‘Government Needs To Increase Land Tax Rates’

“The sobering reality is that to maintain Government services at a reasonable level and to avoid financial failure, the Government needs to increase land tax rates,” Minister of Finance Bob Richards said.

Speaking in the House of Assembly today [Dec 16], Minister Richards said, “Since the global financial crisis and economic recession of late 2008 /early 2009, the Bermuda economy weakened considerably.

“Statistics indicate 5 years of continuous real declines in Bermuda’s GDP, banks have curtailed real estate financing, employment has dropped and there was an unparalleled exodus of companies and employees from Bermuda, all of which having an unprecedented negative effect on every sector of the economy, the property market in particular.

The Minister said, “The residential assessments, on a whole, are seeing ARVs below their 2009 assessed levels of rental value. The segment most affected has been the “executive” rental properties, particularly the larger units.

“Commercial rents, overall, have also fallen dramatically from 2008/2009 levels of rental value as a direct result of the aforementioned issues. Recent consolidations within the reinsurance sector coupled with the outsourcing of backroom staff off Island, have led to even less international business related employment and a consequent glut of office space in the city of Hamilton.

‘It is important to note that using the 2015 ARVs and the current land tax rates would result in an overall loss of approx $19.1m in land tax revenue for the Government. This is a loss in revenue the Government can ill afford to have, particularly as the Government has made huge strides in reducing the deficit and needs to continue to build on this work.

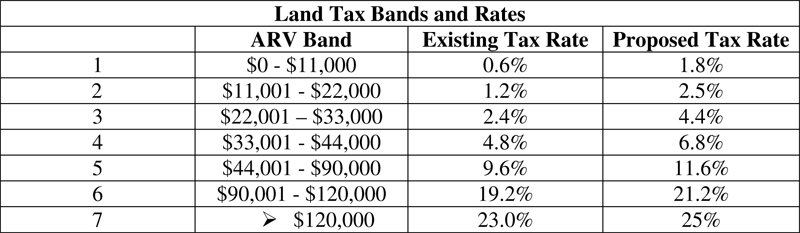

“In order to minimize the impact to Government and the tax payer, and having carefully considered all of its options, the Government proposes to maintain the current tax band structure and only change the rate for each band as follows:

“In addition, as a result of the overall decrease in ARV’s and the proposed increase in rates, the Government intends to amend the exemption provided for Bermudians over 65 years living in his or her own home per section 3A of the Land Tax Act 1967 to reduce the ARV from $50,000 to $29,000,” Minister Richards continued.

“And lastly, in order to minimize the impact of the Revaluation on the land tax revenue for Commercial and Tourist units, the Government also intends to increase the tax rate from 5.5% to 7% for these categories. These changes keep the tax on these elements the same as they were previously.

“The Government has always maintained that everyone in Bermuda needs to do their part in helping to pay off the deficit left by the last government. Therefore the purpose of this Bill is to amend the land tax rates to ensure no loss of revenue to the Government and so that this Government can continue to do the work the people elected us to do and get our economy back into a healthy state.

“The sobering reality is that to maintain Government services at a reasonable level and to avoid financial failure, the Government needs to increase land tax rates.”

The Minister’s full statement follows below:

Mr. Speaker, I rise today to advise Honourable Members of the amendments to the Land Tax Act 1976 [the Act]. These amendments provide for revised tax rates for various Annual Rental Value [ARV] bands.

Mr. Speaker, since the global financial crisis and economic recession of late 2008 /early 2009, the Bermuda economy weakened considerably. Statistics indicate 5 years of continuous real declines in Bermuda’s GDP, banks have curtailed real estate financing, employment has dropped and there was an unparalleled exodus of companies and employees from Bermuda, all of which having an unprecedented negative effect on every sector of the economy, the property market in particular.

2008 was the peak of the market and we have seen a sharp decline in rental and capital values, with some property types being hit particularly hard. In other words there was a bubble in Bermuda property markets and the bubble has deflated.

