Column: Airport Project Video Was ‘Misleading’

[Opinion column written by Craig Mayor]

On October 31, the Ministry of Finance [MoF] released its video “The Best Option For Bermuda” that describes why the Government to Government [G2G] option is the best option for the Airport.

The video uses slides with text to clearly state the advantages and disadvantages of the EBA [repair Wade] and G2G [build] options. The comparisons focus on each option’s impact on national debt and weakened sovereign credit ratings [which lead to higher interest costs].

CITV video “The Best Option For Bermuda”

Astonishingly, my review of the video found that most of the stated advantages for the G2G option were incorrect, false or at best misleading.

Most alarming and inconceivable is the fact that MoF did not include the cost of the estimated Airport Revenues [$37m/year] less Expenses [$10m/year] which will be handed over to Project Co [$27m/year] in its calculation of the G2G cost [$585m].

This amounts to an estimated $810m understatement of the G2G cost, which after adjustment becomes $1,395m [nearly 2.4 times the G2G estimate].

Screenshot from CITV Video: For the EBA Option

This statement is invalid. To assume that it will cost $500m to refurbish Wade is totally invalid because this cost is based on the 2006 terminal specifications and cost [$544m].

- Under the 2006 Airport Master Plan the cost of the proposed airport was $544m.

- The 2006 terminal was much larger and had very different features including high speed ferry docks and marinas for private boats.

- In the recent PAC meeting the Finance Secretary said the 2006 terminal was a “Rolls Royce”

The proposed 2016 Aecon plan has been scaled down from the 2006 plan. It is a different concept and therefore not truly comparable to the 2006 plan.

Screenshot from CITV Video: For The G2G Option [$585m cost]

This statement is false. It is impossible to spend an extra $585m for the G2G option without increasing GoB debt [in times of deficit].

- From 2009 – 2016 Government of Bermuda [GoB] total expenditures exceeded revenues by $2.4bn [$300m/year average deficit].

- When GoB is spending more than it receives, $585m in additional expenditures for G2G will increase the deficit and can only be paid for by additional borrowing [increases in public debt]. For this reason, GoB borrowed $665 million in October to pay for anticipated 2016 deficits and refinance existing loans.

Screenshot from CITV Video: For the 2006 Wade Upgrade [$544m]

This statement is not correct.

- GoB’s financial condition was significantly better in 2006 that it is today. In 2006 GoB debt was only $173m whereas in 2016 debt is $2.4bn. Debt will continue to increase until GoB is able to earn more than it spends [surplus].

- In 2006, GoB could have borrowed more than it is able to borrow today. In 2006, borrowing $585m million to build a new Airport would not have bankrupted GoB.

- Ten years on [2016] with a significantly weakened financial condition, GoB has far less ability to borrow $585m [G2G] without causing adverse impacts on interest rates and Sovereign credit ratings.

Screenshot from CITV Video: GoB Needs An Off Balance Sheet Option With No Impact On Debt

This is correct but it has not been fully achieved under G2G. Unfortunately the G2G option is not completely off balance sheet.

The Minimum Revenue Guarantee for Project Co increases GoB liabilities and it will be described as a new contingent liability in GoB’s financial statements. By increasing total direct and indirect liabilities the Revenue Guaranty will impoverish GoB’s Sovereign ratings.

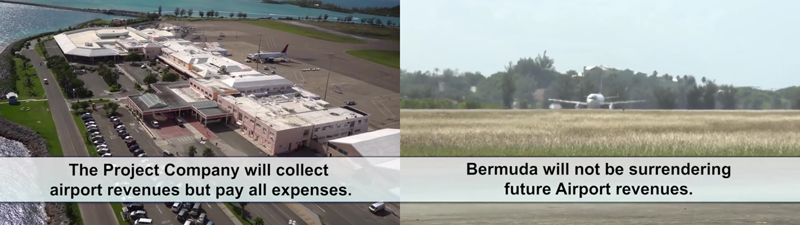

Screenshot from CITV Video: For the G2G option

These statements are false and misleading because [i] Project Co will only takeover and pay approximately 50% of current GoB airport expenses and [ii] GoB will surrender [transfer] all of its pre-existing Airport revenues to Project Co for 30 years to enable it to finance its debt and operations.

