BTA: Ninth Consecutive Quarter Of Growth

[Updated] Bermuda Tourism Authority [BTA] CEO Kevin Dallas is holding a press conference today [May 8] to provide information on the first quarter visitor arrivals report.

We will have additional coverage later on, and in the meantime the live video of Mr. Dallas press conference is below, and as an additional note for those interested, Bernews will be hosting a live interview with Mr Dallas at around 4.00pm today, to further discuss these results and tourism in general.

Update: The live video has ended and the 20-minute replay is below

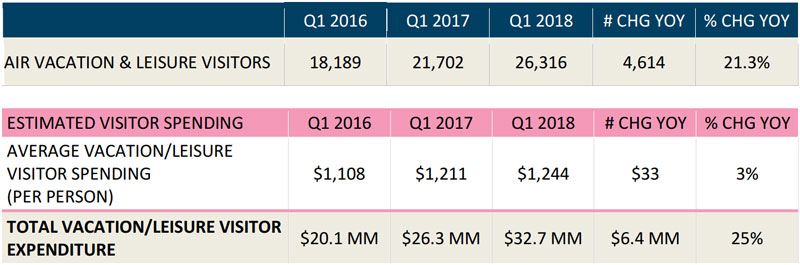

Update 3.36pm: The BTA said, “The Bermuda tourism industry is off to a strong start in 2018 with leisure air arrivals and leisure air visitor spending both up sharply in the first quarter, besting last year’s first quarter numbers which turned out to be part of a record-breaking 2017.

“Leisure air arrivals were up 21 percent in the first quarter of 2018 when compared to the same time period the year before. Leisure air visitor spending grew 25 percent. The first three months of 2018 mark the ninth consecutive quarter that Bermuda’s tourism industry has grown in vacation air arrivals and spending.

“The steady comeback of Bermuda’s tourism industry, which began statistically in January of 2016, is now continuing into a third consecutive year. After a decades-long malaise, this is very encouraging news for our tourism industry’s workers, business owners and investors,” said Bermuda Tourism Authority Chief Executive Kevin Dallas.

“With reduced hotel inventory and cancelled flights there was no shortage of challenges to overcome in the first quarter, but our industry has proven resilient once again – double-digit percent increases in leisure air arrivals and spending are further steps in a long growth trajectory that is built on solid marketing fundamentals put in place by the Bermuda Tourism Authority.”

“Six local properties had a portion – if not its full hotel inventory – offline for renovations during the first quarter. It represented a 12 percent reduction in the country’s hotel inventory, making those rooms unavailable to visitors. Additionally, 16 flights were cancelled between January 1st and March 31st, 2018 largely due to weather challenges in the US feeder markets. Those factors did not slow Bermuda’s momentum of growth.

“Overall the first quarter is a low volume quarter for our tourism industry when compared to the rest of the year so it’s too early to call it an indicator of the full year’s performance,” Mr Dallas explained. “That said, as a standalone quarter, it’s gratifying to see growth in the last three winters because it means Bermuda is putting a dent in the seasonality problem that has been an industry weak spot for decades. We need to keep at it, there’s a long way to go to make the industry profitable in the first part of the year.”

Lodging Performance

The BTA said, “Hotel occupancy grew 2 percent in the first quarter of 2018 when compared to the first quarter of 2017. Last year, long-stay America’s Cup-related business had a major positive impact on local hotels in the first quarter. A year later, the America’s Cup business was replaced with leisure visitors who stayed fewer days and paid higher rates.

“Hotel sector revenue per available room [RevPAR] and average daily rate [ADR] were both higher in the first quarter – 6 and 4.5 percent respectively. Meantime, vacation rentals were off slightly, falling 7 percent in share of visitors, but up in the number of overall visitors.

Air Capacity

“A 15 percent increase in air capacity was a significant factor in first quarter performance. This is especially true out of Boston where leisure air arrivals grew 73 percent in the quarter thanks largely to a 117 percent increase in available seats from Logan International Airport. JetBlue Airways increased its seasonal service from Boston to year-round service, which increased capacity greatly and proved to be popular with travellers.

Mr Dallas said, “We see the same positive impact from Boston we saw out of New York when the air capacity increased at JFK. When supply and choice increase, demand goes up too and the net result is more travellers to Bermuda. We’ve worked very closely with JetBlue on a more robust marketing partnership to fill newly added airline seats and it is clearly paying dividends for the airline and Bermuda.”

