Bermuda Chamber Comment On Q2 GDP

The Bermuda Chamber of Commerce has issued a statement responding to the latest Q2 2025 GDP figures.

A spokesperson said, “The Bermuda Chamber of Commerce welcomes the release of the Q2 2025 GDP figures by the Department of Statistics, presented by Minister Jason Hayward. Whilst we note the 1.2% year-over-year contraction in real GDP in the quarter, it appears to be driven mainly by a widened trade deficit from higher imports and this warrants further context.

“It is important to note that imports of goods, from a GDP accounting perspective, reduces the net economic impact. However, for the Bermuda context, this generally reflects positive underlying activity, such as heightened investment and consumer demand, which can drive broader prosperity. This highlights one of the potential limitations of relying fully on the final GDP output.

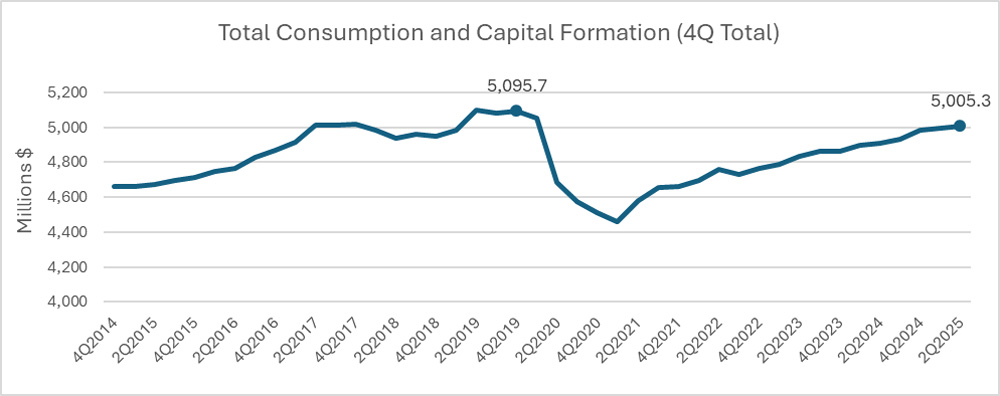

“The Chamber is encouraged to see a 1.0% growth in household consumption, 5.1% increase in gross capital formation from ongoing investments and construction, and overall recovery trends. The following chart demonstrates the 4th Quarter moving totals [to account for seasonality] of just the Consumption [Personal and Government] and Capital Formation [Construction and Machinery/Equipment]. This shows continued growth and recovery, albeit we note this measure still is 1.8% behind 4th Quarter 2019 levels. The Chamber believes that this representation of GDP provides a more informed view of the true domestic economy experiences when speaking on GDP.

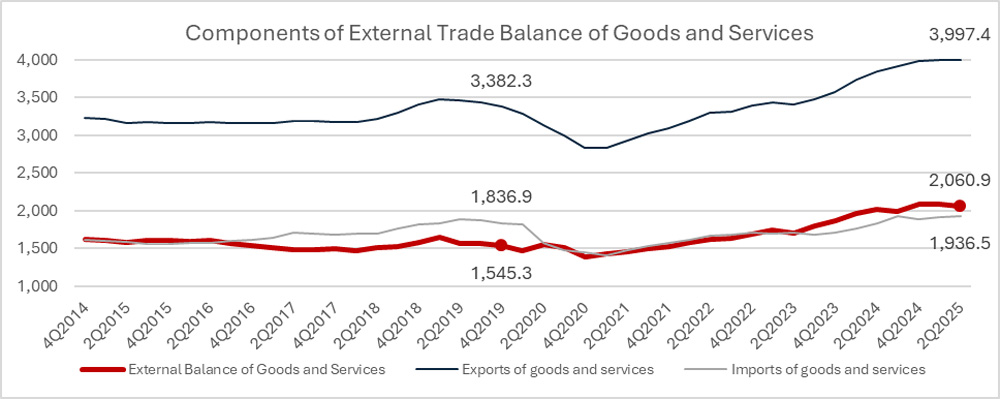

“When we look at the contribution from the external balance of goods and services, which factors in Export of Services [which largely represents International Business and Tourism] netted off against the Import of Goods and Services [largely imports to the Island, but also locals travelling overseas]. The 4th Quarter trade balance movement is below, which indicates movement of these factors – the External Trade Balance runs as a surplus due to International Business, despite Bermuda being fully reliant on imports. The External Balance is calculated as exports minus imports.

