Govt: 2019/20 First Quarter Fiscal Performance

The Ministry of Finance today [Sept 17] reported on the 2019/20 First Quarter Fiscal Performance.

2019/20 First Quarter Fiscal Performance:

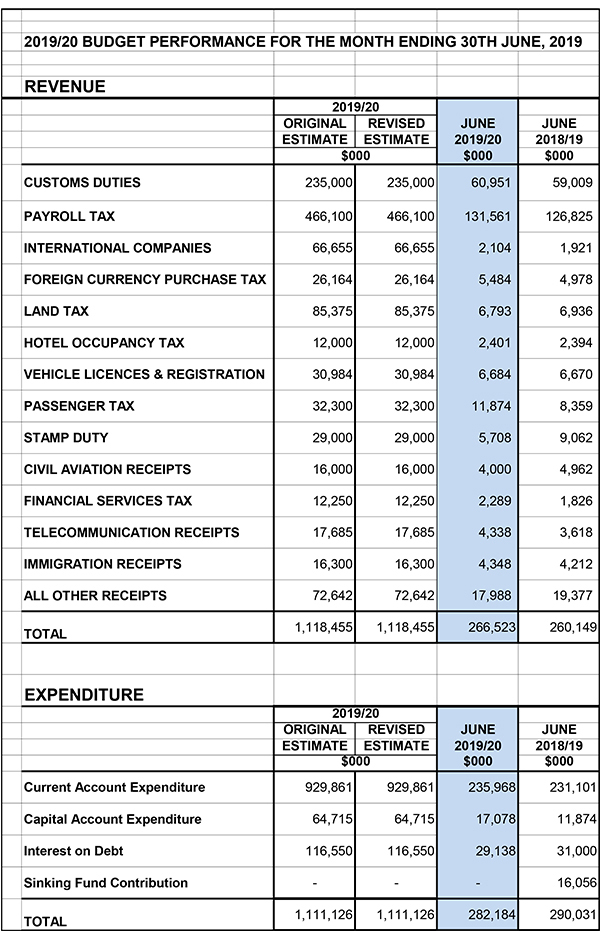

A Government spokesperson said, “The headline numbers for the 2019/20 National Budget was: a revenue target of $1,118.5 million; current expenditure of $1,046.4 million, including debt service; capital expenditure of $64.7 million; and a projected surplus of $7.4 million.

Highlights are as follows:

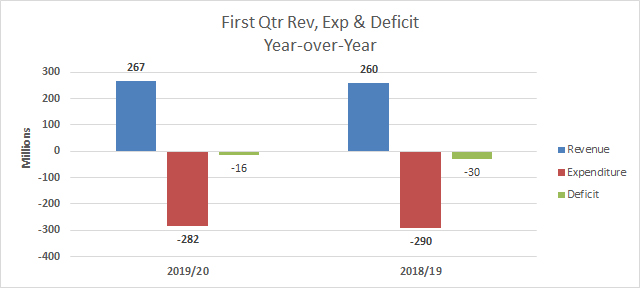

- Revenues collected are $6.4 million higher than in 2018 and are in line with Budget estimates;

- Current expenditures, excluding debt service, are $4.9 million higher when compared with 2018 and are consistent with Budget projections;

- Capital expenditures are $5.2 million higher than in June 2018 and are in line with budget estimates;

- Interest on debt for the first three months is $1.9 million less than last year;

- The Government deficit for the period was $14.2 million less than last year;

- No new borrowing was incurred during this period

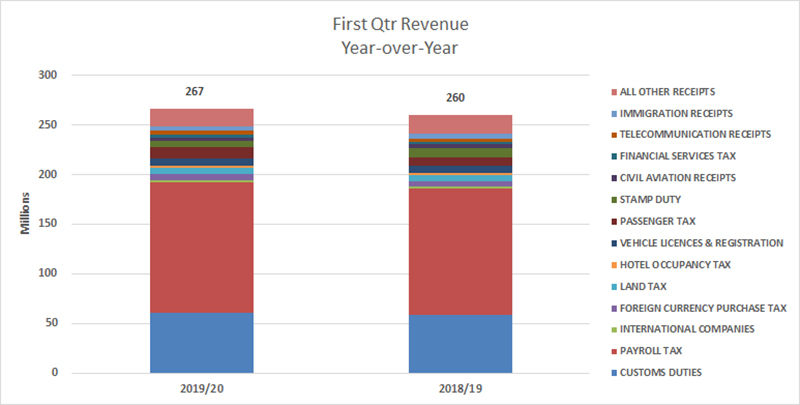

“Revenues for the three months ending June 2019 are $266.5 million; this is $6.4 million [2.5%] higher than in June 2018. The primary reason for this increase is due to an increase in Payroll Tax collections of approximately $4.7 million above 2018 collections, higher Passenger Tax collections of approximately $3.5 million above 2018 collections and higher collections in Customs Duty of $1.9 million above 2018 collections.

