AM Best: ‘Reinsurance Market To Bear Brunt’

A.M. Best expects the reinsurance market to bear the brunt of insured losses from damage on Bermuda caused by Hurricane Nicole, according to a new briefing.

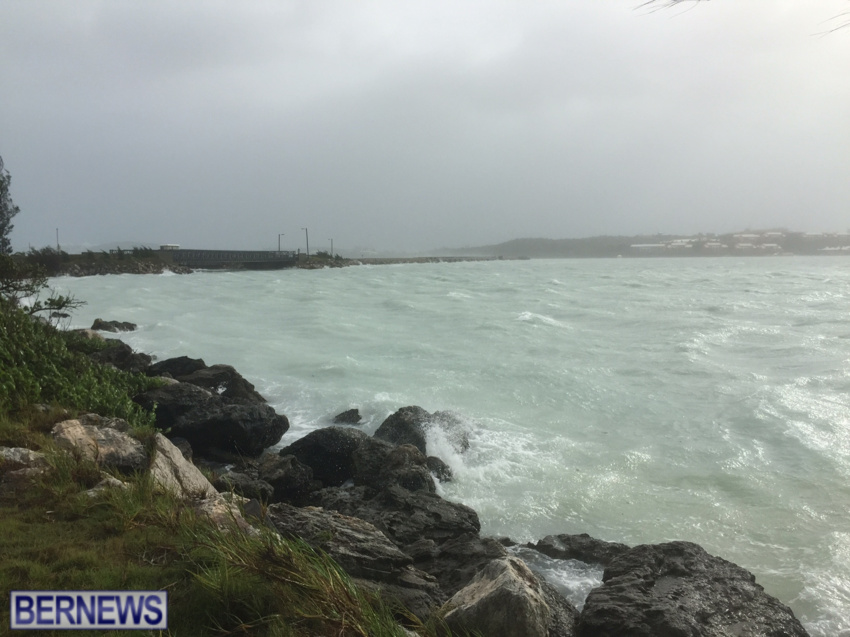

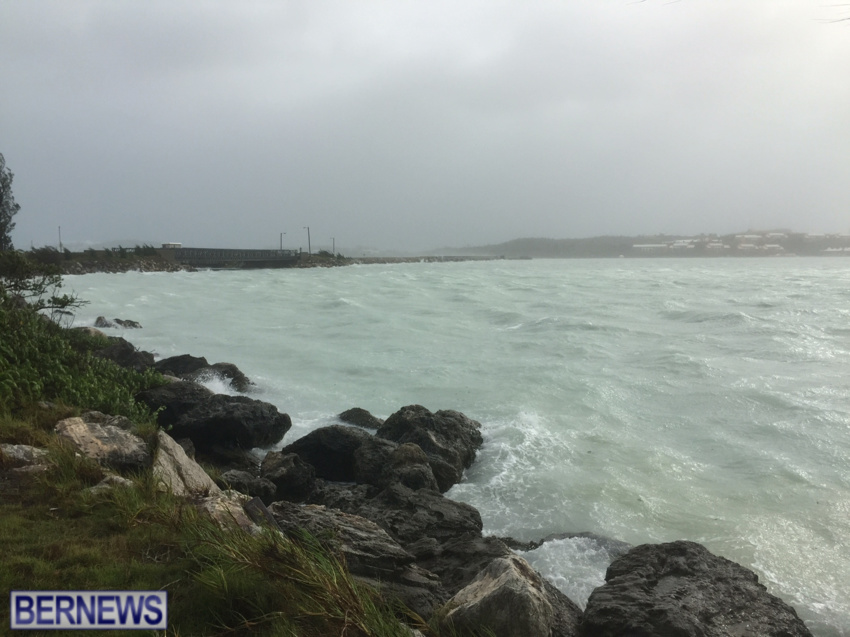

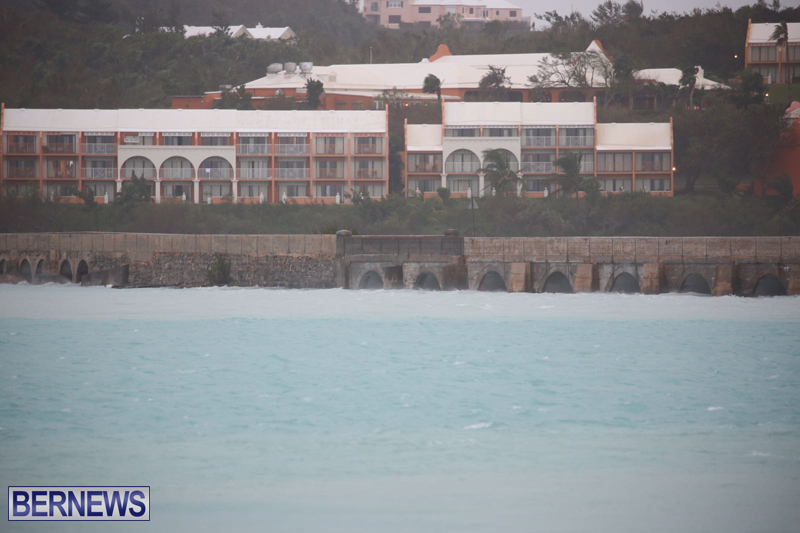

The company said, “Hurricane Nicole inflicted a direct blow on Bermuda on Oct. 13, 2016, as a category 3 hurricane. The eye of the storm passed directly over the island, causing Bermuda to experience sustained winds of 120 mph, heavy rains, widespread power outages and significant coastal flooding as a result of storm surge.

“The Best’s Briefing, “Bermuda Property/Casualty Insurers Likely to Look to Reinsurers in the Wake of Hurricane Nicole,” notes that primary domestic property/casualty insurers are heavily reinsured with manageable retentions.

Slideshow of the aftermath of Hurricane Nicole:

-

“A.M. Best anticipates that domestic insurers will be insulated from any major financial impact resulting from the storm, given their extensive use of property quota share reinsurance.

“Reinsurance panels are generally composed of large, global, highly rated counterparties. Recoverability and liquidity are not viewed to be a concern and cash call provisions within catastrophe reinsurance treaties will be utilized, if necessary.

“For the reinsurers themselves, this event does not represent a material financial impact and should be easily absorbed. A.M. Best will continue to monitor the situation as it develops and will evaluate any ratings impact from this severe weather event on an individual, company-by-company basis.”