Moody’s Downgrades Bermuda’s Rating To A2

Moody’s Investors Service has downgraded Bermuda’s issuer and senior unsecured ratings to A2 from A1, and said the outlook remains stable.

In response to the downgrade, Minister of Finance Bob Richards said, ”Given the momentum we continue to gain in reducing the deficit, as outlined in the government medium-term expenditure framework, it is disappointing that Moody’s has chosen to downgrade Bermuda.”

The Minister of Finance said the report will not change his plans to balance the budget by fiscal year 2018/19, saying: “Keys to getting Bermuda back on a balanced footing include avoiding becoming too aggressive in cutting expenditure, because that would mean huge lay-offs and/or cuts to government programs such as Financial Assistance, Health and Education. Also we must not excessively increase taxes, because that would only put a burden on our people and discourage foreign direct investment.”

The Minister further added, “Standard & Poor’s affirmed our rating at A+ and furthermore, in February of this year, Moody’s published a glowing report on Bermuda titled ‘Bermuda’s Fiscal Consolidation Efforts Bear Fruit, a Credit Positive.’ It would therefore seem inconsistent that Bermuda should be downgraded by Moody’s now.”

The statement from Moody’s said, “The key drivers of today’s rating downgrade are the following:

- 1] Despite improved economic prospects, Bermuda’s economic strength continues to lag that of A1-rated sovereigns.

- 2] Bermuda’s fiscal strength continues to trail many A1-rated peers due to its high interest burden even as its debt metrics have stabilized at a moderate level.

“The stable outlook reflects our view that with economic prospects beginning to improve and the government’s consolidation program expected to support a gradual improvement in the fiscal position, debt metrics will remain stable over the rating horizon.

“The country’s foreign currency long-term bond and bank deposit ceilings were changed to Aa3 from Aa2 and A2 from A1, respectively. Foreign currency bond and deposit ceilings remain P-1. The local currency ceilings were changed to Aa3.

“Despite having experienced positive growth in 2015 for the first time since 2008, Bermuda’s economic strength remains some way below that of its A1 rating peers. At ‘Moderate (-)’, Moody’s assessment of its economic strength is below the ‘High’ median score for A1-rated sovereigns, and more in line with lower A-rated peers.

“That score balances Bermuda’s high level of wealth and a highly internationally-competitive insurance industry, against its small, open economy and weak growth performance and prospects. On a comparative basis, Bermuda’s economy of $5.8 billion is very significantly smaller than the ‘A1′ median of $256 billion.

“Even as the country emerges from recession, we do not think that the negative impact of its size on its credit profile will be compensated for by growth: we forecast that Bermuda will grow on average 1.8% annually in 2016-20, lower than the 3.0% median forecast for A-rated peers.

“The latter factors weigh on the island’s overall economic resilience and point to Bermuda’s higher susceptibility to shocks than A1-rated sovereigns.

“Despite continued challenging economic conditions, the government’s adjustment measures taken under the Medium Term Expenditure Framework have led to the stabilization of its debt-to-GDP ratio at about 40% since 2013. At this level, Bermuda’s debt burden is in line with the median for A1-rated sovereigns.

“However, given Bermuda’s more narrow revenue base, its interest burden is significantly higher than that of its A1 rating peers, with the interest payments-to-revenue ratio exceeding 12% — the second highest among A-rated sovereigns — compared to a 4.5% ‘A1′ median.