The Land Valuation Department conducted a revaluation of land, after which a 2015 Draft Valuation List was produced. The Draft List confirms the widely held opinion that rental values in the open market have fallen between the valuation date of 31st December 2009, upon which the current 2009 Valuation List is based, and the 1st July 2014, valuation date, upon which in the 2015 Draft Valuation List is based.

The residential assessments, on a whole, are seeing ARVs below their 2009 assessed levels of rental value. The segment most affected has been the “executive” rental properties, particularly the larger units.

Commercial rents, overall, have also fallen dramatically from 2008/2009 levels of rental value as a direct result of the aforementioned issues. Recent consolidations within the reinsurance sector coupled with the outsourcing of backroom staff off Island, have led to even less international business related employment and a consequent glut of office space in the city of Hamilton.

Therefore, the 2015 Draft Valuation List displays reductions across all property sectors, overall, as rents have steadily declined since 2009. One should also note that there will be some minor adjustments to a small minority of the proposed ARVs before the final 2015 Draft Valuation List is published on 31st December 2015. This is due to the ongoing refining process of the figures and the completion of Maintenance of the Valuation List cases to reflect property changes.

Mr. Speaker, it is important to note that using the 2015 ARVs and the current land tax rates would result in an overall loss of approx $19.1m in land tax revenue for the Government. This is a loss in revenue the Government can ill afford to have, particularly as the Government has made huge strides in reducing the deficit and needs to continue to build on this work.

In order to minimize the impact to Government and the tax payer, and having carefully considered all of its options, the Government proposes to maintain the current tax band structure and only change the rate for each band as follows:

In addition, as a result of the overall decrease in ARV’s and the proposed increase in rates, the Government intends to amend the exemption provided for Bermudians over 65 years living in his or her own home per section 3A of the Land Tax Act 1967 to reduce the ARV from $50,000 to $29,000.

And lastly, in order to minimize the impact of the Revaluation on the land tax revenue for Commercial and Tourist units, the Government also intends to increase the tax rate from 5.5% to 7% for these categories. These changes keep the tax on these elements the same as they were previously.

Mr. Speaker, the Government has always maintained that everyone in Bermuda needs to do their part in helping to pay off the deficit left by the last government. Therefore the purpose of this Bill is to amend the land tax rates to ensure no loss of revenue to the Government and so that this Government can continue to do the work the people elected us to do and get our economy back into a healthy state.

However, Mr. Speaker, we have aimed to deliver an adjustment in land tax rates that is fair to all sectors of the real estate market.

Mr. Speaker, the sobering reality is that to maintain Government services at a reasonable level and to avoid financial failure, the Government needs to increase land tax rates.

Mr. Speaker, the Ministry of Finance is confident that this approach will provide the Government with the same level of revenues collected on land and believes that the rate increases are both equitable and fair.

Mr. Speaker, this Bill is tabled using the Provisional Collection of Revenue Act 1975 which enables it to have statutory effect from first reading, which is the day of tabling – i.e. today.

Thank you, Mr. Speaker

And they need to lower their outrageous wages, starting with de guy who makes $1000,00 a day and got an $80,000 bogus bonus!!!!!!!!!!!!!!

Someone needs to give you a hoverboard for christmas.

Ya boy can afford to be jolly , you nominate him and then you second it.

LMFAO

Great.

Reduce that one salary 50% and you still have a $219.5mn annual deficit to close.

Taking more hard earned money from the people is not the answer. People need money in order to spend. It is that simple.

The new tax rates will apply to the new ARV rates which will be released as of December 31st. They, the ARV rates, are expected to decrease so we will have to wait until then to see if the government is actually “taking more hard earned money” or if they have made the necessary adjustments so that they don’t take less revenue in land tax.

So the IB-inflated ARVs’ from pre-2008, which have been maintained throughout the depression, will rightfully (6 years late) drop to reflect the situation, then will be cancelled out by a tax hike. Can’t wait to see my new ARV.

Where do u suggest they get the money for the debts to be paid?

Huh? It was the Government that got us into this predicament. So they have to share some responsibility as well. Why is there a need for a Preimier and a Governor. One needs being made redundant.

The PLP got us into this mess !

We voted out the government that got us into this mess.

