Neal Reintroduces “Bermuda Loophole” Bill

Congressman Richard Neal yesterday [Oct.13] reintroduced long-stalled legislation targeting the so-called “Bermuda loophole” in American’s tax code — a technicality he says allows re/insurers to avoid paying US taxes by basing their companies on the island and in other off-shore financial centres.

Congressman Richard Neal yesterday [Oct.13] reintroduced long-stalled legislation targeting the so-called “Bermuda loophole” in American’s tax code — a technicality he says allows re/insurers to avoid paying US taxes by basing their companies on the island and in other off-shore financial centres.

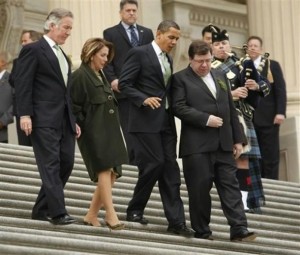

The Massachusetts Democrat — pictured at left with President Obama, House Speaker Nancy Pelosi and former Irish Prime Minister Brian Cowen on the steps of the US Capitol — is now the Ranking Member of the House of Representatives Subcommittee on Select Revenue Measures and his efforts to close the “Bermuda loophole” date back a decade.

For the last year it had been widely expected the Congressman would eventually reintroduce the legislation

If passed by Congress, Rep. Neal’s bill would limit insurers from receiving tax deductions on some reinsurance business they send to their foreign-owned arms.

The proposed legislation has divided the US and international insurance industries, sparked multi-million dollar lobbying campaigns by supporters and opponents — most notably the Association of Bermuda Insurers & Reinsurers — and received strong criticism from Republicans and some Democrats.

Rep. Neal once told “The New York Times” the loophole works this way: Companies that insure against fire, injuries on the job and other property and casualty losses send premiums collected from customers to a corporate parent in Bermuda and treat the transfer as a business expense, even though money is simply being shifted from one part of the company to another.

The business expense gives the American subsidiary a deduction that wipes out taxable profits. And the Bermuda parent can invest the premiums and not have to pay taxes on the investment profits because Bermuda has no income tax.

Congress does impose an excise tax when premium money is transferred to Bermuda, but the tax rate is minimal. The US Federal corporate income tax rate is 35 percent.

The largest companies that operate in Bermuda have long denounced the Congressman’s legislation as protectionist, claiming the tax benefits of the Bermuda move are exaggerated.

In the past the Obama White House has supported a similar — but significantly narrower — version of Rep. Neal’s policy.

Leading Bermuda re/insurance figures and industry analysts have long argued passage of the Neal Bill would cripple the island’s competitive advantage.

“Mr. Speaker, today I am pleased to come before the House to introduce legislation ending a current law loophole that allows foreign insurance groups to strip their US income into tax havens to avoid US tax and gain a competitive advantage over American companies,” Rep. Neal said on the floor of Congress while introducing his revised bill. “I am pleased to be joined in my efforts by [New Jersey's] Senator [Robert] Menendez who is introducing the Senate companion bill.

“Many foreign-based insurance companies are using affiliate reinsurance to shift their US reserves overseas into tax havens, thereby avoiding US tax on their investment income. This provides these companies with a significant unfair competitive advantage over US-based companies, which must pay tax on their investment income.

“To take advantage of this loophole, several US companies have ‘inverted’ into tax havens and numerous other companies have been formed offshore. And, absent effective legislation, industry experts have predicted that capital migration will continue to grow and other insurers will be forced to redomesticate offshore.

“As we grapple with significant budget challenges in the years to come, it is essential that we not allow the continued migration of capital overseas and erosion of our tax base.”

Rep. Neal said his bill was targeted solely at reinsurance among insurers off-shore affiliates which adds no additional capacity to the market “and is often used for tax avoidance.”

“There have been previous attempts to address the tax avoidance problem resulting from reinsurance between related entities,” he said. “Congress first recognised the problem of excessive reinsurance in 1984 and provided specific authority to Treasury under Section 845 of the Tax Code to reallocate items and make adjustments in reinsurance transactions in order to prevent tax avoidance or evasion.”

Rep. Neal said in 2003, the Bush Treasury Department testified before Congress that existing mechanisms were not sufficient.

Consequently Congress expanded the authority of the US Treasury to not only reallocate among the parties to a reinsurance agreement but also to recharacterise items within or related to the agreement.

