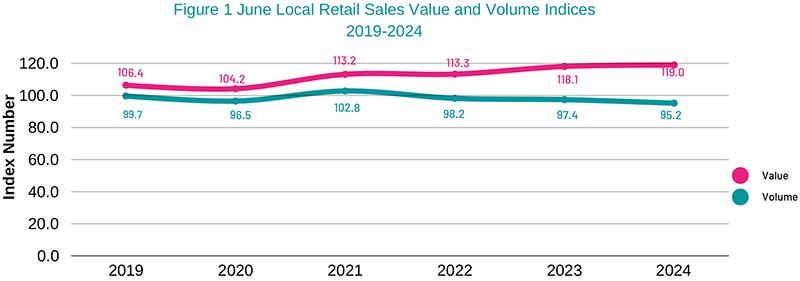

Retail Sales Decreased 2.3% In June 2024

After adjusting for the retail sales rate of inflation – measured at 3.2% in June – the overall volume of retail sales index decreased 2.3% when compared to June 2023, according to the recently released Retail Sales Index.

A Government spokesperson said, “Today, the Ministry of Economy and Labour released the June 2024 Retail Sales Index publication. June’s volume of retail sales index decreased 2.3 per cent compared to last year. In value terms, retail sales increased to an estimated $111.0 million.

Chart extracted from the report:

“Three of the seven sectors recorded year-over-year volume index increases in June 2024:

- The sales volume for Food Stores increased 1.1 per cent.

- Motor Vehicle Stores’ sales volume increased 6.9 percent.

- Service Stations’ sales volume increased 1.2 per cent.

“The following sectors had a decrease in sales volume compared to the previous year:

- The Liquor Stores’ sales volume fell 1.6 per cent.

- The sales volume for Building Material Stores decreased 8.3 per cent.

- The sales volume at Apparel Stores decreased 1.6 per cent.

- The sales volume in the All Other Store Types sector [comprising stores selling household items, furniture, appliances, electronics, pharmaceuticals, and tourist-related goods] decreased by 8.6 percent.

“Selected overseas declarations increased 47.5 per cent compared to June 2023.

“The public can review the June 2024 Retail Sales Index report at https://www.gov.bm/retail-sales-index-rsi.”

The full June 2024 Retail Sales Index publication follows below [PDF here]:

The usual monthly sales news. Volume down, prices up. Hard to explain why this is so when Burt and Hayward keep saying how well the economy is doing. Clearly doing well in a particular segment, not the one helping Bermudians.

Inflation is up (higher than the United States for a change), volume of sales is down, but our economy is doing great!

I kept it simple because you used to rejoice that our inflation rate is lower than the USA’s:

Widgit Cost

US $100.00

Bermuda $130.00

Inflation

US 3.0%

Bermuda 2.50%

New Cost

US $103.00

Bermuda $133.25

Difference $30.25

Feel good? The same Widgit is still more expensive in Bermuda.

“you used to rejoice that our inflation rate is lower than the USA’s”

Was I rejoicing or was I mocking the suggestion that our rate of price inflation could possibly be lower than that of the United States?

You tell me as you have never stated that you were mocking anything nor added (sarcasm) at the end of your comments. As I have just proved, having lower inflation does not mean lower prices than in the US.

I would have hoped that it was obvious that my comments were mocking. It is economically impossible for price inflation in Bermuda to be lower than price inflation in the place from which we import the majority of our goods.

Please correct my math as you see fit. Logic does always apply, but I understand your point.

“Selected overseas declarations increased 47.5 per cent compared to June 2023.”

When it’s cheaper to buy your widget in the US, fly back with it, pay 25% duty and you still pay less for your widget than you would here, there’s a problem somewhere.

But Hayward said new Retail companies was up?…

Continuing decline of a sector that contributes to this island (and government’s piggybank) more than credited for. What help does Retail get given a continuous decline? NONE!

INFLATION not only hurts the the buying public .