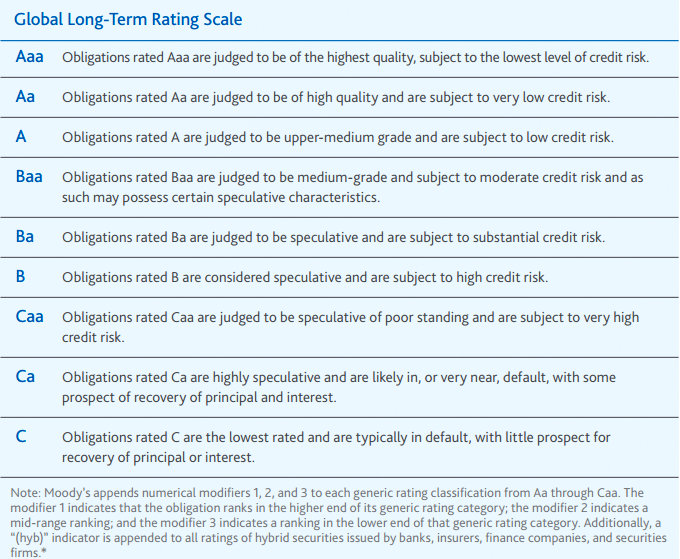

Moody’s rating scale chart extracted from their ratings definition reference guide [PDF].

“The need to devote greater resources to servicing its debt leaves Bermuda with considerably lower fiscal flexibility than its A1-rated peers and less able to absorb shocks. Moody’s assessment of Bermuda’s fiscal strength remains ‘High (-)’, below the ‘Very High (-)’ median score for A1-rated sovereigns.

“The stable outlook is predicated on a return to positive, if moderate, economic growth and declining budget deficits in the next few years which should allow Bermuda to retain economic and fiscal strength consistent with its A2 peers.

“The Bermudian economy experienced a recession between 2009 and 2014, with output contracting on average 3.3% annually. Moody’s estimates that Bermuda emerged from this recession in 2015, with GDP expanding about 1.5% in real terms last year.

“Positive economic momentum should carry into 2016 and 2017 supported by increased tourism activity related to the 2017 America’s Cup, as well as by increased investment on tourism-related and public infrastructure projects. Moody’s expects that the economy will accelerate to 2.3% on average in 2016-17 and will grow 1.0-2.0% during the following three years.

“The fiscal outlook will be closely tied to the economy’s performance as additional deficit reductions will rest more on revenue measures in coming years. Authorities envisage balancing the budget by 2018/19.

“This fiscal path would ensure that the government’s debt metrics remain stable, although Moody’s does not expect a significant decline of the interest burden.”

But you are going to have to increase taxes Bob!

Already been announced, hasn’t it?

Then what would you suggest ‘Sickofantz’.

Nothing is free.

Not good enough. The PLP supporters expect the OBA to have fixed the financial disaster that their party created by now.

Where is that magic wand which would have eliminated the debt by now?

Oh its all the PLP’s fault… Someone is lost in the Triangle. Keep drifting.

Spin doctor – if you don’t cut the civil service/reduce expenditure the UK is going to have to take over the place and do it for you. Seems to me this is what the OBA should be focusing on instead of an airport.

The two go hand in hand…do they not? Foreign cash infusion, local employment, local goods being purchased, payroll taxes being collected, ect, etc. It doesn’t really take much to connect the dots. Am I missing something?

Creating unemployment by aggressively laying off civil servants, when there is probably no private sector alternative for many of them, is simply paying Paul by robbing Peter. You’ll create unrest and put a further load on financial assistance.

Some countries have kickstarted their economies by paving roads. It puts people to work. Replacing a decaying airport facility, which despite its quaint veneer is rotting at the core, doesn’t seem like a bad idea as far as capital projects go. If you don’t think its decaying then go ask someone who works at, or maintains, the airport.

As long as the project is managed correctly and there is sufficient fiduciary oversight, the airport project makes good sense to me.

The Minister of Finance said the report will not change his plans.

Will the OBA get rid of Moody’s, like they did Fitch…

Is there a back-story to this? I know that in the private sector having multiple ratings can be expensive and unwarranted so dropping a rating agency wouldn’t necessarily be seen as an issue. Not sure how that translates to jurisdictional ratings though.

Agree for the most part, but we simply CANNOT continue to pay Civil Service when 1.) there isn’t enough work for them to do and 2.) when we don’t have the money to pay them. Keeping these people employed for the simple sake of not making them unemployed is ridiculous. That would be akin to paying your barber to continue cutting your hair when you’ve gone bald 2 years ago…just so your barber doesn’t become unemployed.

