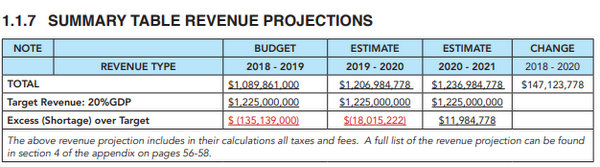

‘Additional Yield Of Approximately $147 Million’

If the tax policy recommendations in the Tax Reform Commission’s report are implemented, an “additional yield of approximately $147 million could be generated over a 2-3-year period,” the report said.

The Tax Reform Commission’s Report was tabled in the House of Assembly on Friday, and the Government said they will “closely evaluate and consider all recommendations” and the “appropriate consultation with the various stakeholders will be conducted before any major changes are made to our tax system.”

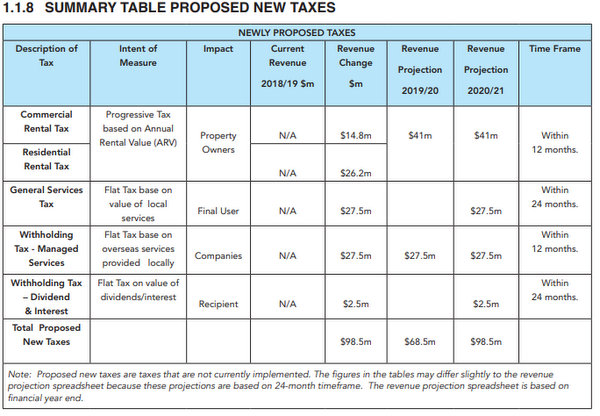

One of the proposed new taxes is a tax on rental income as a “means of generating revenue and broadening Bermuda’s tax base,” with the report recommending a flat tax of 5%.

It also recommended a General Services Tax of 5% tax levied on services, a Managed Services Tax which applies to services outsourced by local companies to foreign service providers, and a withholding tax on interest and/or dividend income that is attributable to local companies

A Government spokesperson said, “In the House of Assembly on Friday, November 16, 2018, Junior Minister of Finance Wayne Furbert tabled the Report of the Tax Reform Commission, on behalf of the Minister of Finance Curtis L. Dickinson.

“The report outlines the recommendations put forward by the Commission to make Bermuda’s tax system fairer,enhance Bermuda’s global competitiveness and to broaden the tax base in order to reduce the reliance on payroll taxes.

“In the 2017 Throne Speech, this Government committed to creating a Tax Reform Commission and as a result, the Tax Reform Commission was formed under the Tax Reform Commission Act 2017.

“The purpose of the Commission was to conduct a review of Bermuda’s system of taxation and revenue collection and make recommendations on tax reform to Parliament.

“More specifically, the Tax Reform Commission was given the following mandate by the Minister of Finance:

- “Examine Bermuda’s tax system and determine any measures that may be taken to best enable a system of taxation and revenue collection that is equitable, effective, efficient, competitive and transparent;

- “Increase public sector revenue yield from 17% of GDP to a minimum of 20%-22% of GDP; and

- “Prepare and submit a report and recommendations in accordance with section 7 of the Tax Reform Act.

Minister Dickinson said, “Over the past nine months the Tax Reform Commission met on average twice a week conducting extensive research and due diligence to understand what options were needed to modernize Bermuda’s tax system and provide proposals for the administrative aid which will be needed to support the recommendations contained within the Tax Reform Commission’s Report.

“As a result, the Commission determined that if the proposed tax policy recommendations are implemented, an additional yield of approximately $147 million could be generated over the next 2-3-year period, increasing government revenue to approximately $1.26 billion [20% of Gross Domestic Product [GDP]] by 2020, compared to 17% of GDP in 2017.

“The Government will closely evaluate and consider all recommendations included in the report and as per this Government’s normal custom and practice, the appropriate consultation with the various stakeholders will be conducted before any major changes are made to our tax system.”

The full Tax Reform Commission Report 2018 follows below [PDF here]:

the GVT has come up with some innovative clever way to “yield” new revenue.

Um..nope…. just more tax , increasing the cost of being in Bermuda.

Tax and spend. Go BERMUDA GVT.

