BHEC Releases Actuarial Report & Other Data

The Bermuda Health Council [BHEC] has released its annual Actuarial Report, along with additional information in the form of data tables and data briefs.

A spokesperson said, “The Bermuda Health Council believes that a fundamental way to transform health for the future is to create transparency in how the health system is currently working. The Council releases its Actuarial Report.

“This report discusses Standard Health Benefit [SHB] and Mutual Reinsurance Fund [MRF] services to be included in the coming fiscal year and an analysis of the prior year. In addition to this release, the Council is also providing additional information on its website for greater context in the form of data tables and data briefs. This data will be available to the public for use and review.

“These data tables include information such as counts of premiums and claims paid, utilization of services by procedure code, a listing of procedure codes by specialty area, and progress of National Health Accounts data. The data briefs include various data analyses that have been completed that are outside of the generation of significant reports.

“The Council will regularly update these data tables and briefs; expanding their scope in accordance to the Council’s strategic goals.”

Dr. Ricky C. Brathwaite, Acting CEO of the Health Council, said, “We are a very data-driven organisation. We are excited to contribute further to the health system with our new data tables. Each of our internal project teams relies on data that is reported from our partners and system stakeholders to make the best decisions and recommendations possible for the system.

“When data does not exist in certain areas, our Health Economics and Regulations teams collaborate to develop surveys for primary data collection, or utilise secondary datasets to support our work.”

“To demonstrate the type of documents that will be available on our updated website, the Health Council is highlighting data with respect to health system premiums and claims. This data aligns with the information that is reported for SHB within this year’s Actuarial Report.

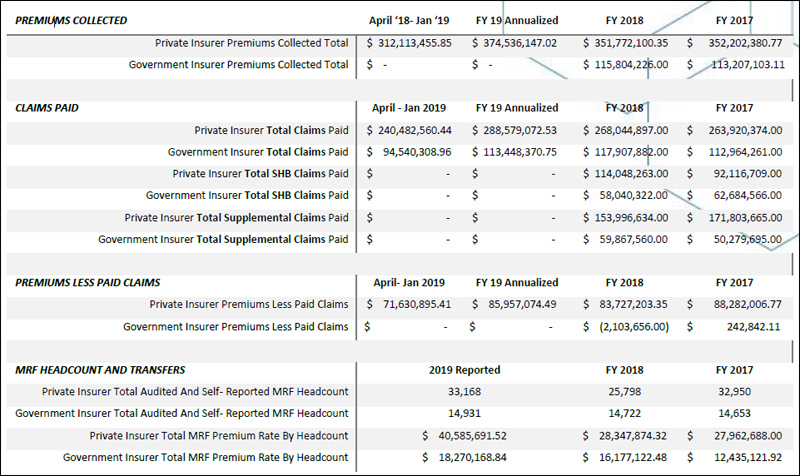

“The following table presents a break out of insurance premiums collected, overall claims spent, and projections for the Mutual Reinsurance Fund [MRF] payments between the fiscal year 2017 and the most recent fiscal year. The comparison is then made between the government and private insurance entities in alignment with the categorization presented within the Report.

“The primary data provided is for the 2017 and 2018 fiscal years as reported by industry within financial documents. In the 2019 fiscal year [1st April 2018 to 31st March 2019] monthly data claims and premiums have been reported through the Council’s data collection process and confirmed by individual insurers.”

Highlights

- Premiums collected showed an increase of 6.47% in funds collected from clients who are insured by private insurers between FY2018 and FY2019. FY19 data for government plans was incomplete.

- The projected total claims paid for the FY2019 show an increase by 7.6% for private insurers. FY19 data for government plans was incomplete.

- Each year all insurers provide the number of unique individuals they insure to determine the “headcount” which is used by the Actuary and within the Actuarial Reports to determine the Standard Premium Rate.

- In FY2020 [beginning 1st June], the MRF premium transfer rates will be $331.97 per eligible person per month. This premium includes cover for all hospital SHB claims and other MRF transfers [total $195M]. In the previous year, FY2019, MRF and SHB claims were paid separately as $101.97 per headcount [$60M] and over $150M in SHB claims respectively, for a sum total of $210M paid.

- At $355.31 per insured per month [total SPR], the total revenue needed to pay for defined SHB and MRF services across the entire health system in both FY2019 and FY2020 are relatively equal.

The full 2018 Actuarial Report for the Bermuda Health Council follows below [PDF here]:

Read More About

Category: All

This: The projected total claims paid for the FY2019 show an increase by 7.6% for private insurers. FY19 data for government plans was incomplete.

And as of June 1, government is effectively entering the health care business – how on earth can we rely on them to do that if they cannot even complete data, the same data that private health insurers provided!!!!