ocean registered a higher temperature than ever before due to slow down in the cycling and turning of the ocean within its depths. Higher ocean temperature encourages hurricanes. The impact of this change is likely to have a bigger impact on the northeast and possibly in Europe. Researchers are not sure where it will manifest without more modelling. More ocean observations are also needed.

A ‘distributed sensing’ system should be created to deliver data into the modelling real-time. Dr. Brennan T. Phillips, Associate Professor of Engineering, University of Rhode Island, is engineering ocean observation systems and testing them in Bermuda with BIOS. Most observations now are two dimensional, like a TV screen. With deeper readings in the ocean, it become a hologram that captures the dynamics of the ocean turning. “There are very few in the world due to the large infrastructure. They have been costly so not sustainable on an economic basis.” Distributed sensing is possible using fibre optics. This presents an opportunity to build the monitoring along with the Google cable coming into Bermuda. It could provide a comprehensive subsurface view. The practical tactical aspect of testing the new sensing system is in conjunction with BIOS, in addition to the data processing and sophisticated modelling.

There is an increased emphasis on how biological interactions impact ocean health. Dr. Amy Maas, Assistant Professor, School of Ocean Futures Faculty, Arizona State University explained that 30% of CO2 is absorbed by the oceans, in large part due to biology. It happens with plankton and micro creatures that ingest the carbon molecules then draw it to deeper depths. The heating is affecting the ability of the biology to absorb the carbon. The organisms are becoming smaller more prominent and shifting away from those that support the ecosystems. The evolution of biology in the ocean adds to the uncertainties in insurance models. We are learning about the impact of this ocean biodiversity. Life in the ocean is affecting physics. Marine carbon dioxide removal is a curative biology via creatures and chemicals. It must be approached with extreme caution due to unintended consequences in the dynamic ecosystems. It should aim to enhance natural processes.

Dr Brennan added that BIOS is bringing in new equipment next year to assist with methods of measurements of this ecosystem. This creates unique potential in Bermuda for the talent and for laboratories to build this capacity to monitor the health of plankton. The instrumentation and data, as well as partnership and collaboration with Bermuda will drive this new science. Research is cycle driven whereas ILS is event driven. Moderator Dr. Mark Guishard, Chief Operating Officer of the ASU-BIOS initiative, posed the question for the insurance industry, what products are needed from the science of the planet for the state of risk-transfer? Guishard quoted the keynote speaker in asking is there an “elephant in our consciousness,” similar to the idiom of the elephant in the room.

Marine heat waves have occurred off the coast of the Pacific had major impact on fishers and photo-plankton. A 1 degree Celsius change in ocean temperature can drive an 18 mile per hour increase and can push storms into the next category, such as what we are seeing in Gulf of Mexico with Hurricane Milton. Such rapid intensification is monitored. Dr Harris expanded that there are climatology statistics for the Atlantic and Caribbean. The east Pacific does not have network of observations, so the rapid intensification is less anticipated.

What is poorly understood is changes in rainfall, notes Dr Harris. Higher temperatures increase rainfall. Ariel Re studies changes in participation rates, which is changing much faster than the equations. This is bringing more flooding, in addition to the storm surge. This resulting in loss of life and greater property damages, in part due to unexpected influences such as increased participation from the hydrologic cycle.

Accelerating solutions in markets and in the field

If patterns are intelligible and processing power is available, how do people translate these into action? “Action is miserable,” said Eusebio Scornavacca, a Director and Professor at the School for the Future of Innovation in Society at Arizona State University [ASU]. “Be sure to pursue good data, otherwise, it is making bad decisions faster.” It is important to recognize that problems are not based in silos of intellectual study disciplines. To solve complex and dynamic issues they must be addressed holistically, “think across areas. Be problem centric.”

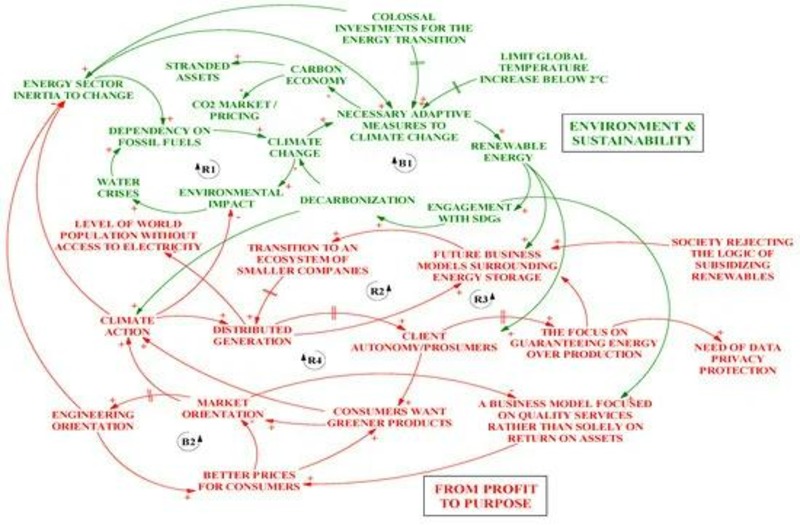

Sustainability From Profit to Purpose: How Electric Utility Multinationals Visualize Systemic Change. Centre for by Rodrigo W. Dal Borgo and Pedro M. Sasia Applied Ethics, University of Deusto, 48007 Bilbao, Spain.