Speaking in the House of Assembly today [Dec 16], Minister Richards said, “Since the global financial crisis and economic recession of late 2008 /early 2009, the Bermuda economy weakened considerably.”

I thought it was totally the PLP’s fault.. Now all of a sudden it’s due to the “Global Financial Crisis?”

Bob, wasn’t supposed to stray away from the normal blame the PLP rhetoric; he might make his supporters upset.

Name one of our trading partners and/or similar sized/structured economies that recorded 5 years of negative GDP growth?

Those job losses in Bermuda were not actual losses as the positions still exist, just in the jurisdictions in which they transferred them to.

Eco 101 states to save during the boom times and let the private sector stimulate economic growth. During the down times the savings made by the Government is to be used to stimulate economic activity.

unfortunately for all of us the previous Government did the exact opposite and as such we are unable to spend our way out the economic downturn and hence why our recession lasted 4 years longer than most of our peers.

Bob essentially stated that when he said:

“Mr. Speaker, the Government has always maintained that everyone in Bermuda needs to do their part in helping to pay off the deficit left by the last government”

Your blind… US and most countries are still in debt … i belive the US has been in debt for over 50 years…

Firstly, I asked which one of our trading partners and/or similar sized/structured economies that recorded 5 years of negative GDP growth? Debt doesn’t correlate to recessions.

And if you are comparing the debts of the US and BDA you are truly the blind one. One economy is based on 1.5 pillars with a limited tax base, the inability to print money and that produces absolutely nothing which means we export nothing and import everything.

So I will state it again:

Eco 101 states to save during the boom times and let the private sector stimulate economic growth. During the down times the savings made by the Government is to be used to stimulate economic activity.

unfortunately for all of us the previous Government did the exact opposite and as such we are unable to spend our way out the economic downturn and hence why our recession lasted 4 years longer than most of our peers.

While the other is the world’s super economic power, with the deepest and most liquid debt markets to which all global institutions and investors place their investments due to its strength, has a tax base of 300mn+ people and a Federal Reserve which prints out what they need (not necessarily a good thing).

Sorry…last paragraph should have been the 3rd.

I suggest they raise tax rates on International Business !

Paula Cox did that back in 2009, with payroll tax. Perhaps you’ve forgotten how that turned out? Let’s be perfectly clear here, IB businesses are here because it’s advantageous for them, any benefit for Bermuda is incidental. Raise taxes, they re-domicile/close operations locally and go elsewhere. Make no mistake, this debt is on the heads of every Bermudian man, woman, and child, both living and generations to come.

Simple. Look to where our biggest expenses are..

Start with the unnecessary CS positions. Then move to CS who don’t/can’t do a good job. Then improve the overall efficiency of the CS.

Next find our missing money.

Then talk to about increases my taxes.

Let’s simply remove 20% of the CS starting with the 20% on work permits…

That would be fine. Just make sure the do nothings and screw ups are next.

Bob’s going to have to be real careful. Raising taxes can have the effect of negating any feel-good factor which results in higher local spending. IMO whether we are in or out of the recession is not totally clear and raising taxes could push us the wrong way. Damned if he does, damned if he doesn’t ./..

see people start losing there house or houses not nice it getting crazy bda

The rise is so small. Everyone is freaking out for nothing. You should have listened to the House. Maybe u would he a better understanding. Don’t blame the oba. You know who to blame.

Small – If you look at it in real terms, the lowest band has tripled & the second lowest band doubled. That’s going to hit a lot of lower to middle income families. Furthermore, it means that the rents are going up to compensate.

for some people 25%, house empty soon even with it rented out to IB folks!

Would you rather people lose their jobs?

Starting with those who are here on contract.

He is talking about Government jobs as they consume over 50% of Government revenue as of now.

Add debt service expenses and general operating overheads to the salary expense and that is nearly two thirds of Government revenue spoken for.

Then add another $200mn+ (annual deficit) onto the debt each year and it will only get worse. And yes your so called ‘grass root’ Bermudians will feel the pain of Government financial mismanagement the most. But despite the facts you and yours oppose cost cutting.

Expect more of the same if we continue down the same road.

And let’s not forget the previous Government’s payroll tax rise, duty rises and foreign currency purchase tax increase which was solely enacted to try and cover the exploding costs to simply run the Government.

Chickens have come to roost.

That’ll be you then Onion Juice

That depends. Is it a necessary job and are they competent?

Great pojnt. So you would only get rid of 1,000 or so civil servants then. Just the ones we don’t need.

That’s a good start….

Why do people need more than one house?

Thanks PLP

what do you really know?

How about cutting the fat out of the civil service, then I wouldn’t mind paying increased land taxes.. Now it feels like we are just burning our hard earned money on waste and incompetency!

Exactly!

I am tired of having to pay more into an ineffective system that simply wastes my and our hard earned monies.

Fix the wastage highlighted by the SAGE and AG reports before expecting us to foot the bill for Government inefficiencies and a bloated civil service.

But this is what happens when the Government can’t enact necessary cut backs on the biggest expense.

It will only get worse until the civil service inefficiencies and wastage are finally sorted. However, this happen because of politicians being too scared to make the hard, but necessary decisions.

You have one Party that won’t increase spending, but at the same time won’t cut expenditure where it needs to be reduced.

On the other hand the other Party promises a spending spree and a cut back on taxes which is oxymoronic in and of itself.

Unfortunately, many in this island seem to think we can continue on as we are with no repercussions.

But the first civil servant to be laid off will likely cause the unions to ‘shut the island down’. They are looking for any excuse to show the OBA Government who is in charge as was demonstrated by the mass protest at Bob’s town hall meeting on Public Bodies Reform Act.

No like Bob’s insulting letter.

Hahahahahahahahaha, you really do believe everything they tell you.

Unfortunately you can’t do that. They will just run to the union. Then we will he a island wide issue. But cutting civil service is the answer

They have been cutting civil service headcount, by attrition, hiring freeze except for key positions and voluntary retirement.

But cuttig the civil service is nowhere near enough to get us out fo this mess. WE HAVE TO INCREASE GOVERNEMENT REVENUE AND THAT MEANS TAXATION. It won’t be popular but it HAS to be done.

Ensure that people earning over 750k pay payroll tax on all money earned – ensure that those companies pay payroll taxes on dividends as they are being used as a means to shift/ hide income and avoid taxation – that is a common tactic employed in Bermuda – seems to violate the OBA shared responsibility concept…

Won’t help. There’s no other way to feed the debt service cost.

Government Services….. Does this mean you will have enough money to cut all the overgrowth around Bermuda before the next tourist season. I noticed you have finally started cutting North Shore growth back. Of course at the end of the season when all the tourist are gone.

And protection for the motor cyclist during Winter.

Duhhh

And the biggest percentage increase is for those living in the most modest homes – 2.4% to 4.4% is almost a 100% increase. Certainly not the fairest way to treat those who probably struggle the most to even own a home.

So the richer you are, the less your tax hike. Great…

ARV @ 11,000, you go from $66 to $198 (increase of 100% or $132)

ARV @ 120,000 you go from $27,600 to $30,000 (increase of 8.33% or $2,400)

Shouldn’t the rich pay more than the [suffering, unemployed] middle and low income classes, who are suffering the most? Maybe not 100% more, but surely more than 8.33%. Can they add now scales for ARV of more than 120,000?

If someone has a more expensive home, then they have a bigger mortgage and greater expense to pay. Adding another $2,400 to pay is not small by any stretch of the imagination.

Folks rent properties instead of buying seem to be the current winners…rents went down.

Why not introduced a renters tax on the person renting to the tune of $100 per year?

agreed. renters need to share the love as well as the property owner who is burdened with the land taxes while the tenants benefit from the resultant services.

Every landlord should be figuring landtax as part of the property overheads as part of the rent. No different than every retailer who has to include the duty on goods they sell.

Don’t know of any ARVs that are $11k max, and I work in the industry and see these figures all the time.

They are tiered bands hence the rise will affect everyone as each band is increased. So yes every home owner will be affected by the increase in the $11k ARV band as it is the lowest on the scale.

