Bermuda’s GDP Per Capita: $85,747 In 2013

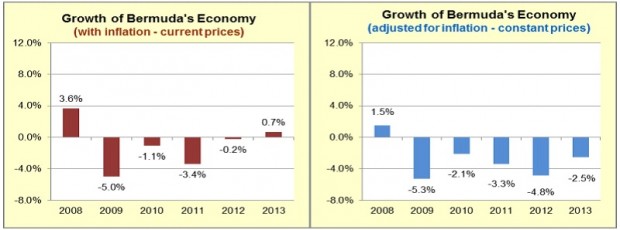

In 2013, Gross Domestic Product [GDP], which measures the total value of goods and services produced in Bermuda, edged up 0.7%, however when adjusted for inflation, the growth in economic activity declined 2.5%, according to a report released today [Sept 4] by the Department of Statistics.

The report said, “Despite an increase in job losses compared to 2012, six of the fifteen industries recorded growth in value added led by the hotels & restaurants and international business industries.

“The modest increase in economic growth translated into a 0.4 per cent rise in GDP per capita which was measured at $85,747 per person in 2013.”

The value added by the international business industry increased for the second consecutive year, with a 3.9% rise in economic activity in 2013, while the value added for the hotel and restaurant industries increased 6.1%.

Activity in the transport and communication industry increased marginally by 0.5%, while the wholesale and retail trade sector registered a marginal decline of 0.3%.

In 2013, construction activity fell 4.4% to $169.5 million, and the report said the overall drop in demand for construction services led to 126 fewer workers being employed in the construction industry in 2013.

The value added from real estate and renting activities decreased 2.3%, the electricity and water industry and manufacturing industry recorded declines of 5.7% and 5.8%, respectively, while value added in the agriculture and fishing industry rose 1.3%.

The full 15-page report courtesy of the Department of Statistics is below [PDF here]

Read More About

Comments (78)

Trackback URL | Comments RSS Feed

Articles that link to this one:

- MP Burt: Diversification Must Be The Priority | Bernews.com | September 5, 2014

- Dr. Grant Gibbons On GDP Economic Report | Bernews.com | September 9, 2014

Well it appears that the hotels and restaurants are doing very well, along with ib. I,for one,think it is full time for them to begin to function without all the concessions which they currently enjoy.

… concessions? What concessions? You mean the “concessions” that allow them to keep more of the money THEY rightfully earned? You think the Government has some claim on their profit?

I believe what they are reffering to are the duty exemption, hotel refurbishment act, and payroll tax exemptions in some areas.

I’d leave them, while the trend for them is currently up, a quick snap on revoking incentive programs can turn that right around to a downward one… especially in the hotel and restaurant. We have not had a sufficient return of jobs to our economy to warrant such a recall and I would certainly leave any incentive programs that focus on local employment.

Remember, the next employment statistics will show a larger drop in the construction employment area, as the hospital project is closing, and the 500 – 600 jobs from that will now be dependant on small projects. Course, not all of those 500 – 600 jobs were local, but still we are bound to see another couple hundred construction jobs go from our economy.

The more successful businesses can get with incentive programs, the better chance they will have after the incentive programs, short term loss vs long term gains, it is a balancing act, any removal of incentive programs should be by a scaling back system rather than a snap recall.

Bermuda’s GDP per capita is a completely useless number.

Most of the GDP of Bermuda is created by international business, which is owned by foreign nationals. So you are basically taking the amount earned by non-nationals, dividing it by the number of nationals, and getting a number that shows… absolutely nothing.

Yes, but not all of those are foreign nationals and those foreign nationals employ many Bermudians in many sector of our economy, whether directly or indirectly. The more money they have, the more money that will make it to Bermudians, especially in the technical trade/services and low skill jobs. It is a good trend and if it continues, we will behind to see more and more Bermudians having a positive impact on our GDP again. Pro-foreign investment in our island is very much pro-Bermudian.

The issue with Bermuda’s GDP statistics is that so much of it cannot be taxed because of the country’s statutory undertaking not to tax exempt business profits, turnover, etc until 2035.

Normally GDP is taxable in some shape or form and reflects the possibility for Government to raise revenue for services, social programmes etc.

But that is how Bermudians benefit. The high salaries made by these exempt company executies and workers trickles down into Bermuda through rent payments, and various other disposable-income expenditures. This is how Bermuda operates. This trickle-down effect puts enormous sums of money in Bermuda’s economy and makes it possible for thousands of people make a living.

