Bermuda Reinsurers Petition Congress

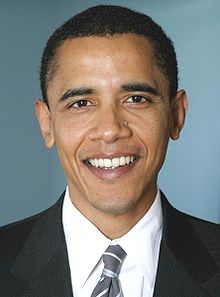

President Barack Obama’s inclusion of a proposal to deny tax deductions for certain reinsurance premiums paid to foreign-based affiliates by US insurers in his Budget plan has drawn criticism from Bermuda reinsurers.

President Barack Obama’s inclusion of a proposal to deny tax deductions for certain reinsurance premiums paid to foreign-based affiliates by US insurers in his Budget plan has drawn criticism from Bermuda reinsurers.

The Coalition for Competitive Insurance Rates (CCIR) — a Washington lobby group which includes the Association of Bermuda Insurers & Reinsurers [ABIR], European reinsurers and the Risk and Insurance Management Society (RIMS) — objected to the proposal in a letter sent to the chairmen and ranking members of both the US Senate Finance Committee and House of Representatives Ways and Means Committee.

“This is similar to legislation introduced in the 111th Congress by Rep. Richard Neal (Democrat, Massachusetts) — legislation which was widely opposed by consumer advocates,insurance industry experts, and trade analysts,” said the letter, which was sent last week. “Unfortunately, this proposal is being advocated as a possible tax revenue offset by a small group of very large US insurance companies.

“With the enactment of this tax, these companies intend to create a US market share advantage for themselves at the expense of individual and commercial insurance consumers.”

The Neal Bill was specificially targeted at closing the so-called “Bemuda Loophole” in the US Code which he argues allows insurers to avoid paying US taxes by basing their companies overseas. Rep. Neal’s stalled legislation would limit insurers from receiving tax deductions on some reinsurance business they send to foreign-owned arms in Bermuda and elsewhere.

The Neal legislation has resulted in an ongoing, multimillion-dollar lobbying battle between US and foreign insurers in Washington, DC. Domestic insurers, led by W.R. Berkley Corp. and Chubb Corp., set up a Coalition for a Domestic Insurance Industry which strongly supports Neal’s bill. Bermuda and other foreign insurers and trade groups opposed to the Neal bill set up their own Coalition for Competitive Insurance Rates — which aside from ABIR also includes the ACE Group of Companies and XL — to battle both Rep. Neal’s legislation and the White House’s similar measures.

“We oppose these proposals,” said CCIR in its letter to Congressional leaders. “The proposals are bad for consumers. This budget proposal would disallow a deduction for certain reinsurance premiums paid by a US insurer to an international affiliate. In effect, this is designed to punish international insurers by imposing additional taxes on their US operations.”

Saying the proposed tax change would essentially impose “an isolationist tariff on international insurance companies conducting business in the US”, the CCIR letter went on to point out reinsurance capacity providing by off-shore jurisdictions like Bermuda was essential to both American insurers and consumers.

“Reinsurance is an important tool used by insurers to manage risk,” said the CCIR. “The US requires a large amount of reinsurance capacity to cover such events as natural disasters, large scale industrial accidents and acts of terrorism. A substantial part of this reinsurance is supplied by non-US reinsurance companies.

“The effort to create a punitive tax regime on international carriers will result in less insurance capacity and increased costs for US consumers. A robust insurance market open to as many competitors as possible is essential to consumers. This is particularly understood by those in states more exposed to natural disasters where there has been a crisis of insurance availability and affordability and by those who buy certain classes of commercial insurance that have historically suffered from contractions in availability of coverage.”

The CCIR pointed out insurance regulators from hurricane-prone states including Florida, Louisiana, Mississippi, North Carolina, South Carolina have gone on the record opposing the proposed tax.

The Obama Administration calculates the proposed reinsurance tax would cut the US budget deficit by $2.6 billion between 2012 and 2021.

Comments (1)

Trackback URL | Comments RSS Feed

Articles that link to this one: