Maher: Tax Loophole Masquerading As Country

American political pundit Bill Maher targeted Bermuda in remarks made on Friday night’s [June 6] episode of Real Time with Bill Maher on HBO, calling the island “a tax loophole masquerading as a country”.

Mr. Maher’s comments followed the release of the “Offshore Shell Games” report [PDF/52 Pages], which was produced by the U.S. PIRG Education Fund and Citizens For Tax Justice.

The report labeled both Bermuda and the Cayman Islands as “notorious tax havens,” saying that approximately 64% of companies with tax haven subsidiaries had them in Bermuda or Cayman.

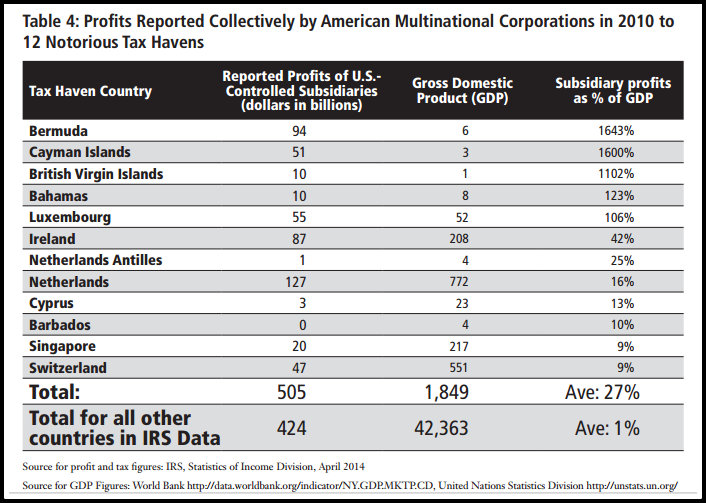

The report also said that Bermuda had some $94 billion in reported profits from U.S.-controlled subsidiaries of American companies.

Speaking during Friday’s episode, Mr. Maher quoted U.S. Senator John McCain as saying “Russia is a gas station masquerading as a country,” and went on to call Bermuda a “tax loophole masquerading as a country.”

Mr. Maher said, “I read this week in the paper Citizens for Tax Justice pointed out that American companies have $94 billion in profits in Bermuda, which is interesting because the GDP of Bermuda is $6 billion.

“Which means the people of Bermuda have spent 15 times more than they make on American products. I think Bermuda is a tax loophole masquerading as a country.”

Audio of the Bermuda mention on HBO’s Real Time with Bill Maher

“The loopholes in America’s corporate tax have grown so outrageous that our policymakers should be embarrassed,” said Steve Wamhoff, Citizens For Tax Justice legislative director.

“The data in this report demonstrate that a huge portion of the supposedly ‘offshore’ profits are likely to be U.S. profits that are manipulated so that they appear to be earned in countries like Bermuda or the Cayman Islands where they won’t be taxed. Policymakers should close the loopholes that make this manipulation possible.”

Bermuda has some 177 mentions in the 52-page report, which was slightly less than other jurisdictions such as the Cayman Islands, Luxembourg, and Switzerland.

Chart extracted from the report:

Finance Minister Bob Richards has addressed the “tax haven” accusation on multiple occasions, once saying: “If there are problems with the UK, the US or anybody in Europe collecting their taxes, it’s because their system is deficient, not because we’ve done something wrong.

“We haven’t set up our country to be a tax haven. The situation we have in Bermuda is that we have a tax structure that goes back over 150 years.

“We haven’t changed our tax system in 150 years so it has to do with the tax systems in the developed countries. If there’s a revenue shortfall, it’s the tax systems in these countries,” said Minister Richards.

In addition, Britain’s Prime Minister David Cameron said he does “not think it is fair” to refer to Overseas Territories as tax havens, as “they have taken action to make sure that they have fair and open tax systems.”

And the US is a War mongering bully that thinks it can critique everyone else masquerading as a country.

Please… You can get a pizza faster than an ambulance in the US. And carry guns around like you still live in the 18th century. So don’t be so quick to Call other countries “Not countries”

“Finance Minister Bob Richards has addressed the “tax haven” accusation on multiple occasions, once saying: “If there are problems with the UK, the US or anybody in Europe collecting their taxes, it’s because their system is deficient, not because we’ve done something wrong.”….He might be right but…what if……?

What if?

Do we really want the US to fix their tax loop-holes?

If the USA does fix the Tax loop-holes will Bermuda and other countries still stand to benefit?

Bermuda relies heavily upon IB, and if this loop-hole in the US is fixed, and their Tax structure is changed, it might leave up a creek without a paddle.

The matter is not a simple one, and Bermuda needs to plan now, for the possible future changes that will hit us sometime. Lets not go sleep on the job, and look into the future for alternative solutions… after all Bermuda is in Washington lobbying against changes,,, so what does that mean or say…

We should not be so quick to judge Bill, but instead attempt to examine the long-term impact upon Bermuda and in which direction should Bermuda be moving in, as he is not the only one that holds the same views.

Watch his HBO shows , then judge Bill.

Bill is what he is – a comedian masquerading as a political pundit.

And over the last few years, he’s made no disguise of his biases, leanings and agenda. Which is fine as an individual, and he’s made a lot of money from his shows, but nobody should believe that he’s some kind of beacon of truth and fairness.

On top of the blatant hypocrisy, the US has Delaware, Nevada, and New Hampshire whose tax laws create the same legal environment as Bermudas’.

Yes…..and my fake plants died….apparently …I forgot to pretend to water them…

Bill Maher is correct – big American corporates have taken advantage of our 150 year old tax system to avoid paying tax because of loopholes in their law. Why on earth do you think we have such a large International Business presence guys? The view??????

The quicker every Bermudian realizes this and understands that those loopholes are being closed with FATCA and other tax programs the quicker we can accept that we are just a loophole masquerading as a wealthy country and allow the OBA to do something about it. Because if we stick with the Bermuda for Bermudians and discourage foreign investors the quicker we’ll be back to a what we really are, a country without natural resources……….. we can’t sell pink sand!

Agree. But it still sticks in the craw to hear Americans throwing around insults when the biggest tax haven in the world is probably Delaware.

The US is a hypocritical gun factory masquerading as a country.

If you don’t know what you are talking about, don’t comment!!!

That is not why there is such a large international business presence. Get your facts straight before making erroneous allegations on topics you have no knowledge about.

Sorry but if you were to list the top ten reasons that international business is in Bermuda at least seven of them would relate to tax.

Speed to market…otherwise opportunity missed.

Robust and equivalence in regulation.

Industry knowledge base

Industry peers, client and competition proximity

Industry excellence

Go back and read it again blah blah blAH

Then do please enlighten me Logic76, why is there such a large international business presence here?

Companies pay tax in the US on their US operations and earnings. Something people fail to mention.

Why should a comapny pay US tax on their Japan operations when the Yen never gets used in the US?

Logic, fact is that if you had to list the top ten reasons that international companies are here at least seven of them would involve taxes.

Cow Polly, As for FATCA, it’s aimed at Americans that are “cheating” by not reporting offshore income. It’s not aimed at legitimate businesses.

Agreed but one could argue that even for legitimate businesses, FATCA is going to be onerous for reporting purposes, just ask HSBC who are spending millions to be compliant. But as we’ve all observed over the past few years, being located offshore is now viewed as being ‘unpatriotic’ and companies are being targeted such as Google and they will have to evaluate the reputational risk of being here.

Logic. Your name wreaks of irony. You’re just one of those people who tells others about how wrong and ignorant they are without stating a single fact or giving a reason for your contrarian positions.

All you did was state that he’s wrong and doesn’t know anything and you’re probably feeling proud of how clever you think you are.

You need to go find a soul. Or a brain at least.

I’d say I have a functioning brain. Fact is that the “tax loophole” argument is merely smoke and mirrors. Let’s use my “ironic” name for a second shall we?

Closing the non-to-barely existent loopholes leads to what?

What sector is IB predominantly composed of?

The answer is insurance and reinsurance. The BMA only licensed 4 banks last time I checked! Let’s just say for a second that those “loopholes” are suddenly closed. What does that mean for Joe Blow on the block? The trickle down effect leads to higher premiums for you, me, and everyone else (the consumers). Do you think the industry is going to simply eat the extra tax? Of course not, it’ll passed on down to the public. Every election period this “loophole” argument comes up and quickly dies down. Bermuda is extremely open and transparent when it comes to taxation, despite what the French say.

There may be more people working here in the IB sector but the majority of the 94 (and that’s only the US is not Reinsurance) its a plethora of ‘global’ companies which have opted to domicile here to avoid tax. What is avoiding tax on profits well it is refusing to pay for the infrastructure of the countries in which they make their money, the schools, the welfare state, the hospitals. The very infrastructure that they could rely on while they were building their companies and their profits.