However, not everyone has an ARV high enough that falls in the higher bands (i.e. $33k and above).

So people will lower ARVs will only be affected up until their band threshold while the higher ARVs will in actuality experience an increase in every rate band and as such a higher payment.

And don’t forget the Minister has claimed that the 2015 revaluation has resulted in lower ARVs due to the last revaluation being during the boom.

So in essence this rise is on lower ARVs which in theory, according to the Government, will result in a wash (i.e. no real increase in payment requirements).

That’s why he stated that if they kept the current rates on the lower ARVs the Government would lose $19mn in tax revenue. That cannot be a good thing considering the fact that we have a $200mn deficit with the Government unable to cost the biggest expense item which consumes over half of our annual revenue.

It is either tax rises or greater austerity. Can’t have it both ways.

I would not mind both! But we are only getting higher taxes and no austerity.

it will be interesting to see if our ARV’s really do go down. These ARV’s have been historically low, compared to Bda’s actual rent levels. Example, a 3 bedroom, well kept cottage in Paget, ARV $39,600. Equates to $3300 a month. Surely a 3 bedroom stand alone cottage can get more than that?? I doubt that house will be getting a reduction, just an tax increase.

Exactly. But unfortunately the richie riches run the show. Cant be pissing off the money now can we?. Smh. And they wonder why theres such animosity between the rich and the poor. Not that they really care. They’re rich afterall. The whole world works that way. We r all doomed

It’s already a progressive tax where the higher values pay a higher rate. That’s not regressive, Quinton. And even using your example, I think you can see that the higher value house pays a much bigger dollar increase than the lower value.

Who do you think is paying the bulk of landtax in the first place? It sure is not middle Bermuda & down. Those with the ARV $120,000 & higher are paying the bulk of it.

It is their choice, just like all the people who drive around in class G & H cars. Nobody holds a gun to your head & forces you to have these things that pay alot of taxes. That is the beauty of a consumer based tax system. You want 5 star stuff, you pay the high tax. Your choice. You could live in a smaller house & drive a small car & pay less tax.

The big grumble here is that the Government is not giving value for the tax received. Too much is wasted away on too many civil servants who do far to little to earn it.

What part of that does Bob & Co. not understand?

Let’s hope the Minister is correct in his assertions that the lower ARVs to be issued coupled with the higher rate bands will result in little to no increase in terms of new payments.

However, based on my calculations on the new rates outlined above my annual land tax payable will increase approximately 50%. Again this is prior to the supposed reduction in my ARV.

As someone said above there is something not right about asking people to pay more into a current system that simply wastes my hard earned dollars. Why should I pay more when the Government is spending $200mn+ more than they should and when they seem to be pretty ineffective at collecting taxes.

This is on top of the damning AG reports and SAGE document which clearly highlights the rampant inefficient use and mismanagement of tax payer funds.

Everyone knows what needs to be done, but politics will prevent it from actually being done.

Sorry, but until the waste, incompetence and over staffing in the CS is dealt with I cannot get behind this.

I agree fully – Let’s remove the 20% on work permit holders immediately…

….and the waste/incompetence….are you willing to be equally decisive?

The government needs to implement income tax for individuals receiving a higher wage. They work in numerous countries through the world. Income tax bracket systems where the more you make the higher you are taxed on your income. Decreases taxes on the poor and increase taxes on the rich are one of the only ways to fix Bermudas economic problems.

My proposition for income tax :

Under $79,999 per annum – no tax

$80,000-$99,999 – 10%

$100,000-$149,999 – 15%

$150,000-$249,999 – 20%

$250,000 >= – 25%

I know many Bermudians would be against this but it’s a proven fact that strengthening the middle class is a means of increasing the prosperity of any countries economy. The middle class are the biggest consumers. Strengthening it means more consumption, which means more jobs and more money in circulation. Right now the current system is only destroying the middle class and greater increasing the gap between the rich and poor which ultimately will only make the economic woes worse.

I think it’s time that wealthier Bermudians stopped fussing over lining their pockets and started thinking about the future of our nations greater good not only for us but for future generations. A system like this in my opinion needs to be implement to change Bermudas economic status. Furthermore, it will aid in adding more funding to the education of young people (which is greatly needed) and could possibly mean the implementation of free basic healthcare for all.