Kelly Barr, Associate Vice President & Chief Alliance Officer of ASU Global Futures Laboratory, matches industry with academics and brings in the community. Barr is responsible for organizing the contacts within ASU. This is the way to orchestrate a workable solution, otherwise research is in isolation. Conversations occur before undertaking research. At this juncture there is no time to waste; “tt is imperative we have an impact.”

Wildfire Water Solutions [WWS] brings really big water solutions to fires at 20x typical volumes and increases fighting productivity. Michael Echols, CEO, explained that 60% of cost the firefighting is bringing water. WWS exists to limit liability and catastrophic outcomes. They use software algorithms to forecast and route resources to fight dynamic fires. “Great innovation comes from interpretation.” Echols asked, “Who has the backs of the people on the ground?” Fire is increasing in frequency and intensity, while accelerating faster. WWS also is deploying solutions on the suppression side to minimize damage before fires start.

James Robinson, Founder of Cactus in Bermuda, details data-rails and risk for insurance. Underwriters might not have access to sufficient facts. In addition, siloed decision-making is ineffective. Collaboration is important. Collaboration is real for very lean organizations. “One thing has changed for innovation. There is a new model for insurance distribution, Managing General Agent [MGA].” According to Investopedia, MGA is an entity that acts as a broker and has underwriting power on behalf of an insurer. There is no room for politics in the decisions. Solutions are not sales driven. Robinson emphasizes that solutions to risk transfer must be from data driven results.

Risk transfer has been built for society, explained Hanni Ali is Vice-Chair of ILS Bermuda and Group Head of ILS & Sustainability at Hamilton Insurance Group in Bermuda. She has spent her career looking for ways to apply science and data. Information is spread across society. The principle of acceptance to science and technology is evolving in the marketplace. It is used to fund insurance coverage for catastrophic risk. Parametric insurance is a developing option, based on a dollar exposure and on a perspective of loss. How quickly can it be interpreted and actioned for policy holders? Money spent on mitigation before an event occurs is money well spent. Some 25% on the cover for Hurricane Milton is coming out of Bermuda.

ILS can drive the sustainability project under a framework from the BMA. Reinsurance evolved to protect the world from the highest catastrophic events, some known as Cat Bonds. There is a difference in the ability to risk transfer for extreme weather versus climate impacts such as drought and increased precipitation. The latter are less protected by insurance. There is possibility. The capital may be open to proposals. “Insurance is a source of good” and an impact for societal benefit.

If it wasn’t for the necessity for a Covid rapid solution in 2020, there would not be the current technologic agility, noted ASU Scornavacca. The speed of disruption is unprecedented in history. It requires our partnership to develop solutions. The deadly sins of progress are: focus on disruptor, working in silos, mycotic view of disruption [i.e. weather or policy], organizational rigidity, or lack of adoption. The solution is found in a technical system driven by a natural social system. What is the balance between mitigating risk and fostering innovation, so that societies do not ignore critical risk signals, asked an audience member? Pixelation was an answer, thereby sizing an issue to ensure proper attention for the size and prominence of the risk.

In closing, Moderator Weinstein said, “The Bermuda license will passport you around the world.” He encouraged Bermudians to take advantage of the Arizona State University ASU connection. Enrolees will be able to attend ASU as a local student and/or take advantage of the many scholarships put in place. Whereas there are typically barriers to access of US education system, AZU is lifting those for the Bermuda students and offering an array of degrees. This generation understands the importance of being relative and making a difference.

Regulatory innovation can promote adaptation, mitigation & protection gap reduction

