Ministry: 2015/16 First Half Fiscal Performance

The headline numbers for the 2015/16 National Budget are a revenue target of $931 million; current expenditure of $1.08 billion, including debt service; capital expenditure of $68.7 million; and a projected deficit of $220 million, the Ministry of Finance said today.

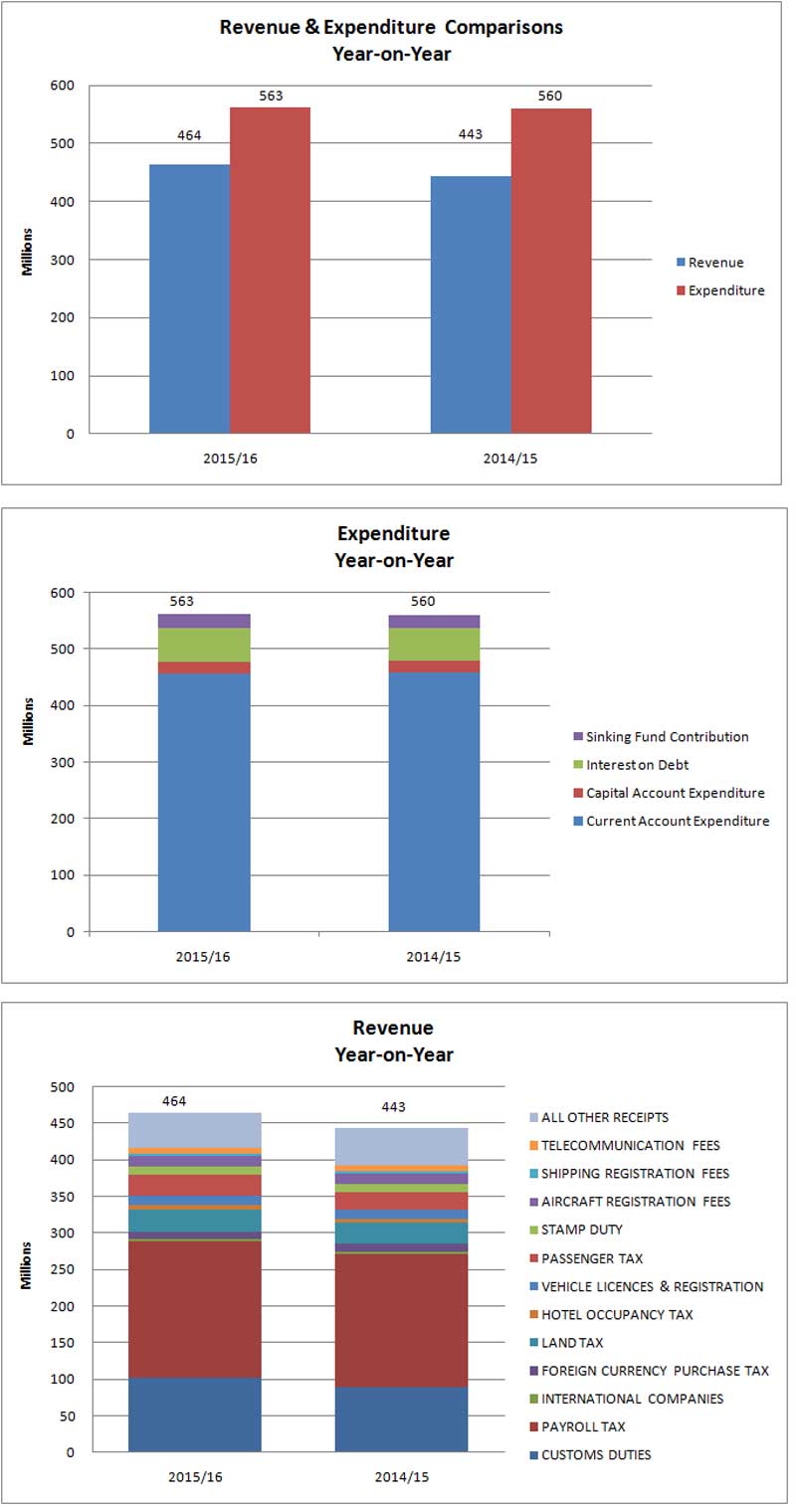

In reporting on the 2015/16 First Half Fiscal Performance and providing an updated Economic Review for 2015, the Ministry said that revenues for the six months ending September 2015 are $464.2 million; this is $20.7 million [4.7%] higher than in September 2014.