Champions.

They have no idea..

Wonder if we are going to hear any results from there big trip try8ng to find someone crazy to refinance our debt or whatever.

How about just getting the people who completely skirt paying taxes to pay their fair share. What a concept?!

Where is the RAGE commission the Pee El Pee was going on about when they were in opposition?!?! Titty milk got them thinking another way now… Ha ha ha!!

What a laugh and sorry to say the best they can do is to increase taxes …plp faithful how does this feel …those apartments second houses you were making out pretty good but here comes those 25-11 you voted in to take some of that away hope you are still wearing green. When you put unsuccessful business people in charge you have a good chance of having an unsuccessful government…..lets vote 36-0 you might as well because soon their aren’t going to be enough people left here who care

NO CLUE on how to grow the economy and attract real business. Tax, tax, tax. All PLp can do is invent new taxes to cover a failing economy and their increased spending. Keep drinking the cool aid. We’re all worse off.

How does this help the avg Bermudian? It doesn’t.

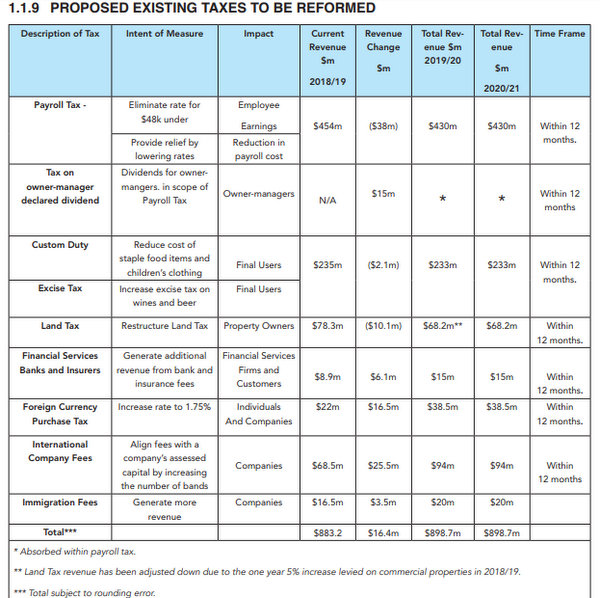

1.75% foreign currency tax – since everything is imported and must be paid for in foreign currency, the price of everything just went up… This is an enormous increase.

Much can be said for all the other new taxes.

The basic problem (like so many countries) is that nobody has the courage to tackle the root cause – a bloated civil service with low productivity.

Tax and tax is always the easy way to purge the money from the country. You cannot build the economy like that. So, where are the jobs in the private sector? It seems that this bunch is clutching at straws. the PLP does not have a clue. Yes! Clueless, opaque, xenophobic, divisive, hypocritical, deceiptful, incompetent, no integrity; up the creek without a pedal.

Unfortunately, protesting out side parliament grounds would be fruitless. Nothing is being done to move us forward whether they are in-house or not. And what is Walton Brown doing about a “ Pathway to Status” to make PRC’s feel welcome and part of us? Will the PLP push them out like it did the exemption companies?

the plp have decimated the public purse and now looking for other ways to get their hands on people’s money.

So that’s an extra $147m they plan to take from us.

That’s a measure of how incompetent and inefficient this government is. Any idiot can spend more money. It takes no talent at all. The PLP are $147m more inefficient than anyone else. That’s the extra cost of having voted these clowns in.

A flatlining economy, no growth, and more taxes. Yup, just the ticket. Declining demand for goods and services, and more redundancies to come.

Utterly clueless. 15 years of abject failure.

As long as we have a government that is determined to spend more than it rakes in then this is the way to go. Tax the “haves” until the “have nots” drive them from Bermuda.

The irony of linking revenue to Bermuda’s GDP which is not calculated in the normal way. For example GDP rose when the Civil Servants were given a pay rise. So the tax will increase to pay for more debt, not to pay down debt. Since the Government is unable to collect all of the present taxes, why create new ones? Taxes should be reduced, and this can be achieved by reducing the cost of Government and collecting outstanding and current taxes.