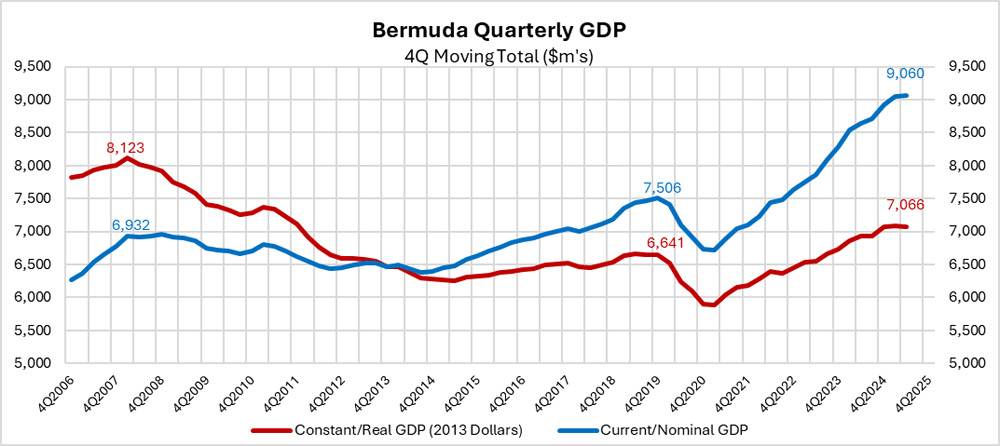

“The following provides the long-term trend of the Real GDP [in 2013 Dollars] of the 4th Quarter moving average of GDP against the 4th Quarter moving average of Current GDP. This context allows for the trends to be seen easier and can see that overall GDP recovery has slowed in the most recent periods, however, overall GDP is trending higher than in 2019 and has also shown a recovery back to 2012 levels at this time. This assessment may differ from the Annual GDP results due to different methodologies; however, this view provides more context.

Data Lags

“We reiterate our earlier 2025 concern about data release delays: this Q2 report came 198 days after quarter-end, versus last year’s [2Q 2024 data] December 5 release. As urged by the Chamber and the Fiscal Responsibility Panel, we call for a clear, predictable schedule for key economic data to improve transparency and confidence. Additionally, we also note that Retail Sales Index and Consumer Price Indexes at the time of writing are only released up to July 2025 [which itself was released on 11 December 2025 – 133 days after the period]. Given how key these releases are to understanding the health of the local economy and cost of living impacts, we again stress the timely release of this information on a set schedule. Additionally, the Labour Force Survey results come out 12 months after the time period of the survey – we would expect that a preliminary high-level summary of key figures should be available on an earlier timetable and would strongly encourage this to be explored further.

Employment Income and Jobs

“We note the 6.5% rise in employment income [noting we await the release of the detailed tables to review further], with strong gains in international business [8.2%], and construction [5.5%], albeit we do not know the split of salary increases vs new employees driving this. Public administration expenditure increase of 19.9% is of some concern given this can highlight the potential imbalance relative to the private sector, but we also note that some of this increase was due to one-time payments per the March 2025 announcement on Salary Uplift for Public Officers [Salary Uplift for Public Officers | Government of Bermuda], and we do not expect to see elevated levels of this extent.

“Recent employment data from the 2025 Bermuda Job Market Employment Briefs [based on the 2024 Employment Survey] indicate overall job growth of 1.8% or 585 filled jobs between 2023 and 2024, reaching 33,451 total filled jobs-a positive sign for economic health and growth prospects. However, Bermudian job gains remained modest amid an ageing population and low unemployment, with filled jobs still below pre-pandemic levels for Bermudians. We await more granular quarterly breakdowns to better assess balanced growth across local businesses and sectors.

“We also note that during these updates, registrations of new businesses is often a feature, however, the Chamber does question if this is a reasonable measure to use. Firstly, it is unknown which businesses are truly operational and hiring staff and at what levels. Secondly, whilst it was outlined that 32 new local registrations in 2Q 2024, along with 50 in 1Q 2024, which brought the total to 4,048, recent Official Gazette notices reveal significant churn, with hundreds of local companies struck off and dissolved:

- August 2025 [GN0824/2025]: 100 local companies.