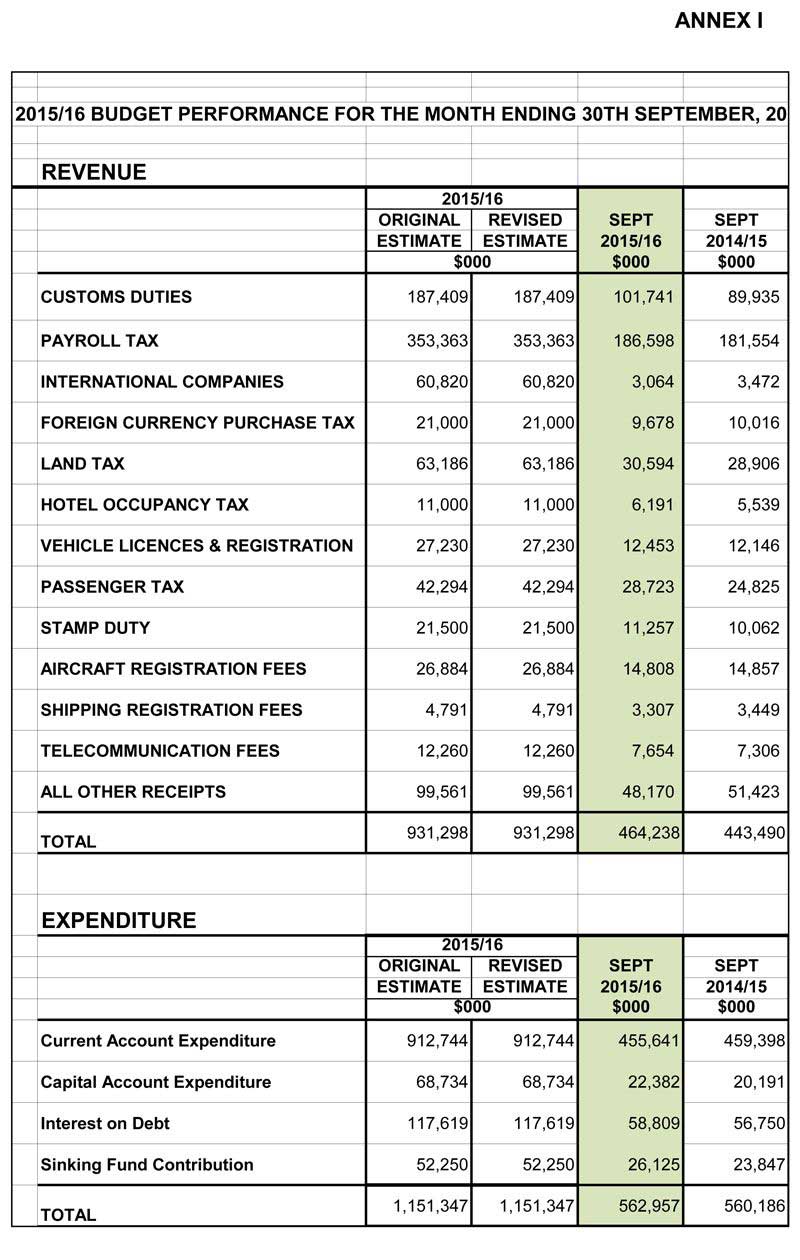

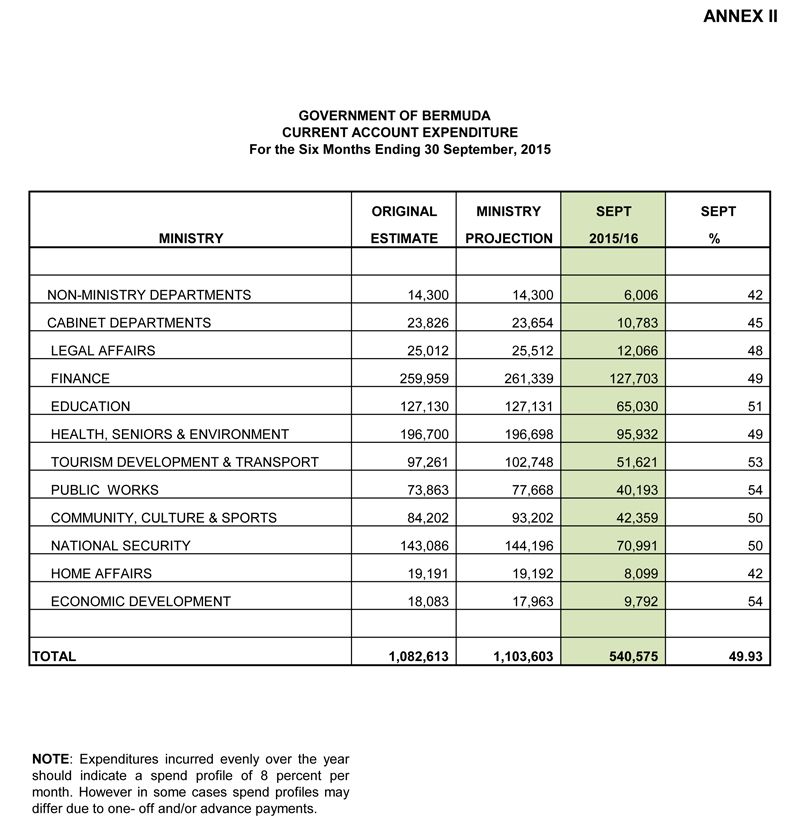

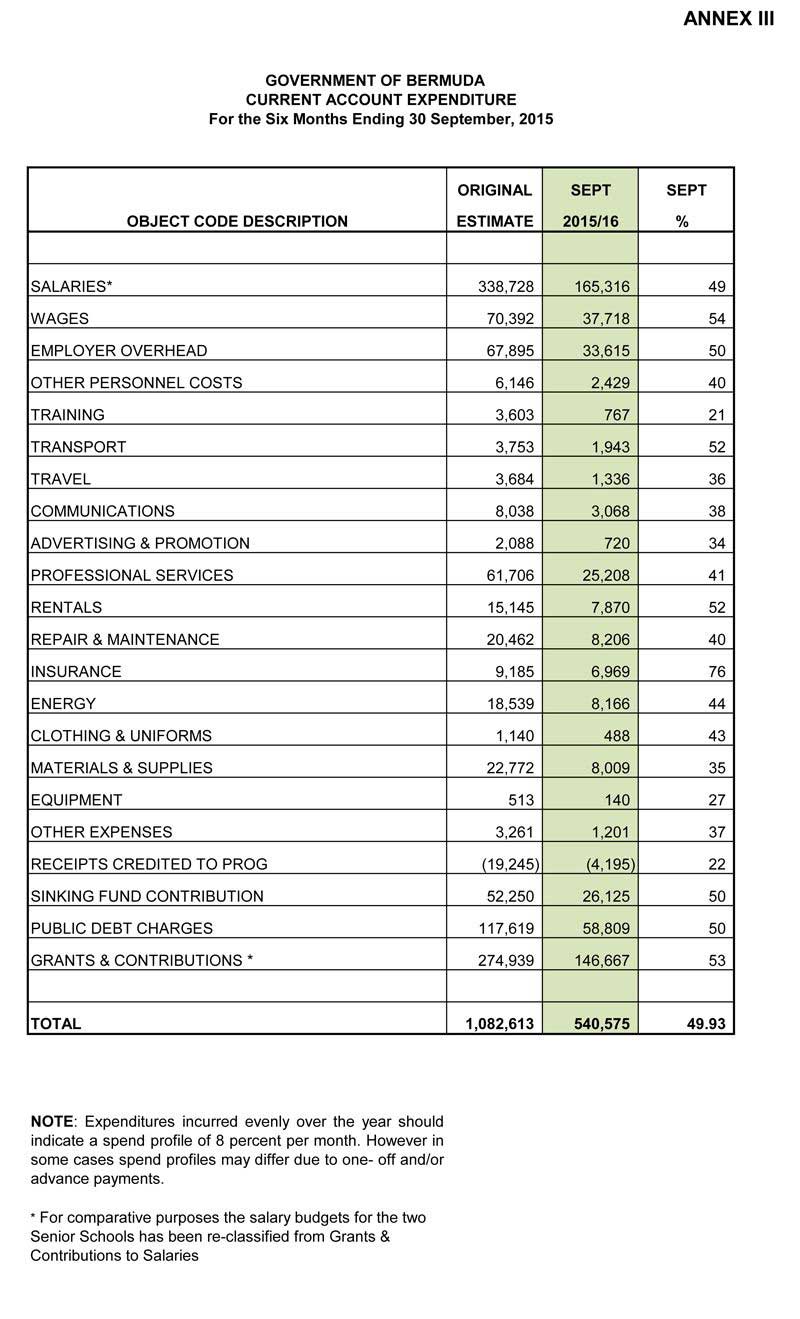

“Current expenditures, excluding debt service, for the first six months ending September 2015 are $455.6 million; this is $3.8 million [0.8%] lower than the amount spent during the same period in the last fiscal year,” the Ministry said.

“It should be noted that Government current account spending to date has been reduced in spite of the fact that the furlough initiative has ended which accounted for a significant amount of savings last year. The current year reduction is therefore due to proposals and other budget reduction measures taken in the 2015/16 Budget.”

