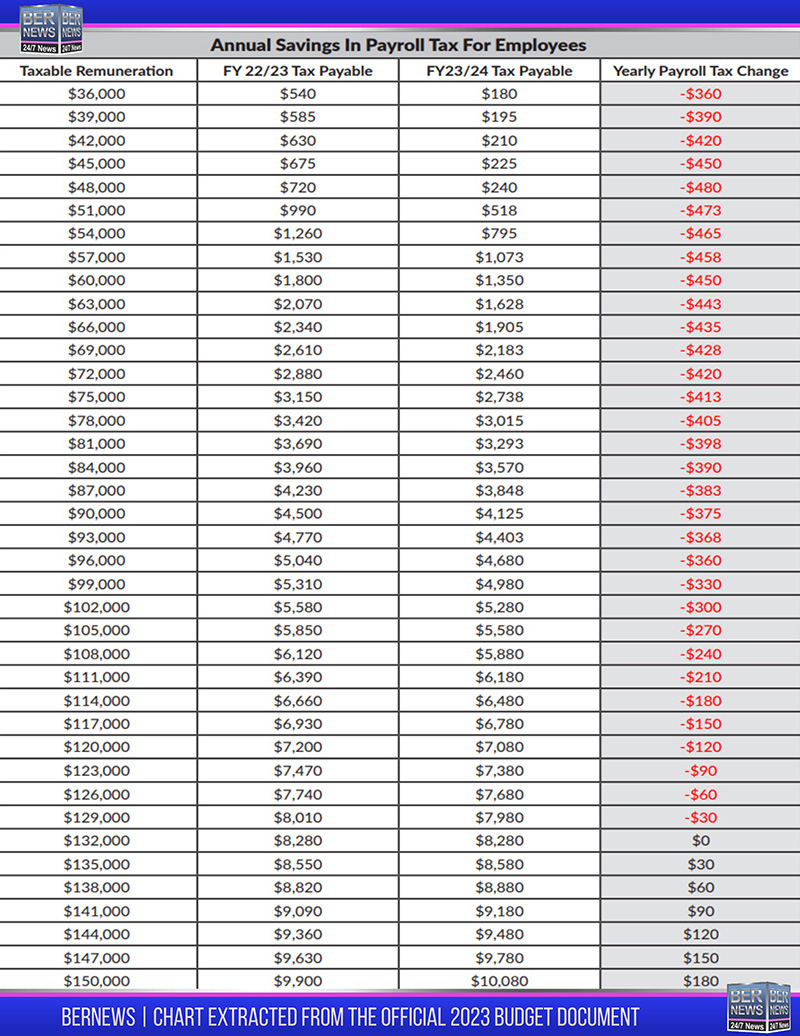

Chart: Savings In Payroll Tax For Employees

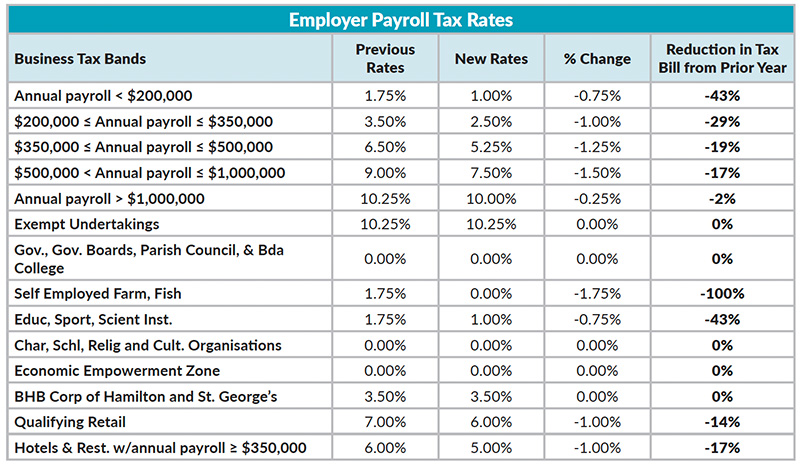

People making $132,000 or less per year “will pay less in payroll taxes” and small businesses will see “their payroll tax liability decline by as much as 43%,” Premier and Minister of Finance David Burt said as he outlined changes to payroll tax set to take effect in the 2023 Budget.

“Small businesses, the lifeblood of most economies, will see their payroll tax liability decline by as much as 43%,” Premier Burt said, adding “This is a budget for growth, and what is necessary for growth is that you support the businesses that can provide growth in the economy.”

#1 | Chart extracted from the 2023 Budget document

“Any individual making $132,000 or less per year will pay less in payroll taxes next year,” the Premier said. “This represents 86% of Bermuda’s workforce; 86% of the workers in our economy, who give their time and talents to produce for their employers, will pay less in payroll tax next year.

You can read the Premier’s full comments on payroll tax here, and the chart below — which was extracted from the official budget document — lays out the “annual savings in payroll taxes for employees.”

#2 | Chart extracted from the 2023 Budget document