We have Payroll tax of around 12% (That is income tax.)

And ‘Hospital Levy’

Both are forms of income tax , so we already have it , x’s 2

Funny that for a place considered ‘low tax’ or ‘tax free’ our base tax structure is one of the highest in the world but the uneducated still think we’re tax free.

HA! Had that argument with non other than David Saul when he was Premier. He stopped by during one of his jogs to check on his constituent. Very nice of him to do that but BIG mistake.

There was a rather heated discussion over whether payroll tax was indeed income tax or not.

From then on he only waved as he went by.

I will fall into the 10% bracket and I can tell you straight up that I am not wealthy and the additional tax would be devastating to my family.

I barely keep my head above water as my significant other is unable to work as at this time due to health reasons. As such my whole family is on my health insurance which is the largest deduction from my monthly pay, followed by payroll tax, pension and government social insurance.

So by taking away another $1,000 or so from me a month I would be unable to meet my mortgage payments (and the new land tax rate) and would be forced to sell my house, or would have to cut back on my $200 a week grocery bill for my family (which as it stands now is still insufficient to for my family on a weekly basis), go into arrears at BELCo etc.

I am unable to save now and so income tax would actually put me in the red. Unfortunately, unlike our Government I can’t run massive spending deficits and continue on like nothing is wrong.

I am not wealthy by any stretch of the imagination and your proposal would actually just about destroy my family’s already limited well-being.

There are many like you. Potentially land rich but cash poor. Everything is spoken for in day to day living plus the mortgage on the house that you hope to someday own free & clear.

There are also plenty who bought at or near the top of the real estate market before the bubble burst. Bermuda has never seen real estate drop like this before.

Of course Bermuda never had a PLP Government before. One PLP Senator thought it was funny that so many lost so much wealth. Guess he is a renter.

Lots of people over extended thinking real estate would always go up. They were wrong. Now they are upside down in their mortgages with homes comanding high ARVs & the taxes that go with them.

Now Bermuda is broke & Government has to find money somewhere. Look whose door they are knocking on.

Hold up boss…your math is wildly inaccurate. No on is proposing to take “another 1000 a MONTH”! That would be $12,000 a year, and if this represents a 10% increase, that would mean your current property tax is $120,000!!! So don’t jump off the bridge over this.

Property taxes in Bermuda a ridiculously low to begin with compared to most jurisdictions. I’m guessing your increase is more in the realm of $500 a YEAR! And that is more than reasonable after 5 years of no adjustments.

If you read their post and my reply it was regarding the imposition of income tax (not land tax) that would hurt my family’s financial well-being.

Apologies. I did not realize your comment was in reply to another post on a different topic. That makes more sense.

Nonetheless , our property taxes ‘seem’ low compared to other jurisdictions because our total tax base rate so much higher than theirs in the first place.

For example , 2 identical cars .. One is $15,000 in the US the other is $32,000 in Bda .. reason ? Tax .

Gas .. $2.15 a gallon in the US , Bermuda = $8.77 . Reason ? Tax

And there’s a thousand other examples . Don’t forget , payroll tax and Hospital levy are both forms of income tax too .

I believe Not Wealthy was replying to Income Tax’s post above proposing income tax.

And there is the end of IB. Gone forever.

We already pay payroll tax. Are these rates in addition to payroll tax? Will you also be reducing duty rates or so they stay the same too?

Define “income”. Are dividends income? Is Interest income? Or are you suggesting we simply tax salaries?

The rates you put up there and the simplistic view of an income tax remind me of the Canadian Income Tax Act. When it was first introduced it was about 3 or 4 pages and was a temporary measure to help pay for WW2. It is now a huge Act, volumes and volumes of provisions. Once the politicians get ahold of it it will grow exponentially.

Funny commercial property taxes just went up….

Now they’re going up again….

And you’re saying it’s fair for all?

Sounds like they are trying to keep the same dollar amount in taxes and making the percentage equal to that. Can anyone confirm that?