“Debt service costs for the first six months ending September 2015 are $84.9 million. This represents $58.8 million in interest payments and a $26.1 million contribution to the Government Borrowing Sinking Fund. Debt service to date is $4.3 million more than last year’s period. This is due to higher debt levels.

“The $58.8 million paid in interest expense represents 12.7% of the revenue collected for the period. For comparative purposes, it should be noted that the average for countries rated similar to Bermuda is 4.1% of revenue collections.”

The full statement from the Ministry of Finance is below:

2015/16 First Half Fiscal Performance:

The headline numbers for the 2015/16 National Budget are as follows: a revenue target of $931 million; current expenditure of $1.08 billion, including debt service; capital expenditure of $68.7 million; and a projected deficit of $220 million.

Revenues for the six months ending September 2015 are $464.2 million; this is $20.7 million [4.7%] higher than in September 2014. It should be noted that the increase in revenue is due to a larger collection in Customs Duty, Payroll Tax and Passenger Tax which are offset by lower receipts in all other revenues.

In general, total revenues are tracking in line with budget estimates and the strength in Payroll Tax and Customs Duty receipts increases the chances of meeting the total revenue target of $931 million for the current fiscal year.

Current expenditures, excluding debt service, for the first six months ending September 2015 are $455.6 million; this is $3.8 million [0.8%] lower than the amount spent during the same period in the last fiscal year.

It should be noted that Government current account spending to date has been reduced in spite of the fact that the furlough initiative has ended which accounted for a significant amount of savings last year. The current year reduction is therefore due to proposals and other budget reduction measures taken in the 2015/16 Budget.

In general, current expenditures, excluding debt service, are presently tracking slightly below budget estimates. The $455.6 million spent in the first six months of 2015/16 represents approximately 49.9% of the total current account budget of $912.7 million.

Capital expenditures for the period ending September 2015 are $2.2 million higher than in September 2014. This is primarily due to the increases in the 2015/16 Capital Budget for Airport Redevelopment and The America’s Cup.

Total current and capital spending to date, excluding debt service, is $1.6 million [0.3%] lower than last year’s spending.

Spending pressures have continued in the social areas with ongoing demand for financial assistance with expenditures in this area being above budget in the first six months of 2015/16. Other potential unexpected and unavoidable expenditures in current account expenditures in 2015/16 are being closely monitored. To the maximum extent possible, these items will be covered with current budget allocations. Also, in order to remain within the Government’s 2015/16 total budget appropriations of $1.15 billion, Government has implemented various cost saving measures for the remainder of this fiscal year.

Debt service costs for the first six months ending September 2015 are $84.9 million. This represents $58.8 million in interest payments and a $26.1 million contribution to the Government Borrowing Sinking Fund. Debt service to date is $4.3 million more than last year’s period. This is due to higher debt levels.

The $58.8 million paid in interest expense represents 12.7% of the revenue collected for the period. For comparative purposes, it should be noted that the average for countries rated similar to Bermuda is 4.1% of revenue collections.

For the first six months of 2015/16 Government incurred a deficit of $98.7 million, compared to a deficit of $116.7 for the corresponding period in 2014/15. This deficit was financed by drawing funds from the Sinking Fund and draws on the credit facility recently arranged by the Government. Part of the projected 2015/16 budget deficit has been financed by the remainder of the $800 million that was borrowed in 2013 and the rest will be financed by the credit facility the Government has with a local bank.

Excluding debt service, Government recorded an $8.6 million current account surplus for the first six months of the year, the first time this has happened in seven years.

Gross debt at the end of September 2015 stood at $2.25 billion and debt, net of the Sinking Fund, was $2.16 billion.

Bermuda Economy 2015: Updated Economic Review

Summary Economic Indicators: Updated Economic Review 2015

*Comparative data over the first half of calendar year 2015, except when otherwise indicated.

- The headline rate of inflation in August 2015 stood at 1.4%, year-over-year. The year-to-date average rate of inflation measured 1.8% while the 12 month average rate was 1.6%.

- The primary causes of inflation during the last twelve months were the increased costs of medical supplies, prescription drugs and health insurance premiums in the Health & Personal Care sector, rising food costs and higher prices for various household goods in the Household Goods, Services & Communications Sector.

- Imports declined over the first two quarters by 5.5% to record a total of $450 million. The decrease was mainly the result of a $16 million or 28% reduction in the importation of fuel due to the declining cost of fuel. There was also a decline of 6.6% in the imports of food, beverages & tobacco.

- During the first nine months of 2015 there was a 1.4% increase in the number of visitors to the island. The number of air arrives declined by 2.8% while cruise visitors grew by 3.9%.

