Sugar Tax: Bill To Tax Chocolate Items At 75%

The Customs Tariff Amendment Bill proposes to increase the duty rate to 75% for items affected by initial launch of sugar tax in April 2018, and also apply a 75% sugar tax to chocolate items containing added sugar.

Speaking in Parliament on Friday, Minister of Health Kim Wilson said the Customs Tariff Amendment Act 2019 [PDF] proposes to increase the duty rate to 75% for food and beverage items affected by the sugar tax on 1 April 2018, and apply the above-mentioned duty rate to chocolate and cocoa preparations containing added sugar.

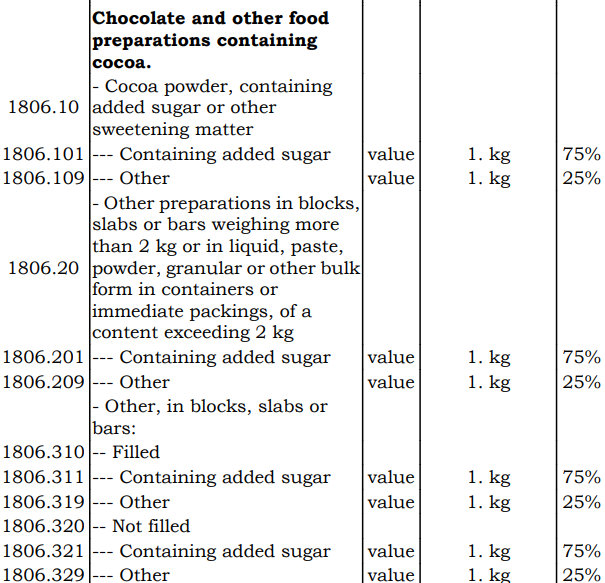

Screenshot from the Customs Tariff Amendment Act

“I will be proposing an amendment on the floor to remove breakfast cereals from the items that would have been subject to the sugar tax in the Bill as Tabled,” the Minister said.

“This decision followed consideration of additional feedback received and it was determined to postpone their inclusion until the tariff code can differentiate between high-sugar cereals and healthy breakfast cereals.

“In June 2018 the Government introduced, as promised in the Throne Speech and the Budget Statement, an increase in the duty rate on sugar sweetened beverages, candies and pure sugar. These proposals were outlined in detail in in the Ministry of Health’s Sugar Tax Consultation document and subsequent reports.

“I advised my Honourable colleagues in June 2018 that Bermuda’s new sugar tax would be phased-in gradually. Today it is proposed to raise the duty rates on the said items to 75% from 1st April 2019.

“On 1st October a 50% duty rate was implemented on the said items as part of a transitioning phase. In addition to the full 75% duty rate implementation, chocolate is proposed to be included in the tariff as of 1st April 2019, also at the 75% sugar tax rate.”

The Health Minister added, “It is estimated that currently diabetes and kidney disease account for 10% of the country’s total health spending. This means just 2 lifestyle-induced, preventable conditions are costing us $78 million dollars. This has to stop. The sugar tax is an important part of the measures needed to change choices and behaviour.”

“The Government has eliminated duty on potatoes, cauliflower, broccoli, turnips, carrots, oranges and apples to further support healthier nutritional choices, showing this Government is absolutely committed to improve our diets.”

The Minister’s brief follows below [PDF here]

Tax and spend more PLP !!!!!!!!!!!!!!!!

So why pick and choose?? Tax processed food and

red meat and fatty hamburger,

does far more harm than chocolate bars.

Tax certain fruits with high pesticide content, tax fullfat dairy, tax chips-carcinogenic apparently google it, tax gmo bread, tax roundup so Burch can’t buy it,

all these things are bad for you and contribute to obesity

We just need to overtax every single already 100pct higher cost than US item in grocery store and we will save the people from diabetes right?

Ya big win in plp

So disappointed in this myopic action that has no regard or context or support attached for the struggles

average people have trying to buy food

You just made it a heck of alot worse Wilson

Gmo’s are not bad for you.

If the PLP cared about your health,then tax revenue from sugar would be used to supplement cost of healthy groceries. This is not the case so see it for what it is or continue to gobble up the endless BS

plp looking for more of the public’s money to spend.

You got what you voted for…NOTHING for YOU!

Still all over the place smh…

New cereal bar must have kicked up a fuss lol…

Jokers!!!

10% health related, 90% revenue related, PLP are running out of areas to get money! Why not tax fried chicken and the likes which contributes greatly to obesity and heart disease, at the end of the day when these type of taxes bump up the cost of living we (the people) will need our salary’s increased to keep up. Expensive Bermuda. No more deserts after dinner ☹️

Life in Bermuda just gets sweeter and sweeter.

