Premier Announces Changes To Payroll Tax

“Moving to the employee payroll tax, the headline is this: any individual making $132,000 or less per year will pay less in payroll taxes next year,” Premier and Minister of Finance David Burt said.

In delivering the 2023 Budget today, the Premier said, “The payroll tax changes in this Budget that I am about to announce come as a result of meaningful consultation that has taken place following the release of the pre-bud-get report. With our commitment to a transparent budgeting process, it was essential that the Government shared its considerations and the challenges faced when putting together an annual budget that maintained our path to a balanced budget in fiscal year 2024/25.

“It must be remembered that the revenue proposals contained in the pre-budget report were made against the backdrop of the loss of revenue from the aircraft registry due to Russia’s invasion of Ukraine and the lost funding as a result of ending the travel authorisation. Those two items alone represented approximately $40 million of revenue that will not accrue to the Government during the next fiscal year.

“This is a budget for growth, and what is necessary for growth is that you support the businesses that can provide growth in the economy. That means not just international business but also local businesses large and small, our tourism establishments and our re-tail outlets.

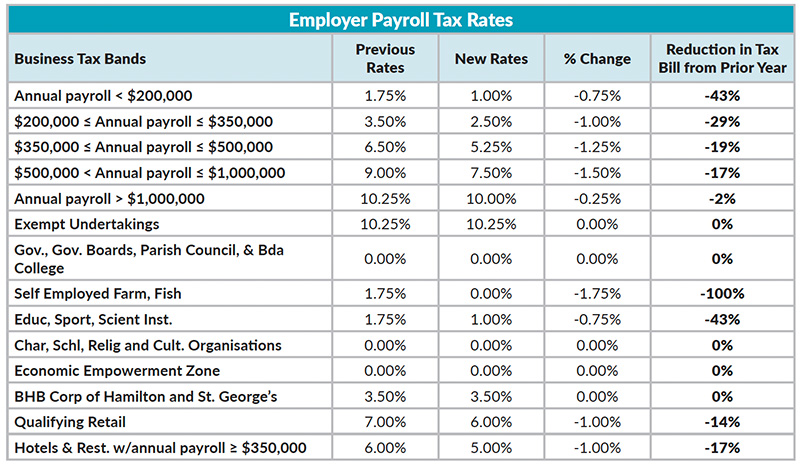

“Before I go into the details, let me get to the headline: no business in Bermuda will pay any more in employer payroll taxes in this budget than last year; all employer rates will either stay the same or will go down. Small businesses, the lifeblood of most economies, will see their payroll tax liability decline by as much as 43%. We will deliver payroll tax re-ductions to retailers, gyms, convenience stores, construction companies and truckers. Our hotels and restaurants, which are still recovering from the impact of the pandemic, will see their payroll tax liability decline by 17%.

“Moving to the employee payroll tax, the headline is this: any individual making $132,000 or less per year will pay less in payroll taxes next year. Yes, Mr Speaker, this represents 86% of Bermuda’s workforce; 86% of the workers in our economy, who give their time and talents to produce for their employers, will pay less in payroll tax next year.

“As I said at the start of my presentation today, this is a budget for growth. It is a budget that reflects the fact that Bermuda must position itself to be a place that is attractive to business owners and business creators who will power the economic growth required for the Bermuda economy to succeed.

“Now to the eagerly awaited details:

Employer Payroll Taxes

- Businesses with an annual payroll of up to $200,000 will see their payroll tax rate move from 1.75% to 1%, reducing their payroll tax liability by 43%.

- Businesses with an annual payroll of $200,000–$350,000 will see their payroll tax rate moved from 3.5% to 2.5%, reducing their payroll tax liability by 29%.

- Businesses with an annual payroll of $350,000–$500,000 will see their payroll tax rate moved from 6.5% to 5.25%, reducing their payroll tax liability by 19%.

- Businesses with an annual payroll of $500,000–$1,000,000 will see their payroll tax rate move from 9% to 7.5%, reducing their payroll tax liability by 17%.

- Businesses with an annual payroll of $1,000,000 or more will see their payroll tax rate move from 10.25% to 10%, reducing their payroll tax liability by 2%.

- Exempt businesses will see no increase in tax liability, with their payroll tax rate remaining at 10.25%.

- Self-employed farmers and fishermen will see their payroll tax rate move from 1.75%to 0%, eliminating their employer payroll tax liability completely.

- Education, sport and scientific institutions will see their payroll tax rate move from 1.75% to 1%, reducing their payroll tax liability by 43%.

- Qualifying retail businesses will see their payroll tax rate move from 7% to 6%, reducing their payroll tax liability by 14%.

- Hotels and restaurants with an annual payroll of $350,000 or more will see their payroll tax rate moved from 6% to 5%, reducing tax liability by 17%.

Employee Payroll Taxes

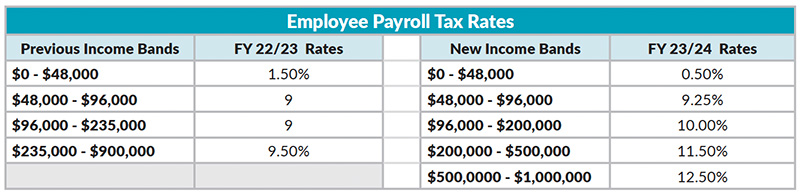

“Bermuda’s system for employee payroll taxes is regrettably complex. One of the hallmarks of a good system of taxation is that it is simple to understand. Unfortunately, the current structure of our employee payroll taxes is anything but simple. Although the Government desires to simplify this tax system in the future, while we are in the midst of a review of our tax policies due to the required implementation of the OECD Global Minimum Tax, that necessary simplification will not be delivered this year.