The first increase in GDP since 2008. Finally we are out if recession.

The PLP nightmare is starting to become history.

Looks that way. Thank you OBA for restoring confidence in our economy through measured, well considered and pragmatic policy decisions. Let’s hope the rising tide floats ALL boats.

You are so funny

OBA has no plan and our recovery only stems from the world economy coming back.

But I guess the PLP caused the Global Downturn in your eyes.

What global downturn? Biggest myth perpetrated on the stupid. Well, apart from Baby Jebus.

So millions of people losing their jobs, is a myth?

You don’t really know what the word ‘recession’ means, do you.

recession

rɪˈsɛʃ(ə)n/Submit

noun

1.

a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

Now I do

And Bermuda’s recession started when Term Limits came into effect and continued until they were reversed… lasting far longer than other countries’ coincidental recessions.

I’ll give you $100 if you can explain in reasonable terms the mechanism by which the global recession caused Bermuda’s ongoing 5 year recession. Go.

Jus’ Askin’ says:

September 5, 2014 at 9:13 am

As we depend on others for the strength of our economy. Our only exports tourism and IB were seriously impacted. If people are not spending here, this is the effect.

FACT – We Do Not Control Our Cash Flow and We are Dependent on Others

Feel free to give the $100 to any charity of your choice

Nah. IB, which is over 90% of our GDP, did fantastic over the past five years. IB just decided to do much more of its business in other places, for reasons discussed time and again.

The 12 month recession that affected some countries, and which was mostly over by 2009? Is that the mythical ‘global downturn’ you’re talking about?

But I dont think the average person is going to look at a GDP increase as encouraging just yet, rather theyd want to see more tangible things like unemployment dropping?

Hang on now! Don’t count all your Chickens yet — were still got a ways to go even though were starting to show signs of progress.

Were still got an unemployment Problem and a rising National Debt to fix.

We are not out of recession. There was still a real drop in GDP after factoring in inflation and only the real number matters.

But hopefully the PLP economic train wreck is starting to be cleaned up.

So the first full year of OBA government sees the first increase in GDP for 5 years. Finally we are out of recession.

No we aren’t. The figures adjusted for inflation say otherwise. Real GDP actually declined 2.5 percent. Economically, Bermuda is still in trouble, no matter what the feel good press releases say.

GDP rose rather than fell. That means the recession ended. I know hate to see it, Portia.

You are so wrong it isn’t even Funny. But hold on to your fantasy and see if Bob Richard’s agrees with you.

He will not, as you are talking pure nonsense.

Still a big improvement from the past few years.

But it’s an increase in GDP, even if it’s nominal. That’s better than the reduction in nominal GDP we’ve had every year since 2008. It’s a sign of improvement, and it’s progress.

Such progress cannot be acknowledged as it is against the “plan.”

Actaully not reallly.

If Nominal GDP shot up 6% and inflation was 8% the economy is still contracting as Nominal measures the volume not the value.

The real number is the only one that matters.

I think serengeti’s point was that in previous years, nominal GDP decreased, so an increase in GDP is an improvement over recent years. That is to say the decrease in real GDP is smaller than in previous years.

Agreed! A more reliable metric would be the Retail Sales Index in comparison to the Island population and the medium income of Bermudians. Unemployed Bermudians leaving the country would actually increase GDP.

I see. This metric is showing something positive, so you discredit the metric and suggest something else. Move the goalposts. Got it.

Juxtapose this report against the financial assistance report and we will see exactly where the rubber meets the road .

Yes, the PLP’s destructive policies hurt those who could least afford it and set back social justice for all. We all know.

Looks like the OBA are finally starting to undo the damage.

Who was Premier of Bermuda in 2008? OMG it was Dr Evil !

Anyone surprised ?

You do know in 2008 is when there was a GLOBAL DECLINE in countries GDP?

But hey, facts mean nothing in this country

The ‘global decline’ affected some countries, not all. There were many that avoided it. And it lasted 12-15 months in most countries, not 5-6 years.

But hey, facts mean nothing.

As we depend on others for the strength of our economy. Our only exports tourism and IB were seriously impacted. If people are not spending here, this is the effect.

FACT – We Do Not Control Our Cash Flow and We are Dependent on Others

Would you please keep repeating this! Some people in our Island JUST DON’T GET IT!

Other countries were in and out of recession in a year. Our recession lasted 5+ years. Our economy was mishandled.