- December 2025 [GN1165/2025]: 126 local companies.

- January 2026 [GN0007/2026]: First notice for 80 more [with final strike-off pending].

“This highlights the cautionary tale of using certain measures, as other measures are required to gauge the domestic entrepreneurial ecosystem’s health, as these strike-offs represent approximately 7.5% of the register.

Retail Sales

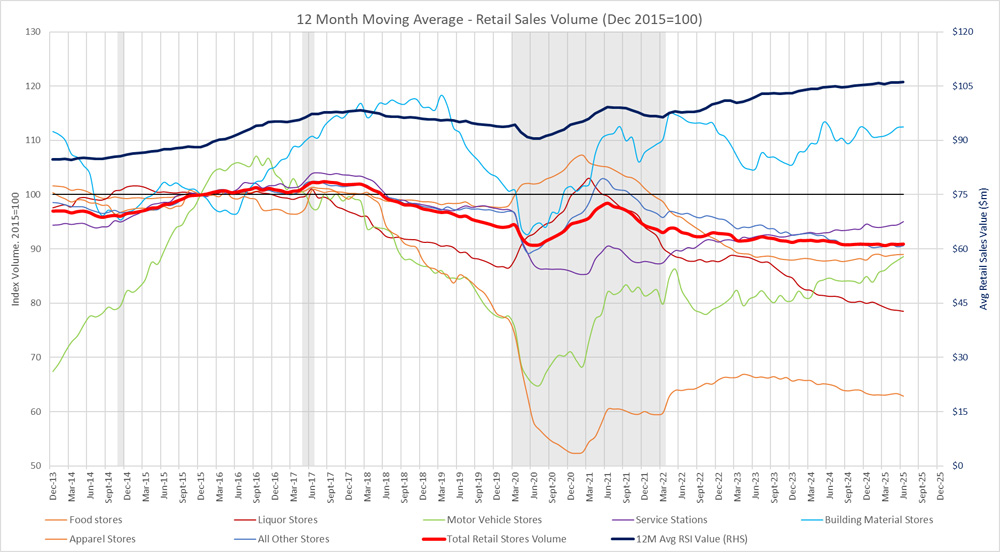

“As previously noted, the most recent Retail Sales Index [RSI] data available covers July 2025, released on December 11, 2025 [133 days after the period end]. The RSI provides valuable insight into domestic consumer activity, as it tracks goods sold by local retailers and captures the majority of in-island retail spending.

“On a 12-month moving average basis [which smooths out seasonality and monthly volatility], the Retail Sales Volume index [based on 2015 constant dollars] has remained remarkably stable over the past 11 months, fluctuating narrowly between approximately 90.7% and 90.9%. This indicates that the post-COVID decline in real retail volumes has largely plateaued and stabilized, even as monthly figures show some variability. For example, July 2025 volume fell 1.5% year-over-year, whilst value rose 1.1% [reflecting inflation of around 1.6%]. The continued upward trend in Retail Sales Value highlights the ongoing impact of price increases and cost pressures in the local market.

“Context is important when interpreting longer-term trends: the temporary spike in retail activity during the COVID-19 period was driven primarily by substitution toward Grocery and Liquor Stores [due to restrictions on bars, restaurants, and other out-of-home spending, which are not fully captured in the RSI]. Additionally, among the categories, only Building Material Stores have consistently trended above the 2015 base-year levels in recent periods – though this partly reflects the unusually low baseline for building materials in 2015.

“Overall, the stabilized volume trend suggests underlying resilience in the domestic retail sector, despite periodic monthly fluctuations and broader economic headwinds.

