HSBC: Tips On Saving & Investing Your Money

[Advice column by HSBC Bermuda]

I’ve always heard that I should invest my money instead of allowing it to sit in my savings account. However, I don’t really understand investing. What is difference between the two? When and how long should I invest for?

Saving vs. Investing Your Money

The challenge with savings accounts

With interest rates at an all-time low, a savings account is not as attractive as it used to be. When you take into account how inflation can eat into the value of your money, you need to think about how you can maintain its purchasing power over the long-term.

In a savings account, your money might be protected but chances are it won’t buy as much in ten years’ time as it will today. As you look further ahead to your retirement years, the impact of inflation on your savings could become even more significant.

The alternative

If you are able to put aside money monthly for three years or more, then one route to potential growth could be to invest it. Investing could bring a much greater potential for growth than a savings account, but carries with it the risk that you could get back less than you invested.

Saving and investing your money both have their place in a financial plan and an HSBC Wealth Specialist or Premier Relationship Manager can help you develop your strategy.

Start investing earlier to finish further ahead

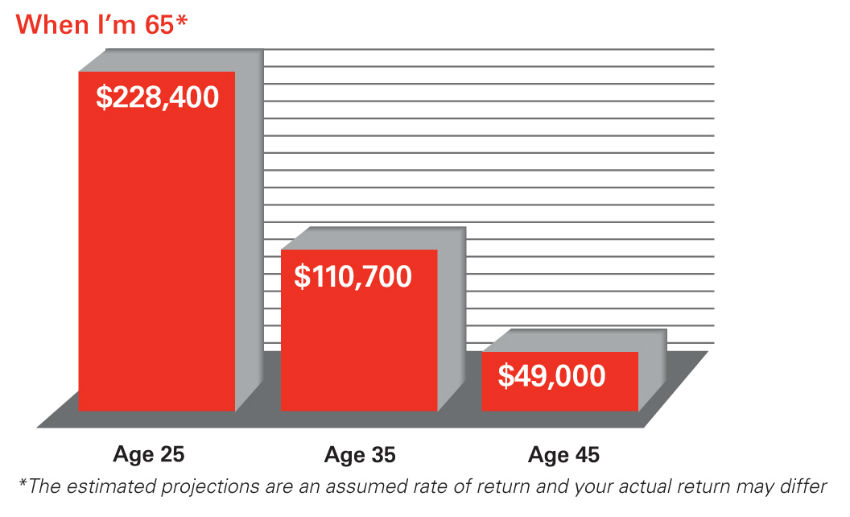

Regular investing puts the power of compound growth on your side and the earlier you start, the more you may have. Imagine three investors, aged 25, 35 and 45, contributing $100 every month until they reach 65. They all earn an annual average return of 6.5%.

The 25 year old ends up with over $117,000 more than the 35 year old and over $179,000 more than the 45 year old. But no matter when you start, we can show you how a regular investment plan can help you realise your dreams.

Invest regularly

It makes saving easier by adding discipline to your regular savings plan. Additionally, by investing regularly and buying investment shares in fixed dollar amounts each month, you purchase more shares when the price is low and fewer shares when the price is high, lowering the average cost per share over time in a fluctuating market.

To discuss your finances and future goals in person, make a free Financial Planning appointment on www.hsbc.bm/planning or by calling 299-5959.

Investors should be aware that performance returns are affected by market fluctuations. Investing entails risks, including possible loss of principal. Issued by HSBC Bank Bermuda Limited which is licensed to conduct Banking and Investment Business by the Bermuda Monetary Authority.