So when/if it all turns and ARV goes up at next assessment, will the percentage reduce? You know, since you’re only doing it to keep your head above water right now. Yeah RIGHT!

A direct quote indeed, but fails to recognise a major part of the story, which is that the Land Valuations are being revised lower and the result will be that we will be paying the same amount as we pay right now. As a result, the Govt. will end up collecting the same amount in taxes, $19 million a year, from Land Taxes.

Government/s have been doing this for years.

It helps secure the infrastructure.

No one is going to loose their home.

If you own one your fine.

Stop the bullsheet some of you.

Think before you type.

Land tax is like a parking ticket as many don’t pay.

hindsight is 20/20. if i had known that homeownership is not what it is touted to be, i would have paid rent, saved my money and be in a better position to find a country where the quality of life is good and the cost of living is lower than here.

or better still, spend my money, make irresponsible decisions and get a monthly cheque from financial assistance. that’s how it’s done, isn’t it?

“The Government has always maintained that everyone in Bermuda needs to do their part in helping to pay off the deficit left by the last government.”

Is it just me or is anyone else highly insulted by this statement..?

I think it is time bie!…how long will the people like me that pay every single tax that is possible…work day n night just to ensure that a slice of bread is available to my family…never asked the govt. for assistance …huh? Now you want me to wha??

Land tax…biggest crime in the world…Someone explain to me why I have to pay tax on something that is bought and paid for…It is where I live…There is NO INCOME derived from it…but it’s very expensive to maintain therefore the strain of more money going down the drain…now ya tellin me wha?

I guess the old conspiracy theory of “you think! you own it,but YOU DON’T”…sounding pretty much true jus about now.

Do your research,then you will find that globally,there is a growing trend of there being less wealthy people,and more poor people…don’t see a good outcome there…The middle class has become the new poor and the rich are being relegated to fill the middle…hence the 1% controlling factor…

Stay tuned…2016.

“The sobering reality is that to maintain Government services at a reasonable level and to avoid financial failure, the Government needs to increase land tax rates,” Minister of Finance Bob Richards said.

What he is saying in a nutshell is that he really has no idea except to ring blood out of Bermuda limestone . A novel idea indeed .

Bermuda deserves better then low rent solutions to our financial woes .

That quote is taken out of context. He also said that if the revised valuations came into effect without increasing the tax rates, the Govt. would end up getting less tax revenue, which can’t happen. So, as the valuations will be lowered, reflecting the lower rental rates, the taxes will be raised to generate the same level of taxes as right now.

And because you see absolutely no problem with paying more for less , everyone else should as well ?

You and I and everyone else that owns a house will be paying the same amount as our last land tax bill. What is so bad about that?

It was already a ripoff.

A low rent solution from a lazy politician .

What this group needs to do is get up off of their backsides, pull their fingers out and have a commission on the, as Larry Burchall says ” high level of incompetency”in the Civil Service, and the missing money.Then start thinning out the bloated civil service.

If they choose not to do so, then they are just as bad as the opposition, and it is time for them to go!

Bob, What’s the problem with the tax hike? It will affect mostly poorer blacks .Yes government needs more money, but you have yet to deal with the waste, alleged theft, low job productivity, and duplication of services in Government – ( $90 million dollars ). We asked you to go and talk to the banks about the reversible mortgage, but not a word. The spread between savings and loans/mortgages is criminal, but you have not said a word. IB is prepared to pay more in taxes ,but not a word from you. The OBA was voted in to stand up for the Little Man, but so far, what have you done? Do something for the Little Man. People that own property out right, are unable to borrow against them. The banks have changed the goal post again, and you have not said a WORD. Do something for the Little Man. WHAT IS SO HARD ABOUT THAT ?

It affecs everybody.

It was the PLP wh destroyed the middle class of this country. Black people who worked and saved their whole lives, who had a house with apartments to rent. Doing well. Suddenly the PLP decided prosperity was bad. They chased out the expats living here and destroyed rental incomes and home values. And Burch gleefully gloated about it.

Idiots.

We will all now pay for the excesses of some.

