ABIR Comments On Planned Payroll Tax Change

The Association of Bermuda Insurers and Reinsurers [ABIR] said while they fully support the introduction of payroll tax progressivity, they urge the Government to “develop existing sources and new alternatives to the payroll tax as a means for raising revenues” as an “overemphasis on the payroll tax makes Bermuda operations even more expensive than alternative insurance hubs.”

Changes To Taxes Revealed In Budget

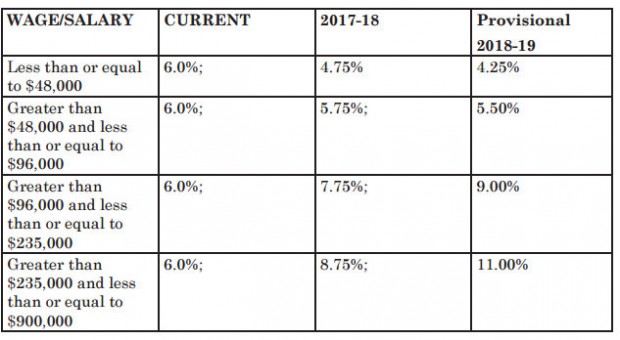

Introducing a new Financial Services Tax, changes to the payroll tax system, and raising the maximum taxable salary level from $750,000 to $900,000, were a few of the financial initiatives revealed as Finance Minister Bob Richards delivered the 2017 Budget.

In explaining the changes to the payroll tax system, the Minster said, “In the situation where an employer is currently passing on the maximum amount of 6% to an employee, an employee earning in the lowest band [1] will receive a tax cut of up to $600 p.a. in 2017/18.

“The next band [2] provides for a tax cut of $600 – $720. Band three provides for a tax decrease of $720 to an increase of $1,713. The top band provides for an increase of $1,713 to $29,000.”

ABIR Comments

ABIR Chairman, Mr. Kevin O’Donnell said, “ABIR respects the Bermuda government’s commitment to strengthening the Bermuda economy and reducing the debt to place the country on a firm financial foundation.

“ABIR fully supports the introduction of payroll tax ‘progressivity’—an applaudable effort to build some equity for taxpayers in the current system, and right away.

“The change in overall tax rates is significant, and as with any major tax reform, should be introduced via a glide path over time so as not to cause a sudden increase in the payment of taxes by one or more sectors.

“In an increasingly connected world, every effort must be made to make sure Bermuda remains a competitive job market.

“ABIR urges the government to develop existing sources and new alternatives to the payroll tax as a means for raising revenues.

“Having a diverse revenue base will helpfully ease pressure on the payroll tax for everyone’s benefit. An overemphasis on the payroll tax makes Bermuda operations even more expensive than alternative insurance hubs.”

You can click here to view our live blog, and click here to view all our coverage of the 2017 Budget.

Parasites on the road to serfdom! Without a vision people parish.

Good bye International Business. We really bit the hand that feeds us. There are more attractive jurisdictions out there.

The amount some of them earn….they could do with passing a bit more of it on. Some of these people earns millions….they’re not hurting.

Exactly!!!

Hope: get a clue! If these companies pick up and leave, sure the high earners and their jobs go with them, BUT so do MANY LOCAL JOBS! Quit thinking only of the high earners that you hate and think about the little guys that will be left with no income.

Stop whining – maybe they should also ask the law and accounting firms to pay on their bonuses which are erroneously positioned as dividends -

If the PLP had implemented this payroll tax hike the ABIR response would have been much more biting and hard hitting.

Although they said this nicely and respectfully, it is clear to see this change was unadvised and they are not supportive of it.

Clearly. And where are all the OBA’ers with their harsh complaints about chasing precious IB away? Two-faced ….

So the rich are crying because they are being asked to share the sacrifice? Cry me a river!

How is this a “shared” sacrifice? Lower income earners just got a break. That’s certainly not sharing! Not to mention the fact that many individuals that fall into the lower income brackets were the ones that voted the plp into power, putting us into this mess!

Why hasn’t the civil service been cut? Why haven’t ministers taken significant cuts? Why don’t churches pay taxes?

Don’t get me wrong – I’m all for having those that make more money pay a greater percentage in taxes. Just don’t call it a shared sacrifice when there actually isn’t much sharing going on!

Who’s been doing the brunt work of the shared sacrifice? The low income wage earners all this time. People who earned over $250k weren’t even taxed until recent years.

Very selfish indeed.

It’s clear that this change WAS advised.

Reading between the lines it’ seems abir is far from happy

ABIR, what are your recommendations for “developing existing sources and new alternatives to the payroll tax as a means for raising revenues”?

The simple reality is that Bermuda must raise approximately $1.2b. All of the stakeholders should meet to determine the best method for raising the funds on a shared sacrifice basis.

it is obvious that the PLP should be included in the discussion since there is a god chance that the next budget will be delivered by a PLP Minister of Finance.

I think this is a start. But I believe the tax cap should be removed entirely, at least until we are out of debt.

Here here!!!!

Raising revenue thru rises in taxation is all well and good, a most vtal concern is the seemingly extravagant tastes of a number of ministerial people as well as inordinate waste of the public purse. If there is a waste of 15 to 20 million a year..i.e renting space when we have more and more space becoming available in our public school system, year after year. A tremendous amount of money has been put forward for Americas Cup, more roads been paved than usual, building in ruins for years being renovated — and who benefits from the Cross Island, veteran businessmen, not the struggling youth. So financial assistance we pay out thousands more each month, than some government department be creative and allow disadvantaged youth, unemployed, and single mothers be guided to run their own businesses.

Raise tax on toilet paper!

Taxes should be added to those sending money out of Bermuda through Wester Union.

The company charges around 20% give or take per transaction, and have operated for years with no tax, the 5% will be passed straight on to the customers anyway.

Unfortunately this is very true.