Algonquin Announces Q3 Financial Results

Algonquin Power & Utilities Corp — the Canadian company that owns BELCO — reported their financial results for the 2023 third quarter.

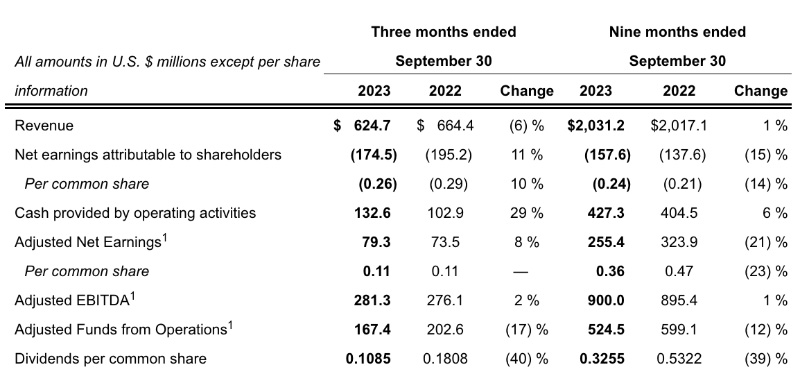

A spokesperson said, “Algonquin Power & Utilities Corp announced financial results for the third quarter ended September 30, 2023. All amounts are shown in United States dollars unless otherwise noted.”

Third Quarter Financial Results

- Adjusted EBITDA1 of $281.3 million, an increase of 2%;

- Adjusted Net Earnings1 of $79.3 million, an increase of 8%; and

- Adjusted Net Earnings1 per common share of $0.11, no change, in each case on a year-over-year basis.

Quarterly Results

The spokesperson said, “Regulated Growth from New Rate Implementations – In the third quarter of 2023, the Regulated Services Group recorded a year-over-year revenue increase of $12.1 million due to the implementation of new rates and recovery of investments at the Company’s CalPeco, Empire, Granite State and Bermuda Electric Systems as well as the Park Water System. New rates were offset by unfavourable weather affecting wind production at Empire Electric’s renewable assets.

“Renewable Operating Performance Reduced by Unfavourable Weather – The Renewable Energy Group previously added the Deerfield II Wind Facility, which achieved COD in March 2023. This growth was offset by more challenging weather conditions at its wind and solar assets.

“New Facilities Commissioned within the Renewable Energy Group – On September 16, 2023, the Renewable Energy Group achieved full commercial operations at the 87.6 MW Sandy Ridge II Wind Facility, located in Pennsylvania. The Sandy Ridge II Wind Facility has agreed to sell its output to a leading technology company, pursuant to a renewable energy purchase agreement. In addition, on October 10, 2023, the Renewable Energy Group achieved full commercial operations at the 108.3 MW Shady Oaks II Wind Facility, located in Illinois. The Shady Oaks II Wind Facility has agreed to sell output to a leading financial institution, pursuant to a renewable energy purchase agreement.

“Higher Interest Expenses Reflect Growth Financing and Macro Environment – In the third quarter of 2023, interest expense increased by $19.2 million year-over-year, with approximately one-third of this increase due to the funding of capital deployed in the second half of 2022 and first half of 2023, and approximately two-thirds attributable to the increase in interest rates on variable rate borrowings.

“Empire Electric Securitization – In July 2023, oral arguments were heard in Empire Electric’s appeal of the regulatory decision regarding Empire Electric’s securitization of costs incurred in connection with the February 2021 extreme winter storm and the retirement of the Asbury coal plant. On August 1, 2023, the court affirmed the amount eligible for securitization of $290.4 million as compared to the Company’s original aggregate request of approximately $363.0 million. The Company intends to securitize in line with the commission’s order to recover these costs. The order excludes a portion of carrying costs and taxes which leads to a net after tax loss of $48.5 million.”

I DO NOT KNOW HOW YOU NOR YOUR SHAREHOLDERS CAN SLEEP AT NIGHT. YOU WILL PAY YOUR DEBTS WHEN YOU CROSS OVER!