China, USA, Europe & Japan resorted to central bank money printing and bailouts to boost their economies. Bermuda never had that luxury.

And Bermuda borrowed a couple of billion dollars, presumably spent on something in our economy, but it didn’t stop the economy shrinking year after year.

Citation please

http://youtu.be/yVheuRWVqYI

Financial assistance only became a problem (un-sustanable) because the PLop lost a lotta jobs! Sorry u lose! Just face the fact that its some what a positive sign!

A positive indicator. Long way to go though.

Statistics…..!!!

Most of the indicators reflect a current need – you need a loaf of bread and milk, so you go shopping; the washing machine has packed in so you buy a new one. Yes, they reflect a trend, but only that. Perhaps the best indicator is the construction industry – this reflects a perceived future need AND confidence in your future ability to pay for that investment. You are not going to add that extra bedroom unless you perceive a continuing future need and the money to pay for it. So too additional office space, hotel improvements, whatever. Simplistic yes, but you get the drift. And right now the outlook of the construction industry remains bleak, especially with the hospital job finishing up.

All politics aside, we still have a long way to go Bermuda……

I tend to treat data from the Department of Statistics with caution. Here’s an example. GDP is stated as $5.6bn or $85,747 per capita. This equates to around 65,000 “capita”. Are there that many people in Bermuda? This after so many people have left Bermuda in the past seven or so years? One of those numbers, and possibly both, appear to be incorrect.

As an addition, I’d like to see Larry Burchall do one of his examinations of this release as he has been vocal in his position about a decrease in population and the accuracy of information provided to the Ministry of Finance.

Government’s muddle over ResPop is now showing through. It shows up in this report on GDP.

Look at three figures. ONE – GDP at current market prices for 2013 = $5,573,710,000. TWO – look at GDP per capita = $85,747.

Do the arithmetic: $5,573,710,000 GDP divided by $85,747 GDP Per Capita = 65,002 ResPop. This is the ResPop reported by Government in the July 2013 Bond Prospectus.

But Government surveyed the 2013 ResPop and changed its “estimate” of the 2013 ResPop to 61,954. Government reported this lower ResPop number in February 2014 – six months before this GDP report came out. Properly, the Government should have used its “new” ResPop number.

Let’s look at that THIRD figure: $5,573,710,000 GDP divided by 61,954 ResPop = $89,965 GDP Per Capita.

That $89,965 is way higher than the $85,747 reported. It suggests a massive improvement in Bermuda’s overall economy. But nothing else supports the idea of such a massive improvement.

Very, very, clearly. In simple primary school arithmetic, you can see the primary mistake. Government has got a very basic number horribly wrong.

Re-read my piece, from last week, on ResPop.

Then scratch your head and anything else that you can reach….. Things are in a mess!

Thank you Larry. To me this indicates that both the GDP and ResPop numbers are incorrect. If GDP has stabilized but in realty ResPop had dropped from 65,000 to probably around 58,000 in 2013 then surely GDP should have dropped further. Then there is the question of what is drop in the working ResPop? However, in my opinion the calculation of Bermuda’s GDP is dangerously flawed because of the influence of IB. GDP in simple terms is a base upon which Government revenue can be measured against, but IB output/earnings cannot be taxed. As such it is not a reasonable or safe basis as a measure of the Island’s financial health. So with a flawed ResPop and a flawed GDP calculation it is little wonder that Bermuda is in the mess it is in.

On the bright side if the population estimate is too high that would mean Bermuda’s GDP was at that level with less people meaning a higher GDP per capita. even better.

Had the OBA not got into Jet Gate affair, trying to bust the BIU, PRC’S, Land Issues, and concentrated on rebuilding the Economy without disturbing the common man – we could have been much further ahead than this report suggest.

As we move further down the road I believe that the economy will improve substantially but unfortunately other Issues will

escalate into bigger problems than what we see now. – especially the privatization program! only wanted by 40% of the Residents living

in Bermuda. – one has to wonder who is calling the shot’s.

Looks to a rising economy with lots of turmoil ahead.

The reality is that the vast majority of Bermudians live in POVERTY LEVEL PAY and cannot afford to eat or go to the doctors at all.

I don’t need a degree to realize by common sense, that this trend will only cause our economy to crumble increasingly quickly as the number of poor grow.

Capitalism is an archaic system meant to serve and create an ogligarchy. Anyone who has not yet, or cannot realize this, should have any degrees they posess stripped from them – because it is in plain sight!