“Congress specifically cited the concern that these reinsurance transactions were being used inappropriately among US and foreign related parties for tax evasion,” said Rep. Neal. “Unfortunately, as recent data shows, this grant of expanded authority to Treasury has not stemmed the tide of capital moving offshore.”

Rep. Neal said since 1996, the amount of reinsurance sent to offshore affiliates has grown dramatically, from a total of $4 billion ceded in 1996 to $33 billion in 2008 — including nearly $21 billion to Bermuda affiliates and more than $7 billion to Swiss affiliates.

“Use of this affiliate reinsurance provides foreign insurance groups with a significant market advantage over US companies in writing direct insurance here in the US,” he said. “We have seen in the last decade a doubling in the growth of market share of direct premiums written by groups domiciled outside the US, from 5.1 percent to 10.9 percent, representing $54 billion in direct premiums written in 2006.

“Again, Bermuda-based companies represent the bulk of this growth, rising from 0.1 percent to 4 percent. And it should be noted that during this time, the percentage of premiums ceded to affiliates of non-US based companies has grown from 13 percent to 67 percent. Bermuda is not the only jurisdiction favorable for reinsurance. In fact, one company moved from the Cayman Islands to Switzerland citing ‘the security of a network of tax treaties’, among other benefits.”

Rep. Neal said a coalition of US-based insurance and reinsurance companies has been formed to express their concerns to Congress.

“They wrote to the leadership of the House and Senate tax-writing committees urging passage of my prior bill because, as they wrote, ‘This loophole provides foreign-controlled insurers a significant tax advantage over their domestic competitors in attracting capital to write US business’,” he said. “With more than 150,000 employees and a trillion dollars in assets here in the US, I believe it is a message of concern that we should heed.

Rep. Neal told Congress this is why he was again filing legislation to end what he called the “Bermuda reinsurance loophole.”

“This proposal has been developed working with the tax experts at both the Treasury Department and the staff of the Joint Committee on Taxation to address concerns that have been raised with prior versions of the bill and develop a balanced approach to address this loophole,” he said. “The proposal is consistent with our trade agreements and our tax treaties.

“Specifically, the proposal I am filing today effectively defers any deduction for premiums paid to foreign affiliated insurance companies if the premium is not subject to US tax. This is accomplished by denying an upfront deduction for any affiliate reinsurance and then excluding from income any reinsurance recovered [as well as any ceding commission received], where the premium deduction for that reinsurance has been disallowed.”

Rep. Neal said the bill allows foreign groups to avoid the deduction disallowance by electing to be subject to US tax with respect to the premiums and net investment income from affiliate reinsurance of US risk.

“Special rules are provided to allow for foreign tax credits to avoid double taxation,” he said. “This ensures a level-playing field, treating U.S. insurers and foreign-based insurers alike.

“The legislation provides Treasury with the authority to carry out or prevent the avoidance of the provisions of this bill.”

“This ‘deduction deferral’ proposal is similar to one contained in the administration’s budget this year. In an effort to combat earnings stripping, this bill uses a common-sense approach, which will effectively defer the deduction for premiums paid until the insured event occurs — thereby restricting any tax benefit from shifting reserves and associated investment income overseas.”

Rep. Neal said “ending this unintended tax subsidy for foreign insurance companies” will stop the capital flight at the expense of American taxpayers and restore competitive balance for domestic companies.

“Closing this loophole does not impose a new tax,” he said. “It merely ensures that foreign-owned companies pay the same tax as American companies on their earnings from doing business here in the United States.

“Congress never would consciously subsidise foreign-owned companies over their American competitors. Thus, there is no reason an unintended subsidy should be allowed to continue.

“Mr. Speaker, I appreciate the opportunity to address the House on this important matter and I assure my colleagues that I will continue my efforts to combat offshore tax avoidance, regardless of what industry is impacted.”

Rep. Neal added that a fuller, technical explanation of the bill can be found on my website.

Read More About

Comments (21)

Trackback URL | Comments RSS Feed

Articles that link to this one:

- Report: ‘Neal Bill Will Hurt US Consumers’ : Bernews.com | November 7, 2011

- ‘Strong Objections’ Raised To Bermuda Bill : Bernews.com | November 16, 2011

The Government needs to copyright the word Bermuda.

