Bermuda Spotlights Fintech Innovation In NY

Bermuda highlighted its regulatory and legal framework for fintech business, as a delegation of government and industry experts returned for a second year to “Blockchain Week” in New York for Consensus 2019.

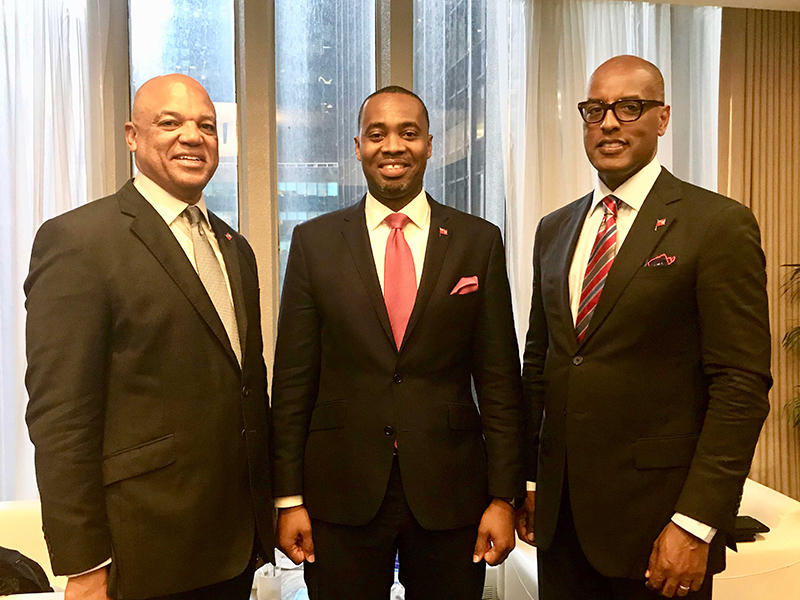

Premier David Burt, accompanied by Finance Minister Curtis Dickinson and Bermuda Business Development Agency CEO Andy Burrows, led a group of regulatory and industry representatives to the annual three-day midtown conference which attracted 4,500 attendees, including major sponsoring companies such as IBM, Deloitte, Microsoft, Citi, RBC and eBay.

Along with a business development team from the BDA were Assistant Financial Secretary Stephen Gift, Chief Fintech Advisor to the Premier Denis Pitcher, and fintech experts from the Bermuda Monetary Authority [BMA], and global law firms Appleby, Conyers, Walkers, Deloitte Bermuda and PwC Bermuda.

“Events like this are important because they bring a lot of the major players from well-established companies that are going to be the largest companies of the future,” said the Premier.

“It’s a long-term investment and it takes time to build relationships, but this has given us the opportunity to talk about the innovative work Bermuda has been doing and to raise our jurisdiction’s profile in this space.

“We’ve had meaningful discussions with companies that want to set up in Bermuda, with those already in the process of setting up, and with some who are investing in companies that want to set up in Bermuda.”

Bermuda’s fintech environment has evolved substantially since the island sent a delegation to Consensus just one year ago, the Premier noted, with key initial coin offering [ICO] and digital assets business legislation now in place, along with a dedicated fintech unit, regulatory sandbox, and Innovation Hub at the BMA.

“That certainty is now paying dividends,” he said, “and we are attracting interest from excellent prospects. It bodes well for the future.”

Bermuda’s robust regulation won the spotlight Monday during a Consensus panel that featured the BMA’s Senior Advisor for Fintech, Moad Fahmi, along with peers from Japan and Australia.

“It was a great opportunity to discuss regulation of digital assets with fellow regulators and industry bodies,” said Fahmi. “The digital asset industry is evolving rapidly and moving towards institutionalization—our robust digital asset framework is fit for purpose to welcome entities looking to meet the Bermuda Standard.”

Minister Dickinson and Burrows also held a series of meetings outside the conference with institutional investors, family offices, funds and private equity managers, fintech incubators, influencers and investors in technology and digital assets businesses.

“We took the opportunity while in New York to meet with leading companies in the wealth management industry to discuss opportunities for their businesses in Bermuda,” Minister Dickinson said.

“The discussions were fruitful and provided the Bermuda team with valuable insights that can be used as we continue to improve our service offering in our evolving wealth management pillar.”

“There were many synergies, and underpinning everything is technology, with digital assets now viewed as an asset class driving every industry sector,” said Burrows.

“Notably, many of our meetings this week were direct offshoots of our BDA industry forum in New York back in March, so the follow-up is underway and the conversations have begun.”

The Premier met with various media, including Reuters, Bloomberg Radio, and Yahoo Finance. He also took part in a video interview with futurist and author David Shrier, an associate professor at Oxford University’s Saïd Business School, who leads Oxford’s fintech and blockchain strategy programmes.

Read More About

Category: All, Business, News, Politics, technology

Good Work Burt.

What did he do? The same thing he has been doing for two years now. Where are the results? If this was the Opposition you call it a photo op and a waste of money junket.

Odd that Premier Burt seems OK meeting with people and trying to get them to invest in Bermuda, who look like the people that Rolfe Commissiong, and certain posters here, trashed Sir John Swan for mentioning. Why isn’t Premier Burt talking with a more diverse section of the business community?

Looks like Burt may secretly agree with Sir JS.

Famous is out of the loop.

Look at those chuckleheads.

18 years of draconian, protectionist and insular immigration policies have crippled Bermuda, and these idiots still don’t get it.

There’s less cash flowing in the local economy, more beggars, shortfall in pension funding, shortfall in healthcare funding, declining retail sales, fewer jobs, declining enrollment at primary schools, low confidence….

All you do is come one here and blog pure WHITE WASH! Later you wonder why the PEOPLE don’t want to swing back to the OBA. You believe your blogging actually helps the OBA but in reality you hinder them. People can see your insanity and racism. Now ask yourself why did we work so hard to change the name from UBP to OBA overnight?

Who mentioned race? Who mentioned the OBA?

I am merely pointing out that we have ineffective at best, incompetent at worst, political leadership who have and continue preside over the decline of Bermuda.

This isn’t about the OBA dimwit, it’s about digging ourselves out of hole created solely by the PLP. Now if you voted for that you need to own it, but don’t accuse me of racism because you cannot admit to your failure and responsibility. Grow the F up.

…please go on!

SO many people DON’T GET IT!

‘Insular immigration policies?’ Or policies that ensure the Bermudian first? Last I recall there were close to 4000 Bermudians who have moved away.. Luring them back HOME could be a start? Oh right, not those ones.

“..Or policies that ensure the Bermudian first? ..”

So how are those polices working out then?

Of course they don’t get it. All that matters is 25-11