Mosaic’s Cyber Underwriting Unit In Bermuda

Mosaic Insurance said they are “building out a cybersecurity underwriting unit in Bermuda, to align its global business strategy around the fast-growing risk.”

A spokesperson said, “The specialty insurer has transferred its cyber team underwriter George Cole from London to the company’s Bermuda corporate headquarters, following his temporary secondment to the island late last year. The move adds another cyber underwriting hub to Mosaic’s expanding network; the company currently has cyber underwriters in London, New York, and Chicago, with plans to add more in Toronto and Frankfurt later this year.”

“Bermuda is a center of excellence for underwriting and it’s going to be a really important market for the growth of cyber insurance,” said Yosha DeLong, Mosaic’s Global Head of Cyber. She will participate at tomorrow’s Bermuda Risk Summit in a 9:30a AST panel, “Bridging the Cyber Coverage Gap,” examining cyber need and pricing, and how to manage cyberrisks effectively.

“There’s a lot of thought leadership and innovation coming out of the Bermuda market, in the cyber space, in particular,” said DeLong. “Part of that can be attributed to this market’s ability to be nimble when looking at product solutions, and it’s going to be a great opportunity. I envision Mosaic launching new products out of Bermuda as we further develop this business line around the world.”

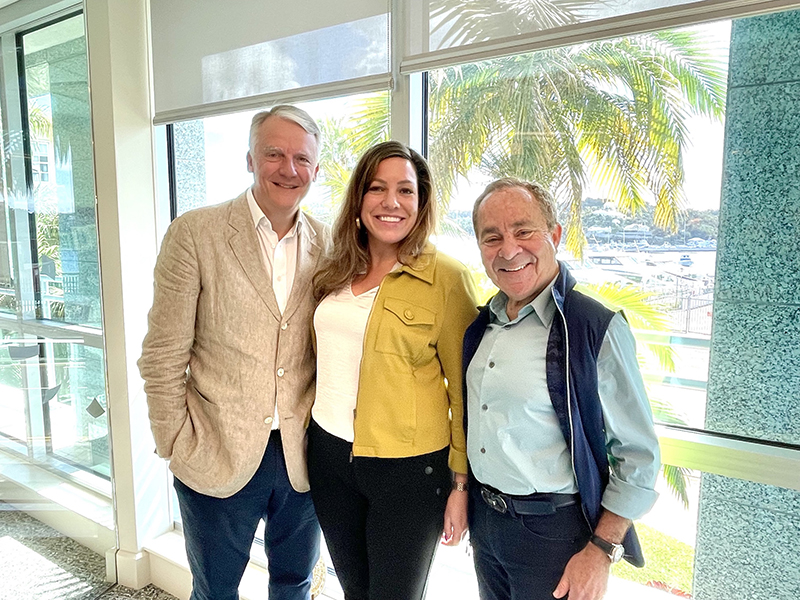

Mosaic’s Global Head of Cyber, Yosha Delong, with Co-CEOs Mark Wheeler [left] and Mitch Blaser. Delong is at the company’s corporate headquarters this week to speak at the Bermuda Risk Summit

“Amid the global rise in ransomware and other impactful attacks, cybersecurity is a core area of expertise for Mosaic and one of its six specialty products that reflect a high technical barrier to entry. The company’s other lines include transactional liability, political risk, political violence, financial institutions, and professional liability,” the company said.

“Cole will underwrite cyber opportunities coming through the Bermuda marketplace, focused on securing high-excess layers of coverage for Mosaic’s global clients. Mosaic intends to provide cyber solutions and thought leadership in major insurance hubs across the globe, with Bermuda playing an important part in that distribution strategy.”

“With cyber underwriters now in place in the UK, US, and Bermuda markets, Mosaic can provide coverage across major insurance placement hubs. The company will be looking to further build out its Bermuda presence in this line, with the hiring of an additional cyber underwriter there this year.”

“I’m excited to progress our cyber strategy in Bermuda and build out a well-balanced cyber portfolio,” said Cole. “The opportunity we have in Bermuda—to gain visibility into the global market, understand our customers’ changing cyberrisk requirements, and offer commensurate risk-transfer solutions—is unlike that of any other marketplace in the world.”

Mosaic’s cyber underwriter in Bermuda, George Cole

“Insurance traditionally has a look-back perspective across all lines,” said DeLong. “Cyber is forcing us, as an industry, to look forward, anticipate change to threats and prevention, focus on recovery from events, and work with insureds to improve their overall security posture and culture.

“Cyber is a peril, not just an insurance product—and cyber events affect all insurance lines of business,” she added. “There’s an opportunity for innovative cyber insurance solutions, as well as an obligation for cyber insurance carriers to influence and implement overall cybersecurity improvements and minimum expectations across the globe.”

The company added, “Mosaic is developing market-leading aggregation studies, risk-assessment, loss-prevention, and response capabilities to ensure its cyber underwriting product is informed by advanced data analysis; the company is also highly discerning in the risks it decides to take on.

“Last month, Mosaic began activating $20 million in cybersecurity capacity in the US market through its syndicated capital program. Under the initiative, a core part of Mosaic’s model, capital from participating carriers is deployed through a partnership with hybrid fronting carrier Transverse Insurance Group.”

Read More About

Category: All, Business, technology