“There has been much conversation regarding the Government’s proposals to make our employee payroll taxes more progressive. It is important that Honourable Members recall that employee payroll taxes are not the liability of employers under the law. The changes made to the payroll tax system in 2016 created two separate and distinct entities responsible for the burden of the payroll tax: the employer and the employee. I am cognizant that some businesses in the country may choose to cover their employee’s tax obligations. However, that choice cannot be used as an argument against ensuring that we have a more progressive system of taxation in Bermuda for income from labour.

“Based upon the feedback that the Ministry of Finance has received, and following conversations with cabinet colleagues, the following payroll tax system will be in place for employee payroll taxes for the tax period commencing April 2023.

“To ensure that increases to higher brackets of taxation are not as dramatic as proposed in the Pre-Budget Report, the Government of Bermuda has elected to introduce a fifth marginal tax bracket. Whereas previously there were four different tax bands, there will now be five.

“Again, Mr Speaker, I understand the complexity of this tax system and the difficulty that it places upon employers to calculate the rates of taxation for their employees correctly, and I want business owners to know that the Government recognises how challenging that is. One of the aims and objectives for the review of the tax system, following the recommendations from the International Tax Working Group on Bermuda’s implementation of the Global Minimum Tax, will be to look at how to simplify this marginal tax rate system.

“As I stated earlier, the headline of the payroll tax reform for employees is that any employee making less than $132,000 will pay less payroll tax this year than they paid last year. This amount captures 86% of Bermuda’s workforce, which means that today this PLP Government is delivering a tax cut for 86% of the workers in this country.

“Now to the details:

“As I have just stated, prior to this year there were four marginal tax brackets, however, for the tax period ending June 2023, there will be five marginal tax brackets:

“These new tax brackets will be charged at the following marginal rates:

- For the first $48,000 of income, the employee payroll tax rate will be 0.5%.

- For the next $48,000 of income, the employee payroll tax rate will be 9.25%.

- For the 3rd marginal tax band income earned between $96,000 and $200,000, theemployee payroll tax rate will be 10%.

- For the 4th marginal tax band income earned between $200,000 and $500,000, theemployee payroll tax rate will be 11.5%.

- For the 5th marginal tax band income earned between $500,000 and $1,000,000, theemployee payroll tax rate will be 12.5%.

“It is essential for all persons to recall that these are marginal rates, meaning that all persons pay the same rate for income in a band. So, someone making $250,000 will pay 0.5% on their first $48,000 of income, just as someone making only $48,000. Alternatively, someone making $96,000 does not pay 9.25% on all of their income; they pay 0.5% on the first $48,000 and 9.25% on the amount between $48,000 and $96,000.

“With these revised marginal rates, the highest effective employee payroll tax rate will now increase from 9% in the current fiscal year to 11.2% in the new fiscal year, and the total amount estimated to be collected in fiscal year 2023/24 from employer and employee payroll tax is $504.5 million.

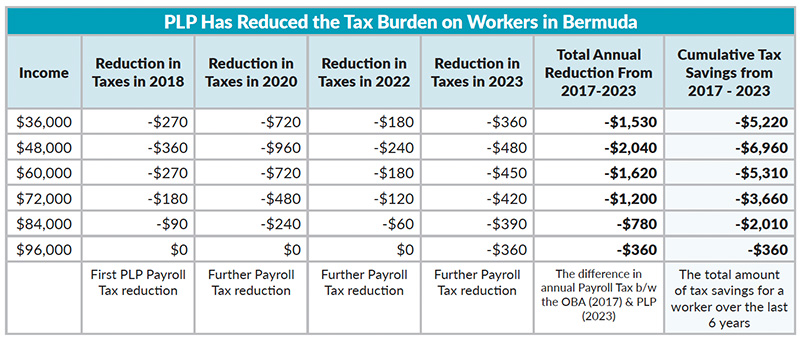

“Before this Government was re-elected in 2017, workers making $48,000 a year were paying $2,280 a year in payroll taxes. Since then, this Government has steadily reduced the tax burden on Bermuda’s workers, and we have continued to do so in this budget. Next year, that same worker will pay only $240 [0.5%] in payroll tax, a reduction of $2,040. Mr Speaker, this means that since this Government was elected, workers earning $48,000 have paid nearly $7,000 less in payroll tax. Meaning $7,000 more in their pockets to spend on things that they and their families need.

“To summarise, there are no employer payroll tax increases for any business in Bermuda. All local businesses will see their payroll taxes decrease, and 86% of the workers in Bermuda will see their taxes decrease. More money in the pockets of workers and more relief for local businesses – that is how you build a path to sustainable economic growth, and that is what this PLP Government has delivered and will continue to deliver.

Maternity and Paternity Leave Exemption from Payroll Tax

“This government is proud of its record of expanding employee rights, and we are also proud that we extended paid maternity leave from 8 weeks to 13 weeks and paid paternity leave from 0 to 5 days. However, during maternity and paternity leave, employers are subject to paying payroll tax for their employees who are not currently working in their business. Therefore, the Government will exempt employers from paying payroll tax on the salaries paid to their employees while on maternity and paternity leave.”

For all our coverage of the 2023 Bermuda Budget click here and for ongoing live updates click here.

Now watch the International Business community vote with its feet.

Their response? Hire less Bermudians.

An unbelievably stupid budget, peppered with flat out lies, pathetic political posturing and deliberately harmful to Bermuda.

I wish my home country would care for its pple like this PLP gvt . Well done Bda gvt.

Terrible. When’s the next election? We have to get rid of these idiots. Driving our country into the ground.

A slap in the face to IB. The one part of the economy of this country that works well to all our benefit, and Burt can’t resist screwing it up.

What an amateur.