- Based on MoF 2016/17 estimates GoB will transfer to Project Co all revenues [$37m/year] and Project Co will take over approximately $10m/year of existing Airport expenses. This results in an estimated net cost to GoB of $27m/year, or $810m for 30 years.

- The cost will be increased by additional amounts paid to Project Co under the Revenue Guarantee and reduced by amounts received as profit shares [after Project Co debt has been repaid]. As stated by GoB, these amounts cannot be reasonably forecast.

- It doesn’t matter whether [i] GoB retains and collects the net revenues and issues Project Co cheques totalling $27m/year or [ii] GoB surrenders the net revenues directly to Project Co for collection. In both cases GoB’s cash flows will decrease by approximately $27m/year, which under generally accepted accounting principles represents a direct cost to GoB of developing the airport. Project Co will use these funds at its discretion to repay its debt and subsidise operating costs.

- Over the 30 year concession, the additional $27m/year cash loss will increase GoB deficits by $810m.

- Because MoF has not included the cost of its payments to Project Co to build and operate the Terminal [$27m/year], MoF has made an enormous and inconceivable error in calculating the G2G cost estimate.

G2G airport cost is estimated to increase to $1,395m due to GOB’S inconceivable failure to include its payments to project co totaling $810m over 30 years

As noted, GoB will surrender $27m/year in net revenues to Project Co as payment for the airport development. Astonishingly, MoF’s calculation of the G2G costs [per Figure VIII of MoF Financial Cost report] erroneously excludes the cost of $810m in payments to Project Co.

- MoF’s cost estimate defines the G2G cost [$585m] to be the sum of [i] Retained Government Services [$9m/year] + [ii] Airport Quango Costs [$3.6m/year] + [iii] Duty Concession [$50m] + [iv] Energy Subsidy [$2.7m/year]. Costs are increased in future years for inflation/other factors.

- With the exception of the $50m duty exemption, GoB’s cost estimate only includes new airport “operating” costs that will be payable by GoB [quango, electricity subsidy etc]. There is no line item for amounts paid by GoB to Project Co to “build and operate” the airport.

- Without any doubt, the $27m/year cost that will be paid to Project Co [30 years] for building and developing the airport is not included in MoF’s cost estimate.

- As stated by MoF “there is no free lunch” – no one can get a new airport for free. Yet MoF’s cost estimate magically states that GoB will get a free airport because it does not have to pay Project Co anything to build and develop the airport.

- By erroneously excluding GoB’s payments to Project Co, MoF’s G2G cost is estimated to be understated by $810m. Assuming there are no further errors in MoF’s G2G estimate [$585m], the new terminal is estimated to cost $1,395m.

Quote: “Under the G2G option we will not need to increase the national debt”

This is false. As noted above, the G2G option will increase BoG spending by approximately $1,395m [$585m per MoF plus $810m cost understatement]. Under deficit spending this expenditure will increase national debt by $1,395m and significantly weaken Sovereign credit ratings.

Quote: “Under the G2G option we will not need to guarantee finance costs”

This is completely false. Project Co’s financing costs will be supported by GoB’s “Revenue Guarantee.”

- Under the Minimum Revenue Guarantee, GoB will inject cash annually as necessary to ensure Project Co’s loan payments can be made.

- GoB’s liabilities under the guarantee will be described as contingent liabilities in GoB’s Financial Statement Notes.

- The new Contingent Liability will increase GoB’s total direct and indirect liabilities and weaken its overall financial strength.

- Airport arrivals have plummeted from 639k [1980] to around 385k in 2015 [60% decline]. It is impossible to predict with reasonable certainty if and by how much air arrivals will decrease, increase or remain the same over the next 30 years.

- Given uncertainty over future arrivals and the current low volume of passenger revenues relative to the loan principal, it is uncertain whether Project Co can repay the debt. For this reason, Project Co would not have been able to borrow circa $250m without the financial support of the GoB guarantee [which is soley intended to ensure Project Co can service its debt and maintain investment grade ratings on its debt].

Quote: ”G2G will avoid negatively impacting Bermuda’s credit”

This statement is false. Credit rating agencies [Moodys & S&P] have recently stated that Bermuda’s unsustainable debt levels must be contained &/or reduced to prevent further declines in Sovereign ratings. Under the G2G option, GoB credit ratings will be reduced significantly by [i] the $1,395m increase in debt and [ii] GoB’s Revenue Guaranty to Project Co.