My opinion.If they looked closely at the FAT they could trim from the over bloated civil service, less TRIPS, less useless brain dead initiatives and PAY ATTENTION TO the OVERSPENDS and actually TIGHTEN THEIR OBSSEION with spend and actually keep within or better UNDER budget they could save far more than this new proposal. RUN IT LIKE A BUSINESS NOT A CANDY STORE.Shows their acumen for running a real business

I hate to say it, but majority of the PLP MPs are taking home more money than they ever have!!

Dont expect the gravy train to dry up any time soon!!

These guys are going to kill of the rest of the Bermuda economy with the hike in FCPT alone.

boooo PLP boooo ruining the lives of every bermudian here to cover for your own mistakes and loss of billions when in power last. boooooo you better fix this, not make it worse for us!!!

There are a lot of sensible realizable savings that could be implemented instead of raising taxes – which the less well off always end up paying for in the end as the smart money simply moves on…

Halve the number of MPs or cut their salary in half – minimum savings $990,000.00 per year

Get rid of TCD vehicle inspections and have this work done by certified private garages

Get rid of the entire ministry of education and put headmasters in charge of schools and their reappointments results contingent.

Halve the size of the self serving, self perpetuating BMA. Half of what they do is a complete joke, just ask CID if you don’t believe me. BMA is a large part of the problem businesses do not choose to establish here.

Ban all Government overtime. It’s a racket, it you make it available, of course a way will be found to avail of it.

More submissions to this newly constituted independent commission are welcome.

Probably an idea from the coffee shop.

OJ? Cmon man, i know u have something. Howz it feel mate? Everything they said they wouldnt do they r doing and guess whos feeling it the most? U and me. BRO

$2370 per person per year less for every Bermudian.

it is unbelievable….

do they really know what they are doing ?

anyway

it is decided

I will close down my little shop here in Bermuda ( by end of June 2019 ) and move over to another island.

that effects 4 persons , two are ‘nasty’ foreigners and two are Bermudians who can look after a job in the fintech industry

reasons :

increasing taxations in Bermuda ( everything got more and more expensive )

extremely high labor costs , due to above

extremely high living costs ( and I don’t see an end )

race driven environment , all foreigners are ‘evils’

now many of the so-called grass root Bermudians will cheer and say : we don’t need you , bye-bye

I am just a little piece of the cake ( IB ) but have a look into the offers for home sales and rent. the numbers climb almost every day.

what does that mean ?

many company will reduce their presence here or at least reduce it .

good – more jobs for Bermudians , or is it just that they fade away and take the jobs ( for foreigners as well as Bermudians ) with them ?

good luck Bermuda , increase the CS and tax the remaining population much , much more

What a disaster for middle class Bermudians.

From 1996 to 2013 the Government-the-day (UPB,PLP and OBA)were only able to extract, on average, 16% of GDP. During 1998 to 2012 the PLP maintained the same average when the GDP doubled and yet the taxpayer’s purse did not in proportion to GDP growth. One only need read the Auditor General’s reports from 2007 to 2012, and the Commission of Enquiry into the Government accounts from 2010 to 2012 to understand why!!

The very same leadership, with the help of ex-UBP/OBA members of Parliament, now realize the unfair tax burden is the problem. The real problem is self-interest which is still very much in play.

I am all for the principle of Government’s tax income as percentage of GDP. It has maintain a sustainable GDP growth, increase the working population,improve operation efficiency(implement SAGE Commission recommendations)and tax reform.

GDP=Working Population + productivity. Unless do this, we will fail!!

There will be a whole bunch of derelict buildings in Hamilton within a couple of years.

The only way to grow an economy is to reduce taxes.

Zane was in the news a couple of days ago talking about tax relief for those in the vacation rental business. Then this.

Zane owns a business and understands. Furbert has no clue.

1. Those skirting their taxes are to pay their fair share.

2. Keep the tax rate as low as possible.

3. Manage the public purse better – outsource as many government departments as possible to keep the monies and spending in order – it is all about accountability which the public sector seems to have a hard time with no matter who is in power.

4. Find ways to stimulate the economy – it is called having a vision for the future of Bermuda.

5. All Bermudians should work together in this regard – be part of the solution and not part of the problem. Is this too idealistic?

KISS – keep is simple stupid. Easy enough . . . come on people!!!