Tear off the bandaid now OBA. Do what must be done.

The OBA don’t know what to do. All they care about is that airport project.

I get your point, however if the barber was my brother and I knew that without the work he would be destitute and would need to move into my spare room, I would probably continue to get haircuts until he could get back up on his feet. I agree with you though, I would need to be sure that I could afford it.

I would favor a gradual reduction in the civil service as the economy continues to recover. We have an ageing population and there will be a certain level of natural attrition. I have no idea of the projected numbers however I am sure that has been looked at. To make dramatic lay-offs in the short-term would shock the system, both socially and economically. To not decrease the civil service artificially increases the demand for workers and is inflationary, so I get your point. However the genie is already out of the bottle.

To avoid dramatic layoffs in the civil service we need to find the tax revenue to help support it – America’s Cup, the Airport Project, more international business, increased tourism should all serve to do that. I wish there was more of a focus on the projected net economic impact and ensuring appropriate oversight of these projects and less debate over the initiatives themselves. No question that conceptually these all bring in the foreign cash and revenues that the island HAS to have to sustain itself.

Don’t forget….the PLP have big ideas about how to fix this. In 2025.

I’m sure that when PLP gets back in next year that that will be able to fix these pesky problems.

1. Get rid of all the expats

2. Insist that us Grass roots Bermudians get all those top jobs.

3. Free houses for everyone in Tucker’s town.

4. Print lots more money and give it out for free.

Problem solved.

The prospects of the PLP getting back in is scary.

Ed Case must you indulge in the colour blind casual racism that is so typical of a certain type of white Bermudian resident.

Maybe you need a good nickname. How would Ed “Trump” Case do?

“….must you indulge in the colour blind casual racism that is so typical of a certain type of white Bermudian resident.”

Oh the irony.

Keep up the good work Bob (and OBA). It is comforting to know that with the OBA we have stable, intelligent, knowledgeable, and honest politicians working for the good of ALL Bermudians. You have done an amazing job of ‘pulling us out of the PLP hole” in a few short years. Thanks Team !

as much as I want to believe the OBA is doing Good ! Moody tells us a different story could it be that we are so far gone that many are profiting at our expense and ready to run when the cookie crumbles????

Moody is basically telling Bermuda that what we have in a finance minister isn’t exactly working out for us . This governments performance hasn’t impressed anyone but the hardcore fan base of the UBP/BDA/OBA . But you needn’t take my word for it , just a few months ago Bob Richards had to own a downgrading from another ratings agency .

This downgrade is evidence of two things.

One – the economic condition that the PLP put us in is far worse than all of us even imagined. All those who were involved in the PLP Government at that time should be ashamed. Those who are still in politics should resign.

Two – the OBA have not done enough to turn the situation around and have lacked innovation and leadership and most importantly they have failed to convince the people that their policies are good for them resulting in them distrusting the Government.

This leaves us with a terrible quandary which is no matter which party is in power the future looks bleak!

This trend is more than disturbing it shows a more critical intervention in the financial health of the country needs help now.

Just continuing the past failed PLP policy and former UBP policy will do we can not allow a OBA failed policy.

The OBA Minister of Finance must stop the boat from sinking no matter what the Unions and the PLP say.

Every week the Parliament make new more complicated law and regulations that stop any reasonable person from opening a business if they think for themselves.

Increasing the civil service and regulatory organizations will only suck more money in fees and tax from those job creators who will at some point either quit or leave for somewhere they can find better opportunity. What will be left are those who become social and economic liabilities for our country.

Can someone PLEASE reveal what is being done to service and pay down our debt? At what point will we feel we might all have to contribute something?

When Vexed Bermoothes learns that Bermuda’s national debt currently works out to about $58,000 per person, he suggests putting “a National Debt Clock in front of the Cabinet Office, just to remind those sweet talkin’ big spenders what they are doing to Bermuda’s future generations.”