“In general, total revenues are tracking in line with budget estimates and the strength in Payroll Tax, Passenger Tax and Customs Duty receipts increases the chance of meeting the total revenue target of $1,118.5 million for the current fiscal year.

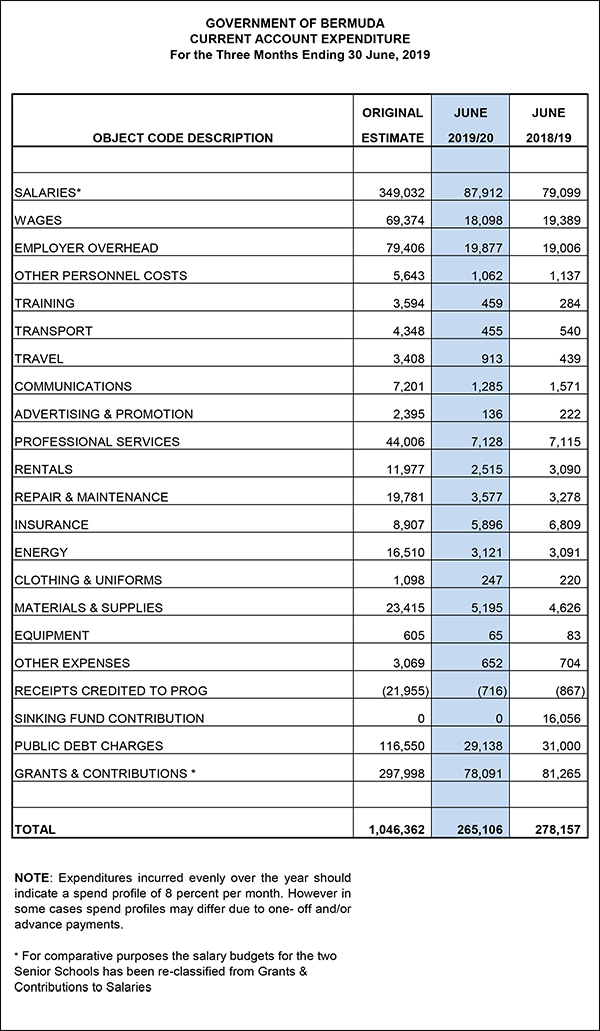

“Current expenditures, excluding debt service, for the first three months ending June 2019 are $235 million; this is $4.9 million [2.1%] higher than the amount spent during the same period last fiscal year.

“Government current account spending to date is higher during this fiscal year when compared to the same period last year mainly due to salary negotiated pay awards, offset by lower expenditures in grants and contributions and insurance.

“In general, current expenditures, excluding debt service, are presently tracking in line with budget estimates. The $236 million spent in the first three months of 2019/20 represents approximately 25.4% of the total current account budget of $929.9 million.

“Capital expenditures for the period ending June 2019 are $5.2 million higher than in June 2018. This is due to structural refurbishment of bridges, refurbishing ferry docks, capital maintenance on Tynes Bay and new capital grant amounts to the BHC.

“Capital expenditures are presently tracking on budget. The $17 million spent in the first three months of 2019/20 represents approximately 26% of the total capital account budget of $64.7 million.

“Total current and capital spending to date, excluding debt service, is $10 [4.1%] million higher than last year’s spending.

“Interest on debt for the first three months ending June 2019 is $29 million. Interest on debt to date is $1.9 million [6%] less than last year’s period. This is primarily due to the refinancing of more expensive government bonds in November, 2018 when Government executed an international bond transaction.

“For the first three months of 2019/20 Government incurred a deficit of $15.7 million, compared to a deficit of $29.9 million for the corresponding period in 2018/19. This deficit was financed with working capital. No new borrowing was incurred during this period.

“Gross debt at the end of June 2019 stood at $2.58 billion and net of the Sinking Fund debt was $2.461 billion. In May 2019 $100 million of Private Placement notes matured. Government drew from the Sinking Fund to pay off these Private Placement Notes which reduced interest expense on an annual basis by $7.38 million.

“One quarter does not make a year, but these figures are concrete facts that indicate that this government is determined to work for the people of Bermuda while also maintaining control of the public finances.”

Why is there no mention that in 2018/19 there was a sinking fund contribution of approx $50m but this has been dropped for 2019/20? This means in effect the deficit for 2019/20 is approx $50m more that shown. Similar smoke and mirrors to when Paula Cox dropped the payment into to Government Pension Plan to keep the deficit down. Bermuda is still paying for that folly.

“In general, total revenues are tracking in line with budget estimates and the strength in Payroll Tax, Passenger Tax and Customs Duty receipts increases the chance of meeting the total revenue target of $1,118.5 million for the current fiscal year”

This just days after raising our debt ceiling by $250 million!

So basically they squeezed $6mn of taxes from the already stretched public simply to pay $5mn more in public salaries.

Guessing increased taxes will be the norm on annual basis to pay higher civil servant salaries and benefits.

Yeah, that seems sustainable. Good luck with that.