The vast majority of Bermudians are not living in poverty.

@Reality – “The vast majority of Bermudians live in poverty” – that is pure nonsense.

by the way PRIVITIZATION WAS STARTED BY THE PLP!

So you uneducated people not paying attention can stop yakking about the OBA doing this when the darn PLP did it to start with!!!!!!!!

The PLP also created the poo-hole that is our economy right now, and the OBA is trying to lift us out of this cess-pit! THANKS FOR NOTHING, PLP!

The only agenda the PLP has ever had was black interests, hence why they were founded by Black Panther and Brown Cadre members and fought for socialism!

P.L.P. Progressive Labor Party is an internationally-used term for a SOCIALIST government system which favors ONE RACE above all the others!

You are a Comedian

Hi Reality,

I understand your frustration about how the PLP continues to try and recreate the truth almost on a daily basis and I agree there is no ownership of the damage they did to Bermuda. However that being said, I don’t think it’s fair in the least to call their followers uneducated, somewhat blind or somewhat gullible possibly, but to say uneducated is insulting. We need to love thy neighbour and in many cases turn the other cheek when it comes to the PLP if Bermuda is going to get through this.

Global recession, blah blah blah.

Can one of you please provide a rational answer as to why none of our major trading partners and/or similar sized/structured economies didn’t experience 5 years of consecutive negative GDP growth as Bermuda did?

“Global recessions” didn’t cause the previous Government to increase the deficit by 1,421% between 2004 and 2008 (year end March 31st) which was caused by growing expenses by 43% while simultaneously only increasing revenue 19% over the same time period. Just to clarify this financial mismanagement occurred before what some commentators continually refer to as the “great recession.”

Between 2005 and 2012 the previous Government increased expenditure 57% while revenues grew by 17% which in turn increased the budget deficit by 1,912%! As a result of this blatant financial “mismanagement” the BDA’s net debt exploded from a 2005 level of $128 million to $2.42 billion in 2012 which is a 1,787% increase!

“Global recessions” don’t cause Governments to continually (as was the case over the time period in question) overspend by 30%, 50% and even more on capital projects resulting in hundreds of millions of wasted tax payer monies.

“Global recessions” don’t cause Government to receive 4 consecutive qualified audits on their financials as was the case under the financial stewardship of the previous Government.

“Global recessions” also don’t cause Governments to cease performing financial audits on the $1.5 billion underfunded pension plans run by Government for almost 5 years (see SAGE report) or ensure that all quangos are being audited in a timely and effective manner (re: BDA College).

“Global recessions” don’t cause the bloating of the civil service and the aforementioned debt which in turn now consumes nearly TWO THIRDS of annual Government revenue which leaves little to nothing in terms of investments in upgrading BDA’s infrastructure and social programs.

“Global recessions” don’t cause Governments to raise payroll tax in the middle of our deepest recession which deepened our recession even further and coupled with anti-business policies pushed these locally domiciled companies off of our shores into more expensive jurisdictions to do business (i.e. Zurich, Ireland, etc.). One would think that any Government and especially the Minister of Finance would have taken a basic Economics 101 course which states save during the good times, spend during the bad and don’t raise taxes when in a recessionary environment.

None of the financial mismanagement noted is a direct cause of the ‘global recession’ myth that some wish to deflect to when this topic arises. There has been a slowdown in growth, but that doesn’t equate to a deep recession as BDA has felt over the last 5 years. Eventually some will have come to the realization that the previous administration left BDA in such financial bad shape that they prolonged the recession in this island while all others started their recovery many moons ago.

And the scary thing is that there are people in this island advocating for the return of the PLP as they beleive that somehow they will resucitate the economy they strangled and essentially destroyed in less than 10 years of serios mismanagement.

No mention of OBA’s contribution to our debt in a shorter period of time.

Where is the $750 million that the OBA borrowed?

The $800 million borrowed was due to the financial state that the PLP left the Government in once they were booted from Government.

The inherited $350 million deficit could not be wiped out immediately as the shock to the system would have resulted in the prolonging and further deepening of the recession as was caused by the PLP’s decisions while in power.

If they didn’t tap into the debt market and lock into the historically low rates than the other option would be to immediately cut the overspending which would be primarily civil service job cuts as that is the largest expense for Government. This was even noted that when they first took the reins of Government they had to borrow as a means to meet civil service pay checks.

