Fiscal Responsibility Panel Annual Assessment

The Minister of Finance today [Dec 12] released the second annual Assessment Report of the Bermuda Fiscal Responsibility Panel.

In the 2015 Budget Statement, the Minister announced the intention to establish a Fiscal Responsibility Panel in order to “increase transparency and international credibility, Government intends to establish an international, independent committee to review, monitor, assess and publicly report on the fiscal progress of the Government.”

The panel’s more detailed remit is “to provide Bermuda’s Parliament, Minister of Finance and Financial Policy Council with an annual published assessment of the island’s fiscal strategy, focusing on progress in meeting our medium term objectives for public spending, taxation, borrowing and debt reduction.”

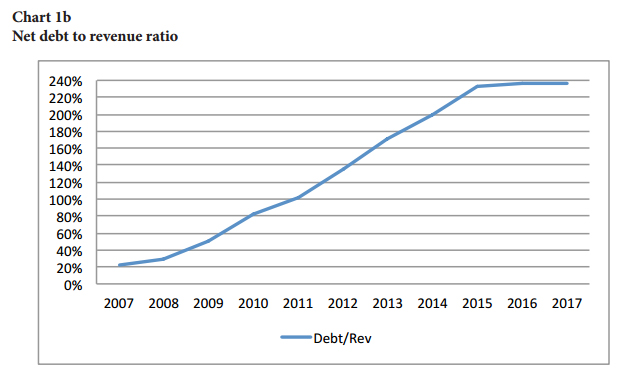

The Ministry said, “Similar to its initial report, the panel was asked to “review progress towards the Bermuda Government achieving a balanced budget by 2018-19…[and] prospects for further progress towards meeting the aims of reducing debt and debt service to less than 80% and 10% of revenues, and for implementing the rule that net borrowing can only be considered to finance capital spending.”

“In making its assessment the panel was asked to “review the impact of the most recent Bermuda Government annual budget; the credibility of macro and fiscal assumptions underlying Government projections; and the risks that could affect progress in meeting the island’s fiscal goals, offering advice where needed on ways to refine these goals, and on adjustments to fiscal strategy and tax and spending policies needed to achieve them.”

“The Panel had meetings with various institutions and individuals during the course of its discussions in Bermuda during the period November 14-18, 2016.

“During these discussions the Panel heard views about Bermuda’s economic prospects [and risks to those prospects] and challenges, in the short, medium and longer term; the Government’s plans to achieve budget balance by 2018-19 and the desirable speed of progress towards meeting its longer term debt targets; and the desirable and feasible balance between expenditure and revenue measures and preferred options for both.

“While the Panel consulted many individuals and organisations it should be noted that they are an independent panel and the judgements and recommendations made are their own.

“The Panel was the same as last year and was chaired by David Peretz, an independent consultant on international financial issues who has worked in the UK Treasury, the International Monetary Fund and the World Bank, and has experience in advising on strategic and economic issues affecting small countries.

“The other members are: Jonathan Portes, Principal Research Fellow at the UK National Institute of Economic and Social Research, whose expertise covers a wide range of economic policy issues, including fiscal policy, labour markets and immigration, poverty, and international economic and financial issues; and Peter Heller, retired Deputy Director of the Fiscal Affairs Department of the International Monetary Fund, who has written extensively on public finance issues, pensions and health care, and long-term demographic challenges.

The Minister said: “The Government is certain that the Panel’s Report will be a useful document to assist with the Government’s deficit and debt reduction strategy and I encourage the general public to thoroughly read the report to get a better understanding of the various fiscal challenges facing the Government.”

The second Annual Assessment Report of the Bermuda Fiscal Responsibility Panel will be tabled in the House of Assembly when it reconvenes in February.

The 40-page Bermuda Fiscal Responsibility Panel Annual Assessment follows below [PDF here]:

What happened to the proposals last year that were being phased in? There was supposed to be a service tax, and a tax on local company dividends. If they have been dropped and replaced with other ideas, why? Taxing local company dividends is a no-brainer. It’s a well-known payroll tax loophole for well-paid professionals.

Nice to see the OBA continue with their agenda of transparency. Simply put, they have been the most transparent government in Bermuda’s history – despite what the opposition and their supporters would have you believe.

If the panel’s independence is agreed, perhaps they should be given a specific remit to review the proposed Airport Deal and inform the general public what the deal entails.

No political bias one way or the other, just an objective summary and analysis of the deal.

The OBA is still continuing the debt trend, unacceptable. TRIM BACK THE CIVIL SERVICE. I’m tired of my taxes increasing to keep people in jobs who protest more than they work!!!

I wonder if they were asked if it is fiscally responsible to be contemplating building an airport at this time when we face so many increased risk.

We don’t have a choice whether or not to build a new airport if we want to be a tourist and international business destination. However, based on the heat this topic has created, maybe a review by the FRP is worth considring. Tight remit, just “is this the best way to finance the new airport in our current financial situation”?

Sadly the current actions by the vocal minority have very little to do with the airport and more to do with an agenda that they are being used to support.

I would however favor this group having a look at the deal and commenting on it through the lens of our need for an updated gateway facility and how we finance it given the current precarious finanical position Bermuda finds itself in given the increased debt load established by the previous and current administrations.

Some have suggested that the panel assess the airport project. But what’s the point?

Last year, the UK Government commissioned Deloitte to provide a preliminary report on the project, identifying gaps and deficiencies in the proposal, against which the Government of Bermuda was to work, plugging in the gaps so to speak.

This year, the Government then commissioned a Value for Money Assessment prepared by Steer Davies Gleave, which is a consultancy firm out of the UK with transport and aviation expertise. As a subject matter expert, their opinion really should be given deference.

(Incidentally, both reports were made public.)

This, however, was not enough for the Opposition, who then shifted the goal posts and called for a review by the Aud-Gen.

Interestingly, the issue with the panel is the same as the Aud-Gen – neither really has large project management experience or expertise, either in general or pertaining to airports, with their respective specialties being macroeconomic policy and accounting. The panel would likely decline to perform the task.

Even if they did, what would happen if they provided a favourable opinion, as per Steer Davies Gleave? Opponents to the project would question their expertise, allege that they were biased for having been commissioned by the Govt, etc. So once again, you will see more shifting of the goal posts. No one will be satisfied.

At this juncture, there is just no further use for reports and appraisals. People’s views for or against the airport are more or less crystallized. The Govt just needs to commit to the project or back out. The longer that the decision is put off, the more likely it will cost time, money and resources to be in a negotiating posture with CCC / Aecon.

The scope of the two reports are very different and it might have been better for Deloitte to be asked to opine on whether the identified gaps had been adequately covered rather than ask a second company to opine on a perceived value for money.