Ministry: 2016/17 First Quarter Fiscal Performance

The Ministry of Finance provided information today on the 2016/17 First Quarter Fiscal Performance.

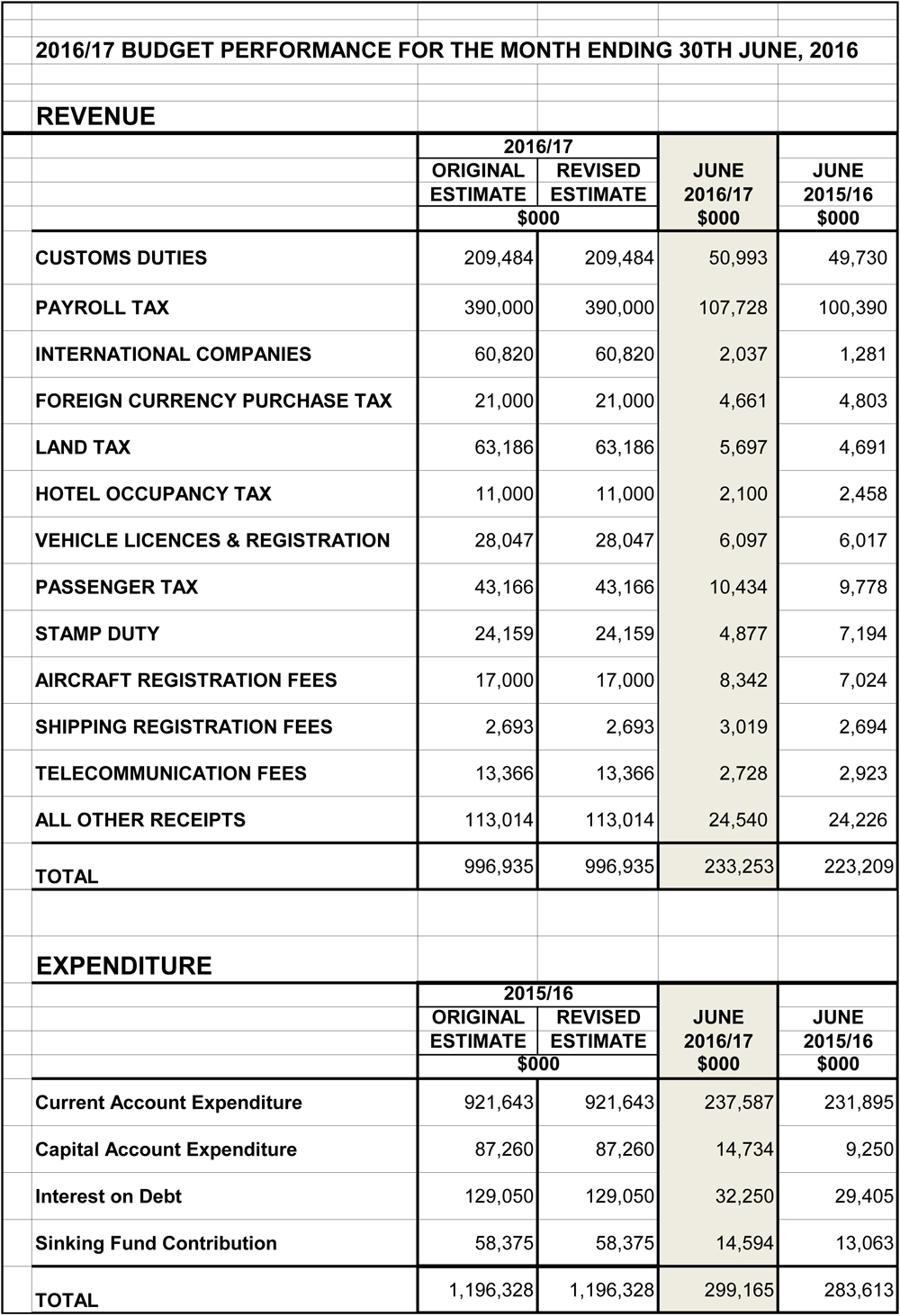

“The headline numbers for the 2016/17 National Budget were: a revenue target of $996.9 million; current expenditure of $1.11 billion, including debt service; capital expenditure of $87.3 million; and a projected deficit of $199.4 million,” the Ministry said.