The $800 million borrowed is to cover the projected deficits over the next 3 budget cycles. This year alone the Government is forecasting to cut the deficit by $70 million with further reductions planned for the next few years as recommended by the SAGE commissions ‘glide path.’ Let me reiterate: this Government DID NOT create the deficit, but they have to work and live with it.

So to answer your, um, question the need to borrow the $800 million to cover the deficits created by the previous administration is a direct consequence of their financial mismanagement outlined above.

Do you believe then the Government should not have borrowed to cover the deficit and inherited expenses and thus should have embarked on immediate and drastic cost reductions as a means to close the budget gap? If they did I can only imagine the response: anti-Bermudian yada, yada, yada.

Now that I have addressed your deflection of a post why don’t you return the favor by telling me how what I have stated in my original post is wrong or something along those lines and whether or not you believe that our current financial situation is solely due to your ‘global recession’ myths and why the PLP deserves no blame for your financial woes.

There was nothing wrong with your original post. PLP are not solely to blame for our financial woes.

Like many, you failed to mention the OBA’s contribution to the overall debt. PLP racked up 1.4 billion a average of $100 million a year during their time in government. OBA did $750 million in a little over 1 year.

When You leave out certain things it comes across as one-sided.

OBA borrowed the money, with the intent to cover their own a**e$ for the time in they are in government. OBA did not come in with a plan, thus they borrowed the money and that is a FACT.

Again the borrowing of the $800 million was a necessity and not an option when the OBA gained power.

It was borne out of necessity due to the mauling and destruction of our finances by the PLP solely. No one else helped them destroy our sound financial position with the then Opposition even noting the excessive borrowing and overheating economy. These warnings were dismissed as fear mongering and the rest.

So when you say that the OBA increased our debt in less than one year it is you being disingenuous and trying to exemplify that they increased our debt for no good reason. The borrowing was necessary because of the deficit caused by the PLP’s severe financial mismanagement. You act like this Government had any other option to cover their INHERITED expenses.

If they did not borrow then the other option was to cut Government expenses and close the INHERITED $350 million deficit via massive cuts immediately. That was not an option to pursue in the middle of a recession. Economics 101 my friend.

The PLP are 85% responsible for our current financial woes whether some want to acknowledge the facts or not is not my problem.

The truth is an offense, but not a sin.

If Jus’Askin’ doesn’t get it by now he never will . And he’s got a lot of company , regretfully .

If the OBA didn’t make that loan there would be NO civil service left to pay in 4 years time . How do ya like them apples ?

And that’s a FACT . Not the rubbish J/A posted.

If the plans to privatise government work goes through your point is mute

Don’t even realize the word is ‘moot’ .

Your comment should have been left mute JA – Even with privatization we would be still still left with the huge debit left by Dr Brown and his cronies to pay off.

And what he doesn’t seem to realize is that even with privatization/mutualization taxes are not going to go down and we’re still going to have to pay.

Just that the new service provider will be able to do it cheaper than what it currently costs us.

So , if those currently on gov’t payroll opt to go with the new service provider rather than be unemployed they’ll find out what the rest of us in the private sector have been living for the last few decades , especially the last few years.

Then they’ll experience what ‘shared sacrifice’ is really all about.

Liar/Lair and Jus’Askin

Also when the OBA took over the current year was almost complete (with a $350M+ deficit) that needed to be financed and the budget for the next (this current) fiscal year was already approved (also not financed) therefore the OBA had to deal with 2 out three years of unfinanced deficits that were completely not of their making in a very short period time after taking office. The one budget that they ARE responsible for I believe is on track to have a reduction in expenses of 15% or so.

Jus’Askin…those are 100% facts not political smoke and mirrors.

Let’s see what happens with 2015-2016 budget

You mean like when they try and save costs ( because we have no choice now) by cutting thr civil service and the PLP and BIU throw all their toys out of the crib and yell unfair? Bet you can’t wait for that?

For those that may not be aware… the value of REAL GDP is the value that matters, not nominal GDP. Nominal values of GDP change from year to year due to changes in the quantities of goods and services, and/or changes in prices. Real GDP removes the impact of prices changes, allowing us to better determine if we are really better off than previous years.

With that said:

2013 Nominal GDP (current prices )= +0.7%

2013 Real GDP (constant prices) = -2.5%

It seems that we are not out of the woods yet…although there are signs of improvement.

Have a good day.

The Bermuda oil tanker has slowed almost to a stand still, hopefully it will be turning around soon!