That jerk thinks the cure all is to collect more taxes by force so support the ever increasing welfare state. Why doesn’t he work on forcing the software developers, tech support call centers, manufacturing plants, home electronics, auto parts, toy makers, etc to move back from china and india which will create jobs and put the middle class american back to work. Oh no he can’t do that because he owns shares in those companies and he’s probably got lobbyist filling his pockets with cash and gifts.

Might as well do ‘Triangle’ as well. Won’t stop anything if it it passed.

And the house of cards continues to fall. At least our previous premier got out with his hide intact. It isn’t going to be a pleasant “good morning” for most of 2012.

HAHAH like the insurance companies would let this happen…

indeed, before it becomes used in this setting to denote something seedy and nefarious. Paula, Kim, the Scott Brothers anybody….???

Funny…..the Americans didn’t have aproblem accepting all the money paid out from Bermuda when the twin towers went down, nor did they have problem collecting the cash when the space shuttle blew up or all money they got from us for catastophy in New Orleans. All of that insurance money came from Bermuda……….Oh, I also forgot about the hundred barrels of English gunpowder we gave to you. Some of us got hung for that one and now you want to hang us again. Maybe we should send you a bill for all that gunpowder we stole for you; with interest.

What?? That was absolutely not money that came from Bermuda. It was American money, that is being stored in Bermuda because it helps the Americans avoid tax. Don’t kid yourself. Your going on about gunpowder…how bout we stick to relevant issues?

Uh, do you have even the most basic grasp on how insurance works? Where do you think the money came from before it got to Bermuda? Or wait… let me guess, it was always here and we just handed it over out of the goodness of our hearts.

The money pad out to natural disasters was paid for through premiums that Bermuda reinsurers have profited off of for years, Bermuda did not GIVE it to America. As for the gun powder…. like you always say… forget about the past and move forward! It’s not what you did yesterday but what you can do tomorrow!

You idiots can’t read. I know very well how insurance works. I never said Bermuda gave the money for those payments, I said it came from Bermuda; i.e. Bermuda based insurance companies. Sorry you didn’t catch that, but I guess you were all in attack mode when you started reading. Do you know that five out of every ten homes in the United states are ultimately insured in Bermuda? Although that may have dropped off recently with some companies quietly slipping out the back door.

As for the gunpowder……..well, aren’t we supposed to learn from our history!!!

Here you have the PLP on the doorsteps of DC; making the US our BFF’s and here they go and stab us in the back…..quite typpical of them. Nothing but backstabbers. And Im sure our soveriegnty laws someone protect us against this in some sense…..but it will be nice if the BDA GOV go onto this pronto….

why not go on strike! Maybe your sovereignty laws are like alfac and will pay your bills! I’m sure Obahma is waiting for the call.

I thought former premier DREB had a memorandum of understanding with the big wigs in Washington , that by us accepting them shree WIGGA’s , Uncle Sam won’t require his pound of flesh . We now know how naive the big doctor really is .

Bermuda better pray this doesn’t get any traction – if you think we have problems now, look out…!

Why is anyone surprised? This item has been on US government’s agenda for years.

However it is unlikely to amount to anything other than discussion for political purposes.

Wait just a second people! Where are all of you OBAMA LOVERS now? What, no more “I heart OBAMA” t-shirts walking down Front St??? Wasn’t he “your man” just a few short years ago?? Well….what has he done for you lately?? Let me guess, you didn’t realize a guy with no business background wouldn’t know how to run a big business such as the USA? Hmmmm….me thinks you may not have been voting him in by his merits but rather something else… (even though you weren’t actually a voter – just a lame t-shirt wearer.)

stop being a hater…….. and say something constructive…..everything with you is racial…stop it.. then you want to blame the PLP for playing the the race card..just stop…..you have more to offer them rhetoric.

let talk about the US politics and the fact that the president does not have any control over the congressional house or the senate as such he is having a difficult time passing laws, why don’t we pray that we never adopt the US system…..as it does not work….. it just causes grid lock….til the next party gets in power and the games start all over again….

The U.S needs capital and they intend to close all leaks. nothing more than a political discussion? We shall see. I used to live in the U.S and I will tell you, Americans hate being denied what they are entitled to. However, I will wait with my Plan B for the outcome. Seatbelts on everyone… turbulence up ahead!