OBA Plan Amendment To Corporate Tax Bill

[Updated] The OBA plan to bring an amendment to the proposed Corporate Income Tax bill to ensure that any windfall “is properly deployed to address Bermuda’s crippling national debt and crumbling infrastructure,” Shadow Finance Minister Senator Dr Doug De Couto said.

The Government bill is to introduce a 15% corporate income statutory tax applicable to Bermuda businesses that are part of a multinational group with annual revenue of €750M or more, with the Premier noting that it will ”fulfil Bermuda’s commitment to participate in the Global Minimum Tax initiative being implemented around the world.”

Senator De Couto said, “Tomorrow the Government will lay and debate the proposed Corporate Income Tax bill in Parliament. The One Bermuda Alliance will bring an amendment to the bill, to ensure that any windfall from the Corporate Income Tax [CIT] is properly deployed to address Bermuda’s crippling national debt and crumbling infrastructure.

“The Premier has spoken often about this proposed tax and the potential benefits to Bermuda. However, he has chosen not to provide to the public, or is unable to provide, any numbers around the actual impact of the bill, whether they be upside, downside, or even the costs to administer the CIT.

“The One Bermuda Alliance believes that while there can be benefits to Bermuda from the CIT, there are also many risks. One important risk is that the Government will not handle any possible large revenue from the CIT with the appropriate fiscal responsibility and prudence. Indeed, while the problems of our debt and infrastructure have been well-known for a while, this Government has continued to fail to provide a plan to address them.

“Our large debt hamstrings our country in two ways. First, because we have so much debt outstanding [$3.3 billion] , we are not able to get materially any more debt to finance key projects and infrastructure. Second, because the debt interest payments are so high [$130.4 million], the money used to pay interest cannot be spent on our island’s pressing needs.

“The problems with our infrastructure are well-known to anyone who drives on our roads or has witnessed crumbling retaining walls. These problems are also evidenced by Government’s inability to finish renovating our very own House of Parliament, or properly maintain key national assets like Government House.

“The OBA’s amendment will address how CIT funds can be used to reduce our debt and improve our infrastructure. The amendment works as follows. If the CIT revenue exceeds the budgeted amount by a 10% threshold, that revenue is used to pay down our debt to an acceptable level. After that, any excess CIT revenue will be paid into a National Infrastructure Fund, that can be used to fix our roads and other strategic capital infrastructure projects for our island.