Lets face it we are the thorn in the side of benevolent Capitalism. And the reason we don’t have good schools, unemployment benefit, healthcare etc is because we have opted for this model. I am not saying it even SHOULD be any different. What I am actually saying is face the facts IB is here becaUse we are a ‘low tax jursidiction DON’T KILL THE GOLDEN GOOSE.

So why are they here? Codfish breakfasts?

I’m a little unclear on this matter. If Bermuda is not a tax haven then why is IB interested in setting up headquarters in Bermuda. What is the benefit to them? I’m quite sure that they do not come here for the sun and surf. It’s a dubious coincidence isn’t it IB are particularly attracted to countries with little or low tax imposed.

Actually that bottled pink sand crap in gift shops sells pretty well.

Cow Polly,

I believe most people are aware of the importance of IB to Bermuda and IB does not exist via local capital. I do not see the comment Bermuda for Bermudians in any way an attempt to discourage foreign investors, I believe it more an argument that Bermudians should have more inclusion in the economy.

I se no reason why after over 50 years in Bermuda the IB sector in Bermuda cannot have more Bermudians in senior management positions.

So the whole notion about Bermuda for Bermudians, as I see it and maybe I am wrong, is very simply that there should be more Bermudians advancing within the IB sector and replacing foreigners where the requisite experience has been achieved by a Bermudian. A Bermudian should have some expectation of achieving professional advancement within his/her own economy. Note: I am not talking about a birthright, it must come about through hardwork, dedication to gaining the experience and putting oneself in a position to earn advancement……but that opportunity for advancement should be there, many feel it is not.

@ Cow polly- You said it best here in your own statement “American corporates have taken advantage of our 150 year old tax system to avoid paying tax because of loopholes in THEIR law”

If the issue is with American Lawmakers, what has that to do with us? Shouldn’t the appropriate response be what Minister Richards suggested? They need to address that themselves and stop maligning our little island?

Further, your suggestion that the only reason that Companies are here is because of the tax benefit it just WRONG. I work for a US Company, that has an office here in Bermuda and they do not get a tax benefit for being here, they pay full US taxes, yet they are here and growing.

They tax advantage is real but its not the only factor for setting up shop here in Bermuda. You should stop saying that because its simply not true.

@Truth, exactly! The corporates are taking advantage of our tax system and the loopholes in their law. But those loopholes are systematically being closed.

And didn’t say that this was the only reason they were here but one has to ask oneself whether they would remain if those loopholes close.

FACTA is not about loopholes. It’s about illegal tax-dodging.

Nonsense

Clearly you do not know why we have the presence otherwise your comments would not be so stupid.

Bill Maher is a comedian not a scholar the guy has to get two other people on his show to at least one chance at having any chance of an intelligent conversation. What he knows could fill a micron. Which is about the size of his brain. Unfortunately he has an enormous mouth added to this is a recipe for disaster.

Who pulled the usa a**es out of the 911 mess – Bermuda

Who continues to pull usa a**es out of trouble in hurricans, oil disasters and such – Bermuda

who has not a clue – USA politicians and comedians

AND WHO IS THE BIGGEST TAX HAVEN IN THE WORLD – the State of Delaware or City of London depending on whether you count special tax laws specifically designed to avoid taxes.

The amazing thing is that 11 people have disliked Cow Polly’s legitimate and factual point. Are these the people that just want IB gone and out of Bermuda and don’t care anyway?

It takes considerable knowledge just to realise the extent of your own ignorence…

I like long walks….especially when tey’re taken by people who annoy me…

U.S. House of Representative Bill H.R. 2847 (aka FACTA) goes into effect on July 1, 2014. This will make Bermuda redundant as a safe haven for US currency.

Does anyone still remember how to make straw hats to sell to the cruise ship passengers?

and catch fish?

Nope. FATCA requirements are being implemented in Bermuda and are aimed at people (“US Persons”) trying to dodge taxes, not those in legitimate business in Bermuda. Companies world-wide will have to increase their compliance documentation, but the impact won’t extend much more than that for the vast majority of companies. Also, it is being implemented world wide, so the playing field isn’t really changing from a relative sense.

