Report: ‘Neal Bill Will Hurt US Consumers’

Calling the so-called “Bermuda Tax Loophole” in the US tax code “a sophisticated means of tax avoidance”, Massachusetts Congressman Richard Neal says his recently introduced legislation will add billions of dollars to Washington’s revenues.

Calling the so-called “Bermuda Tax Loophole” in the US tax code “a sophisticated means of tax avoidance”, Massachusetts Congressman Richard Neal says his recently introduced legislation will add billions of dollars to Washington’s revenues.

However, if the Neal Bill passes both the House of Representatives and the Senate, US insurance buyers can expect to pay far more for hurricane and other insurance coverage argue market analysts.

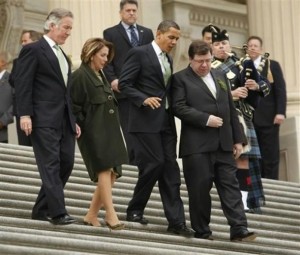

Rep. Neal tabled his long-stalled legislation in the US Congress last month [he is pictured here with House of Representatives Minority Leader Nancy Pelosi, President Obama and former Irish Prime Minister Brian Cowen on the steps of the US Capitol] .

An insurance industry-backed group, the Coalition for Competitive Insurance Rates — supported by the Association of Bermuda Insurers & Reinsurers — commissioned a report that contends US homeowners and business operators, especially those in coastal areas from the Gulf of Mexico to New England, would face rate increases of more than two percent if the Neal legislation passed, an $11 billion to $13 billion impact on consumers.

Bermuda’s re/insurers would then flee the US market, and that would limit supply and drive up the price of insurance — while eliminating any taxes that advocates believe would be collected — said the report’s author, Michael Cragg of the Brattle Group, a Massachusettse consulting firm.

“That is going to essentially tax away all of the profit that would allow them to do business in the United States,’’ Mr. Cragg recently told a Boston newspaper. “There is no economic incentive for them to do business in the US.’’

Furthermore, the companies already pay a share of taxes on US profits, before they take deductions related to offshore transfers, he said.

Companies headquartered in domiciles like Bermuda now dominate the global reinsurance market, reflecting a shift away from the US that began in the 1990s and picked up steam after the September 11, 2001 terrorist attacks and Hurricane Katrina in 2005.

“Those disasters fueled demand for deep capital reserves to cover insurance losses,” reported the Boston paper. “Reinsurance companies flocked to Bermuda, in particular, where regulatory hurdles to opening a company were low.

“Several US companies transformed themselves into foreign corporations by changing their home base to Bermuda. In other cases, foreign companies purchased US firms.

“Through a variety of strategies, many US corporations pay nothing close to America’s 35 percent corporate tax rate. But offshore reinsurance companies typically report lower tax burdens than domestic firms in the same business, specialists on both sides agree.

“One of the largest overseas reinsurance companies, Bermuda-based Everest Reinsurance Holdings Inc., reported that it had no US income taxes to pay in 2010.

“Another Bermuda re/insurer, Arch Capital Group, reported effective total income taxes – US and other countries combined — of just 0.9 percent in 2010.”

Rep. Neal’s fight has been joined by President Obama, who included a narrower version of the legislation into his proposed 2012 budget.

The provisions would curb the ability of these reinsurance companies to deduct as a business expense the money they shift from US subsidiaries to offshore accounts. Closing the deduction is supported by a group of domestic US insurers, including Boston-based Liberty Mutual Insurance Co.

“All we’re trying to do is level the playing field,’’ said Jonathan Talisman, a former deputy treasury secretary retained as a lobbyist by the domestic insurers. Offshore companies, he said, “want to serve the US market, they just don’t want to pay US tax on serving it.’’

“Congress is still revenue-hungry, so action on an amendment incorporating Neal’s draconian reinsurance amendment is still a risk to be managed,” ABIR president and executive director Bradley Kading has said. “The Republican majority in the House will want to look at corporate tax policy generally. The Neal reinsurance tax would be an item they might consider, but the context will be tax policy rather than a revenue grab.”

The proposed Neal legislation has prompted a major lobbying battle between domestic and foreign-based insurers in Washington.

Millions of dollars have been spent lobbying Washington lawmakers by interests on both sides of the issue. Domestic insurers have formed the Coalition for a Domestic Insurance Industry; opponents, mainly Bermuda based, have their competing Coalition for Competitive Insurance Rates.

The bill’s opponents — led by ABIR, the public policy organisation for Bermuda’s re/insurance sector — claim the tax would hurt the availability of insurance and reinsurance in the United States, particularly in areas that are prone to major natural disasters such as hurricanes.

Prominent Washington lobbyist Eli Lehrer — who has consulted for Bermuda’s re/insurance industry — issued a scathing denouncement of Rep. Neal’s proposed legislation in 2009, describing it as protectionist and counter-productive.

“This is the last thing that disaster-prone homeowners need,” he said. “It’s an awful, awful idea.

“This is a battle of US-based reinsurers against US consumers,” he said. “And the consumers will lose if Rep. Neal’s bill becomes law.

“Those who hope for a revenue windfall are hoping in vain. If this bill becomes law, it’s likely that tax revenues will probably fall as companies stop using offshore affiliated reinsurance.”

What is interesting is that Companies like Liberty Mutual, mentioned as one of the advocates for closing the ” Bermuda loop hole”, purchase reinsurance protection from Bermuda Reinsurance Companies.

So whilst they complain about an unfair advantage in Washington, on the other side of their face, they take advantage of having the capacity here in Bermuda and I am sure they are not the only ones. I wonder how much their resinsurance costs would go up if the Bermuda capacity was unavailable to support their program because of protectionist US policies.

Here Here!!!

Coalition for a Domestic Insurance Industry

http://www.coalitionfordomesticinsurance.com/

Wouldn’t it be advisable to highlight both sides of story and let bermudians follow the argument rather than just Bermuda’s. That way Bermudians can decide for themselves where they think this will end up.