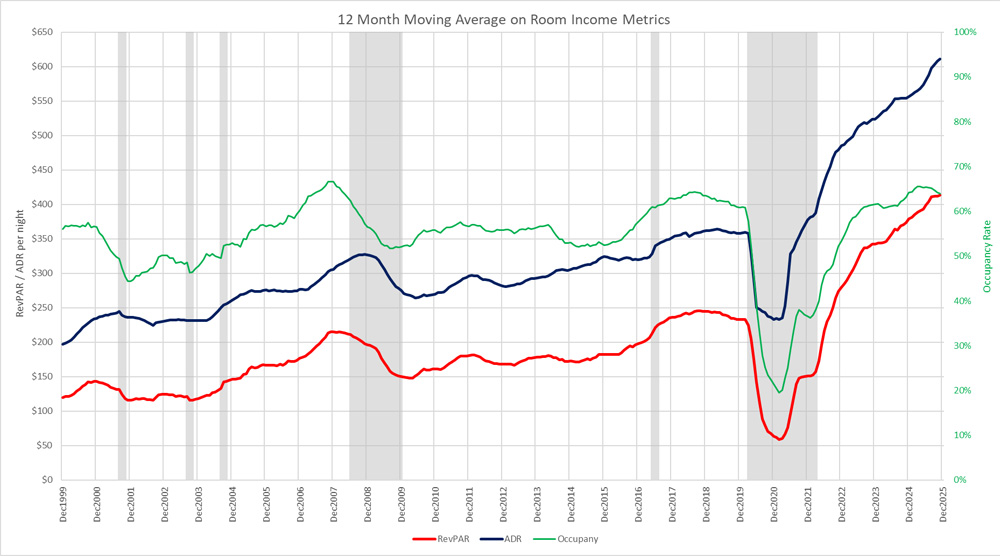

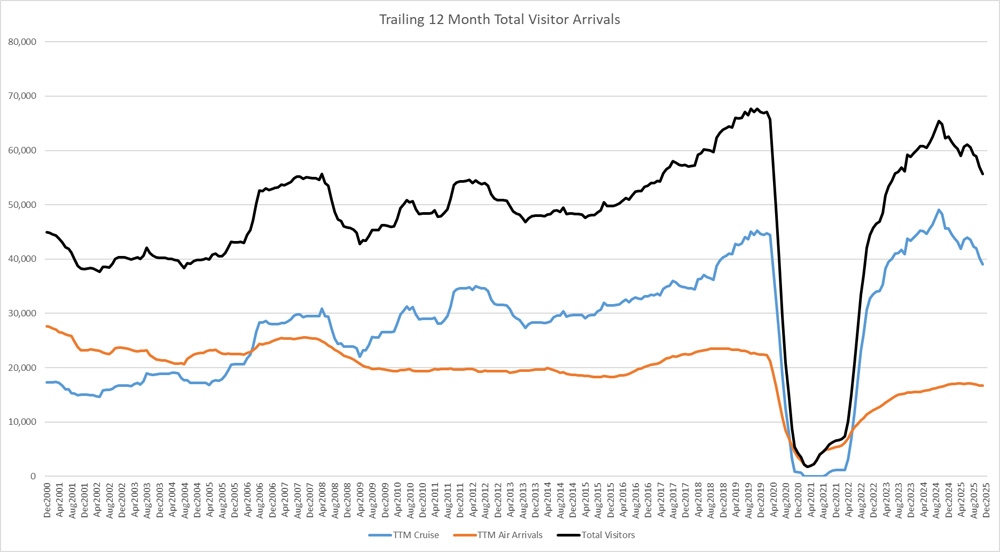

Tourism

“Tourism arrivals fell through November 2025, largely due to hurricanes in August and October, yet hotel performance held strong with comparable occupancy and rising Revenue Per Available Room. Whilst we expect total visitor arrivals to be down for the year, other metrics show that the tourism market remained stable.

“The Chamber eagerly awaits an announcement on the planned opening date of the Southampton Princess hotel as this will be a key factor in continuing to see airlift improvements in terms of size of aircraft and destinations, as well as the integral part that the hotel will play in supporting the International Business activities as well as providing additional opportunities for the domestic market.

“As previously articulated by the Chamber, there are some concerns around the availability of the required labour pool to support such a large-scale opening, and the Chamber looks forward to working with all stakeholders in having collaborative discussions on how this is to be achieved together.

Looking Forward

“We will continue monitoring progress amid global uncertainties that remain on the horizon for the foreseeable future. The Chamber remains committed to partnering with Government on policies and strategies for sustained success. We look forward to the February Budget to understand enhancements addressing housing, data timeliness, balanced sector growth, and a vibrant local business environment.”