“Revenues for the first quarter ending June 2016 are $233.3 million; this is $10.0 million [4.3%] higher than in June 2015.

“The primary reason for this increase is due to an increase in Payroll Taxes collections of approximately $7.3 million above 2015 collections, higher collections in Customs Duty of $1.3 million above 2015 collections and higher Aircraft Register Fees of $1.3 million above 2015 collections, offset by lower collections in Stamp Duties.

“When compared to Budget estimates, total revenues are tracking slightly lower.

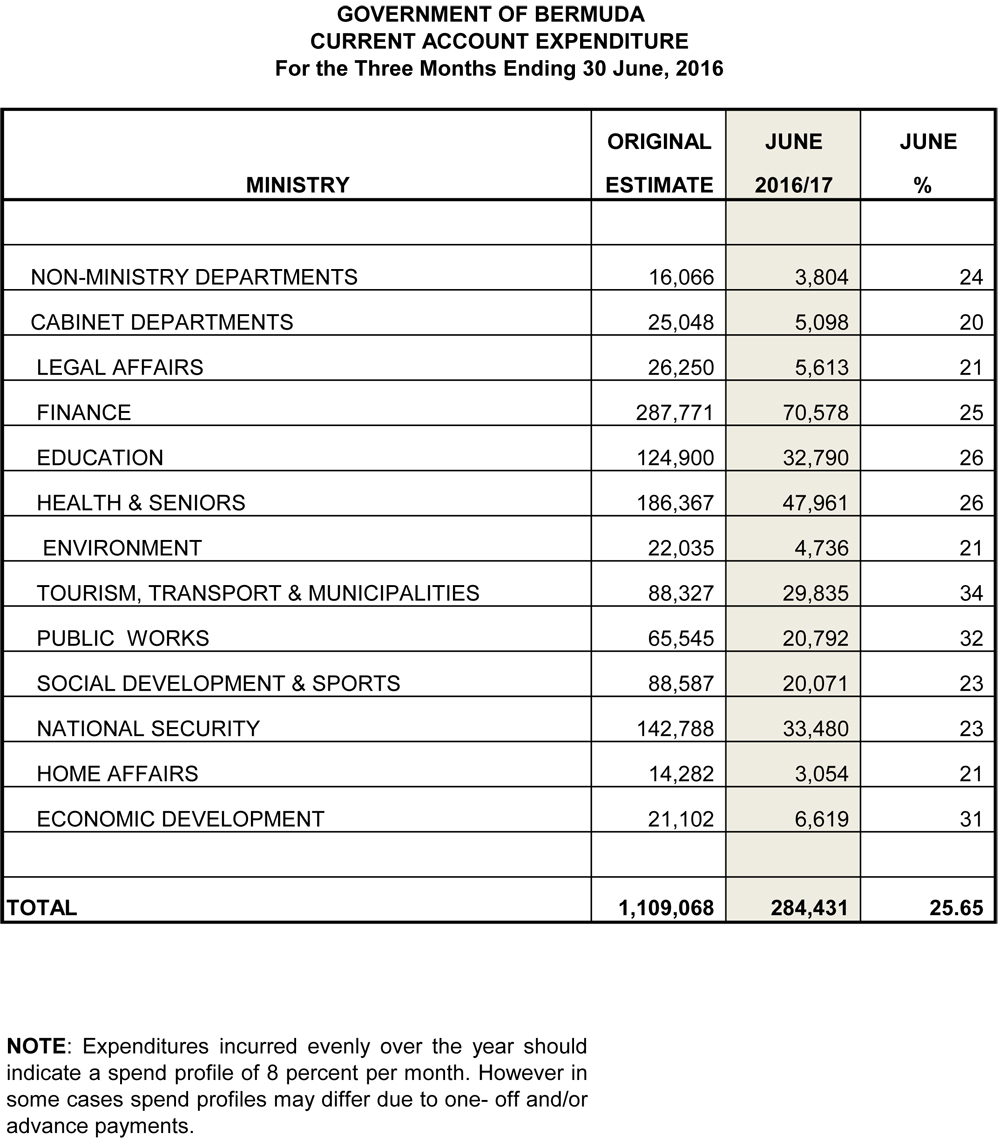

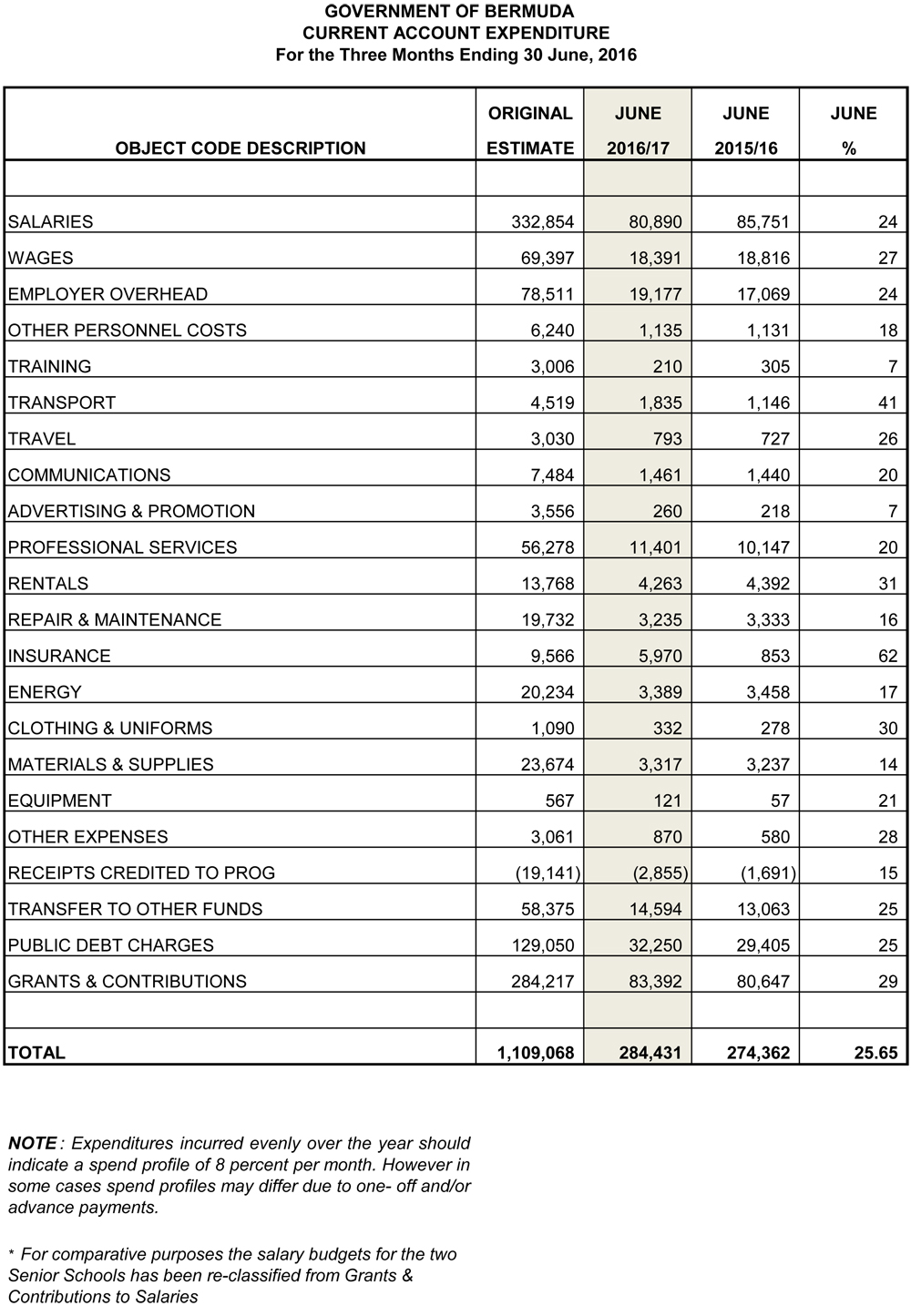

“Current account expenditures, excluding debt service, for the first three months ending June 2016 are $237.6 million; this is $5.7 million [2.4%] higher than was spent during the same period last fiscal year.

“Government current account spending to date is higher during this fiscal year when compared to the same period last year mainly due to increases in various operational grants, increased government overheads due primarily to health insurance premiums, and the expiry of the partial suspension of Government’s matching contribution to the Public Service Superannuation Fund and payment of insurance premiums in the first quarter.

“Capital account expenditures for the period ending June 2016 are $14.7 million which is above the 2015/16 spend for the same period. This is due to increased and new capital grant amounts in particular BHC – Grand Atlantic, America’s Cup and WEDCO – South Basin

