Bermuda Plans ‘Onchain National Economy’

Today at the World Economic Forum Annual Meeting, the Government of Bermuda announced their plans to “transform Bermuda into the world’s first fully onchain national economy with support from Circle and Coinbase.”

A Government spokesperson said, “Circle and Coinbase intend to provide their digital asset infrastructure and enterprise tools to the Government of Bermuda, local banks, insurers, small and medium-sized businesses, and consumers. The companies also plan to support nationwide digital finance education and technical onboarding.

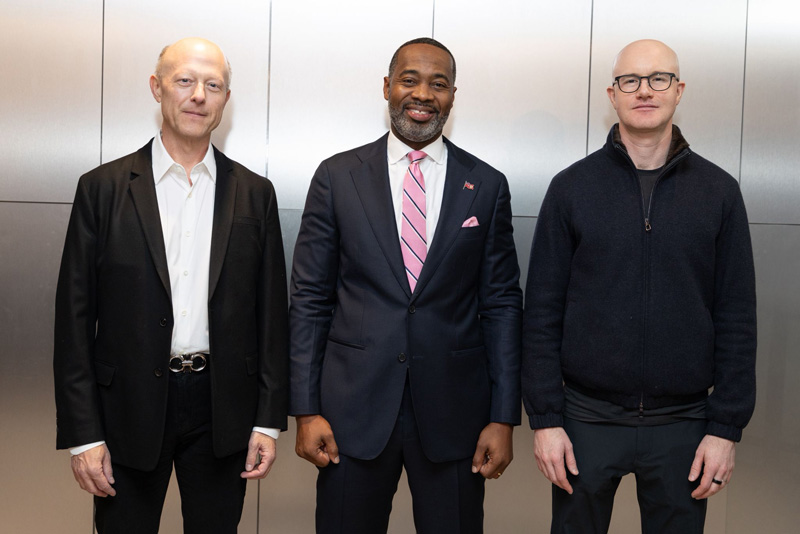

Premier David Burt with Jeremy Allaire – Co-Founder, CEO, and Chairman, Circle, Brian Armstrong – Co-Founder and CEO, Coinbase

“An onchain economy means using digital assets as an everyday financial infrastructure. For a country like Bermuda, a highly entrepreneurial economy with thousands of local businesses, traditional payment rails are expensive and restrictive. Being classified alongside Caribbean and other island jurisdictions, onshore payment processors, and local fiat banking rails drive up fees and squeeze already-thin merchant margins. Digital finance provides an opportunity for a new model.

“With USDC, merchants can accept fast, low-cost, dollar-denominated payments. There are now multiple live examples in the Bermudian market, demonstrating how onchain digital payments allow individuals to transact locally, support economic activity, and meet compliance obligations in a modern, efficient way.

“The announcement builds on Bermuda’s leadership in digital asset regulation. In 2018, Bermuda became one of the first jurisdictions to introduce a comprehensive digital asset framework through the Digital Asset Business Act. Circle and Coinbase were among the first global firms licensed under the regime and have expanded alongside the island’s growing digital finance ecosystem.

“The continued partnership follows a major milestone at the Bermuda Digital Finance Forum 2025, where the three partners executed an airdrop of USDC, distributing 100 USDC to every attendee for use with newly onboarded local merchants. Since then, additional Bermudian businesses have begun accepting digital payments and local financial institutions have expanded their use of stablecoins and tokenized finance.

“The Bermuda Digital Finance Forum 2026, taking place May 11–14, will expand these efforts through broader business participation, greater consumer stimulus, and deeper engagement across the financial services sector.

“Bermuda’s approach is anchored in what The Hon. E. David Burt, JP, MP, Premier of Bermuda, describes as a collaborative model between government, regulator, and industry designed to enable responsible innovation at scale.”

“Bermuda has always believed that responsible innovation is best achieved through partnership between government, regulators, and industry,” said Premier Burt. “With the support of Circle and Coinbase, two of the world’s most trusted digital finance companies, we are accelerating our vision to enable digital finance at the national level. This initiative is about creating opportunity, lowering costs, and ensuring Bermudians benefit from the future of finance.”

The spokesperson said, “The transition to an onchain economy is expected, over time, to deliver tangible benefits for residents and businesses. Benefits include lower transaction costs and providing greater access to global finance through modern digital wallets, and infrastructure that keeps economic value circulating locally.”

“Bermuda has been a global pioneer in digital asset regulation and continues to demonstrate what responsible blockchain innovation looks like at a national scale,” said Circle Co-Founder, Chairman, and CEO, Jeremy Allaire. “We are proud to deepen our engagement as Bermuda empowers people and businesses with USDC and onchain infrastructure.”

“Coinbase has long believed that open financial systems can drive economic freedom,” said Coinbase CEO Brian Armstrong. “Bermuda’s leadership shows what is possible when clear rules are paired with strong public-private collaboration. We are excited to support Bermuda’s transition toward an onchain economy that empowers local businesses, consumers, and institutions.”

The spokesperson said, “Government agencies will begin piloting stablecoin-based payments, financial institutions integrating tokenization tools, and residents participating in nationwide digital literacy programs, laying the foundation for a more inclusive, competitive, and resilient national economy.”

Read More About

Category: All, Business, News, technology

Reading this sent me to the Land Valuation website.

Sankofa House is exempt from land tax because the building is “Commercial (Unusable)”. But how can that be with our thriving digital asset business?

And where with these new “onchain” businesses set up?

Sankofa: Ghanian for “I forgot my keys”…a word from the birthplace of the Atlantic slave trade, the inventors of the Atlantic slave trade, and currently the worst country for human rights abuses in the world.

You must be proud!

How many of those digital currency companies registered in Bermuda, that never hired any Bermudians, that were just paper-based, or were sued & fined for various violations, are still in business?

Perhaps I don’t understand “on-chain” and what that actually means, but I am concerned that moving toward a more digital economy and encouraging digital asset businesses to set-up in Bermuda will open the flood gates to more illicit activity, and as result undermine the reinsurance reputation that Bermuda has built up over the years. It only takes one bad thing to draw regulatory attention from both sides of the Atlantic.

“The term onchain refers to transactions that occurred on a blockchain and have been verified and authenticated. In other words, any data made immutable and permanent on the blockchain is referred to as being onchain. Bringing data onchain ensures its security and transparency at the same time.”

Since the word use of blockchain is now old, onchain is the word of the moment. People simply accepted “blockchain” as a completed transaction. Like global warming to climate change to climate crisis, to fill in the next word. Or, a local check deposit takes 3 days to clear before it actually becomes a deposit.

On course, this all comes crashing down when you cannot access the internet for whatever reason to get to your data.

“this all comes crashing down when you cannot access the internet for whatever reason to get to your data.”

You mean like when a switch at BELCo explodes and all of Bermuda is without power?

it will be similar to banking online if there is a hurricane and you cant go online if power goes out, but your money is still safe.