Dirk, Not true. FATCA is definitely overkill but it won’t make Bermuda any less attractive (unless you think that the reason Bermuda is a “safe haven” because Americans have been depositing money here in order to evade taxes)

Well, great, we will all be able to see whether IB was using us as a tax haven. If we are not a tax haven, there should be no lessening of the attraction that US companies have toward our little island?

A word to the wise isn’t necessary- it’s the stupid ones that need advice…

It’s no wonder that truth is stranger than fiction….fiction has to make sense!

A bill could be written in an hour to close every US tax loophole. Bill Maher correctly places blame on lawmakers, although he does mischaracterize Bermuda. He is a talking head and not an expert on either policy, taxation, or international law and his words should be treated with that in mind.

Bill Maher is a clown masquerading as a journalist.

Whenever you find yourself on the side of the majority,it is time to pause and reflect……you are an enabler…

Patriotism is supporting your country all the time…and your govt….when they deserve it…

Bill Maher pokes fun at anybody or anything…that’s what keeps him employed at HBO! Don’t take him seriously…I don’t.

One itsy bisy last little thing….Don’t go around saying the world owes you a living……

The world owes you nothing….it was here first!

Bill Maher doesn’t know what he’s talking about. In the next few sentences, he and his guests go on to moan about why these companies bring money here (and it’s what Bob Richards said) deficiencies in their own systems.

15cents of every dollar in my pocket comes from “TOURISM”

85cents of every dollar in my pocket comes from “IB COMPANIES”

WHERE ON EARTH DOES YOUR MONEY COME FROM?????????????????

If you didn’t see it wuth your own eyes, or hear it with your own ears,don’t invent it with your small mind and share it with your big mouth…..but yes…it was funny untill….the laughter subsided and I realised an aspersion had been passed…..it was like someone passing wind…hillarious until the smell wafted through past the sound….

But the sound was funny…

I like bill maher, but he needs to talk more about wall street and how the stole hundreds of trillions of dollars from there own people! plus bermudians probably see .05% of the 94 billion that is talked about!

Bill Maher is an entertainer. That’s it. He’s not interested in being accurate when he can simply be provocative knowing no one will be challenging him. He has though, just provided a little free publicity for Bermuda. (Wonder if he can find us on a map.)

Wonder where his 23 million dollars is invested?

Let us not forget that this man is an entertainer. He is not a tax expert, and instead is known for saying outrageous things. Most notably regarding religion.

Tomorrow this will be yesterday’s news.

Next!

Bill, that was hugely insulting to Bermudians and Bermuda. Your ongoing insults and Bullying on TV is quite disgusting, I’m surprised HBO support it.

I’ve always been amazed at the stupidity of people I once thought to be ‘enlightened’. I’ve just added Bill to the list. No understanding of the distinct difference in BDA captives model vs Cayman model. Hey Bill, if you ever suffer the misfortune of your business, your home, etc damaged by a natural catastrophe, I hope your ‘on-shore’ insurance company ‘honors’ your policy without question.

Please do not give this arrogant excuse for what goes for a journalist the time of day..his an idiot masquerading as a talk show host.

Federal workers owe 3.3 billion unpaid taxes…lead by example please….incidently….some dose federal workers are within IRS proper…..were talkin loopholes….loopholes are like opinions….and opinions are like sphincters….everybodies got one …of course when Billy boy says it it does require some significant laughter….when we remember we are all mad,the mysteries dissapear and life stands explained…

Please be advised….forgiveness is the fragrence that the violet sheds under the heal that crushes it…….

Sue, and let his insurace policy pay to fix the damages.

But we are a tax haven! Why not just admit it? Why do YOU people think that Google are here? (They like Gombeys?)

Hey Bill, you better start learning Chinese..

He just doesn’t need to start learning Chinese, he just needs to start learning – period.

I love watching Bill Maher shows makes me feel intelligent for the bull which comes out of his mouth.

Bill Maher is a full of it…

Bill Maher is a racist moron who will say and do anything for attention. No one cares what he thinks.

Don’t know if he is a racist…would probably say he is not.

I think DK left out the i and the c in his name

This is a great opportunity for our Tourism gurus to bring Bill Maher to Bermuda on a free, “Here’s who we are” trip. He clearly doesn’t know who we are, so let’s show him. Let’s expose him to our history and culture and beautiful geography. He may still believe Bermuda to be a tax haven, but we can at least show him that we are a great people with a great culture and history.