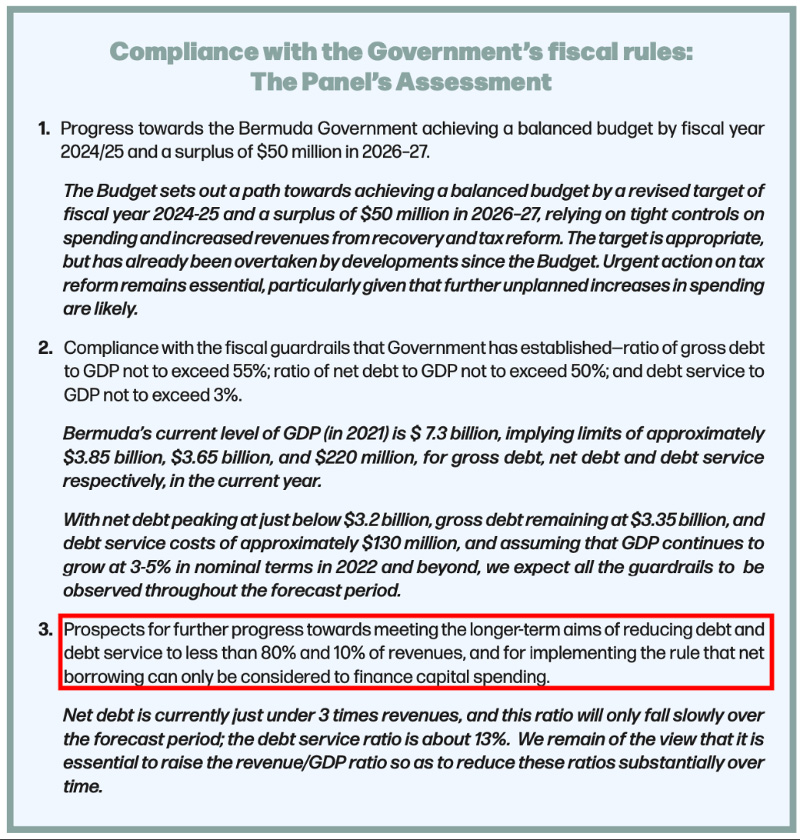

“The amendment defines an acceptable level of debt using the Government’s own existing guardrails, specifically being that total debt should be within 80% of revenue, and debt service [interest] costs should be within 10% of revenue, as outlined in the Government’s latest Fiscal Responsibility Panel report.

“The One Bermuda Alliance looks forward to bringing this important amendment to Parliament and discussing it during the debate. We are confident that it can be a key part of improving Bermuda’s fiscal position, for the betterment of all Bermudians.”

Graphic provided by the OBA:

Update 7:20pm: “It’s disappointing and perplexing that the Opposition is choosing to propose a last-minute amendment on an initiative that has been characterized by significant levels of collaboration and cooperation between the Government, private sector, and the Legislature,” said a Government spokesperson this evening following the issuance of an opposition commentary earlier today regarding the Corporate Income Tax Bill.

“In fact, the Premier and Minister of Finance, the Hon. David Burt contacted the Opposition Leader earlier today to ask that the Opposition withdraw this last-minute amendment as all the matters contained in the amendment are items that are currently being discussed by the Tax Reform Commission. The Premier expressed to the Opposition leader that tomorrow’s debate is not a time for political point scoring, but rather a time to applaud Bermuda’s global leadership in international business and the collaboration that has seen Bermuda achieve this milestone.”

“It should be stressed that there has been considerable consultation on this bill to date, with three consultation papers having been issued, one of which included an illustrative draft of the proposed bill.”

The Government spokesperson continued, “Feedback has been carefully analysed and considered, and to the extent that proposals were not deemed to compromise the integrity of the regime, there have been amendments made to the legislation to reflect the input received.

“In addition, and this is a very important note – two briefings were held for all members of the Legislature including one this past Tuesday where all members of the Opposition were able to ask questions on the bill.

“During the briefings, the technical team at the Ministry of Finance explained that this phase of the legislation is meant to lay the groundwork for the CIT regime that will be recognized and demonstrate Bermuda’s compliance with international standards.

“Simply put, the Government cannot accept this amendment, as it would go against the collaborative approach that we’ve committed to in designing this new tax regime. The legislation has been developed working in close collaboration with industry and other experts in international tax matters.

“It’s absolutely critical to note that this last-minute amendment that was released to the press before it was sent to the Government may jeopardise the countless hours of work that the International Tax Working Group and the Ministry of Finance have expended to get this right.

“The fact that the Opposition would choose a time like this to make a politically motivated attack is shameful. Furthermore, it demonstrates that they cannot grasp the seriousness of this moment for Bermuda and its international business sector.”

“The Leaders of the Association of Bermuda International Companies [ABIC], Association of Bermuda Insurers and Reinsurers [ABIR], and Bermuda International Long-Term Insurers and Reinsurers [BILTR] have all commended the Government’s approach to date and signaled their intention to actively participate in the next steps.

The Government spokesperson added, “The bi-partisan Tax Reform Commission has commenced their work, and the issues that the Opposition’s last-minute amendment is looking to address are part of the terms of reference for that commission, of which the Opposition Shadow Finance Minister is a member.

“Finally, it is the Ministry of Finance’s hope, that the Opposition will do the right thing for the country, and withdraw this last-minute amendment that is an affront to the efforts of the International Tax Working Group and the members of the Bi-Partisan Tax Reform Commission. Bermuda’s political parties have always stood side by side in support of the island’s International Business Sector, and tomorrow should be no different.”

Update Dec 15, 11.23am: Senator De Couto said, “Our proposed amendment concerns critical issues for our island, that are deserving of a full discussion in the House. The OBA looks forward to that discussion. With respect to the Premier’s comments on the timing, we too wish that the Legislature had more time to consider this complex and lengthy bill, which has been presented with little information about its impact on Bermuda’s finances, and at the last possible moment in the year.