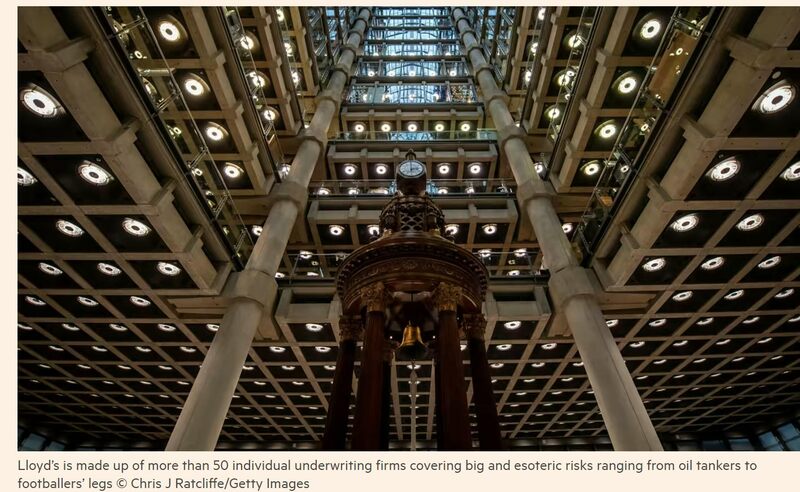

John Huff, President of the Association of Bermuda Insurers and Reinsurers [ABIR] opened the session he was moderating with the announcement that Lloyds Lab has signed an Letter of Undertaking [LOU] with BMA and ABIR to provide education for reinsurance and a financial laboratory for testing new concepts and innovations. It is a historic evolution with complimentary programs. BDA and Lloyds are now a collaborative market. ABIRs has 40% of Lloyds capacity. The MOU signed earlier this year is expected to create a cohort of reinsurance problem statements with Bermuda.

Lloyd’s of London is a regulator as well as a market, sharing best practices. Lloyd’s is driving innovation and governance to meets the needs of the markets place, as well as the impact of the climate change. The culture is shifting toward innovation. Lloyds Lab a separate entity. It is not involved in overseeing the underwriting.

Explained Rosie Denée, Head of Innovation and Academy at Lloyd’s Lab, the lab is a supportive innovative hub [not called a sandbox]. It is aiming to reduce barriers to entry for innovation. In a pass-fail ring-fenced environment, it will not affect other relationships at Lloyd’s. For those who qualify, there is no need to make an upfront investment. The lab can canvas Lloyds’ members for support of the experiments with a suggested 5% of revenue into a pool. Highly competitive to be accepted by the lab, with 250 submission to 10-12 companies to mentor. The Lloyd’s Lab programme provides a 10 week fast tracked incubator to develop ideas into practical outcomes, with the support of industry experts. It is a product development program to bring tested solutions to the market. Individuals can also bring ideas to Lloyds Lab under certain circumstances. There is a global responsibility to move the dial and to have the most impact.

There has to be regulatory scope to test new innovations before they are released to the market. Regulatory innovation is a critical piece for innovation. “Cannot just go out and try new things.” George Alayon is Deputy Director of FinTech Supervision at the BMA. The BMA oversees any capital activities in Bermuda. Six years ago they introduced the Regulatory Sandbox for licensed organizations as well as the Innovation Hub. BMA is aware of its role in creating climate solutions. The unique problems require new solutions. There is a global protection gap problem. This permits subsector testing for agile reinsurance approaches to accelerate progress while the BMA still maintains the core mandates of good governance to sustain our world-class supervisory and regulatory effectiveness, while also helping to address a myriad of social and environmental issues, both locally and globally as noted on the BMA website.

Tokenization of assets and how to monetize new inventions are topics under consideration. Sandbox on underwriting of California wildfires have graduated from the BMA sandbox and in market. It trapped data and provided transparency on how to structure a solution in a method where underwriters have clarity in the product. ILS are specifically examining the model. It will be open to the Ignite Innovation Programme locally with BMA and to other key stakeholders to assess the regulatory hurdles and distribution models. Matching risk with capital is a BMA team expertise. BMA does not make investments. It does manage Investment Fund registrations and can issue invitations to attend project pitches. For this sandbox cohort, the pitch days are still open. Climate is one of the biggest problem the world is facing. However, any solutions need to be fit for purpose and risk-based.

Access to capital collapsed for insurance in Louisiana after companies failed from numerous and sequential hurricanes. Weakly capitalized companies chased premiums down beyond the viability to cover claims. Early this year, Louisiana instituted broad reforms to the insurance written in the State. Louisiana Insurance Commissioner Tim Temple was first elected Commissioner with insurance experience. It is the elected Commissioner who sets priorities in the State. There is a significant protection gap to address. As Temple explained, insurance must be affordable in addition to available and viable.

An increase in damage mediation has been implemented through construction codes and environmental infrastructure to protect the working coast. The State fortified roof programs and construction codes. If private market cannot cover the risk, he is open to discuss how governments can intervene. Two parishes on the coast were hit by hurricane Barry. The community raised the money and rebuilt the levees. In subsequent hurricanes, damaged moved from 1,100 to two properties affected.

If consumers take the time and money in improve their property, they will have protection and piece of mind. There will also be community resilience. Commissioner Temple encourages conversation with insurance companies about innovation. He is driving innovation in regulation and legislation, like was undertaken in Texas and Florida. Temple is committed to finding out what makes Louisiana a state difficult to do insurance business. The state considering new insurance forms such as Parametric Insurance versus fully underwritten damage coverage. “There is a need to modernize insurance”; Commissioner Temple calls for “an insurance renaissance.”

2024 ILS Convergence was made possible engagement from ABIR, ASU, BIOS, and the BMA, along with several insurance, financial, and legal firms. A renaissance is underway. It cannot happen too soon with the increasing climate damage such as Hurricane Milton happening concurrently with the conference.

- Patrice Horner, MBA, EFA

Read More About

Category: All, Environment