The full 2018 First Quarter Visitor Arrivals Report follows below [PDF here]:

The results look good but some things don’t make sense, for example; Hotel Occupancy in March ’17 was 55.3% and ’18 was 55.9%. Hotels are big stakeholder partners with the BTA but are obviously not seeing much of a return on their investment. Seems like the BTA isn’t targeting visitors to increase hotel capacity. If Air Capacity in March was 42,784 seats and the Air Arrivals were 20,018 how can there be 30,572 seats sold? Does that mean 7,805 empty seats were paid for by the BTA/Transport? Being fair a few of those seats could be purchased and not used but no where close to 7,805.

If you have a look at the video of the CEO’s presentation your hotel occupancy question is answered.

On air capacity and seats sold you may not be accounting for the seats bought by residents. That probably explains the gap.

Good questions though.

The 20,018 number comprises entirely visitors to the island.

The 30,572 seats sold number includes residents, so is the total number of sold seats on arriving flights including both residents and visitors.

To take each of those points in turn;

Hotel occupancy is a function of arrivals and length of stay; in Q1 last year we had a large number of extended stay guests – most notably the entire Landrover BAR Team who stayed at the Hamilton Princess for the entire quarter. This year, although occupancy was only up marginally, RevPAR (which is Revenue Per Available Room) grew a healthy 6%.

And while hotel occupancy is important, visitors not staying in hotels also contribute to our economy overall. We think the most important number to watch is visitor spending, which grew 25% in the quarter.

Finally, the BTA does not pay for empty airline seats; we do not do revenue guarantees. The gap between seats filled and visitor arrivals is business and resident travel.

Visitor spending is purely an ‘estimate’ so how is increase arrived at? Don’t understand how increased RevPAR is healthy when occupancy rate is stagnant? Increased RevPAR obviously only relates to guests paying a higher price and not an increase in warm bodies occupying a hotel bed. We all know that travelers searching for a vacation/holiday destination bypass Bermuda because of high room rates. Usually hotels want too first get occupancy rate up to justify increasing the room rate.

Sounds like you’re an expert. Perhaps you should work for Mr. Dallas?

I’m going to go with “maybe not” on that one!

In return Kevin maybe you shouldn’t judge me personally, not nice!

You aren’t accounting for vacation rentals either. I can’t remember the numbers but the amount of people using sites like air bnb is significant and would account for the higher increase in spending while the occupancy rate doesn’t seem to have changed much.

Hold on, a key deliverable to get to an annual bonus is demonstrating how YOU grew arrival numbers and were innovating in re-shaping the Tourism Proposition.

Excuses about Americas Cup not returning aren’t in your job description, nowhere does it say “CEO will be excuses from delivering on his performance targets if AC2017 doesn’t come back for AC2018″

Our Corporate Objectives are set annually by the BTA’s Board of Directors, and annual results (not quarterly) against those objectives are used by our board when they decide whether to award any incentive payments for the team at the BTA.

To explain that Q2 2018 will be difficult to compare to Q2 2017 – especially on hotel rate – because of AC35 (which isn’t annual anyway btw) seems pretty reasonable to me.

A closer look at Leisure Air Arrivals from NYC are down 3.8%, with BTA targeting NYC with the largest percentage of marketing resources what happened there?

Q1 was was a rough quarter for weather disruption – especially out of NYC. We had 16 flights to Bermuda cancelled in January and March (vs 8 from everywhere else).

Given the importance of NYC to Bermuda, its certainly a metric we’ll continue to watch closely.

Interesting how you ignore the 13 cities of residence that showed increases in 1Q18, and just asked a question about the one that showed a decrease.

It seems like the 21% increase in vacation air visitors irritates you.

thank you PLP – well done – all your success

now waiting for something better than the Mickey Mouse AC2017

glorious time are ahead

If you look at BTA reports the cities they choose to compare are the ones that show an increase and skip those that show a decrease. Kevin claims flight cancellations are responsible for NYC decline but I didn’t hear that in any of his interviews or presentations. Someone needs to question the obvious and not accept BTA’s spin as 100% complete or truthful.

The 16 flight cancellations out of NYC between January and March are a fact and public knowledge. Are you asking questions just to try make BTA look bad or are you asking questions to truly seek the answers? Smh, but of course BTA is to blame for the weather.