“Regarding consultation, we acknowledge and recognise the Government’s consultation with business, but note that the general public has been provided little to no information, with which to form an opinion of the benefits and risks of the proposed CIT – only a series of optimistic promises by the Premier.

“The Premier must not forget that Bermuda is a Parliamentary democracy. If the Premier is truly against the OBA’s sensible and principled amendment to tackle our island’s massive debt and restore our island’s infrastructure, then Premier Burt and his PLP members are entitled to vote against it.”

The current state of our roads can be directly linked to the Belco infrastructure project. Insomuch they should be held accountable for repaving every road that they have trenched up. The government would be foolish to take this responsibility on. The FAR increase is likely in response to this proposed tax, and the war in the Ukraine. However since the FAR was approved another war has started in the Middle East and if this tax is approved guess what… Belco will seek another increase in the FAR. With this current inquiry by the RA as a smokescreen to see how much they can afford to increase the FAR again. Why do we allow such nonsense to happen without question? Walter Roban has said publicly he would look into the matter with the FAR increase and then we see the same RA that approved the increase to do the investigation??? Shouldn’t they have done that before approving it??? Why do we not have an arbitration process for this matter??? Obviously because Roban, Burt and Fields (the RA chairman) are in league with each other facilitating our demise. They clearly think they can not be challenged and that’s why Roban has overturned the Environmental Board’s decision to halt the SDO at Southampton Princess. Then the ring leader is tied up in the hit and run incident which leaves a lot of questions about the future of our country. The three stooges need to go!!!

If you believe the roads are bad now and BELCO charges too much, just wait until the roads start crumbling even more because of the extra weight of electric buses and EVs. The loss of gas and diesel fuel taxes will be passed on to Bermudians by the Government, likely through BELCO.

Government allowed it , PLP let it happen. PLP are responsible for this. Wake up already. PLP have been reducing the quality and mileage of road resurfacing each year since they got into power. Now they just won’t bother until in run up to the election where they will put a cheap coat of tarmac to make it look good, That will all start coming up within 2 years.

Lt. Col David Burch says something quite different. He says the PLP Government has been involved in the road works too.

See https://bernews.com/2023/03/minister-burch-on-roads-trenching-projects/

The appalling state of our roads is emblematic of the PLP government. They don’t care if the country goes to ruin. The only things they care about are hating white people and hating foreigners.

It’s not his fault De Coutoy is a UBPoba boy all the way. Plus they’re desperate.

“UBPoba boy”

The UBP was dissolved more than a decade ago. You are still living in the past.

We live in a Bermuda where Buck burrows was a nice guy, who just painted houses.

What about Larry Tacklyn?

No , no , no . It was some guy on the top of the Cathedral in Hamilton. Or maybe the guys who came in from overseas that were in a boat off North Shore who split in a hurry .. lol

I would expect nothing less from the Opposition than to tighten the reins on what will be a boost to the Government coffers by way of the corporate income statutory tax on certain international companies.

Do not bend to the taunts of a few Government bullies who may well be intent on getting access to such a windfall. I think it’s safe to say that, if you are that way inclined, you’re going to turn up the heat on any proposed changes that constrain control and access to that amount of money.

Like the Sugar Tax, the Corporate Tax will go into the General Fund where it is mixed in with all the other revenue. Government cannot tell us exactly where the Sugar Tax money is being spent so why would anyone believe Government would account for Corporate Tax specifically being used for debt and infrastructure?

Hang on Doug, this isn’t free cash.

Make no mistake, if you don’t flow as much back as possible to IB, the companies will walk.

And you should know that Doug, you work for one.

Absolutely correct, and it is not about the money going directly back to the IB but rather about how much of a say they will have in return for their money. This will become financial leverage for them to get their way as well. It’s already incumbent upon them to take social responsibility and “put back into their communities” however they can now push ahead on projects that will benefit them in the long run

Too bad Bermuda is not like the US, where specific taxes from specific sources can be earmarked for very specific applications.

No, everything goes into the general slush fund which every Government department dips their buckets into until there is nothing left.

And this is a Government that thinks that it can handle the responsibilities of independence. WOW!