Interesting that Delaware wasn’t mentioned at all in this report (other that as DuPont’s home state)….do as we say, not as we do is alive and well.

http://www.nytimes.com/2012/07/01/business/how-delaware-thrives-as-a-corporate-tax-haven.html?pagewanted=all&_r=0

In reality, there are several US owned captives domiciled in Bermuda which DO indeed pay tax on their earnings. There is a section of the US tax code 932(d) under which US Citizens or companies may declare earnings from offshore domiciled assets. I managed captives for more than twenty five years and the majority of my US clients filed tax returns under this section.

Probably fair comment, but what is the relationship between subsidiary profits and GDP?

Not sure, but for the purpose of this argument, probably irrelevant.

Perfect timing… I am an Economics major and I just finished writing a 20 page policy paper on the US corporate tax rate. The US are in stiff tax competition… But at their own cost. They have the highest tax rate in the world at around 39 percent at the lowest it has ever been in history.They are never going to be able to control companies shifting of profits unless they incentivize them to not do so (I.e. tax subsidiaries which are never going to happen). So stop pointing fingers! Again, this is nothing new but rather one of the long run effects that should have been included in the 1986 tax reform when the tax rate stood at FORTY EIGHT PERCENT!

Bill is jusy another Prick Masquerading as a Man.

Say it is not so’, I like Bill Maher try not to miss his show; was not watching on this occasion.

It’s no use calling him names; his opinion is the under lining opinion of many Americans and their political leaders.

I always consider that Bermuda’s IB industry is a lot like privacy on the high seas; once supported by many nations; but closed down once it was considered not to be in national interests.

All the more reason Bermuda should begin the process of looking around for it’s next economic leg; all good things have it’s end and so it has been throughout Bermuda’s history of economic development.

FATCA Explained in 4 Minutes… https://www.youtube.com/watch?v=Y-EVF7CZt_w

The hypocrisy of America is in the form one of it’s main reasons of becoming an independent country in the first place, which was to escape high taxes. Now here they are crying that descendants of these same individuals that formed America are continuing the legacy of trying to escape high taxes centuries later..

” Let me issue and control a nations money and i care not who writes the laws”

-Mayer Amschel Rothschild

lets see how many people are awake…

Karen Hudes WORLD BANK Insider `claims` to reveal who`s behind the throne…

the stuff that don’t get published in your Business Weekly…

https://www.youtube.com/watch?v=v2s5wbsuDUc

@keepin it real for real.—-thanks for the link— It was not surprising to me to hear this however, The Popes headdress is called a mitre that represents the symbol of the “fish” for the Pisces age which ended according to the mayan calendar on dec. 21.2012,. That is why the pope joseph Ratzinger stepped done in may of that same year because it is the end of the pisces age which lasted over 2100 years.. we are very special to be living during the handover of this transition to the age of aquarius which is the age of enlightment,when hidden truths will be revealed, Karen failed to bring her point to a crescendo of understanding, as she did not properly explain Akhenaten,whose history in Karnak shows him receiving the rays of the “SUN”, this is back in the 18th dynasty, which is sometimes referred to as a period of heresy, I hope she along with the rest of the whistleblowers will be able to bring forth information in laymans terms to awaken the sleepyheads.once again thanks for the link.. when it comes to Mayers comments, well most comedians are serious people and they usually speak truths that people don’t want to hear so it is put in comic form,.. he is correct BERMUDA is a taxhaven, because it certainly isn’t trying to be heaven on earth for Bermudians

HMMM America Propaganda From the media normal s*** tomorrows another day. Sleep well Bermuda.Have a great day tomorrow.

Money grab..

I realise that the Bermudian economy is not what it was during the “boom times” in the ’70s and ’80s, but I wonder if Mr Maher is aware that, up until our subsequently ill-advised change of Government at the end of last century, we were one of the few countries in the world who actually had a financial surplus rather than a financial deficit?

I would bet any money that his employers HBO or their parent company has at least one dollar somewhere in a Bermuda Trust account!

It is certainly not the IB company that employs people that is the target….it is the thousands of companies who have a presence in Bermuda only on the books of Appleby or Conyers or any other law firm register…they incorporate here because it is easy and conduct their business elsewhere…we pick up some legal fees and get all of the bad publicity that goes along with the designation as a tax haven….never sure why we think we can deny it for that is what we are and saying we are not does not make it so..as for Bill Maher he is a late night comedian and the topic chosen was tax havens…if Google or any of the thousands of other companies incorporated here had to pay tax on foreign revenue would they be here? Probably not….