INFLATION also hurts Governments and it taxpayers , its employees also with increase in cost of esential items.

RECESSION is working !

That is not a ploy to destroy business, the people did no set the trap in the first instance .

The reality of what you hear complaint on the street about escalating run away inflation .

People just can not afford , especially those on fixed incomes ,the increase cost of virtually every item including power and gaswhich were subject to those exorbitent price increases.

Let me take the variable and escalated cost of realestate rentals, certainly not trickle down .

Notably ,the rates are through the roof.

Can that be some what related to interest rates on morthages ? You bet !

If that is not true , then, why do we have rent control to asist the working man to put a roof over his families heads .

By the way making comparisons to other countries economies does not solve our problems .

RENT CONTROL

Can some one tell me why they hurt one man with a mortgage debt to help another, with reduces rents to pay his car loan ?

The smartest man in the World is not the man who knows allot ,

but, the man who knows where he can find it out.

People can’t spend what they don’t have

Sure they can . It’s called a credit card ! lol

.

Seniors walk into a Bank for a loan and are told by the bank . W e dont loan money to seniors I presume this applies to all they also say .

“We the bank do not want to be in a position to foreclose on a senior”.

We are not that stupid we have been at it for years ! we kno if we had defaulted we loose our credibility .

I guess that the bank has branded a large part of the buying community as not to be trusted or not credit worthy.

They payed the ultimate price they lost their account.

Seniors need to be very carefull that the do not caught out with with a medical emergency.

Many smart Bermudians are property wealthy simply because they made the sacrifice ..

Their final mortgage payment was made on the month before their 65 th birthday which coinsided with retirement and the loss of income.

Bermuda in effect has retired , with a very big loan ,which our young people will have to face up to.

as the tax man shows up to the door wit the bill for the fat tax .

Here is where we and what we are facing we are locked into a stalemate.

Go and ask why what causes the problems? it is called over extension take that one step further, the country and its people have very little reserves if any.

Many have amortized mortgage to pay interest and down on.

A big bundle of Land taxes are overdue .

Some not all tax payers found to loop hole, then the tac over due became a form of inhearantace tax .

The Land tax was not need back then so how can it be needed today .

Because it is the easiest tax to collect they just mail out the bill.

My uncalled for advice to yourg people .

Never spend your last penny.

Where did it all begin, and were will all end.

If my memory serves me correctly , Bermuda was fortunate to have large quantities of investment capitol from English investors , however some of tha money not all went to the USA stock market .

Those investors were advises to diversify their portfolio with safe investment in realestate mortgages with the Bank as agent ..

Mortgage investment accounts were set up to accommodate those investors the Bank as agent received a minimal service charge of only .35 %. the lending rate at the time was 7%.

Bermuda whole economy was base on the 7% rate.

We the public knew where we all stood !

The bank invested the lenders principal capital in local mortgages to local people who paid interest only on their debt .

The reason being that the investors wanted their investment to remain in tact and did no want their capital investments to be reduced with monthly reduction in principal by the mortgagee .

( Here is where inflation at 1% could have play a major role however there is a down side . >>> go figure !)

That eased to burden or repayment on the mortgagee, who, was able to save their money at a good interest rate towards final repayment in full of their mortgage say in 10 to 15 years or less .

The U K Government were not comfortable see capitol money being use as for investment over seas, the willing investor had no alternative but to recall their mortgage investments through the Bank.

ALL IS NOT LOST

The Banks created the C/D ( certificate of deposit ) at a very favorable income rate .

Those C/D monies went to refinance all of those mortgages at zero risk to the local lenders.

Virtually every body got in on the deal with as little as the minimum investment of $1,000.

Now you know how the WEST WAS WON !.

Most of our senior will tell you that continually borowing money with the exception of a mortgage is not a good idea.

The loan interest plus charges added to the cost of the loan make the cost of the item become more than it is worth.

People living one day at a time constantly in debt is not living , simply because that idea has broken this islands economy .