Enjoy before the chocolate arrives.

Curious as to why we never see any protestors when the PLP implement these changes: bus schedule, sugar tax, and previous over spending on projects to name a few. So quick to march when it’s not the “people’s party”, but when it’s your own party it is accepted. Please elaborate what the PLP has done successfully since being in the term of power and what they’ve done for the people? I’m more curious to hear a thoughtful response and I am not saying that they haven’t.

So if there is going be tax on sugar, shouldn’t the more healthier stuff duty be lower or no duty at all? What is the plan behind all this!?

There is no plan! This is a total cluster F!!

Instead of the $10 cake going to $17.50 like it should, stores are spreading it out over other goods. So now, the $10 cake goes to $13, but other items like paper towels, frozen peas, salsa…. go up! That’s not fair nor is it in any way, shape or form doing what it is intended to do. This punishes EVERYONE, even those that don’t buy sugary foods.

Figure this half-arsed sh!t out!

That explains why non-sugar items are going up. I couldn’t figure it out.

With the number of vacant agriculture plots, persons could do well growing and processing sugar cane/beets locally negating the tax on raw/pure sugar.

I’ve seen sugar cane grow here in the past, could be an interesting idea to try it on a larger scale. Hopefully processing it isn’t too expensive?

I have two varieties of sugar cane, squeezing cane juice is pretty simple and it is better for you than processed sugar, boiling it down to make sugar comes next, the expense comes when you increase volume.

I must make a point of asking my Guelph educated neighborhood farmer about this idea. He has a special sense of humor , I’m sure he’ll laugh me off of the farm.

See what 25-something does OJ? No Mars bars for you!@

This is not the answer, there are so many other things that cause this which are not being attacked.

I’m healthy and normal weight, but I love chocolate. Guess I’ll just bring it in from overseas.

Those who don’t travel, can’t do that, so another poor tax. Very smart PLP, can you get anything right?

So because a certain segment of society has little to no discipline and takes no responsibility for control of their own diets the rest of society has to pay the price! Well done – this is akin to a teach punishing a whole class for one student’s poor behavior. How punitive can one be? Ones health, like all things in life, begins with us being accountable for ourselves.

Gotta pay for those trips, 1.2m and the mini buses some how.

Voters you’ve done it again.well done.

They are getting carried away and will not be getting my vote in the next general election.

FIRST OFF, WHY DID YOU THINK VOTING PLP IN 2017 WAS A GOOD IDEA ?!?!

I’d like to hear the answer,good question.

Because the alternative was OBA. Duh!

I wish independent MPs ran the house. but that’s a pipe dream.

I did not vote for them nor will I in the future. You all got what you deserve now deal with it. Carry on party people your doing a whole lot of nothing.

Next Election!

I will not be voting!!!!

And that is exactly why they will win again. The power of the “swing voter” right? Smh

Don’t confuse a true swing voter with a PLP supporter whose choices are PLP or abstain.

You mean that’s how the OBA will win again right? Cause that’s how they won in the first place.

No they didnt. Swing voters had nothing to do with it. Vast majority of plp voters didnt vote period when the oba won. We dont have that many swing voters here. Plp will never betray their party cause of…….. well we already know

Health insurance premiums are high because we have one of the most obese societies in the World.

Diabetes and other related illnesses are driving the cost up and up.

All processed foods should have the same 75% tax.

This is not the way, the government needs to take a look at other countries who have lower obesity rates and understand what they are doing or have done to lead to that change. Increasing tax hurt the public more specifically those with lower wages how about instead of increasing the price of sugary foods find a way to decrease the cost of healthy foods. Now I’m not saying that this will solve the problem but this government is ridiculous.

I don’t understand politics well, let alone the Bermuda government but I honestly don’t understand what they’re doing and I don’t think they do either. They are hurting the population.

The Bermudian politicians don’t understand politics either so don’t worry. They are just children playing a game of SIMS within the people of Bermuda. A few megalomaniacs who are out of control.

Bermuda is so weird. Only here could a government screw up so bad that everyone votes for the other party. Then the other party screws up so bad that everyone votes in the first party, like they forgot what happen the first last time around.

Ok so let me get this straight, you’re going to tax at a rate of 75% basically all sugar items, basically those items that WERE afforadable to the average Bermudian, but withdraw duty on potatoes, cauliflower, broccoli, turnips, carrots, oranges and apples. If you want us all to eat healthy why just that select few produce items? You seem to be taxing a hell of a lot more other stuff so where’s the break? Tit for tat if you want to rise the tax on all the bad stuff then you have to lower the tax on what’s good for you. Not just a select few. So anything organic should have a lower tax rate, all produce should be no tax. I’m just saying!