Conclusions

It doesn’t take much common sense to understand that handing over estimated net cash flows of $27m/year to Project Co is a direct cost to GoB of developing the airport Neither GoB’s video nor its Financial Comparison report is credible.

Neither justifies [i] the reasons to build a new terminal, [ii] the economics and cost/benefits of spending $585m under the G2G option [yet alone $1,395m as restated] or [iii] the affordability of the project in terms of GoB debt metrics and credit ratings during these very difficult financial times of unsustainable debt levels and [iv] whether this should be GoB’s highest priority project at this time.

Due to the substantial financial errors and omissions in GoB’s Financial Comparison report and the numerous misleading statements in its recent video, it is clear that the integrity of MoF’s analysis and negotiations with Aecon cannot be relied on to demonstrate that a new terminal [G2G] is in the best interests of Bermuda.

Given the estimated magnitude of the cost understatement [$810m], the project must be stopped immediately pending a full investigation by an independent professional body. It is inconceivable that a project costing nearly 2.4 times the original estimate could ever be justified economically.

Added Documents:

- Craig Mayor is a retired chartered accountant. His qualifications include BBA [University of Western Ontario], CA [Ontario] and MBA University of Western Ontario]. As a practicing CA, he worked with Coopers & Lybrand [1976 – 1983] in Toronto, London and Bermuda followed by two years [1983-1985] with Mobil Oil. During his last 20 years [1985-2006], he was Treasurer and Director for a private company with diversified global operations and investment activities.

Wow what a read I am feeling fuzzy like “Little Johnny” who the Minister always refers to as the little Bermudian boy at home with no milk because the economy is in a mess after the PLP wrecked it.

A small point.

Our visitor arrivals do not even exceed 600,000 passengers a year, the local banks will not accept any cash from these new casinos you plan to build.

Time to start over again, unless in fact this project is really about the off-take agreements for services, electricity, water etc etc

I am not sure what desk warmer is suggesting. The problem is that Bob Richards and his cronies keep referring to the PLP methods of doing business, which if correct most Bermudians were not happy about and that is why the OBA were successful. However, they Bob Richards and his cronies are attempting to make fools of Bermudians by trying to make them believe that this deal is best for Bermudians. The answer is we don’t know and neither do they. I once heard several OBA ministers, but Bob Richards does this a lot. He stated that they were voted to govern. That statement is incorrect. The people of Bermuda voted them in to do the PEOPLES BIDDING. That means they are to do WHAT THE PEOPLE WANT THEM TO DO. To enter into a contract which the people have neither consented to nor want cannot be a contract that the people can be held to be responsible to repay. That repayment responsibility falls on the MEMBERS OF THE OBA government. If the OBA know what their Fiduciary Responsibility is they will not follow through with this airport contract

I wait with interest for the minister to challenge these calculations from an accounting perspective! If a government to government partnership is the best way forward then why did we not ask the UK to partner with us on this project given we needed their consent anyway?

The Minister has no need to… The numbers MR Mayor has given are his perspective/opinion… you can have a 10 other accountants with 10 different opinions… (this is an opinion column.. not a fact column)

Clearly you did not think about your post, because all you have said is that Minister Richards has provided us with his opinion and not the facts!

Dont hold ya breath

this deal should not be going to the house at all until the commission of inquiry completes its job….there is a 4th option that the government has been suppressing in order to get this deal passed. Bermudians have developed a 4th option to deliver the airport and multiple additional projects under the same ppp sole sourced model of deployment and the government has been aware of this 4th option since 2015 and refuses to provide a mou to start official talks about this 4th option…but they want details of the 4th option to be “given to them” without a mou or nda in place.

That commission of inquiry is just a smokescreen. Nothing will come of it in any event except a lot of the peoples money has been given to CD&P to conduct the inquiry. Secondly, it is the hope of the OBA government by holding this commission of inquiry they will throw off the people to what they are attempting to push through the airport project without the people consent. That of course will not work. I personally do not have a problem with the new airport, but the arguments for the airport do not make any sense at all and borders on outright lying to the people. The cost is going to be greater than was told and the jobs created for Bermudians will be minimal, at least the better paying jobs as they will import foreigners to take up the best jobs whilst leaving the worse jobs to Bermudians even if we are more qualified.

I agree with clearasmud. Why did we not ask the UK to partner with Bermuda. They have more in common with us than Canada in any event and from what I can see Canada is not the best country to partner with.