Ascendant Group Announces 2017 Results

In a filing with the Bermuda Stock Exchange [BSX], Ascendant Group Limited announced their 2017 results, with core earnings in 2017 of $18.9 million compared to $13.9 million in 2016.

The filing stated:

Stable earnings at BELCO; significant earnings growth in unregulated businesses

Highlights

- Ascendant Group Limited’s core earnings per share increased 43%, or $0.58 per share year over year, to $1.90. The results were driven by a $0.28 per share increase in core earnings from its unregulated businesses; an increase of $0.20 per share due to lower group expenses; and stable results from BELCO. Ascendant’s net earnings per share was $2.04.

- BELCO’s electricity rates did not increase in 2017.

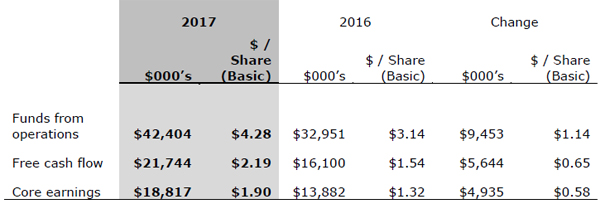

- Ascendant’s Funds from Operations increased 36% or $1.14 per share to $4.28 per share.

- Ascendant’s financial strength positions it to execute on the construction of its approximately $119 million, 56 MW North Power Station and Battery Energy Storage System project, which was approved by the Regulatory Authority in its Order dated, 6 March 2018.

- Ascendant’s Board of Directors declared a quarterly dividend of 11.25 cents per share.

Ascendant Group Limited [“Ascendant” or the “Company”], a publicly traded provider of energy and energy-related services, released its 2017 annual financial results today, with core earnings in 2017 of $18.9 million compared to $13.9 million in 2016.

Funds from operations increased 29% to $42.4 million for 2017 compared to $33.0 million in 2016. Free cash flow was $21.7 million in 2017 compared to $16.1 million in 2016.

Solid results from Bermuda Electric Light Company Limited [BELCO], significant growth in Ascendant’s unregulated businesses and lower group expenses drove higher earnings and cash flows for the year. The Company’s Board of Directors also declared a quarterly dividend of 11.25 cents per common share.

“Our performance in 2017 was very strong from a financial and operational perspective,” stated Sean Durfy, President and Chief Executive Officer of Ascendant and BELCO. “BELCO delivered to expectations while our non-regulated businesses showed tremendous growth.

“Our solid results allowed us to further strengthen our balance sheet by paying down debt. This positions us financially to embark on the construction of the 56 MW North Power Station [“NPS”] and related Battery Energy Storage System [“BESS”] projects that will replace 50% of our existing engine capacity that is well beyond its useful service life. This is a defining moment in the history of our company and allows us to continue to provide Bermuda a reliable electricity supply.”

Regulatory Update

BELCO continues to work with the Regulatory Authority [the “Authority”] to ensure a stable regulatory compact for BELCO and fair rates for customers. 2017 was a busy year with respect to regulatory matters. BELCO received its Bulk Generation and Transmission, Distribution and Retail licences in October.

It also submitted its NPS and BESS replacement generation proposal in December, following its November notice to decommission aged engines totaling 80 MW of installed capacity. The proposal was approved by the Authority in March of this year.

“I am extremely pleased that the Authority has recognised the urgency of proceeding with the development of the replacement generation,” Mr. Durfy continued.

“The 6 March Order enables BELCO to proceed with the implementation of replacement generation from which a number of benefits will be realised by all stakeholders upon its commissioning, including: more cost effective generation, increased system reliability, cleaner operations for the environment and a significant decrease in the vibration and noise levels currently experienced by nearby residents.”

The Company is now actively involved in planning for the future, having submitted its Integrated Resource Plan in February 2018 and following the release by the Authority of its proposed retail rate methodology in March.

Consolidated Financial Review

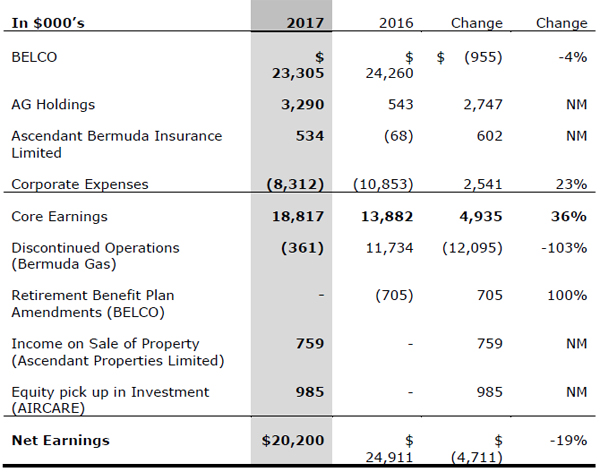

The Company’s core earnings increased 36% to $18.8 million as a result of stable results at BELCO, significant non-regulated earnings growth at AG Holdings Limited [“AG Holdings”], and lower expenses.

The Company’s net income declined 19% from $24.9 million to $20.2 million, largely reflecting the non-recurring $11.7 million gain on the sale of Bermuda Gas & Utility Company Ltd. [“Bermuda Gas”] in 2016, partially offset by the equity pick-up of earnings in AIRCARE LTD.’s [“AIRCARE”] investment in Otis Air-Conditioning Ltd. in the Cayman Islands.

The Company generated $42.4 million in Funds from Operations and $21.7 million in free cash flow during the period, compared to $33.0 million and $16.1 million respectively in 2016. The Company’s strong operating cash flows allowed it to reduce its consolidated debt to $5.4 million, resulting in a year-end debt to total capitalisation ratio of 2%.

The Board of Directors remains committed to increasing total shareholder return. Over the past two years, the Company has repurchased 869,945 shares at a significant discount to book value. The Company’s growing earnings and cash flow enabled its Board of Directors to increase the regular dividend by 50% in June 2017, thus continuing the Company’s long history of paying a regular dividend.

Ascendant also announced in February the appointment of Robert Schaefer as Chief Financial Officer, following the retirement of Mark Takahashi.

Investing for the Future

Ascendant has developed a cohesive strategic plan to lower BELCO’s rates and increase shareholder returns. The Company will continue growing its unregulated businesses by offering new products and services to customers as well as analysing strategically aligned acquisitions. The Company will continue with executing its Capital Plan to enable the integration of new competitive energy technologies to the benefit of Bermuda citizens. The BELCO power generation project team will concentrate on construction of the North Power Station; whilst the grid operations project team will begin the 5 year process of upgrading Transmission and Distribution systems to ensure BELCO provides reliable delivery of electricity under its Transmission, Distribution and Retail license.

The strategic plan has the following objectives:

- Transition by BELCO to a productive and stable regulatory environment that supports the investment required to deliver reliable power to its customers;

- Execute on BELCO’s Capital Plan; in investment of approximately $250 million that is required to modernise BELCO’s power generation and delivery systems in Bermuda including implementing new technologies such as battery storage, advanced metering infrastructure and system improvements to support the addition of renewable energy;

- Achieve a more competitive capital structure by using appropriate amounts of low-cost, long-term debt and accessing equity at the lowest possible cost;

- Reduce our cost structure by investing wisely and by increasing the efficiency of our operations by benchmarking our performance to like jurisdictions; and

- Grow our non-regulated businesses, such as AIRCARE, as well as invest in electrifying transportation in Bermuda.