- Over the first three quarters of 2015, total visitor spending increased by 0.9% settling at $289.1 million.

- 713 new international companies and partnerships were registered in Bermuda during the first nine months of 2015 representing an 18.1% decrease when compared to the 871 registrations in 2014.

- The value of new projects started during the period grew to $89.4 million, an increase of 20.3%.

- Over the first two quarters of 2015, activity in the construction industry declined from an estimated value of work put in place of $79.5 million in 2014 to $38.9 million in 2015. The vast majority of the decline in the level of construction activity was a result of less activity in the Schools, Hospitals & Community Centres Sector and the Hotels & Guest Houses Sector.

- Employment income grew to $1.684 billion in the first six months of 2015, an increase of 0.9%.

- Total consumer spending in retail outlets between January and August 2015 grew by $25 million or 3.5% to register at approximately $726.9 million. Of that amount, approximately $689.6 million was spent locally while $37.3 million was spent overseas.

- Based on figures released by the Bermuda Monetary Authority, Bermuda’s money supply increased by 1.6% year-over-year during the first two quarters of 2015. The growth in the money supply was driven by an increase in Bermuda dollar denominated deposit liabilities.

- The Banking sector’s total assets increased marginally by 0.2% during the first two quarters of 2015. This sector recorded notable gains in Investments [9.1%] in the first quarter and interbank deposits [10.5%] in the second quarter.

- Loans recorded growth of 5.5% at the end of the second quarter, while customer deposits increased by 0.9% over the same period.

At mid-year, the economic data is consistent with the expectations outlined in the 2014 National Economic Report of Bermuda and the Ministry of Finance’s own macroeconomic forecasts. The key point of note is that the prospects for GDP growth look favorable.

Along with The America’s Cup, the proposed reform measures in the areas of employment, international business, tourism and construction are all expected to have a positive impact on the economy beginning in 2015 and beyond. All of these measures will help the economy to eventually grow and in turn assist the Government in its goal of sustainable growth and debt reduction.

All charts provided by the Ministry of Finance:

“Sinking Fund”.

Irony.

For all the service cuts we have undergone, I am holding my head.

The Ministry of Finance has an established record of inaccurate financial reporting with swings as high as $20 – $30 million between estimated revenue and actual. Ministry spending figures are generally closer to reality with much smaller variances.

I hope that these interim revenue figures are not way off….

I note that what’s left of the $800 million borrowed in 2013 will be used to part cover the $220 million deficit for 2015/16; and that the remainder of the $220 million deficit will be covered from the fresh $200 million borrowing in mid 2015..

That $800 million did not go very far or last very long did it?

There is still something very wrong in that Ministry.

That is like a breath of fresh air, the needle is finally going the right way… way to go Bob

A deficit on the budget, is a deficit, is a deficit. It is impossible to continue to spend more than government receives in revenue. We have not even taken into consideration the massive deficits on the pension funds and future health care costs both of which are time bombs given our ageing population. Are we on the road to disaster? Time is not on our side. I hope I am wrong.

Bob Stewart.

I wouldn’t be feeling too comfortable if I were relying on a government pension.

Admittedly, the report is more positive than previous periods, but I do not believe the news at the end of the day is positive. There is still a significant deficit and many believe it is insurmountable with the ever growing financing costs.

I believe bold leadership is needed and we NEED to be looking to do more. I and my fellow Bermudians wait with eager anticipation for the deficit to close with the ramping up of construction and hopefully tourism to stop the financial bleeding, but I pose the question, will it be enough? Maybe the budget will balance, but what then once construction projects have finished? We cannot build on Bermuda forever.

I do not have the answer, but recognizing Bermuda needs new revenue sources as existing sources are already strained and taxing Bermuda’s struggling families further is unwelcome, we as Bermudians need to think outside the box for a new source.

A humble suggestion to encourage the debate, Passive income streams from multiple rental properties are enjoyed by a small percentage of the population (trusts included) and I would expect they are in a better position to absorb increased taxes on their passive revenue streams better than most.

Understandably income tax is a taboo word, but perhaps increased stamp duties or land taxes for third and subsequent properties owned by an individual or entity is warranted and can help generate income for the government, assuming the government can manage the process which is an entirely separate conversation.

the elephant in the room? the bloated civil service that will never allow the deficit to be reduced……..cannot spend more than we make for much longer……

Even if/when the private sector picks up and jobs are available the union will not allow reductions. Members have it too good. Why would they go to the private sector without a fight?

A start would be moving all government pensions to defined contribution. This needs to happen immediately. Whether they think so or not it is the best move for individuals given the state of the pension fund.