If the PLP would have had a forward looking approach to governing Bermuda we would not be in this position.

Sorry HM Opposition you do not deserve to govern until you recalibrate.

This is about our future and your past and continued approach will not solve the problems you created.

Sorry. Respect.

In the words of many a world leader…”Uh oh.. “…..” I’m out of toilet paper!”

“Who the hell used the last bit…and didn’t put on a new role?”

“heeelllloooo?”

“Can anybody here me?”

Why not open more industry to tax? You can tax a new cannabis industry..sure it won’t rake in millions like the US but every bit helps..also won’t need as many police and save money by not prosecuting individuals. Also putting a higher tax on junk food would go along way to help lessen obesity rates insurance rates. Tis a win win for all..But let’s not tax something that doesn’t need to be when there are a whole host of other new options available.

Yeah, so government over spends and then instead of cutting costs they reach for the sacred cow of “OTHER” people’s money to fix their mistake and the problem is never resolved.

They look around and then find the “extra” money they just got and create another, useless program.

This government is just increasing EVERYTHING!!! Time to sell my home, land tax is high ENOUGH….. sick of home ownership in Bermuda!!!!!

3 Bedroom condo for sale in Smith’s…. going once, twice, you can take it… do me the favor…. sickening!!!!!

I’ve got my house up for sale too. At this point I’d rather just take the money earned from it and help my aging parents fix up the (paid off) family homestead. It’s not worth it anymore just to ‘own a piece of the rock’ if I have to work myself into an early grave just to afford a ‘comfortable’ lifestyle.

This is completely crazy,increase land tax during a failed economy.The middle class are struggling now.

You are taking money out of the economy that can be used to stimulate it.

The U.S. is cutting taxes to get the economy kick started.

This should have been done as a last resort.

Everyone knows,expenditures need to be cut such as the Civil Service and over lapping positions.

Goverment are too scared to make the real decisions! Instead they opt on the easy way out and raise taxes. You’ll not get my vote next time around…I’ll burn my ballot before I give it to OBA or PLP!!

CONTROL SPENDING, GIVE VALUE FOR MONEY…….. Ha !

All of your posts are falling on deaf ears, they don’t read you stuff,we are wasting our time, as they consider all of us tax payers as trouble makers.

What will it take to get them to wake up ? THE VOTE !

“The Minister said, “The residential assessments, on a whole, are seeing ARVs below their 2009 assessed levels of rental value. The segment most affected has been the “executive” rental properties, particularly the larger units.” But who has to pay for it? The land tax for low ARVs tripled and doubled, (0.6% to 1.8%= 3 times higher; 1.2 % to 2.5% = more than two times higher and 2.4% to 4.4% almost 2 times higher) while high end houses go up only marginal, in the top bracked by less than 10% of the old rate(4.8% to 6.8% = a third higher; 9,6% to 11.6% = about a fifth higher 19.2% to 21.2% = about a tenth higher and 23% to 25% =less than 10% increase). Let’s take a guess in what bracket the ministers’ houses are. Is there opposition, or do the PLP MPs own expensive houses too? Where is the fairness in this? The poor will have to pay for the loss, which usually only affects the high end market. The lowest bracket is $0-$11000 ARV cannot get lower, but the poor people who only have a low end house will have to pay three times (!) as much land tax, they are the ones who can least afford it! It won’t hurt those multi millionaires in Tucker’s town to pay $2000 more (however, their ARV dropped the most it says, so they probably don’t even have an increase, that is antisocial!), but it will hurt a granny in Somerset to pay $176 instead of $66 for her $11000 ARV home, or a worker in St. Davids to pay for a $23000 ARV house $1,012 instead of $552. Or does that mean that the ARV can be lowered by a whole bracket? Can the poor get an ARV under $0??? Surely no. for the rest of us, will that be done automatically or do I have to apply for that and maybe need to be or hire a lawyer? The rich pay less, the poor pay more, that is fair. If the ARV is 22800, can I get it under 22000 so I won’t have to pay almost 50% more land tax. Reality is, the government is taxing people out of their houses, and it will increase rents for all who do not own property, but mainly in the lower segment.