Tax Reductions For Those Earning Under $96K

Government will reduce payroll tax for those earning less than $96,000, eliminate the employer portion of payroll tax for any disabled employee, and reform the ‘notional salaries’ payroll tax concept, Premier and Minister of Finance David Burt announced.

Payroll Taxes Are ‘Enemy Of Job Creation’

In delivering the 2018 Budget in the House of Assembly, the Premier said, “For as long as I have been speaking in this House, I have been clear that I regard payroll taxes to be the enemy of job creation. Since 2013, the Progressive Labour Party has been consistent in its desire to broaden the tax base away from taxes on labour income only.

Not Implement Tax Increase

“Given this Government’s clear desire to increase the number of jobs in Bermuda, the Government will not implement the second phase of the payroll tax increase put forward by the former Government. Accordingly, all employer rates will remain unchanged and will not increase as planned,” Premier Burt said.

Tax Reductions For Those Earning Under $96,000

Saying that workers have suffered through wage stagnation and increases in the cost of living, the Premier said “to provide relief to those workers, the Government will adjust the payroll tax employee rate bands to provide tax reductions to those earning less than $96,000.

“The lowest employee band will be reduced from 4.75% to 4% resulting in a working couple earning $48,000 each, or a combined total of $96,000 annually, receiving an increase in their take-home pay of $720.

“Anyone making less than $96,000 will see a reduction in taxes; anyone earning more than $96,000 will not see any change in their payroll taxes.”

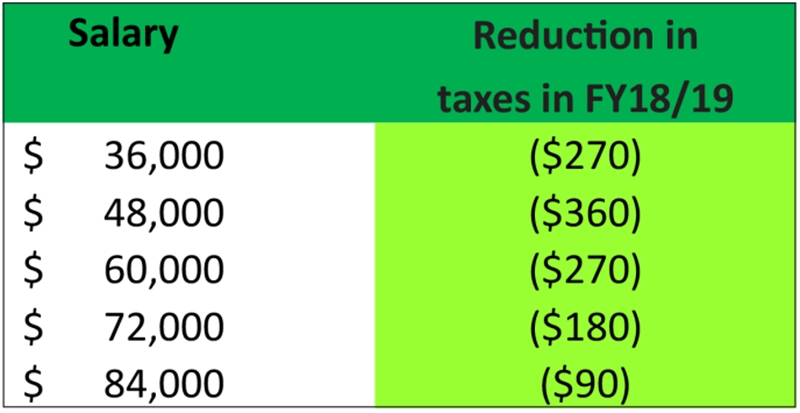

Chart extracted from Budget showing tax savings under the new rates for select salaries

This Change Will Reduce Tax Yield By $5.1 Million

“This reduction in taxes will reduce the Government’s payroll tax yield by approximately $5.1 million,” the Premier said.

41.7% of Total Government Revenues

Payroll taxes make up a substantial portion of the Government’s revenue, with the Premier saying the yield from payroll tax is estimated at $454 million in 2018/19, 41.7% of total Government revenues.

Eliminate Portion Of Payroll Tax for Disabled Employee

Saying the Government “recognises the challenges that persons with disability in Bermuda face,” the Premier said to “assist persons with disability in gaining access to employment and to reward those employers who have already hired disabled Bermudians, we will eliminate the employer portion of payroll tax for any disabled employee.”

Tax Break For Entrepreneurs In First Year

The Premier said new entrepreneurs who register and meet the criteria established by the Bermuda Economic Development Corporation in the creation of a new business will be exempt from the employer portion of payroll tax for themselves and any employees for the first year of business.

Payroll Tax Reform for Notional Salaries

Premier Burt said, “An often-abused part of the payroll tax system is the application of notional salaries [notionals] for payroll tax purposes in owner-managed businesses. These notionals are applied to ‘Deemed Employees’ who earn income partly or wholly through sharing the profits of the business instead of only through salaried remuneration.

“As an example, partners in local law and accounting firms may declare a notional salary of $200,000 while they may actually earn $1,000,000 from their business. In this instance, the partner only pays payroll tax on the $200,000 while not paying tax on their remaining earnings.

“The Office of the Tax Commissioner [OTC] has already taken steps to tackle systemic abuses of the declaration and payment of tax based on notional income levels.

“To further address this problem, the Government will amend the Payroll Tax Act 1995 to provide that for all Deemed Employees, the notional salaries will be replaced with a requirement to declare all income received, on a cash basis.

Change Estimated To Increase Payroll Tax Revenues By At Least $10 Million

“This measure would cover all Deemed Employees to ensure that no one group is singled out,” Premier Burt said. “This change will improve transparency, assist enforcement, and largely eliminate the risk of under-declaration and under-payment.

“It is estimated that this change will increase payroll tax revenues by at least $10 million.”

The 2018 Budget follows below [PDF here]:

Can someone explain this to me. So the lowest tier was decreased from 4.75% to 4%. However no change to the others. My understanding is if you make $60k. The first $48k will now be at 4% and the next $12k will still be at 5.75%. So that means every level receives a reduction.

The tax savings for salaries between $48 & 96k is based on the savings they get in their first 48k of their salary of $360. A salaries get higher than $48k the $360 savings is depleted until it zero’s out at $96K.

Can someone explain this to me. So the lowest tier was decreased from 4.75% to 4%. However no change to the others. My understanding is if you make $60k. The first $48k will now be at 4% and the next $12k will still be at 5.75%. So that means every level receives a reduction of $360.00 at least.

So whats the median income.

Seriously.

If I were were earning $ 96, K per annum i could easily and more than willing pay income taxes Mr Bert you missed the boat on that one.

Make Bermuda Great again.

Why did you not extend income tax revenue to include unearned income like directors fees rental income and dividends.

Sir, we the working class, worked hard, with long hours for what we have. You make me weep !

Government might like to collect and enforce the collection of back taxes.

No more capital projects.

You know that all this is going to increase the cost of living, you also know Bermuda has priced it self out of the market when we pay twice as much for a car than in any other country.

Mr. Bert ,why on earth would you want to increase taxes on cell phones ,as they are the same as the ship to shore radio in boats, cell phones are an emergency device , how many time have cell phones been used by seniors, children , to call the police to catch bergulars,call the hospital by heart patients A CELL PHONE SAVED MY LIFE and they work for boat owners. Mr Burt you missed the Bus on that one Stop catering to the wealthy.

” We the people”

The cell phone tax does appear to unfairly target the less wealthy.

What about those who get paid under the table to avoid payroll taxes?

What about the employers who don’t send an accurate amount of payroll tax to the government because the system is so easy to trick? Allowing employers to send taxes in a lump amount of all employee’s taxes instead of an amount divided into individual amounts accounted for individual employers is an easy system to cheat.

Can someone explain to me what the PLP voters think.s all we get from them is crickets!