I think Pork should be taxed as well

And don’t forget Salted Codfish

These items are killing us

Looking at the screen shot of the customs tariff that is clearly an area that needs modernizing. A ridiculous number of categories that must be multiplied through the tariff.

AS far as the sugar tax, it will have no impact on most people’s health. It would be more beneficial and fair to base health insurance premiums on a formula, a large part of which will be based on weight, lifestyle, and overall food consumption. If the premiums were many hundred dollars a month more they would soon make changes.

Time for a tax on mayonnaise.

Does the high tax work on the price of cigarettes and alcohol? What about the high tax on cars? We still buy them because we want to drive. This is just another stupid idea that makes living in Bermuda frustrating and difficult. We already pay more for about everything now. Bermuda is another world but its getting where you can’t afford to live here.

To the Ministary of unhappiness.

What goes round, comes around, every body looses.

This is not about sugar, this misguided legislation is about a new form of taxation.

” The Bermuda sugar party”.

Cant collect old taxes by creating new taxes.

When they subject other nations to sanctions, increase the already strained cost of living and deprive the merchants of business ,micro – manage peoples life style, all this causes discontent the people loose faith and confidence with their leadership and turn the cheek.

The Government have bigger EU problems they should be dealing with.

Where are they getting their advice from ?

Dissatisfied people turn to food a Bermuda national pastime !

The supermarkets will cover their losses to save their botton line by reducing their work force , not filling vacancies and increase prices on other items across the board, we can see the seniors discounts being discontinued on some items.

Where is the vision ?

This government is beyond a joke

Ludicrous!!!

Ludicrous

Well one positive some ministers waste line might benefit from this.

Yes trolls I know it’s mis spelled.

The Government is not your friend.

When is the next election??

I don’t think obesity or diabetic problems in Bermuda have much to do with chocolate bars but rather too many rum swizzles and dark ‘n’ stormies!!!

More like mac and cheese and peas and rice

Just spend a little time outside any fast food takeout restaurant and look at the regulars. Sugar has little to do with their ‘dimensions’ I’d be willing to bet .

I don’t know who is advising the Government, but they appear to know hardly anything about mental health.

Dark chocolate is a mood stabiliser and appetite stimulant. As a person with chronic depressive illness, who at times finds it next to impossible to eat, dark chocolate is an essential tool in my health plan. So is exercise and prescribed medications.

Taxes are a blunt tool … selective taxes have unexpected consequences. Will the Government allow pharmacies to bring in tax free dark chocolate for mental health survivors like me?

There are going to be chocolate sniffing dogs at the airport.

Prison would be full of sugar mules and on the street dealers peddling 10 gram $50 bags of sugar, “Psst, hey, you need something sweet?” Next thing you know people will be selling themselves for a sugar-fix. Sugar rehab is going to be a growth industry.

If they rax bacon there will be riots in the streets

Bacon is next…

Potatoes? Mashed potato has the same glycemic index as sugar…..SMH

https://www.verywellfit.com/why-do-potatoes-raise-blood-glucose-more-than-sugar-2242317

True, and something else folks may not know is that sugar-cane juice, with a glycemic index of 43 is considered a low-glycemic food that is good for diabetics, in moderation.

Diabetes & Cancer has to do with human growth hormones. Wait for the junk food tax coming soon.

PLP, you should introduce Fried Chicken Tax.

This is the most ridiculous thing I’ve ever heard of – Sugar & chocolate alone are not making people over weight! It’s OVER INDULGENCE of anything that will make people fat!! AND there are some overweight people more healthy then skinny people.

Not purchasing that chocolate bar won’t change your genetics! Instead lets get back to a healthy society that is taught from young…youth sports, healthy lunches, after school sports activities (where did they go?!) portion control, HOME COOKED MEALS, good choices over all for your health!

If you want a cookie have a cookie or 2 or 3 just not the whole bag…I will say this – This sugar tax will not stop people from buying the products AND THEY KNOW THIS!! Your health isn’t really the concern.

Fascism anyone?

If I have heard correctly, ripe bananas have a considerably higher sugar content than maturing bananas. Will we have two prices to contend with at the grocery store?

As well, what about the poor Easter Bunny’s business? Sounds as if he will want to stay down in his rabbit hole. Don’t blame him avoiding the state of political affairs right now.