“Debt service costs for the first three months ending June 2016 are $46.8 million. This represents $32.2 million in interest payments and a $14.6 million contribution to the Government Borrowing Sinking Fund, representing approximately one quarter of the $58.4 million annual contribution.

“Debt service to date is $4.4 million more than last year’s period. This is due to higher debt levels.

“In general, current expenditures are presently tracking slightly above budget estimates. It should be noted that in certain instances expenditures are not made evenly over the year which may distort actual figures when compared to budget.

“Total Government spending for the first quarter of fiscal 2016/17 was $15.5 million [5.2%] higher than the corresponding period in 2015/16.

“For the first three months of 2016/17 Government incurred a deficit of $65.9 million. This deficit was financed by drawing funds from the Butterfield Loan Facility and with working capital.

“Gross debt at the end of June 2016 stood at $2.340 billion. Net of the Sinking Fund debt was $2.253 billion. In May 2016 $30 million of Private Placement notes matured. Government drew from the Sinking Fund to pay off these Private Placement Notes which reduced interest expense by $2.094 million.”

2016/17 Budget Performance for the Month Ending 30th June, 2016 [PDF]

Current Account Expenditure for Three Months Ending 30 June, 2016 [PDF]

Current Account Expenditure for Three Months Ending 30 June, 2016 [PDF]

Please, please cut the civil service to balance the budget. Tired of tax increases to keep someone in a job!

Maybe the debt load and the oncoming tax burden will result in a bi-partisan movement against these politicians. They don’t govern for us – they govern for their personal benefit. $2.3 billion on 25k taxpayers.

welcome to the Bermudian welfare state… how may we help you

Sort of what was happening in Greece and we all know how that turned out…

Just wait ’till they go after our already taxed money in our bank accounts .

And don’t think it can’t happen !

Happened in Cyprus fairly recently.

Just as long as civil servants keep their guaranteed jobs for life, 6 weeks vacation, 14 weeks sick pay. Pay increases. Fat cat pensions.

That’s what is sinking us.

Yes I would like a job please. I am hardworking Bermudian. I sacrificed a lot to be University educated.

I lost my Job during UBPs watch. While unemployed I was working on a project using my University level technical skills however I had to stop because I need money to eat. I am very real mate.

You haven’t had a job since 1998?

You might want to rethink something about your approach.

What is your degree and from what school?

After a $95.6 million dollar deficit going into the new year 2017 The O.B.A government will not be so arrogant about trying to run the affairs .Maybe now they will humble down and confess the truth about running this country.Peace.

Tarbir Sharrieff don’t hold your breath they will never admit or confess to anything Bob the builder is the one and only one who understands how to manage Bermuda affair. Lol smh